Emerging markets debt: Where have all the flows gone?

Fixed Income Boutique

Emerging markets hard currency sovereign debt (EMD) has long held the promise of opportunity, but investor enthusiasm has waned in recent years. Could the tide be turning?

2024 was another year in which emerging markets (EM) struggled to capture significant investor attention. Dedicated flows into the asset class remained limited, with retail EM funds experiencing another year of net outflows. This was despite attractive spreads and a promising interest rate outlook, as markets correctly anticipated the beginning of a US Federal Reserve easing cycle amid progress in the disinflation process.

So, what kept investors on the sidelines these past few years? Elevated risk-free money market rates certainly acted as one deterrent, especially after an extended period of global volatility, with one crisis following another: the Covid-19 pandemic, the war in Ukraine, inflation-related uncertainties, and the looming risk of a banking crisis in 2023. As a result, investors opted to be safe rather than sorry.

A closer look at the timing of the flows supports this hypothesis, which stands in contrast to typical patterns: capital inflows did not materialize in anticipation of positive developments. Instead, they only began to appear after the first Fed rate cut and proved to be ephemeral, driven rather by the heightened uncertainty surrounding the US presidential election.

Despite the lack of dedicated inflows, EM spreads narrowed significantly for both sovereigns and corporate issuers, across both investment-grade (IG) and high-yield (HY) segments, with a notably larger contraction in the latter. In our view, this strongly suggests that there must have been interest from other investors . Indeed, we felt that the opportunity set within EM was highly attractive for developed market (DM) corporate credit investors throughout 2024. EM quasi-sovereign and corporate bonds offered compelling relative value within their peer groups, while DM assets appeared increasingly overpriced after years of quantitative easing (QE), which shielded an ever-expanding universe of DM securities. EM assets, by contrast, did not receive the same level of protection.

Back in 2022, spreads for lower-quality issuers widened dramatically, and several weaker countries lost access to international bond markets, amplifying fears of a surge in credit defaults. However, these concerns were largely overstated, as most sovereign issuers had manageable refinancing needs or could rely on lenders of last resort, such as the IMF, international financial institutions (IFIs), and bilateral creditors. As these default fears dissipated, crossover investors returned to the safer segments of the EM asset class through 2024, enabling dedicated investors to target more distressed names. By early 2024, most B-rated issuers had regained market access, sparking a relief rally.

