Strategies to tackle the top 3 risks in global equity markets

Quality Growth Boutique

Investors may be searching for signs of clarity, but we believe uncertainty and volatility are here to stay. Tariffs will have a significant impact on the global economy and their effects will take time to play out.

In our view, the Quality Growth philosophy rooted in predictability and its balanced construction approach leaves investors well positioned to weather the uncertainty of 2025, and the longer-term market cycles. We can see how our portfolios are positioned for resilience by diving into the three main drivers of the sobering sentiment: 1. Trump 2.0 and tariff-related uncertainty, 2. AI evolution and disruption and 3. a softening macro backdrop. Our Quality Growth portfolios have limited exposure to the most potentially impacted industries, while having significant exposure to industries that we believe offer some level of natural protection.

1. Trump 2.0 and tariffs – a moving target with real impact

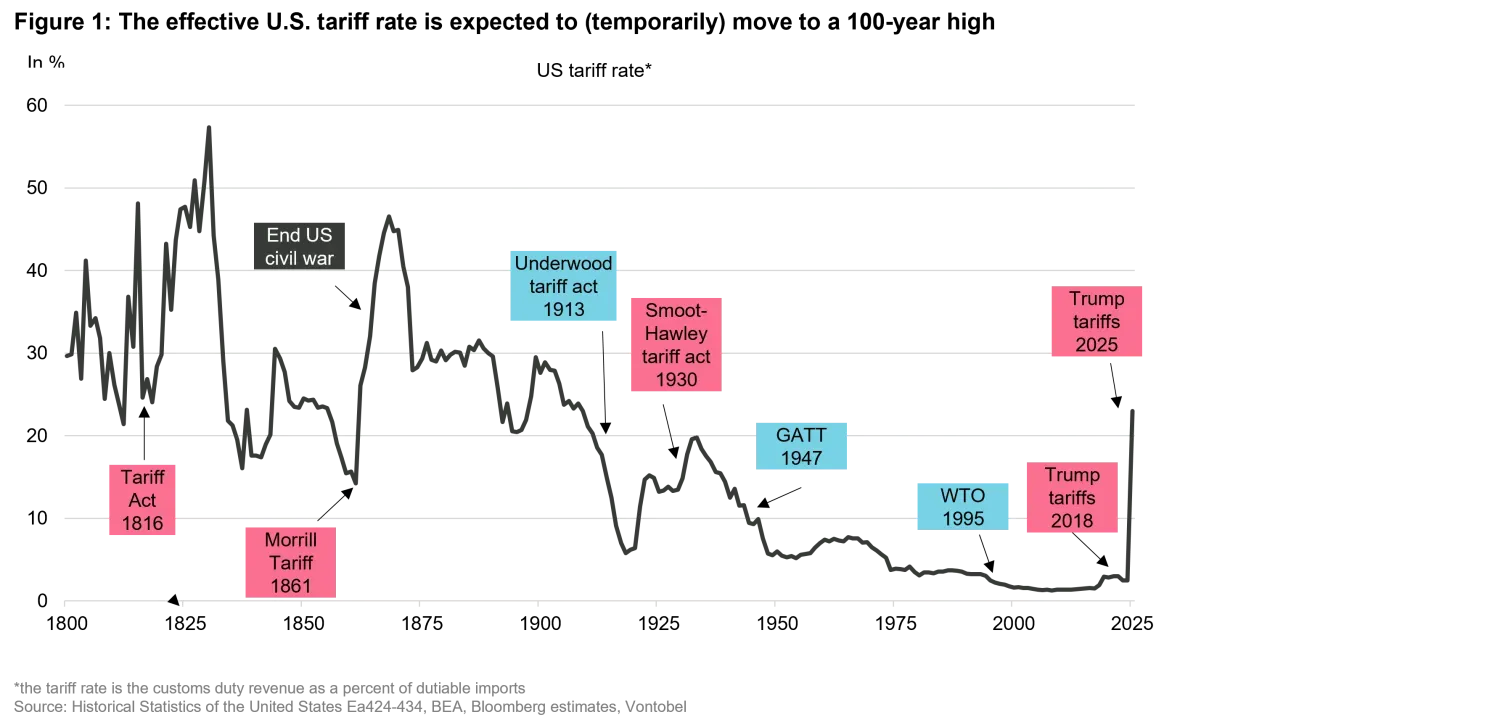

Investors were aware of the Trump administration’s promises of tariffs; however, the announcements on April 2, 2025, “Liberation Day,” took markets by surprise. President Trump announced reciprocal tariffs on a long list of countries, bringing the average effective tariff rate to approximately 25%, the highest level in over 100 years. The news resulted in a sharp selloff, wiping away trillions in market value in the subsequent trading days.

While the tariff conversation is still somewhat of a moving target as various countries attempt negotiations, we believe significant tariffs are here to stay as the President has remained consistent in his views, believing that the post World War II regime of globalization and free trade has decimated US manufacturing. As such, he views tariffs, while a blunt measure, the best way to right this perceived wrong.

