What’s keeping investors awake at night? (and what about EMD?)

Fixed Income Boutique

Key takeaways

- Emerging market fixed income has continued to experience outflows in 2025, despite the strong performance of hard-currency emerging markets debt over the past two years.

- We explore two of the most concerning risk scenarios that may be deterring investors from EM bonds at the moment; potential trade wars and disorderly bond markets.

- Our opinion is that these negative scenarios would not impact EM bonds more than other asset classes. In fact, EM bonds provide significant country diversification, which may potentially dilute unpredictable trade-related risks specifically.

- Moreover, the negative correlation between bond yields and EM spreads provides a potential safeguard against scenarios of persistent inflation and moderate risk-off events.

- A tail risk of rising bond yields, combined with a risk-off event, is possible – when the correlation between bond yields and spreads turns positive. However, we believe this is a low-probability scenario at the moment.

EM fixed income offers the diversification necessary in a highly uncertain environment

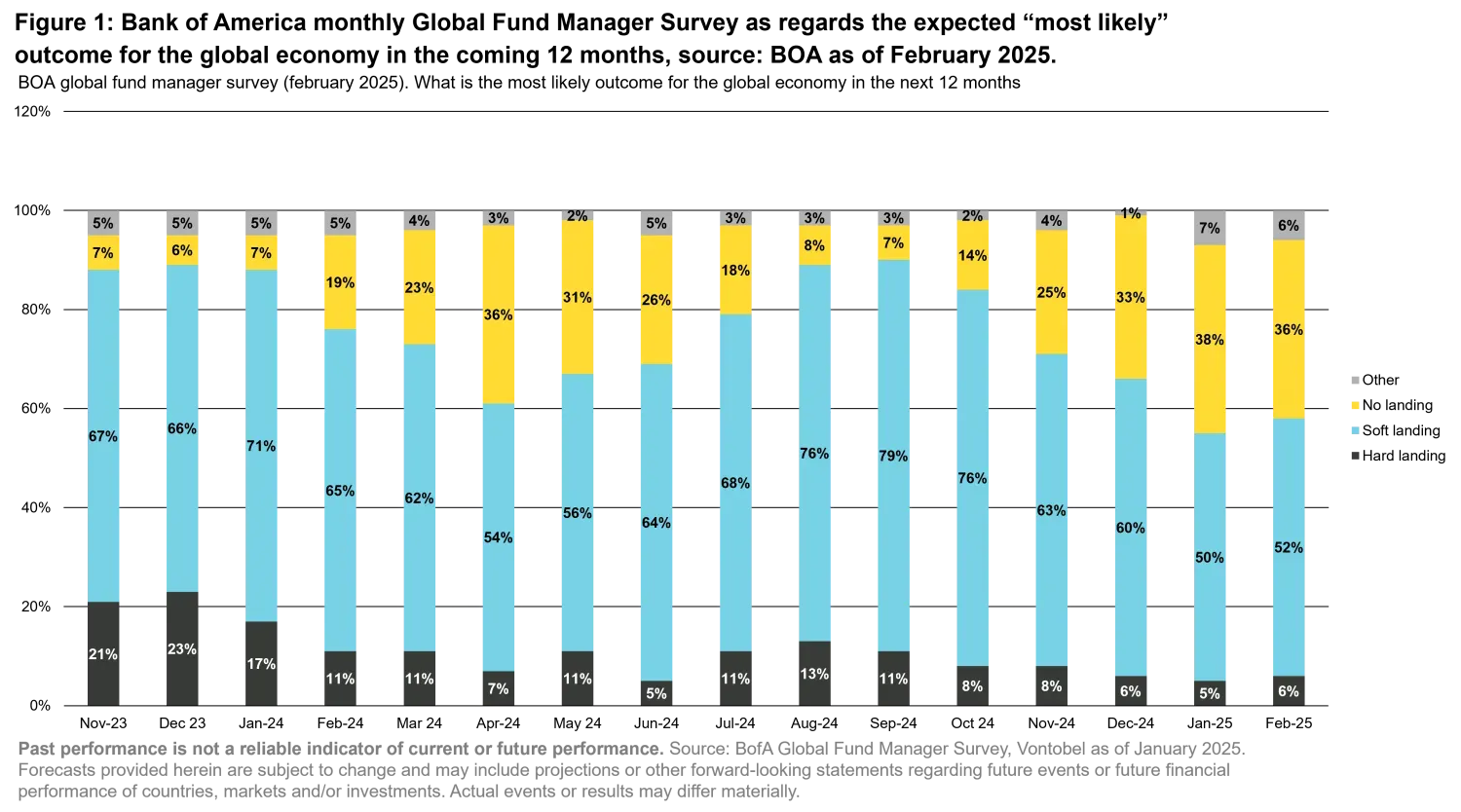

Institutional investors remain resolutely optimistic despite the challenges posed by Trump's trade war 2.0. According to the latest Bank of America Global Fund Manager Survey, institutional investors are predominantly overweight in equities, with low cash levels – slightly below 4% on average. Furthermore, the proportion of investors expecting “no landing” or “above-trend growth and above-trend inflation” continues to increase, although it still represents a minority.

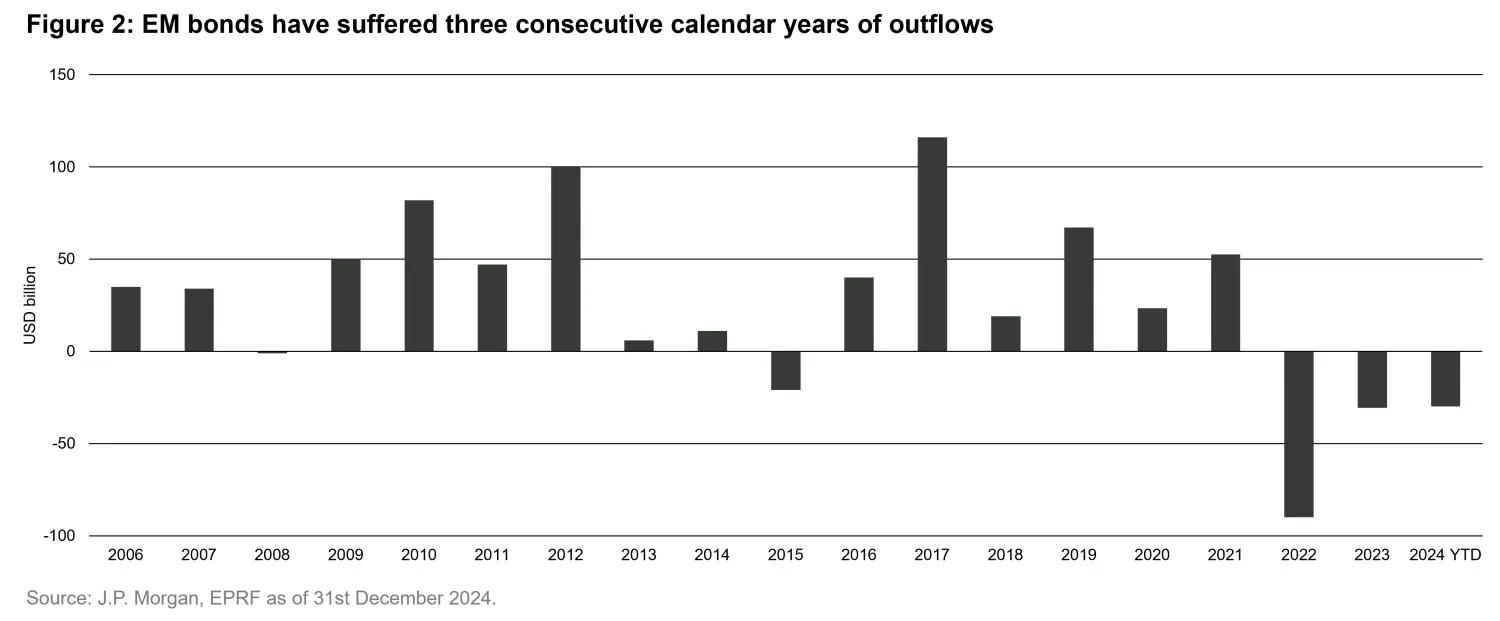

Emerging market fixed income is one of the few risk assets that remains out of favor. Emerging market bonds have experienced three consecutive years of large outflows as measured by EPRF’s fund flows tracking dedicated to EM funds. These outflows have persisted into 2025—albeit at a slower pace recently with $0.5bn in outflows YTD as of mid-February —despite two consecutive years of strong performance from hard-currency EM bonds.

