Access stocks of developed and emerging countries outside the United States.

International equities: finding growth in shifting markets

Quality Growth Boutique

Volatile markets this year have tested investors’ assumptions, including the common belief that US equities are a perennial safe haven. At Vontobel, we have always aimed to own the world’s best companies, wherever they are located, rather than making allocations based on geography. A thoughtfully constructed portfolio that combines leading US and non-US companies can offer meaningful advantages to long-term investors. Here are three key reasons why we believe international exposure warrants consideration:

1. Enhanced performance potential

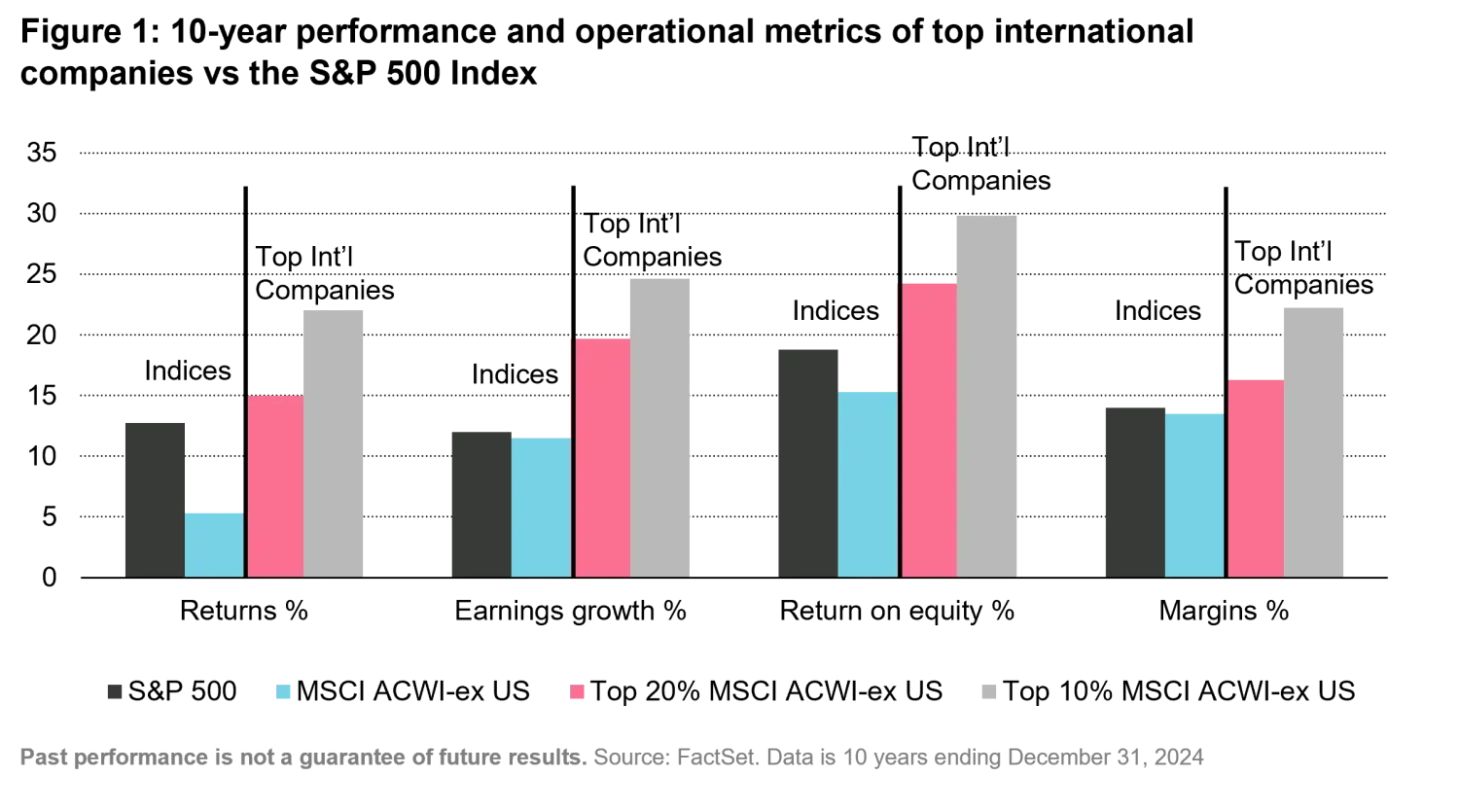

Over the past decade, the top 20% of international companies – representing more than 400 stocks – have outpaced the S&P 500 Index. This strong performance is rooted in solid fundamentals. Yet, due to benchmark composition, uncovering these outperformers requires an active manager to separate the leaders from the pack.

