Fixed income steadies its footing

Fixed Income Boutique

Dear readers,

Welcome to the first edition of the Vontobel Fixed Income Quarterly, a publication launched to guide investors through the waves of information and market developments that break upon us each quarter. In the same way that surfers do, investors too must continually assess a multitude of factors to find their footing amid ever-changing conditions. Purposely published off-cycle to allow time and space for contemplation, the Vontobel Fixed Income Quarterly (“Quarterly”) aims to deliver easy-to-digest yet detailed insights into this asset class.

What can you expect in each edition? Our Fixed Income experts will address pertinent topics and explain what’s driving risk appetite and assessments of relative value across the fixed income universe. Vontobel’s Chief Economist Reto Cueni will also weigh in on the discussion, providing macro-level analysis and insight. And, like any evaluation worth its salt, our Quarterly will engage in an open discussion of the risks and challenges at hand. Should this frank debate appear too salty or cautious at times, do not be dismayed—in addition to my British humor, a keen eye for risk management is part and parcel of my role at the helm of Fixed Income and one of the hallmarks of good active management.

Key takeaways

- The volatility seen in August is likely to be repeated.

- Rate cuts by the US Federal Reserve will make cash and money markets less attractive.

- Credit and rates are now likely negatively correlated.

- Emerging market spreads currently have more value than developed market spreads.

- Economic weakness in developed markets is likely insufficient to cause a default cycle.

A return to normal?

As I write this editorial, I’m struck by the timing: it’s hard to imagine a more striking contrast in the fortunes of fixed income as an asset class than that between the last quarter and the infamous period in 2022. As our slightly tongue-in-cheek cover title indicates, if fixed income was on TikTok, our hashtag could be “Very balanced. Very buoyant. Very bold” right now. That said, a furore did sweep through broader markets this July and early August, and though fixed income appears to have avoided the worst of it, several subsurface currents receive the attention they deserve in the pages to come.

One of our commitments with this Quarterly is to cut out the jargon and explain things simply. So, let’s take a step back to explain that fixed income commentators typically only discuss the following three factors: credit, rates, and the relationship between the two. This is reflected in our publication, with a strong focus on credit and a special section dedicated to rates. While the third element can remain relatively unnoticed by many for large periods of time, it is not to be forgotten. Indeed, this relationship between credit and rates was instrumental in delivering fixed income’s cataclysmic performance in 2022.

That year began with an unusual situation: credit spreads were at historically tight levels and rates across most major economies were at record lows, which made it unlikely that one factor could dampen increases of the other. This scenario has been described by some as the largest financial experiment in history; and it’s hardly surprising that the comedown across fixed income has been so severe these last two years.

By this June, however, fixed income appeared to have returned to a more “normal” footing. In such times it can be assumed that:

When the economy does badly:

- credit spreads should rise, signifying an increased likelihood that borrowers will default; and

- base rates should fall, signifying support from central banks for the economy and growth.

When the economy does well:

- credit spreads should tighten, signifying a decreased likelihood that borrowers will default; and

- base rates should rise, signifying attempts by central banks to avoid overheating and inflation.

This explains how, under “normal” conditions, a negative correlation between rates and credit is created. Or, at a minimum, a dampening effect of one on the other occurs amid “normal” changes in regime. This effect is hardly perceptible over short periods but was well illustrated during the Covid crisis in 2020.

Strangely, it has been so long since fixed income was in its “normal” state that many participants now perceive conditions under the global zero interest-rate policy (ZIRP) regime that dominated the last decade and a half as “normal”. Readers, let me remind you that they are not. Base rates for developed economies are not “normally” zero. Inflation is not “normally” zero. And fixed income is not “normally” sold based purely on return.