In 2022 and 2023, outflows were driven by exaggerated fears of a supposed wave of EM sovereign defaults that ultimately failed to materialize. Why do these outflows persist despite the fact that nearly all high-yield (HY) issuers have regained market access and there is a clear trend of credit rating upgrades within the asset class?

A potential explanation is that the unpredictability of Trump's trade policy has led some investors to question whether it is a good time to invest in emerging markets, which may be on the receiving end of tariffs, sanctions, or lower/no USAID – the latter mainly affects low-income countries that lack tradable debt. Meanwhile, long positions in U.S. equities and HY bonds seem to remain unchallenged, as if Trump's policies pose no threat to U.S. growth, inflation, or corporate profitability. In this article, we will address several key concerns that are keeping institutional investors awake at night and discuss their implications for emerging market fixed income.

Risk scenario 1: What if the Trade War is for real?

The Trump administration has already implemented an additional 10% tariff on imports from China and plans to raise the tariff from 10% to 25% on steel and aluminium imports. Additionally, there are threats of 25% tariffs on Canada and Mexico, as well as reciprocal tariffs on the rest of the world. Countries or provinces that were previously off the radar, such as Colombia, Panama, and Greenland, have also faced these threats. In light of this policy unpredictability, diversification is essential for protecting investors' portfolios.

We believe that emerging market fixed income offers the diversification investors need in an unpredictable Trump 2.0 environment. With 72 countries represented in the J.P. Morgan EMBI Global Diversified Index (along with several additional investable off-benchmark countries), hard-currency sovereign bonds offer broad diversification in a world where predicting the next target is almost impossible. Similarly, hard-currency corporate bonds, as per the J.P. Morgan CEMBI Broad Diversified Index, also provides significant diversification, encompassing companies from 65 countries with a maximum country exposure of less than 6.4% (China) and with around 750 different individual issuers.

The J.P. Morgan GBI-EM, which represents the local-currency index, provides relatively less country diversification, encompassing "only" 19 countries in the index. Despite this, it ensures a maximum concentration of 10% per country, including Indonesia, Malaysia, and Mexico. However, it provides a broader diversification concerning potential interest rates and currency exposures. This stands in stark contrast to EM equities, where a few Asian countries account for nearly two-thirds of the index.

The outlook for hard-currency bonds is less uncertain than that for local-currency bonds, in our opinion. A serious escalation of the trade war 2.0 would likely create a negative scenario for EM local-currency assets, similar to the situation in 2018. However, with EM foreign exchange (FX) already trading at such low valuations (following negative returns in 2024), local-currency bonds have outperformed EM hard-currency bonds so far this year even when valued in USD (as of 25th February, EM local currency outperforms EM hard currency sovereign by 0.91% and EM hard currency corporates by 1.54%, source: JP Morgan & Bloomberg), and that despite the numerous threats of tariffs.

We suspect that the outlook for EM local-currency assets is relatively binary: this asset class could either be the best performer among EM fixed income if the trade war turns out to be relatively mild and short-lived, or it could be the worst performer among the three EM fixed income sub-asset classes, potentially posting negative returns for a second consecutive year if the trade war 2.0 is severe and prolonged, driving USD strength.

Against that background, we believe that investors with a more modest risk appetite would likely prefer exposure to EM hard-currency bonds. These markets provide greater country and issuer diversification against unpredictable trade wars and present less downside risk in the event of a severe trade conflict. However, local-currency bonds offer considerably more upside potential in the case of a mild trade war and should presumably be the preferred choice for investors who are optimistic that President Trump's trade-related threats are more bark than bite.

Risk scenario 2: inflation remains sticky, and the Federal Reserve ceases rate cuts (or even hikes rates)

According to Bank of America's Global Fund Manager Survey from February 2025, inflation prompting the Fed to raise interest rates is identified as the most significant tail risk for 2025, even slightly surpassing the risk of a "trade war triggering a global recession”. Furthermore, the same survey highlights a “disorderly rise in bond yields” as the most bearish development for 2025, which is a highly correlated risk.

US inflation surprised on the upside in January, with consumer prices rising by +0.5% month-over-month (+3.0% year-over-year), compared to the anticipated +0.3% m/m (+2.9% y/y) expected. Additionally, several of Trump's policies—such as taxes, tariffs, and immigration—are expected to be inflationary. It is therefore not surprising that this issue is at the forefront of investors' concerns.