2. Compelling valuations

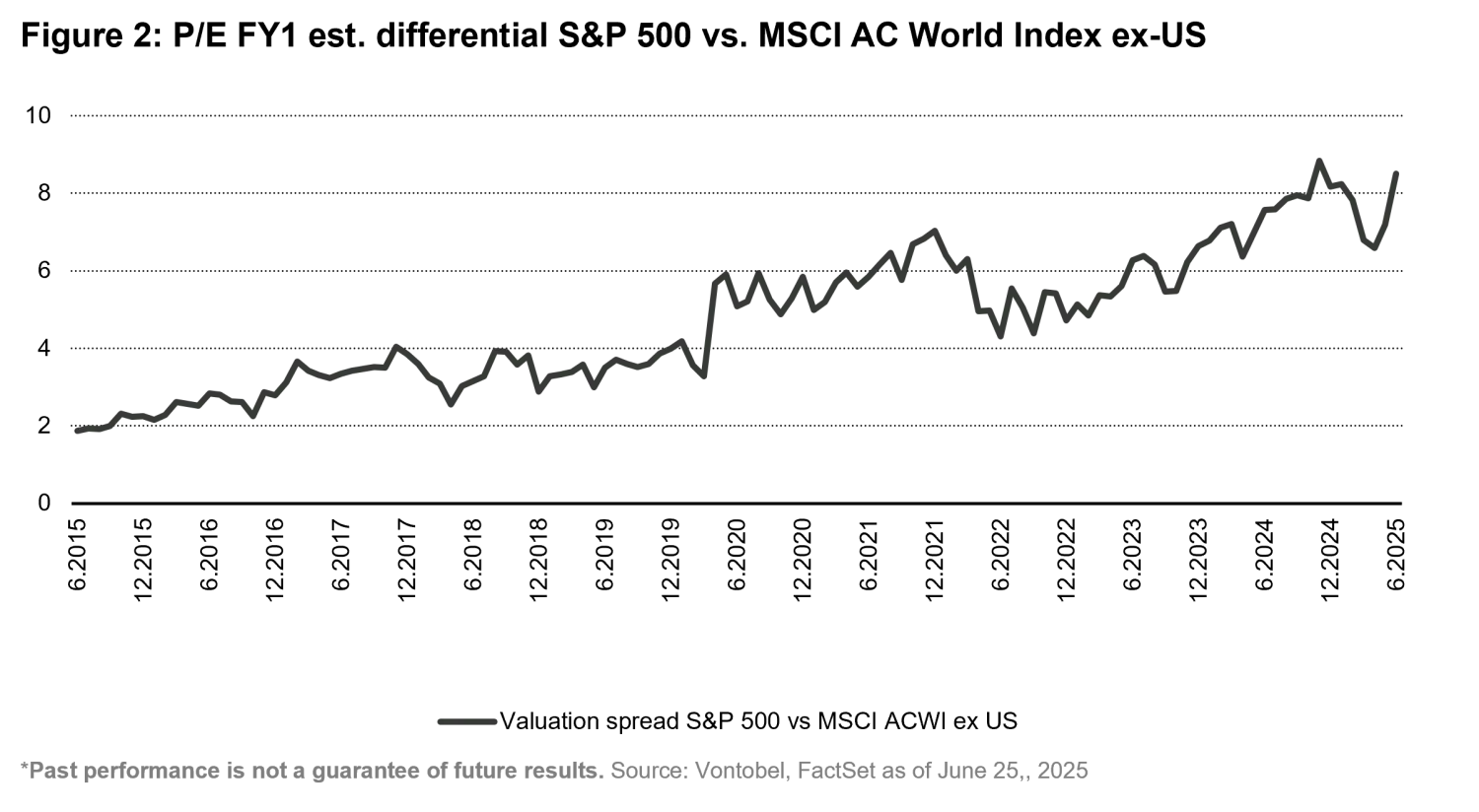

While the valuation gap between US and international equities has narrowed, international markets are still trading at a notable discount relative to US peers. This presents opportunities for investors seeking quality businesses at compelling entry points.

