What we think changes, what doesn’t, in EM fixed income post-election?

Fixed Income Boutique

Key takeaways

- Lower Financing Costs: Funding costs are currently falling for many EM issuers, enhancing debt sustainability, profitability, and economic growth.

- Return of Financial Flows: Lower risk-free rates globally are expected to drive inflows back into EM fixed income assets, supporting tighter spreads and increased demand.

- Winners & losers: not all EM countries are expected to be treated equally in the post-Trump election environment. Who do we think are the potential winners and losers in EM?

What we think Trump’s presidency changes, and what remains the same, for EM fixed income

Financial markets have reacted to Trump’s victory in a relatively smooth and predictable fashion. The lack of drama in the financial market reaction is because this wasn’t a very surprising result. Investors had already priced in a high probability of a Trump presidency through the month of October, so the moves after the election were simply a continuation of what had already been pencilled in for over a month: a stronger dollar, higher US Treasury yields, higher US equity prices, and tighter credit spreads, including EM spreads.

President-elect Trump has made several promises during his campaign, and the markets are pricing in a high probability that at least some of them will be delivered to a certain extent. Let’s focus on the three most consequential ones from an economic point of view.

- First, Trump promised tax cuts, including a reduction of the corporate tax rate to 15% (currently 21%). Tax cuts should boost corporate profitability, which has boosted equity prices. These tax cuts are also likely to provide a boost to the economy, particularly if the promised income tax reductions end up benefiting a large share of the population. But tax cuts will also result in larger fiscal deficits, as it seems unlikely that they would be fully compensated by higher revenues from import tariffs. Larger fiscal deficits and potentially faster growth are good enough reasons to see higher US Treasury yields, but that’s just the first piece of the puzzle.

- Second, higher tariffs on China and possibly on the rest of the world. Given the bipartisan consensus against China (Biden increased tariffs on Chinese Electric Vehicles and solar panels among others) we think higher tariffs on imports from China are highly likely. Threats of tariffs on other countries are also likely but across the board tariffs on the rest of the world seem less probable even though it was part of Trump’s campaign promises. In any case, higher tariffs will increase the cost of imported goods for US consumers and will make the Fed’s job of getting inflation back to the 2% target a bit more difficult.

- Third, lower net migration. Trump made many promises regarding immigration, all of which would result in fewer migrants coming into the US, and in its most extreme form, millions of illegal immigrants could be deported to their countries of origin. We don’t know how strictly these migration policies will be enforced but it’s realistic to expect lower net migration. This is likely to result in a tighter labour market and slower job creation and is expected to result in somewhat higher wage growth and should all else equal also make the Fed’s job a bit more difficult.

The Fed easing cycle will continue, but the terminal rate may end up being higher. At the end of September, fixed income markets were pricing in 7.5 rate cuts by December 2025, which would have brought the Fed funds rate below 3%. Several rate cuts were priced out during October as a Trump victory appeared more likely. A few days after Trump’s election, markets now price in a bit over 3 cuts by December 2025, which would bring the policy rate down to 3.75%. The extent and pace of rate cuts are something that has likely changed with Trump’s election. But with headline inflation down from 9% in June 2022 to 2.4% in September 2024, it makes sense for the Fed to continue its easing cycle despite the uncertainties about the inflationary effect of Trump’s policies. Moreover, while tariffs may have more of an immediate effect on consumer prices, the effects of tax cuts and migration policies are likely to be felt with a significant delay on inflation. Thus, we’re rather leaning towards the Fed cutting rates by more than the market is currently pricing in, although not by as much as markets were expecting back in September.

What changes and what remains the same for EM fixed income?

The US economic policies will undoubtedly have global repercussions and we should expect volatility to be higher than during Biden’s presidency, but the current economic trends are likely to remain in place for a while longer. Most central banks around the world are expected to continue cutting rates. Some of these central banks may be influenced by a more cautious approach by the Fed in 2025, but their decisions will firstly depend on their national inflation and economic developments.

Emerging markets stand to benefit from this global easing cycle through two main channels:

1. first, through lower financing costs, and second, with the return of inflows into the asset class

Lower financing costs will reduce risks for EM bonds, improve sustainability, increase profitability and growth. This first channel is the most obvious and certain, in our opinion.