An eye on the horizon

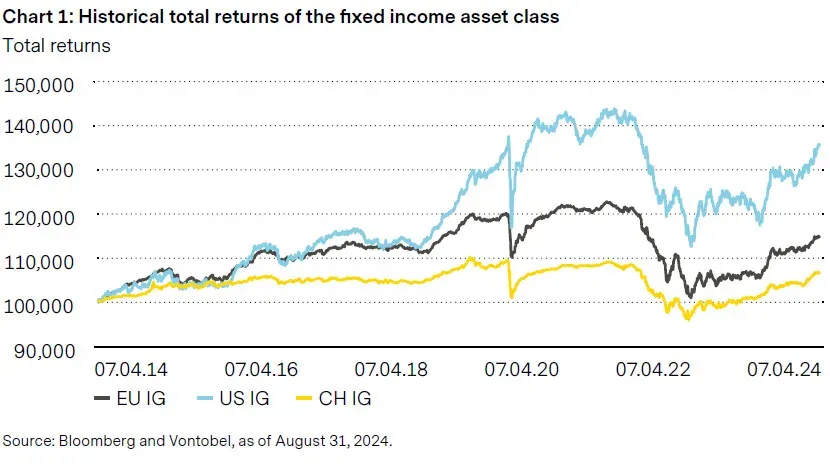

Having weathered the rough swells of the past two years (see Chart 1), I am delighted to tell you that we are pretty bullish about fixed income as an asset class right now. Our optimism is predicated on three fundamental tenets: fixed income’s attractive return opportunities; our belief that the asset class is well positioned to navigate future tests, of which we expect several more; and our belief that, having refound its footing, fixed income is once again capable of providing the much-needed diversification from other, perhaps sexier, asset classes that it failed to deliver in 2022.

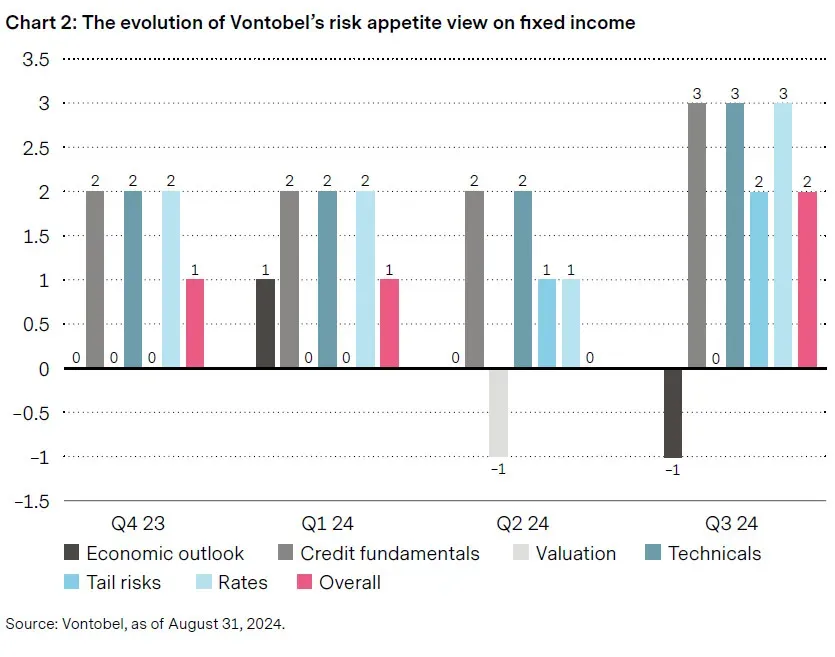

The pages that follow add more color to my optimistic statements, and I hope you enjoy reading them. Chart 2 shows the evolution of our recent risk appetite view; and the “scorecard” provides a snapshot of the evolution of our aggregate top-down view of fixed income as an asset class, with more detailed parameterization to be provided in coming quarters. In the meantime, we welcome all feedback on this new publication, which we plan to extend over time. In closing, I hope our new Quarterly becomes your go-to source for analysis of the most pertinent themes and market developments in the world of fixed income.