Your team in the United States

Our clients are at the center of everything we do

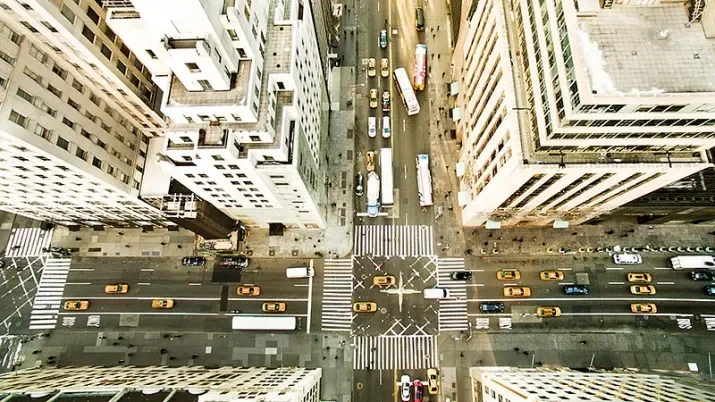

We serve investors in the United States from our offices in New York.

We are an active investment manager with international reach and a multi-asset class approach. Our investment capabilities draw on specialized investment talent and robust risk management, operating within a strong performance culture. We deliver leading-edge solutions for both institutional and private clients.

Our commitment to active management empowers us to invest on the basis of our convictions. We deliver value through our diverse and highly specialized teams.

Who can help you

Matthew McMenamy

Victor Schraner

Mariana Zubritski-Corovic

Where you can find us

New York

Vontobel Asset Management Inc.

66 Hudson Boulevard

34th Floor, Suite 3401

New York, NY 10001

United States of America

+1 212 804 9300