On the external debt side, EM hard-currency bonds are priced using the reference risk-free rates of their currency of denomination (US Treasuries for dollar bonds, and Bunds for EUR bond, for example), offering a spread on top of that reference risk-free curve to compensate for the additional risk. Thus, when the Fed cuts rates and the US Treasury yields decline, borrowing costs for EM issuers also decrease proportionally. And in the case of EM High Yield (EM HY) issuers, borrowing costs generally decrease further as spreads tend to compress in this situation. This is because at very high prevailing interest rates, many issuers can lose market access. This was the case for many EM HY issuers in 2022 and the first half of 2023. Once market access is regained (and this is now the case for most EM HY issuers), refinancing risks are significantly reduced, investors no longer fear high default rates, and this results in tighter spreads.

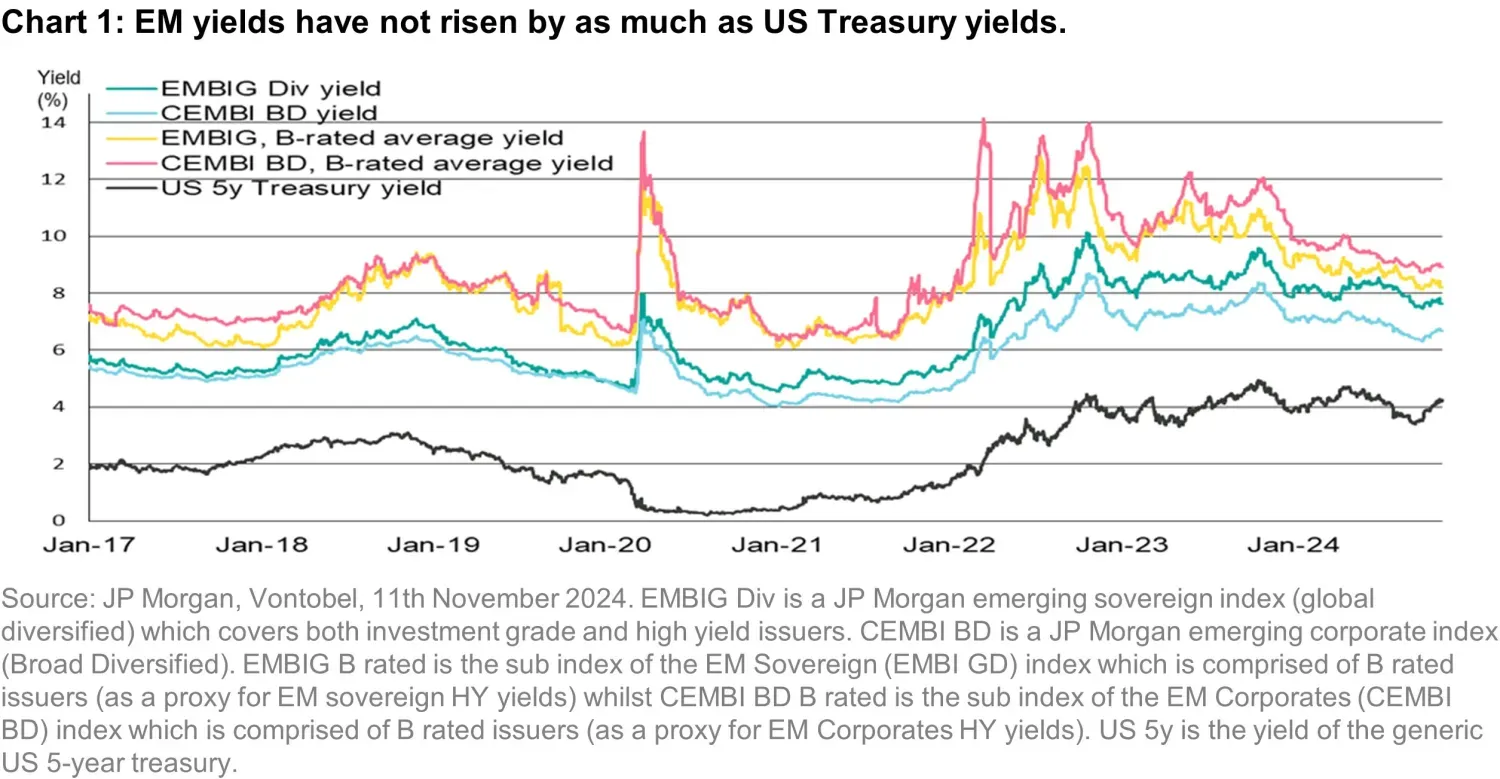

Figure 1 above shows that EM bonds have been resilient to the US Treasury selloff of last month. Spread compression has compensated for higher US Treasury yields, particularly on the riskiest segment of the market (represented in the chart by the B-rated yields). US Treasury yields have been moving sideways for the last year (around 4% for 5-year yields), but EM yields have been on a clear downward trend during the same period, which has been driven by the high yield segment regaining market access.