3. Access to growth industries where the US lags

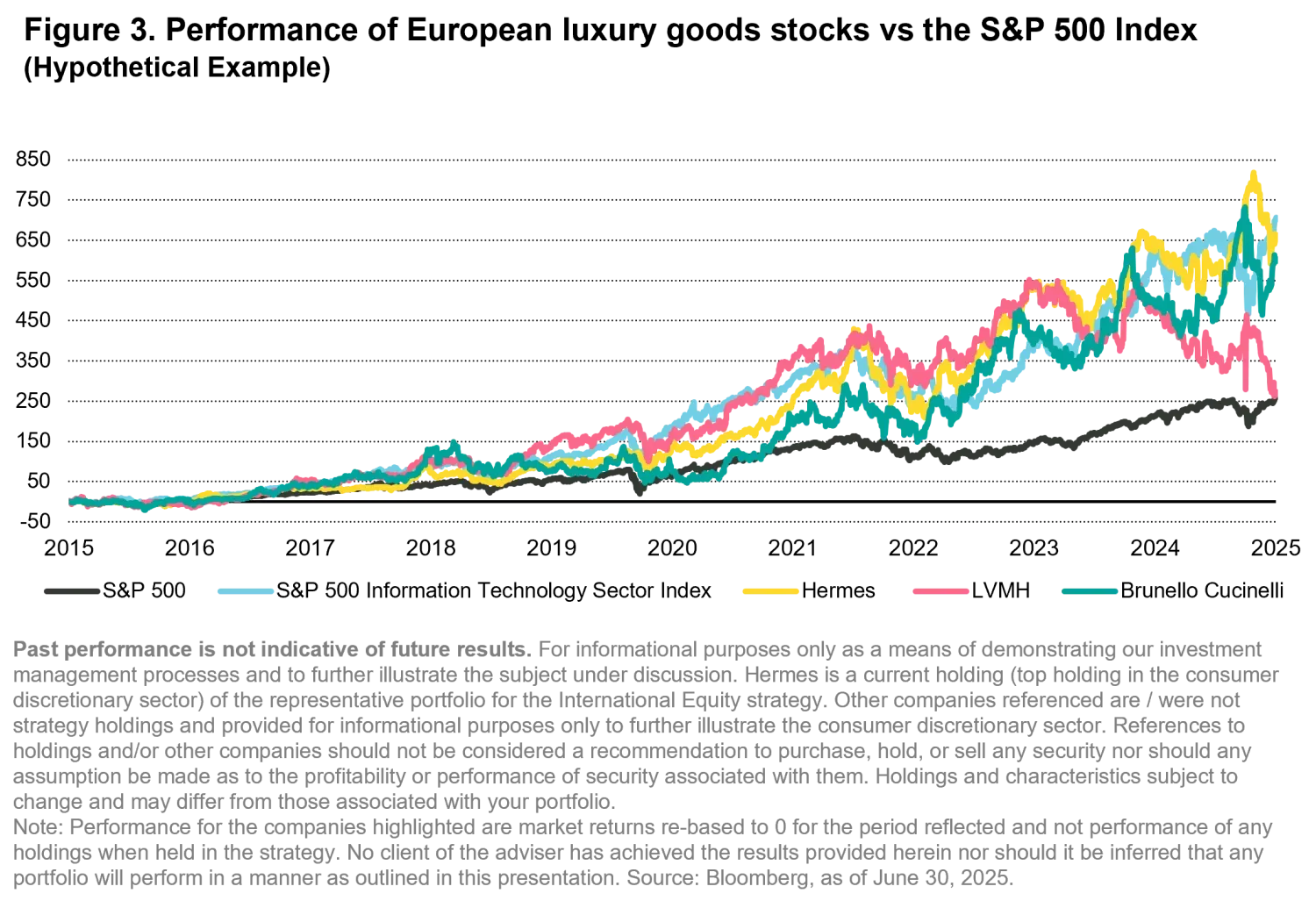

Although US companies lead in many sectors, certain industries thrive abroad. European firms, for example, dominate the luxury goods space – an area that has rivaled the returns of US technology companies, even in markets that are dominated by AI-driven growth.

