Access stocks of developed and emerging market countries.

Active, high-conviction investors

Our goal is to deliver to our clients long-term performance driven by stable, high-quality underlying earnings growth, paid for at sensible prices.

To achieve this, we seek to invest in companies with market leading positions and powerful franchises.

Our investment team has consistently followed this approach for the past 40 years.

In making our investment decisions, we undertake deep, company-by-company research that enables us to bring a clarity of understanding to the long-term market opportunity, susceptibility to competition, management strength and exposure to ESG risk. This is vital to maintain conviction through the bumps and bad headlines over time. Our return goal is built on providing absolute returns that beat the benchmark while exposing our investors to less risk through the economic cycle.

We actively manage our portfolios and are benchmark-agnostic.

As a fiduciary, we put our investors' interests above our own, making every effort to be a partner who understands our clients' needs and objectives.

23.5

bnQuality Growth Businesses

Seek to identify highly-profitable companies with consistent earnings growth, stable franchises and solid fundamentals. Global growth companies that perform well during economic expansions and tend to be resilient in difficult market environments.

ESG Integrated

Sustainability is a core strength required by long-term investors. Management choices towards the company’s stakeholders and the environment can have significant impact on a business. We engage managements on ESG issues.

Independent View

As bottom-up investors, a benchmark does not influence where we invest – but we are cognizant of how our portfolios compare to the broader universe.

Long-term Focus

Aim to compound earnings at a higher rate than the market over a full market cycle, with lower volatility.

Sensible Price

A conservative measure of value, with a margin of safety built into the earnings forecast.

Downside Protection

We strive to position our portfolios to participate in rising markets, but also protect capital in difficult market conditions. We believe that minimizing losses during market downturns has been the key to compounding client returns.

Our specialists

Originating from various countries and speaking many languages, our skilled and experienced global equity research team is passionate about bottom-up, fundamental research. Our investigative analysts dig deeper to help quantify risk and encourage debate. Thinking and investing like business owners, we naturally deviate from consensus views and benchmark weights. We build concentrated portfolios with low turnover from year to year. Our long team tenure – more than a decade on average – is particularly valuable as it enables us to develop a deep understanding of the businesses we cover over time.

First and foremost, our portfolio managers conduct bottom-up, intensive stock research. They collaborate with research analysts and traders on valuations and sizing of positions. Ultimately, portfolio managers make all final decisions regarding purchases and sales.

Donny Kranson, CFA®

Experts on both the markets and Vontobel's strategies, Client Portfolio Managers (CPMs) serve as the client's window to portfolio managers and research analysts. They are responsible for communicating the firm’s philosophy, process, performance, portfolio positioning and risk management.

Research analysts generate the best investment ideas in their individual sectors across the globe, by analyzing, among other metrics, a company's past performance, underlying business model, accounting issues, management track record, and ability to sustain earnings growth.

Donny Kranson, CFA®

Our philosophy

We believe that the earnings growth of an underlying business will ultimately be reflected in its stock price. Since genuine high quality businesses are scarce, our research team focuses on identifying those names that we believe can sustain superior earnings growth longer and are underappreciated by the markets. We believe that we can take advantage of this long-tail growth effect and add value for our clients by carefully constructing a portfolio of these types of businesses.

This belief system drives our bottom-up approach. Without the constraint of a benchmark, we start with a universe of investable names that meet our quality criteria. After rigorous research, we then consider the quality companies that, in our opinion, trade at attractive valuations for inclusion into our portfolios. This is a select group of companies, and, as a result, our portfolios are quite concentrated. By adhering to this investment approach, we seek to protect our clients’ assets in declining markets, while growing their assets in rising markets, thus driving superior long-term risk-adjusted returns.