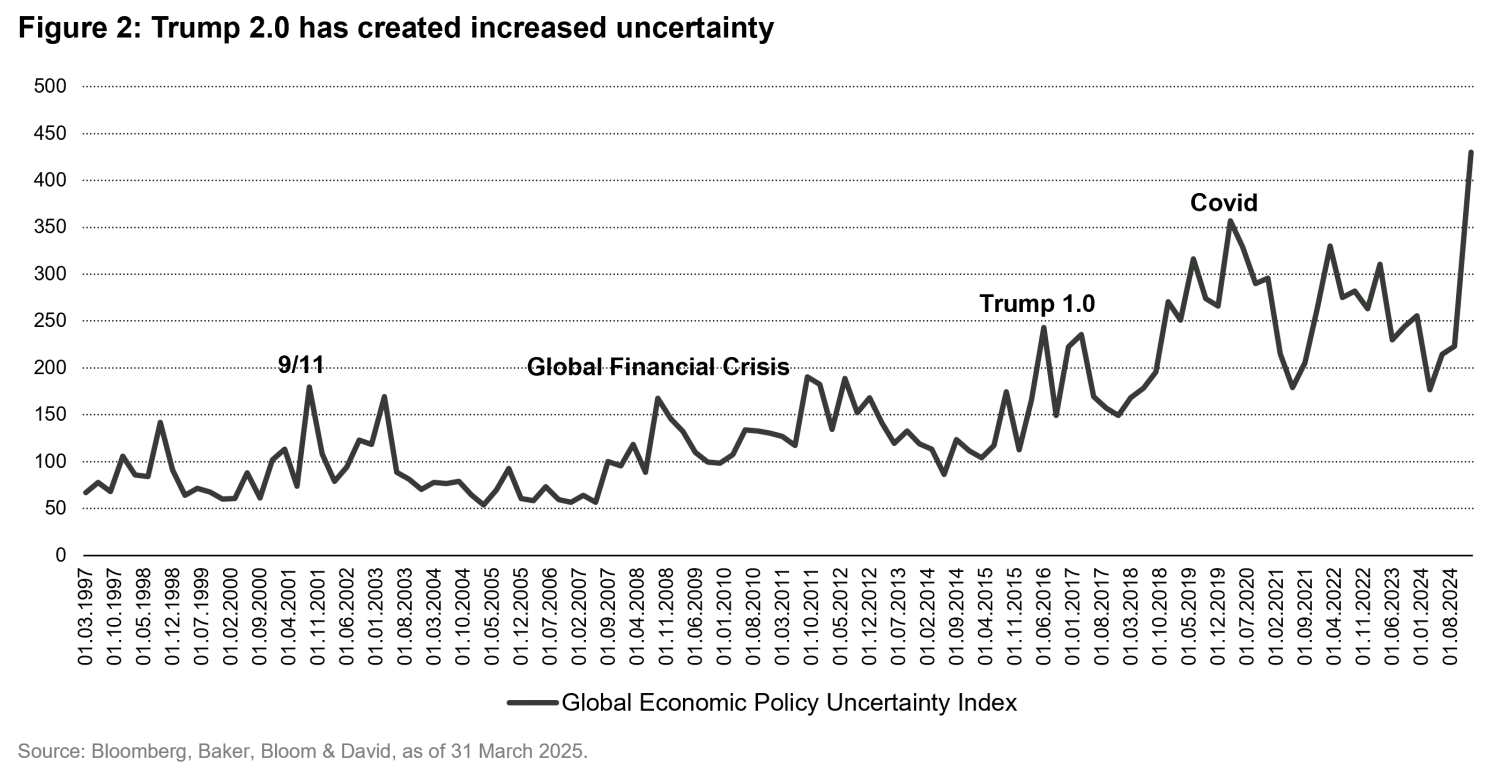

This has subsequently increased the level of trade policy uncertainty, bringing global economic policy uncertainty to a record level, even above what was experienced during Covid, 9/11, or the Global Financial Crisis, as measured by the Bloomberg Global Economic Policy Uncertainty Index (See Figure 2).

And while “Liberation Day” provided some directional insight, it has not provided the clarity investors were hoping for, meaning that uncertain sentiment is likely to be the new normal.

That said, the impact of tariffs will likely not be uniform across industries. We expect cyclical and capital-intensive industries, such as autos, oil & gas, and airlines, to be most negatively impacted. Our Quality Growth portfolios typically have less exposure to these industries given our ongoing focus on companies with low capital intensity, high pricing power and those that face limited competition. Service-oriented businesses tend to possess these characteristics and offer some degree of inherent protection from tariffs given they are free of import constraints. As a result, Quality Growth tends to favor such investments.

The luxury goods industry also tends to be relatively insulated from negative tariff impacts given its structure and target demographic. While luxury goods companies may rely on imports, they cater to the least impacted segment of the population – high-income consumers, who are typically less price sensitive.

2. Softening macro backdrop

While investors brushed off the prospect of a recession in 2023 and 2024, the environment of heightened uncertainty in 2025 has made investors look twice at potential cracks in the macro. Growing policy uncertainty has weighed on consumer confidence. After “Liberation Day”, sentiment worsened further given tariffs were much higher than anticipated, pushing up prices of everyday consumer goods. While data appears strong overall, the lower-end consumer remains under pressure, as in 2024, with this group projected to be the most impacted by higher prices tied to tariffs. The market sell off has also impacted the higher end consumer given it is this demographic that holds a significant percentage of equity ownership. At the corporate level, this is set to weigh on both volumes and margins making 2025 earnings expectations seem unrealistic. In addition, investors are closely watching the labor market, particularly the impact of job cuts related to DOGE on employment and the broader economy.