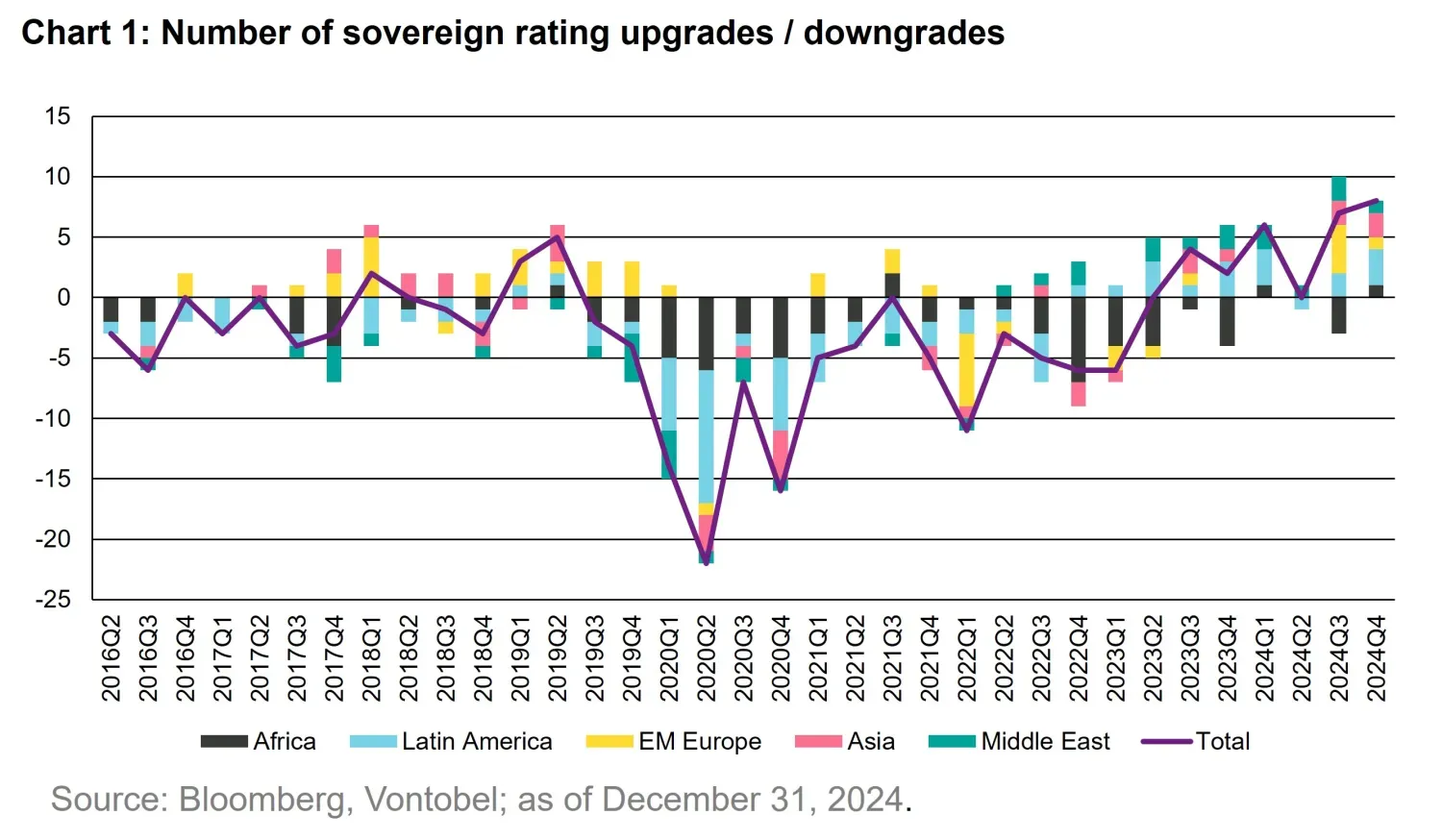

Economic reforms and improving fundamentals justify tighter credit spreads. Many HY countries that lost market access in 2022-23 were compelled to adopt more orthodox policies, including subsidy reductions, and austerity measures. Examples include Turkey, Argentina, Kenya, Nigeria, and Pakistan. These reforms are bearing fruit, and are being acknowledged by rating agencies: for the first time in over a decade, upgrades have outpaced downgrades. This trend is likely to continue, as reflected in credit rating outlooks. A growing number of issuers now enjoy positive outlooks, particularly in the high-yield segment. Moreover, while DM have seen several “zombie” corporates survive due to QE, weaker issuers largely defaulted between 2020 and 2023. The divergence in default cycles between EM and DM is striking: EM sovereign defaults peaked at five in 2022, dropped to one in 2023, and none were recorded in 2024. We expect default rates to remain low in the coming years. Most sovereigns that defaulted completed their debt restructurings last year, leaving the EM asset class in a healthier position.

With spreads currently below historical averages, can we expect flows to return to EM? We believe that relative value holds the key to answering this question: EM sovereign spreads remain highly attractive compared to DM spreads. Moreover, the lower volatility observed throughout 2024 could rekindle investor demand. Another promising development is the reemergence of a negative correlation between core rates and EM spreads, a trend that risk-aware investors are likely to welcome.

While the Fed may not ease monetary conditions as aggressively as previously expected, further easing in Europe could spur increased demand from European investors. Beyond outright performance potential, the capacity to generate alpha is a critical consideration – and here, we believe EM offers significant opportunities.

EMD is a heterogeneous asset class with over 70 countries in the JP Morgan EMBIG Diversified Index with different business and political models, different economic cycles, ratings, strengths, and weaknesses. It is also an inefficient asset class as it is not typically a large percentage of the strategic asset allocation of the investor community. Despite this, we have observed the growth of assets under management of passively managed ETF investing in EMD, or the growth of non-specialized cross-over investors (such as DM corporate credit investors) who tend to focus on a specific segment of the market (typically stronger credit quality names, better liquidity, and extensive research coverage). The presence of these sizable investor communities investing in the same benchmark bonds, or the same areas of the market, can weigh heavily on the technicals of some bonds, exacerbating distortions and mispricings, in our opinion. We find that this in turn amplifies the opportunity set for high conviction, dedicated and active EMD managers.

All things considered, we believe the potential for generating alpha in the EM bond market is abundant. Improved liquidity over the past year has further facilitated the ability to capitalize on market inefficiencies, making EM bonds an increasingly compelling choice for investors seeking differentiated returns, in our view, and now could be the time to reenter the EM market. Whether investors are seasoned or exploring EM for the first time, the potential rewards may be worth considering.