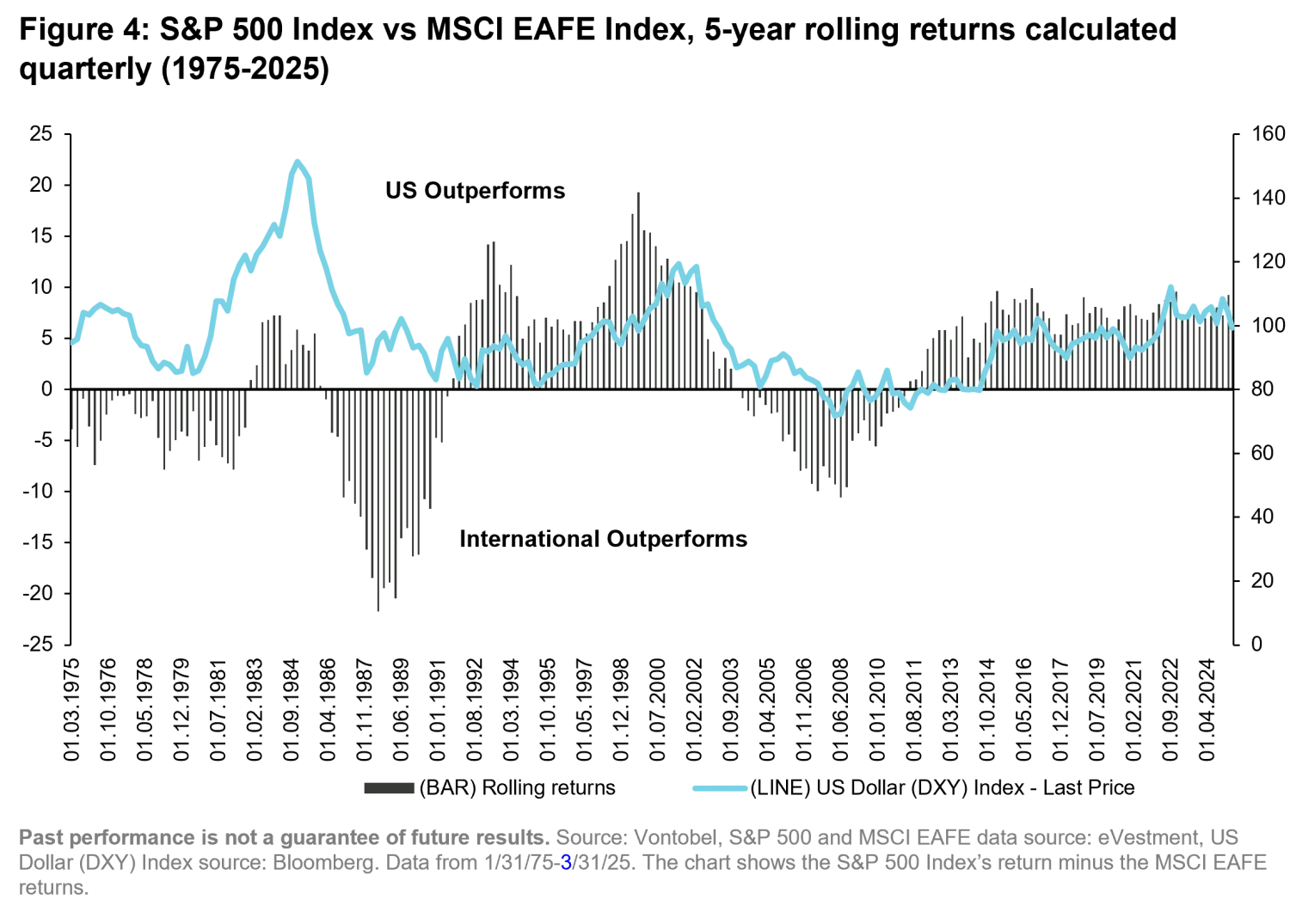

Markets inevitably shift, but global diversification endures

In early 2025, market leadership rapidly shifted. The Magnificent Seven, the strongest basket of stocks in the prior two years, became one of the worst-performing groups while European stocks emerged as one of the best-performing. Market cycles are impacted by a variety factors, most of which are unpredictable. However, we can be certain that shifts will occur. We believe this underscores the importance of holding a mix of domestic and international equities.

Why consider Vontobel International Equity?

Through an active, bottom-up approach, the Vontobel Quality Growth Boutique looks for those great international businesses that can complement portfolios of domestic stocks. We seek strong alpha capture with lower volatility and stronger downside capture than the market over a full cycle.

We focus on companies with predictable business models, sustainable earnings growth, and strong competitive advantages. By diversifying both idiosyncratic risks and currency exposure, we believe we can offer investors lower overall portfolio volatility and a potential hedge when the US is lagging the broader market.

Important Information; Holdings and companies discussed herein for illustrative purposes only to elaborate on the subject matter under discussion. Investments referenced should not be considered as a reliable indicator of the performance or investment profile of any composite or client account. Further, the reader should not assume that any investments identified were or will be profitable or that any investment recommendations or decisions we make in the future will be profitable. Information provided should not be deemed a recommendation to purchase, hold or sell any security. Where noted, portfolio characteristics and investments discussed herein are based on the representative portfolio for the International Equity strategy. There is no assurance that Vontobel will make any investments with the same or similar characteristics as the representative portfolio presented. The representative portfolio is presented for discussion purposes only and basis for the selection is this is the account which we believe most closely reflects current portfolio management style for the strategy. Performance was not a consideration in the selection of the representative account. Investments presented herein are not a reliable indicator of the performance or investment profile of any composite or client account. Lastly, your portfolio may not have the same characteristics and allocations as those associated with the strategy’s representative portfolio. There is no assurance that any securities discussed herein will remain in the portfolio at the time you receive this communication or that securities sold have not been repurchased. Securities discussed do not represent the entire portfolio and, in the aggregate, may represent only a certain percentage of the portfolio’s holdings. Indices are unmanaged; no fees or expenses are reflected; and one cannot invest directly in an index.