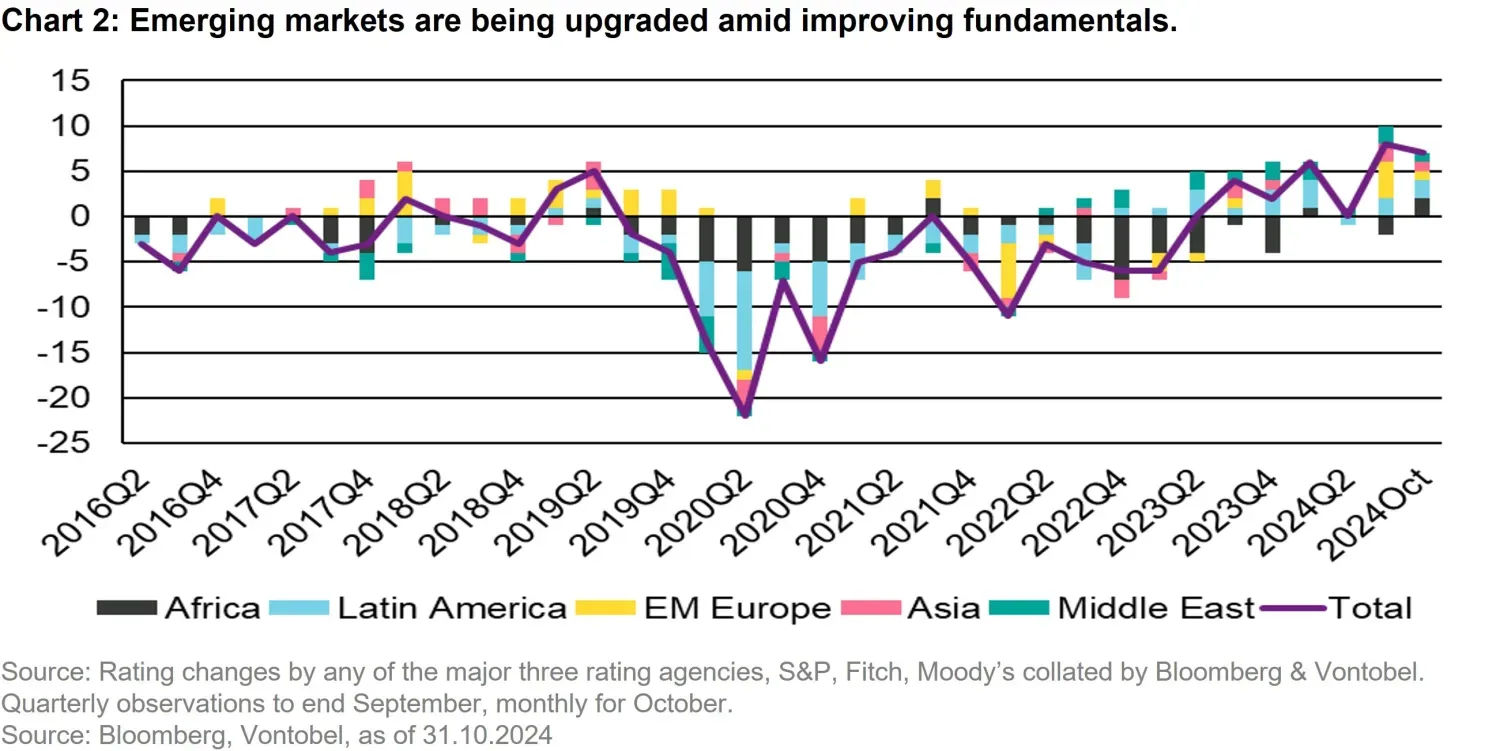

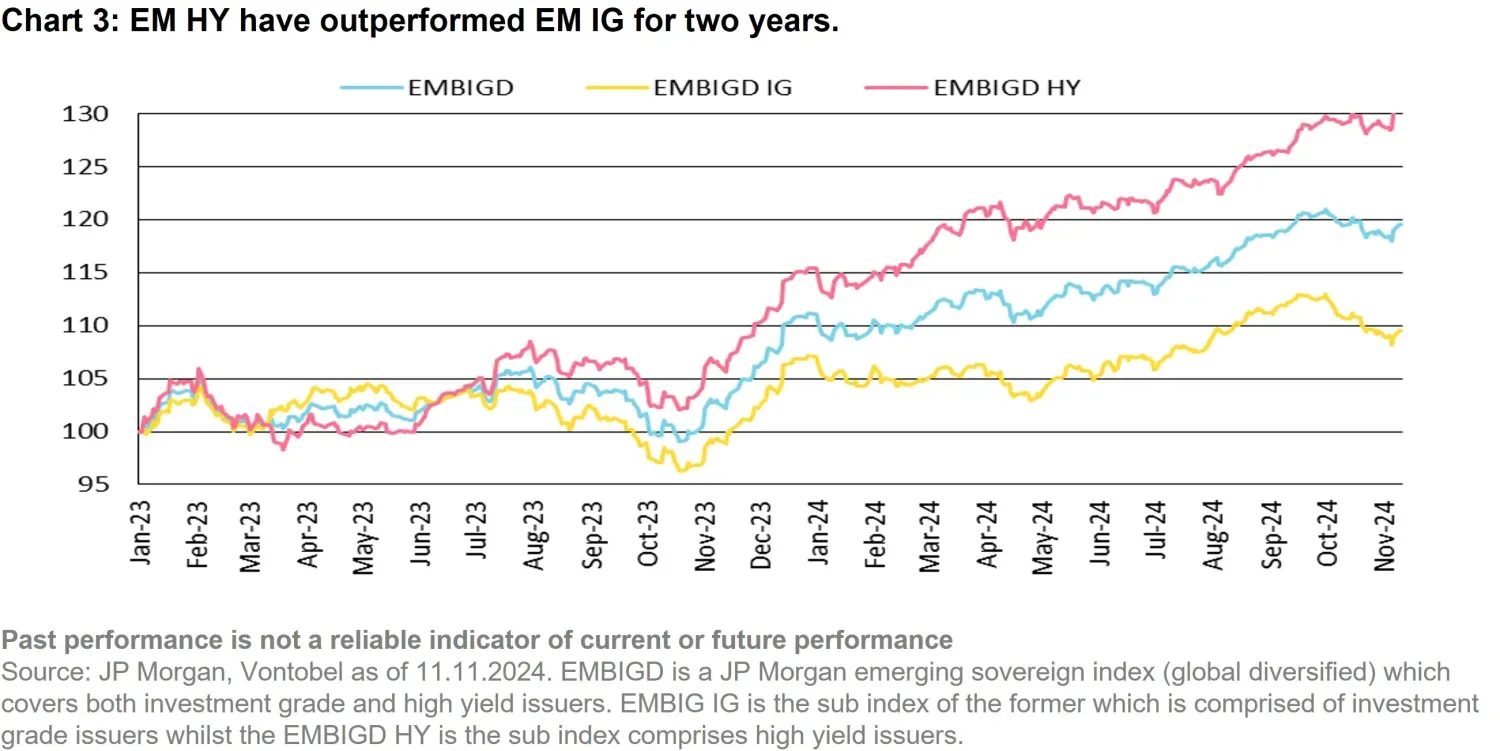

A trend of credit rating upgrades across EM. after years of credit rating downgrades, we’re now observing a wave of credit rating upgrades across regions. This is driven by the implementation of more strict orthodox economic policies across many countries, with Argentina, Turkey, Nigeria, Pakistan among the most noteworthy. This whole virtuous cycle (lower financing costs and better policies) has led to a notable number of upgrades from rating agencies, both EM sovereign and EM corporates, arguably the strongest positive upward trend for almost a decade (see Figure 2 above). These elements go quite some way to explaining the significant outperformance of EM HY over EM Investment Grade (EM IG) for most of the last two years (see Figure 3 below). Looking forward, regardless of whether the Fed manages to cut its policy rate just three times or eight times by the end of 2025, EM issuers should be able to refinance their maturities at more affordable rates of interest – especially when compared to the unaffordable rates of the past two years – and prolong this rather virtuous cycle.

