Fixed income markets in 2025: Shifting terrain

Fixed Income Boutique

Key takeaways

- Credit spreads have tightened; there is less outright value in credit beta.

- Volatility and dispersion remain high; alpha potential is exceptional.

- Tail risks are high and equity markets are in a risk-on environment; exert caution and maintain liquidity.

- Flows into fixed income can support returns in 2025, particularly in emerging markets.

- The path for the Swiss Franc and Euro is more predictable than the USD or GBP.

As we publish our Fixed Income Quarterly report, we aim to provide our perspectives on the current state of the asset class, rather than highlight its benefits as one might expect. It is not easy to strike the right balance at times like this, when some asset classes are reaching unprecedented highs or displaying seemingly irrational degrees of certainty about the future, but we must remain within the confines of the bond markets.

Therefore, in the interest of providing adequate balance, let us state at the outset some of our concerns about the fixed income markets:

- Credit spreads are inside historical averages

- Compression in credit spreads means that the riskiest elements offer even less “value” than the less risky parts

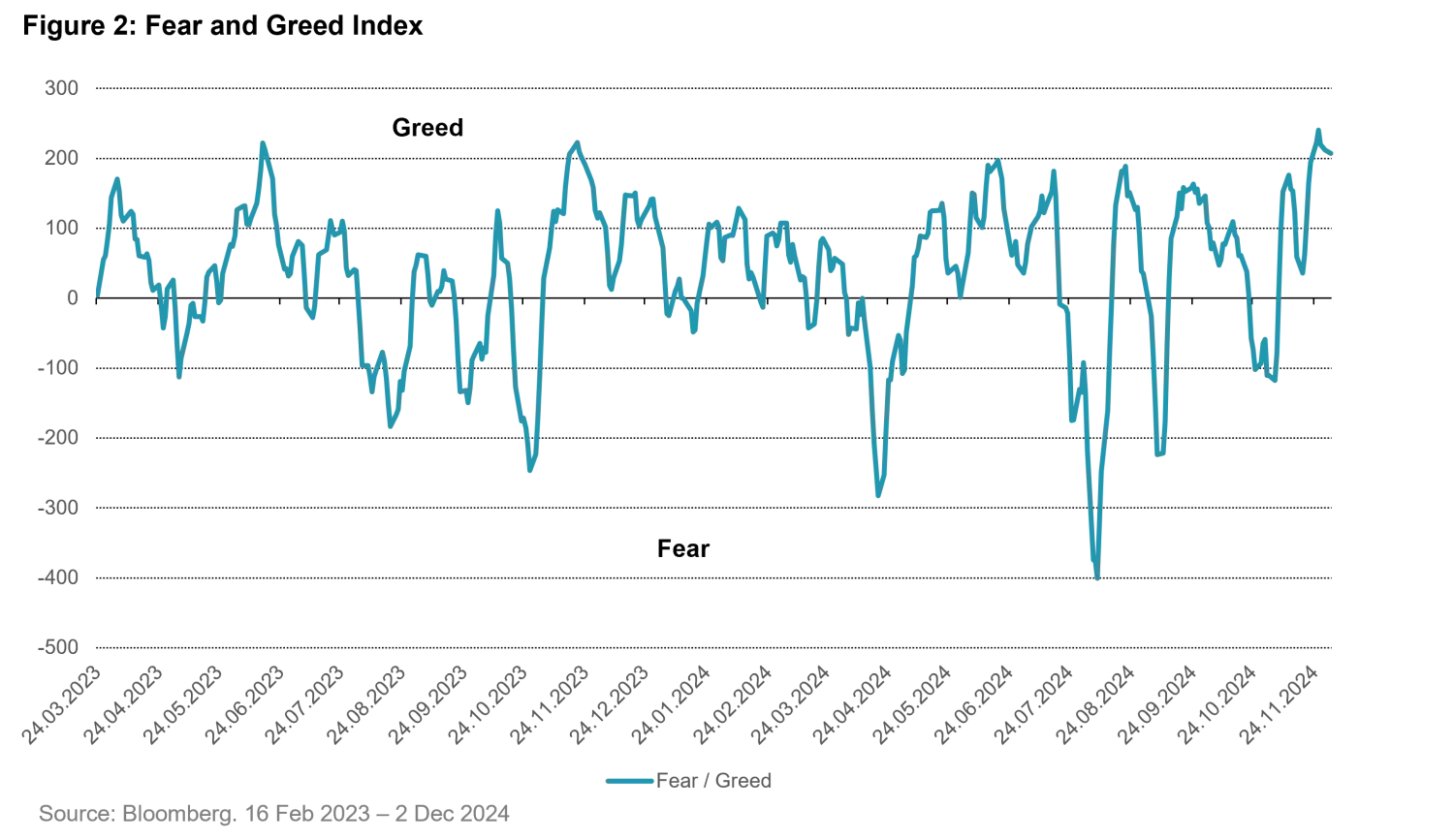

- While uncertainty around geopolitics, US inflation, and the path of rates remains elevated, markets appear somewhat complacent

- Very few defaults occurred during this period of higher interest rates, and as such, we have not seen the cleansing of the Augean Stables that we may have hoped for.