We concur that a scenario characterized by higher inflation and higher bond yields poses the most significant bearish risk for 2025, especially if it coincides with a risk-off event. This situation could arise if aggressive tariff hikes trigger higher inflation. However, it is important to note that this is not a risk exclusive to EM; rather, it is a scenario that would adversely impact all asset classes.

Investors are concerned about such an event because it resembles what happened in 2022, when bond yields increased, and spreads widened simultaneously. However, while these occurrences do happen occasionally, they are quite rare for good reasons.

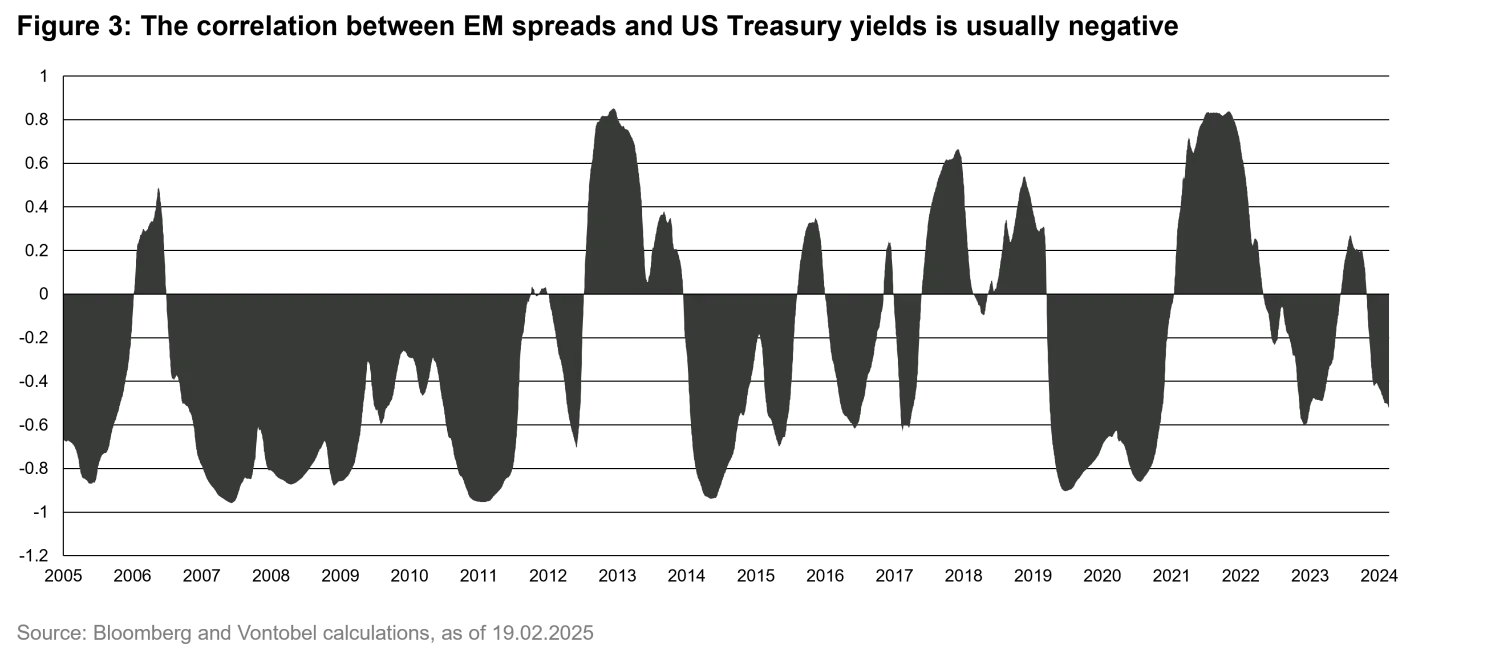

From a macroeconomic perspective, there is a compelling reason why the correlation between EM spreads and U.S. Treasury yields has remained negative for 69% of the time over the past 20 years. The Fed typically implements aggressive rate cuts and engages in QE during recessionary periods, such as the Global Financial Crisis and the COVID-19 pandemic. These periods are marked by the economy operating significantly below its potential, often accompanied by very low inflation, which facilitates loose monetary policy and consequently results in lower U.S. Treasury yields. Simultaneously, these periods of stress are generally associated with higher credit spreads in DM and EM. In contrast, periods of relatively strong economic growth and elevated risk appetite are typically characterized by tighter credit spreads and neutral or contractionary monetary policy, leading to higher yields.