Local-currency EM bonds have a more direct link with the interest rates set by their own central bank, but they are also influenced by global interest rates. Some EM central banks started cutting rates two years ago already. But some of them then paused or took a more cautious approach in 2024. Now that the Fed has started cutting rates, several EM central banks have resumed their easing cycle. This will boost EM local currency bond prices and lower domestic borrowing costs for sovereigns and corporates.

Lower financing costs not only facilitate the roll-over of maturities and have the evident effect of improving debt sustainability. Lower debt servicing costs also improve profitability for EM corporates, particularly for those that are highly leveraged. They also result in more investment projects becoming economically viable and coming to fruition. In feasibility studies, whether a project is analyzed with a financing cost of, say 12% or 8% in US dollars can make the difference between the project going ahead or not at all. Therefore, this channel of stimulus will also result in higher rates of economic growth for Emerging Markets.

2. The second channel is through the return of financial flows into EM fixed income

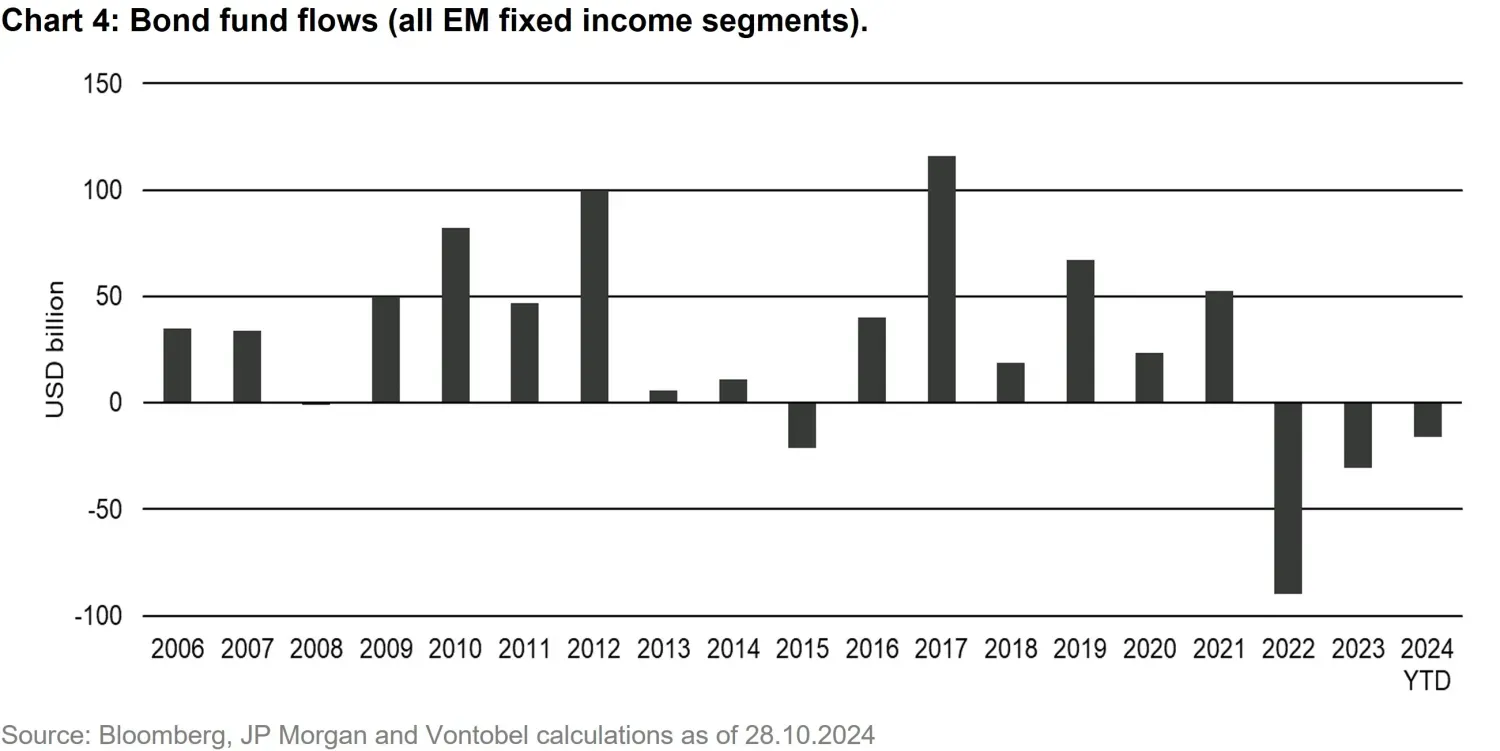

High risk-free interest rates resulted in a lack of interest for investors in EM over the last three years. High global inflation in 2022 resulted in central banks around the world hiking interest rates to levels not seen for decades in the developed world. With DM risk-free interest rates at such high levels, investors didn’t feel like they needed to take additional risks by deploying capital to emerging markets. As seen in the chart below, EM fixed income funds suffered unprecedented outflows over these past two and a half years. There have been some inflows returning to the asset class during the first three weeks after the first Fed rate cut. But the asset class saw outflows again amid the election uncertainty. We have some evidence of inflows through ETFs right after the election results were announced, but the asset class remains quite under-owned by most asset allocators.

Risk-free rates remain elevated at a global level, but they won’t stay this high for much longer, in our opinion. We expect the Fed, ECB, and other DM central banks (except for Japan), to continue cutting rates over the next twelve months. In other words, this is just the beginning of the end for high risk-free interest rates, as inflation continues to normalize towards inflation targets. The pace of interest rate normalization may be a little slower under Trump’s expansionary fiscal policies, tariffs, and tighter migration policies, but it will occur anyway.

This will result in much lower ex-ante expected returns for asset allocators investing in low-risk rates and deposits, and highly rated developed market bonds. Many asset allocators, particularly pension funds and insurance companies must deliver a minimum ex-ante expected return to their clients and will have to allocate a larger share of their portfolios to higher yielding instruments to deliver a minimum expected return. Increasing their allocation to EM bonds is a straightforward way to do this given the notably higher spreads and yields available in EM and we already see this as