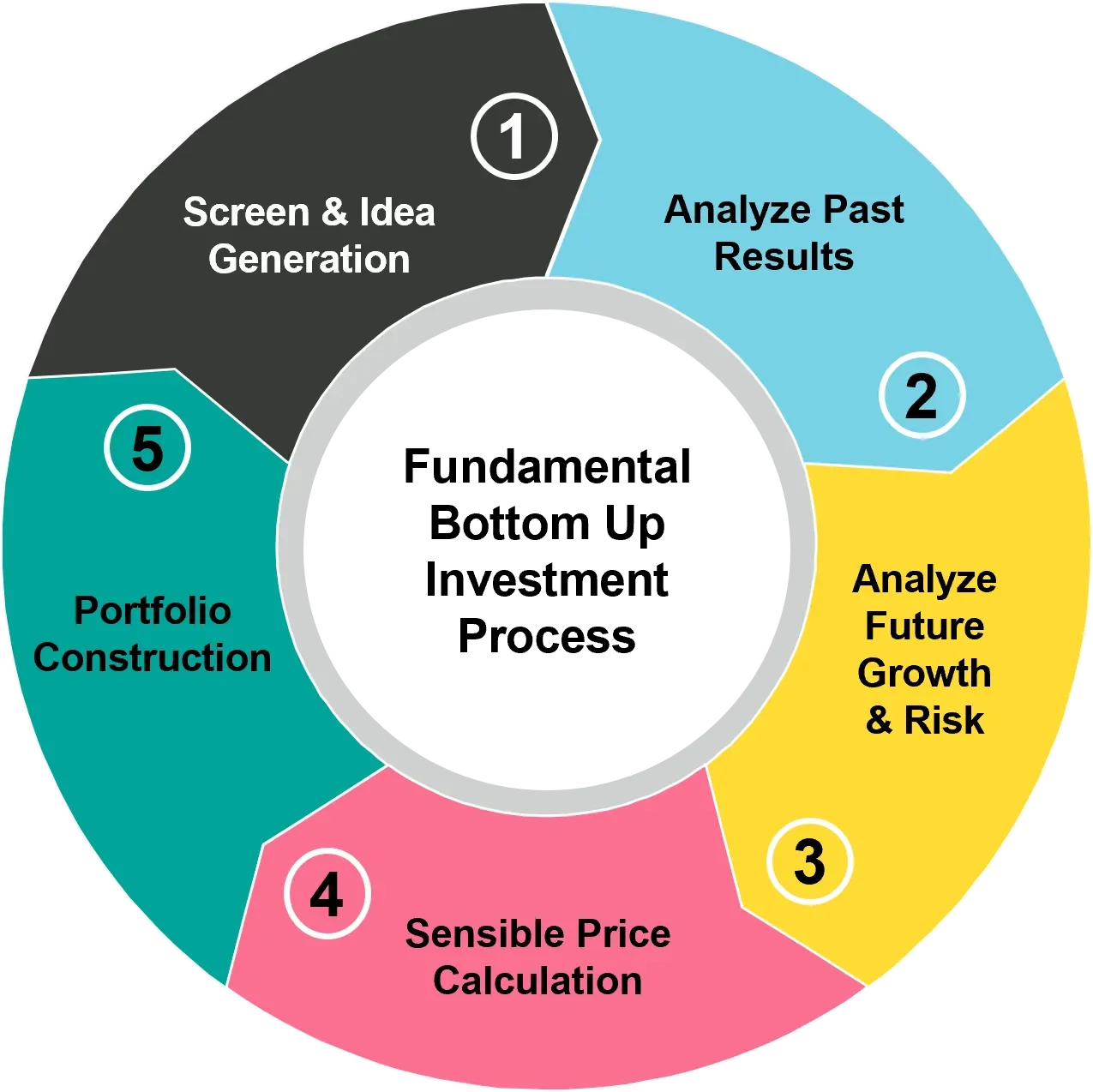

Our process

Our portfolios are built from the bottom-up, company by company. We consistently apply the same disciplined approach across all strategies.

Continuous five-step investment process

- Concentrate on business analysis (bottom-up approach)

- Seek high quality growth at sensible prices

- High conviction portfolio

- Benchmark unconstrained

- Long-term focus

Global Equity

International Equity

Access stocks of developed and emerging countries outside the United States.

Emerging Markets Equity

Access the growth and demographic expansion of emerging markets.

U.S. Equity

Access U.S.-domiciled local and multinational companies.

European Equity

Access European-domiciled local and multinational companies.