Strategy Focus

Our Emerging Markets Equity Strategy is an actively managed, concentrated portfolio covering developing markets. Our approach is based on returns being driven by a long-term investment in companies with relatively stable and predictable earnings growth that can be sustained for extended periods of time. The strategy draws on the expertise of our exclusive 19 strong investment team. ESG is integral to our approach given our focus on relatively stable and predictable ‘quality’ earnings growth combined with long-term holding periods. While the strategy is benchmark agnostic, performance is shown relative to the MSCI Emerging Markets Index.

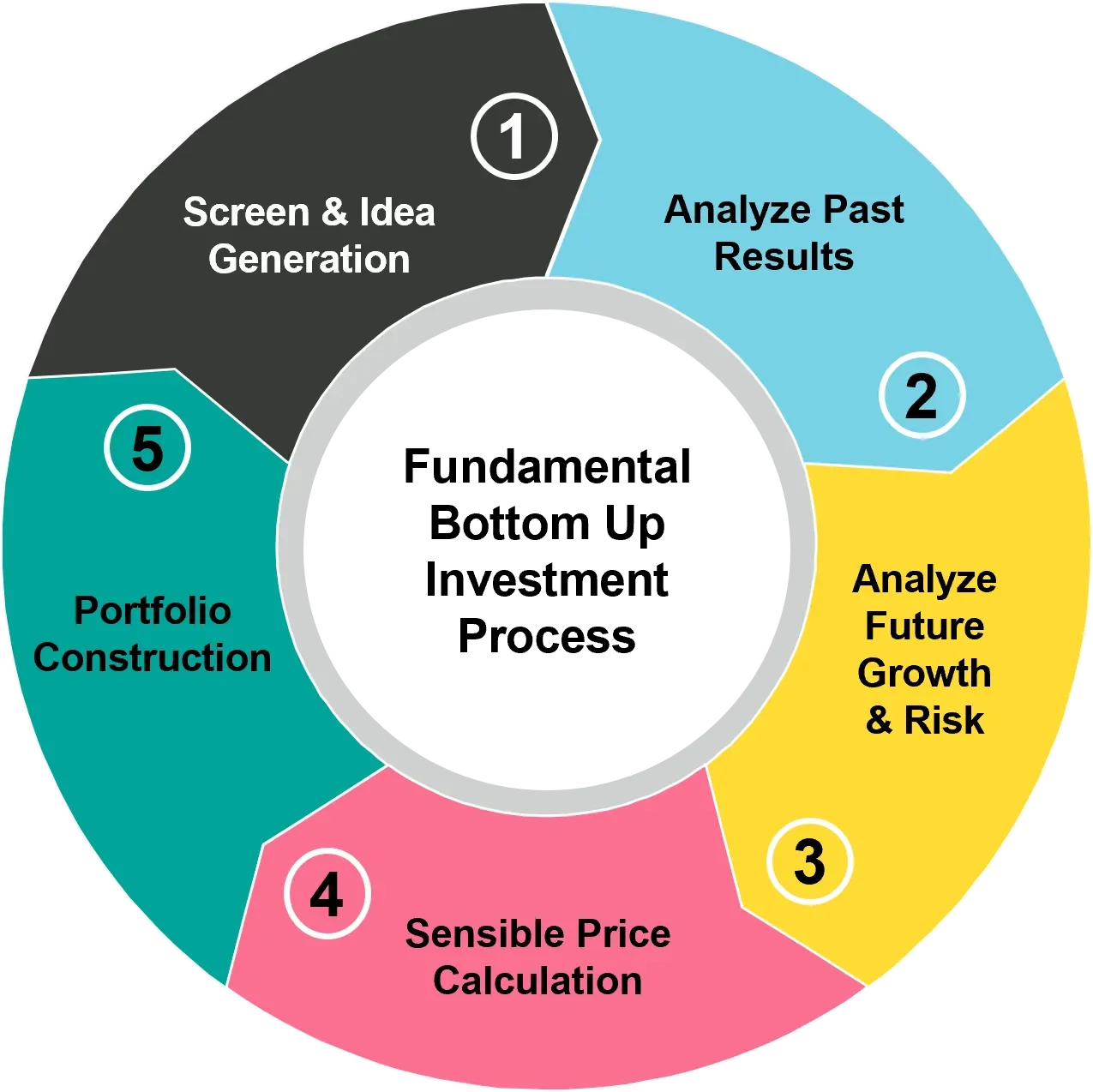

Investment Process

Continuous five-step investment process

- Concentrate on business analysis (bottom-up approach)