Only on rare occasions, such as the taper tantrum in 2013 or in 2022 when inflation surged dramatically alongside the risk-off event of Russia’s invasion of Ukraine, have we observed persistent positive correlations between US Treasury yields and EM spreads. These periods of stress often coincide with times when the correlation between equities and bonds is positive; that is, when the defensive nature of bonds may falter.

The good news is that we are currently experiencing a period of negative correlation between EM spreads and yields. If inflation accelerates or disinflation stalls within the context of a robust economy, yields may rise while spreads are likely to tighten further. In this scenario, credit and EM fixed income can continue to deliver attractive total returns, as was the case during Q4 of 2024.

The dreaded scenario would involve inflation accelerating during a severe trade war, ultimately leading to a global recession, or “hard landing”. However, the implications for bond yields and the Fed's response in such a situation are less straightforward.

If inflation accelerates amid a trade war, we believe the Fed would likely view this tariff-induced cost increase as a one-off shift in the price level rather than a sustained source of inflation. Only a continuously escalating trade war would serve as a persistent source of inflation. Thus far, most global leaders have demonstrated restraint in response to Trump’s tariff threats. Given the Fed’s dual mandate of price stability and maximum employment, we believe the Fed would closely monitor the negative effects of tariffs on U.S. economic activity and would likely avoid raising interest rates unless there is a significant de-anchoring of inflation expectations. Therefore, we consider the scenario of a “disorderly rise in bond yields” to be unlikely. Moreover, whilst investors in the monthly BOA survey do perceive disorderly bond movements to be a tail risk, investors perceive the spill-over risk into a “hard landing” to be a marginal expected outcome (6%) over the coming 12 months. This is illustrated in Figure 1 above of the BOA monthly survey.

To conclude

In our view EM fixed income does not appear more vulnerable than other asset classes to these risk scenarios, and so the recent outflows from the asset class appear all the more surprising. On the contrary, it offers greater diversification against country-specific shocks compared to other asset classes as well as attractive relative valuations, providing extra buffer against potential volatility. Furthermore, the negative correlation between yields and spreads partially hedges this asset class against the risk of rising bond yields. This negative correlation also benefits investors during modest or short-lived risk-off scenarios, such as the one experienced during the first week of August 2024, when markets sold off, EM spreads temporarily widened, and US Treasury yields declined. Finally, we consider the risk of a “disorderly rise in bond yields” combined with a risk-off event—where the correlation between bond yields and spreads turns positive—to be unlikely at this time. This is primarily because we believe that the Fed would likely look through any one-off rise in inflation caused by higher tariffs and instead focus on the negative effects on the US economy.

Important Information: This marketing document was produced by one or more companies of the Vontobel Group (collectively "Vontobel") for institutional clients. Past performance is not a reliable indicator of current or future performance. The return may go down as well as up, e.g. due to changes in rates of exchange between currencies. The value of invested monies can increase or decrease and there is no guarantee that all or part of your invested capital can be redeemed. Investing involves risk, including possible loss of principal. Diversification does not assure a profit or protect against loss in declining markets. Indices are unmanaged; no fees or expenses are reflected; and one cannot invest directly in an index. Any projections or forward-looking statements regarding future events or the financial performance of countries, markets and/or investments are based on a variety of estimates and assumptions. There can be no assurance that the assumptions made in connection with the projections will prove accurate, and actual results may differ materially. The inclusion of forecasts should not be regarded as an indication that Vontobel considers the projections to be a reliable prediction of future events and projections should not be relied upon as such. Information has been obtained from sources believed to be reliable but Bank of America and J.P. Morgan do not warrant its completeness or accuracy. J.P Morgan Index is used with permission. The Index may not be copied, used, or distributed without J.P. Morgan's prior written approval. Copyright 2024, J.P. Morgan Chase & Co. All rights reserved. Vontobel reserves the right to make changes and corrections to the information provided herein at any time, without notice. Any unauthorized disclosure, use or dissemination, either whole or partial, of this document is prohibited and this document is not to be reproduced, copied, made available to others.