Now let us tackle each of these in turn because they, in fact, form the basis of many of our positive views for active fixed income in 2025.

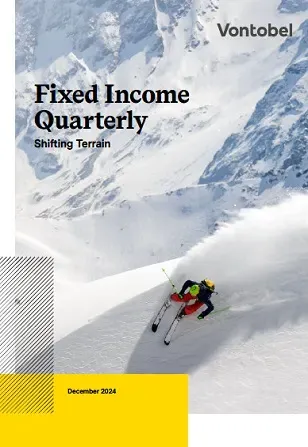

Credit spreads

Figure 1 shows the distribution of credit spreads relative to their historical mean across five major credit default swap indices over the past twelve years. The first observation that I hope to convey is the similarity in these distributions, each plotted using their mean as 100%. In fact, if we had extended the time period to pre-financial crisis, the shapes would have remained consistent, although the means would have shifted to higher absolute levels. The second observation is that a significant portion of the distribution sits at or below the mean. This is a natural consequence of the asymmetry of our asset class. Notably, there is no left-hand tail in this distribution as spreads are bound by zero.

In fact, while each of these indices is tighter than historical averages, the spreads are roughly 75% of mean spreads but closer to 90% of median spreads, meaning that we spend a significant amount of time at or tighter than these levels. Furthermore, having weathered the storm of higher interest rates over the last two years, we anticipate that forward-looking default expectations should have adjusted downwards. Consequently, we believe it is justified that we find ourselves here.

It would be hard to argue that credit spreads offer significant value from here in “beta” terms, but while we stay at or around these levels the ability to generate alpha through dispersion and mispricing should persist.

Compression

High yield spreads have outperformed investment grade spreads, with the lower end of high yield outperforming the crossover space. Additionally, corporate credit spreads have outperformed sovereign credit spreads. All of these are true both in absolute and relative terms. This might suggest that dispersion has diminished, leaving limited opportunities for active managers. However, 2024 has proved almost the opposite. The market has been volatile, dispersion has persisted, and investors can still earn a premium from emerging markets over similar risk developed market credit. Furthermore, investors can still extract value from selecting the right instrument from an issuer.

Indeed, the rising tide has lifted all ships, but not equally. In the following pages, we will discuss the areas where we currently find value, but the key message we want to convey, as we sit at relatively elevated market levels, is that we fully expect to revise our views a number of times in 2025. We may not be able to replicate the substantial alpha generated in 2024, but we are confident that opportunities to do so will present themselves.

Uncertainty

Much of the focus in the coming months will be on the new Trump administration’s much vaunted tariff regime, its effects on trade, implications for China, potential impact on inflation and by extension interest rates. To provide some context:

- Global trade exploded over the past 50 years, escalating from approximately $250billion in 1970 to $19trillion by 2020

- China’s entry into the World Trade Organization (WTO) in 2001 had a profound impact on US-China trade, resulting in an increase from $100billion to over $700billion two decades later

- The US is China’s second-largest trading partner, accounting for 16% of its trade. China is the country from which the US imports the most, slightly ahead of Mexico and Canada

- China ranks as the third-largest destination for US exports, well behind Canada and Mexico but almost twice as large as either Japan or the UK, who comprise the remaining top five importers from the US

The Trump campaign trail was awash with tariff talk and indeed this continues as he approaches the steps of the White House, but markets do not appear to be pricing in a strongly negative medium-term impact. If one thing is certain in this world of uncertainty, it is that President Trump is likely to shake things up. Our view is that, at a minimum, this increases opportunity, but it undoubtedly gives rise to higher tail risk.

No cleansing in developed markets, good cleansing in emerging markets

During the Covid crisis, we saw what could be characterized as a mini-credit cycle. Several high yield US Oil and Gas companies defaulted or filed for bankruptcy. Aside from these and a handful of high-profile banks, few defaults have occurred in developed markets since the Global Financial Crisis. On the contrary, many defaults took place in EM in the last four years, implying that almost all weak links in EM fixed income have already fallen. This has been good news for fixed income investors and a sign that the financial health that has been much discussed has held true. However, it is undoubtedly worrisome for the next few years. A good clear out is beneficial for credit conditions as it tends to bring higher lending discipline and kill off those zombie borrowers. Against this backdrop, we enter 2025 expecting the slow trickle of high yield names in the US and Europe to continue. This is likely to give rise to pockets of volatility and risk aversion, offering opportunities for risk-conscious active investors. In EM, we expect corporate default rates to decline further in 2025.

But now does not appear to be anywhere near the time to dive straight into market beta; 2025 could be fun!