- Seek high quality growth at sensible prices

- High conviction portfolio

- Benchmark unconstrained

- Long-term focus

Portfolio Management

Emerging Markets Equity Composite

Source: Vontobel. All results portrayed are expressed in U.S. dollars. Periods under one year are not annualized. Past performance is not necessarily indicative of future results.

The composite‘s gross rates of return are presented before the deduction of investment management fees, other investment-related fees, and after the deduction of foreign withholding taxes, brokerage commissions and transaction costs. An investor’s actual return will be reduced by investment advisory fees. The composite‘s net rates of return are presented after the deduction of investment management fees, brokerage commissions, transaction costs, other investment-related fees and foreign withholding taxes. Results portrayed reflect the reinvestment of dividends and other earnings. The comparison to an index is provided for informational purposes only and should not be used as the basis for making an investment. There may be significant differences between the composite and the index, including but not limited to the risk profile, liquidity, volatility and asset composition. The MSCI Emerging Markets index is a free float-adjusted market capitalization index of approximately 830 stocks that is designed to measure equity market performance in 24 emerging market countries. The index is calculated on a total return basis with net dividends reinvested. It reflects withholding taxes, but not fees and other investment expenses.

Important information

The index comparisons in this presentation are provided for informational purposes only and should not be used as the basis for making an investment decision. Further, the performance of the composite and the Index may not be comparable. There are significant differences between the composite and the indices referenced, including, but not limited to, risk profile, liquidity, volatility and asset composition. Please note that an investor cannot invest directly in an index.

Investments discussed in the presentation is based on a representative portfolio and there is no assurance that Vontobel will make any investments with the same or similar characteristics as the representative portfolio presented. The representative portfolio is presented for discussion purposes only and is not a reliable indicator of the performance or investment profile of the composite.

Any projections contained in this presentation are based on a variety of estimates and assumptions. There can be no assurance that the assumptions made in connection with the projections will prove accurate, and actual results may differ materially. The inclusion of projections should not be regarded as an indication that Vontobel considers the projections to be a reliable prediction of future events and projections should not be relied upon as such. This disclaimer applies to this presentation and the oral or written comments of any person presenting it.

The inclusion in the composite of the performance of wrap accounts and private client assets could result in a material difference in the performance returns. There can be no assurance that investment objectives will be achieved. Clients must be prepared to bear risk of a total loss of their investment. Due to a varying frequency of the fees being paid and associated compounding effects, the actual difference between gross and net returns may differ from the stated annual fee. For example, on an account with a 0.50% fee, continuous monthly gross performance of 1.50% and the fees being deducted monthly, the compounding effect will result in an annual gross return of 19.56% and a net return of 18.97%. Thus, a $10,000 initial investment would grow to approximately $14,295 gross of fees, versus $14,155 net of fees, over a two-year period. Effective January 2016, the net-of-fees rates of return are calculated based on the fee schedule. All net returns that were previously calculated on a cash basis are linked to the returns being calculated under the new methodology, reflecting daily accrual of fees. Vontobel Asset Management, Inc. (“Vontobel”) is registered with the U.S. Securities and Exchange Commission as an investment adviser under the Investment Advisers Act of 1940, as amended, in the USA. Registration as an Investment Advisor with the U.S. Securities and Exchange Commission does not imply a certain level of skill or expertise. Vontobel is exempt from the requirements to hold an Australian Financial Services License under the Corporations Act in respect of the financial services it provides to Australian wholesale clients under ASIC Class Order CO 03/1100. Vontobel is regulated by the US Securities and Exchange Commission under US laws, which differ from Australian laws.

Insights

What we don’t know: the gap between AI hype and economic reality

2026 global equity outlook: the promise and peril of an AI-driven market

Beyond the AI bubble: finding predictable growth in video game stocks

Finding resilient growth amid tariffs and AI volatility

Fierce competition and unclear monetization of AI models in China