This has resulted in a downward revision in GDP and an increase in the odds of a recession, ranging from 40-60% depending on the source. While we do not make such predictions as bottom-up investors, we do believe the impact of uncertainty and tariffs will be meaningful and will weigh on economic growth. Given our emphasis on predictability and stability, we believe that the earnings of our companies are more likely to materialize in any economic environment; however, in our view this is more amplified during times of slowdown or recession.

3. AI evolution and disruption: playing the changing AI game

Much of the exuberant environment in 2023 and 2024 was driven by the prospect of immense possibilities tied to large language models (LLMs), which drove the stock prices of perceived AI beneficiaries through the roof. During this time, the pick and shovel companies, such as Nvidia, received the most attention given their key role in the AI value chain. Until very recently, Nvidia offered the leading sophisticated GPU chips, which were viewed as a necessary input into advanced LLMs. While we believe AI will unlock tremendous opportunity, we believe that Nvidia lacked the predictability in earnings growth we seek at Quality Growth, given its current business model and state of the industry. While the growth prospects are large, earnings growth is dependent on Nvidia continuing to offer the “golden” chip solution and tremendous amounts of AI spending. Given advancements in AI are rapid and disruption in technology is the norm, we believed earnings were impossible to understand, which posed an investment risk given where valuations stood. That said, as uncertainty continues to drive market volatility, we are closely monitoring the landscape for attractive entry points into opportunistic names that we previously deemed too richly valued.