crossovers investors are investing in EM. Therefore, we expect inflows into EM fixed income to return much more significantly in the period to come. This should provide substantial technical support to EM spreads and prevent them from widening significantly even if some global risks do materialize. Moreover, we’d expect robust flows into active management given the alpha generation opportunities over and above benchmark returns presented by this heterogeneous, inefficient, and currently somewhat dislocated asset class.

A stronger US dollar is negative for the EM sentiment. The US dollar recovered by ~5% since late September against major currencies (as per the DXY index), although it remains shy of its 2024 highs back in April. Higher expected US interest rates have boosted the greenback, but this need not be the beginning of a strengthening trend. The US economy is still expected to slow down through 2025, and while tax cuts and deregulation can boost animal spirits, trade wars and immigration curbs will pull in the opposite direction. We think a Harris victory would have been more positive for the EM sentiment on the margin via a weaker dollar, but a more bullish risk appetite is compensating for this stronger US dollar, at least in EM hard currency markets. EM local currency has suffered when valued in USD in these past six weeks, but so have the bulk of major currencies. EM local currency when valued in EUR for example has fared significantly better than when valued in USD.

The risk on mode is very positive for EM bonds. Many investors had reduced risk ahead of the election and seem to be reallocating capital to risk assets as evidenced by the ongoing equity market’s rally and the tightening of credit spreads in DM and EM alike. The promise of tax cuts and deregulation seem to be dominating the risks of trade wars for now. Just like in the DM world, EM spreads are tighter than historical averages, but they do not look all that expensive when compared to historically high equity valuations. This relative value perspective should also contribute to the return of inflows to EM bonds.

Trump’s victory will result in winners and losers across EMs. The promise of higher tariffs on China is one that we expect will be delivered and therefore leaves little doubt that China should be among the losers from this election. Other Asian economies may suffer too given their economic integration with China. Mexican assets are also likely to see increased volatility as we think the USMCA trade agreement will probably come under scrutiny ahead of the 2026 sunset clause embedded in the trade agreement. On the positive side of the spectrum, we think Latin American countries with right-wing leaders will tend to benefit from a Trump presidency. Argentina’s President Milei will travel to the US this week to meet with Trump and Elon Musk, and it is conceivable that the US will find ways to financially support Argentina. Other countries like Ecuador and El Salvador could also benefit in a similar fashion. In the case of Brazil, we don’t think the country will gain or lose much despite having a left-wing president. Brazil is a large, closed, economy that is less sensitive to global trade than the average EM, and its commodity exports to China – its main trading partner – do not appear to be at risk.

Any projections or forward-looking statements regarding future events or the financial performance of countries, markets and/or investments are based on a variety of estimates and assumptions. There can be no assurance that the assumptions made in connection with the projections will prove accurate, and actual results may differ materially. The inclusion of forecasts should not be regarded as an indication that Vontobel considers the projections to be a reliable prediction of future events and projections should not be relied upon as such. Vontobel reserves the right to make changes and corrections to the information and opinions expressed herein at any time, without notice.

Information has been obtained from sources believed to be reliable, but J.P. Morgan does not warrant its completeness or accuracy. The Index is used with permission. The Index may not be copied, used, or distributed without J.P. Morgan's prior written approval. Copyright 2024, J.P. Morgan Chase & Co. All rights reserved.

“BLOOMBERG®” and the Bloomberg indices listed herein (the “Indices”) are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the Indices (collectively, “Bloomberg”) and have been licensed for use for certain purposes by the distributor hereof (the “Licensee”). Bloomberg is not affiliated with Licensee, and Bloomberg does not approve, endorse, review, or recommend the financial products named herein (the “Products”). Bloomberg does not guarantee the timeliness, accuracy, or completeness of any data or information relating to the Products.

This document is not the result of a financial analysis and therefore the “Directives on the Independence of Financial Research” of the Swiss Bankers Association are not applicable. Vontobel and/or its board of directors, executive management and employees may have or have had interests or positions in, or traded, or acted as market maker in relevant securities. Furthermore, such entities or persons may have executed transactions for clients in these instruments or may provide or have provided corporate finance or other services to relevant companies.

In the United States: Vontobel Asset Management, Inc. is registered with the U.S. Securities and Exchange Commission as an investment adviser under the Investment Advisers Act of 1940, as amended. Registration as an Investment Advisor with the U.S. Securities and Exchange Commission does not imply a certain level of skill or expertise. Advisory services for any strategies discussed herein are offered through a Participating Affiliate structure between Vontobel Asset Management, Inc., Vontobel Asset Management AG, and Vontobel (Hong Kong) Limited. Where applicable, certain investment staff may be deemed as Associated Persons and therefore subject to SEC requirements as part of the Participating Affiliate structure.

In Canada: Vontobel operates in connection with our investment and business activity pursuant to the following: Vontobel Asset Management Inc. relies on the International Adviser Exemption in the provinces of Alberta, British Columbia, Saskatchewan, Ontario and Quebec and the Investment Fund Manager Exemption in Ontario and Quebec. Vontobel Asset Management AG relies on the Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

For US Offshore and LatAm: Information herein prepared and approved for institutional / professional investors and approved for use in certain jurisdictions only. Vontobel offers a variety of products and services intended solely for qualified investors from certain countries or regions. Your country of legal residence will determine the products or services that are available to you. Information herein should not be considered a solicitation or offering for the sale of any investment product or service to any person in any jurisdiction where such solicitation or offer would be unlawful or prohibited. Furthermore, this information is not intended for use in any jurisdiction which would subject Vontobel to any registration, licensing or other authorization requirement within such jurisdiction or country. It is the responsibility of the recipient to inform themselves and observe applicable regulations and restrictions for their respective jurisdiction(s). Information herein is not intended for retail investors and/or distribution to the general public in any jurisdiction.

Although Vontobel believes that the information provided in this document is based on reliable sources, it cannot assume responsibility for the quality, correctness, timeliness, or completeness of the information contained in this document. Except as permitted under applicable copyright laws, none of this information may be reproduced, adapted, uploaded to a third party, linked to, framed, performed in public, distributed, or transmitted in any form by any process without the specific written consent of Vontobel. To the maximum extent permitted by law, Vontobel will not be liable in any way for any loss or damage suffered by you through use or access to this information, or Vontobel’s failure to provide this information. Our liability for negligence, breach of contract or contravention of any law as a result of our failure to provide this information or any part of it, or for any problems with this information, which cannot be lawfully excluded, is limited, at our option and to the maximum extent permitted by law, to resupplying this information or any part of it to you, or to paying for the resupply of this information or any part of it to you. Neither this document nor any copy of it may be distributed in any jurisdiction where its distribution may be restricted by law. Persons who receive this document should make themselves aware of and adhere to any such restrictions.