To capitalize on the growth opportunity tied to the AI evolution, we focused our attention on more predictable businesses, typically software businesses that continue to embed AI capabilities into their product offering to help customers drive efficiencies. We believe these players can continue to benefit from AI tailwinds, while also offering more predictable and sustainable streams of earnings growth given their existing businesses are well established, diverse, and not dependent on AI evolving in one specific way.

The LLMs released by Chinese start-up DeepSeek highlighted the vulnerability of pick and shovel companies as the threat of lower spending requirements for industry leading AI models posed significant challenges to the providers of such chips. Investors were quick to abandon the prior AI darling, and Nivida shed almost USD 600 billion in market capitalization in just a few hours. During this time, software and services type companies have been relatively resilient. Ultimately, the long-term winners of AI remain unknown, however we continue to gain exposure to growth opportunities through avenues with greater transparency, predictability, and resilience, such as professional services, consulting, and software businesses.

From exuberance to uncertainty: Quality Growth built for the “cycle”

There is very little certainty about a market cycle – its duration and each phase within it is nearly impossible to predict. And cycles are impacted by a variety of factors, mostly unknowable, such as geopolitics, monetary policy, investor sentiment, innovation, and unforeseen shocks.

While history can draw useful parallels, no two cycles are exactly alike. Despite this, our industry often makes specific predictions about turning points but tends to miss obvious risks or even lose sight of the cycle itself.

Our Quality Growth philosophy is rooted in avoiding such impossible predictions and focuses on generating alpha in areas where there are more “knowable” factors, which we believe lies at the business level. As such, we aim to identify companies with predictable business models with the ability to grow earnings faster, but most importantly, with more resilience and predictability than the broader market. Over the long term, we believe this enables participation in most of the upside, while limiting the downside exposure, supporting outperformance over the market cycle regardless of its nature or duration.

2023 and 2024: An era of optimism and hope of a never ending “cycle”

Markets were clearly in the rising portion of the cycle during 2023 and 2024, with extreme exuberance supported by the seemingly limitless possibilities tied to AI, investors overlooking the prospects of a recession, expectations for inflation to moderate, a dovish US Federal Reserve’s readiness to implement rapid rate cuts, and a general indifference to geopolitical risks. Yet, the exuberance played clear favorites, driving strong but narrow tailwinds, which resulted in a heavily concentrated US market driven by the Magnificent Seven and a significant overweight to the US in global indices.

These narrow tailwinds meant that durable businesses with strong and resilient earnings growth were underappreciated. While many of these names delivered solid absolute results, they trailed the market darlings. We did not, however, abandon our Quality Growth discipline. While we do not predict market or macro cycles, we do know that no market environment is permanent, and downturns are inevitable. We also observed cracks in the macro landscape that the exuberant sentiment glossed over.

2025: Uncertainty weighs on the “forever” cycle

So far in 2025, new variables have disrupted the optimism of the prior two years. Signs of economic slowdown became more apparent, and Trump 2.0 brought heightened policy uncertainty, particularly around tariffs. We also saw shifts in the geopolitical environment and questions around the “AI winner-takes-all” mentality. Investor sentiment began to sober, and the “forever” up-cycle mentality began to waver.

In 2024, the overall Earnings Per Share (EPS) growth of the S&P 500 was 10%, but it would have been lower without a handful of big tech companies. The market anticipated stronger earnings for the rest of the S&P 500 companies in 2025. This has now been called into question due to increased economic uncertainty and the impact of tariffs. Although bottom-up consensus for the S&P 500 EPS has not materially shifted, stock prices have declined ahead of likely downward earnings revisions.

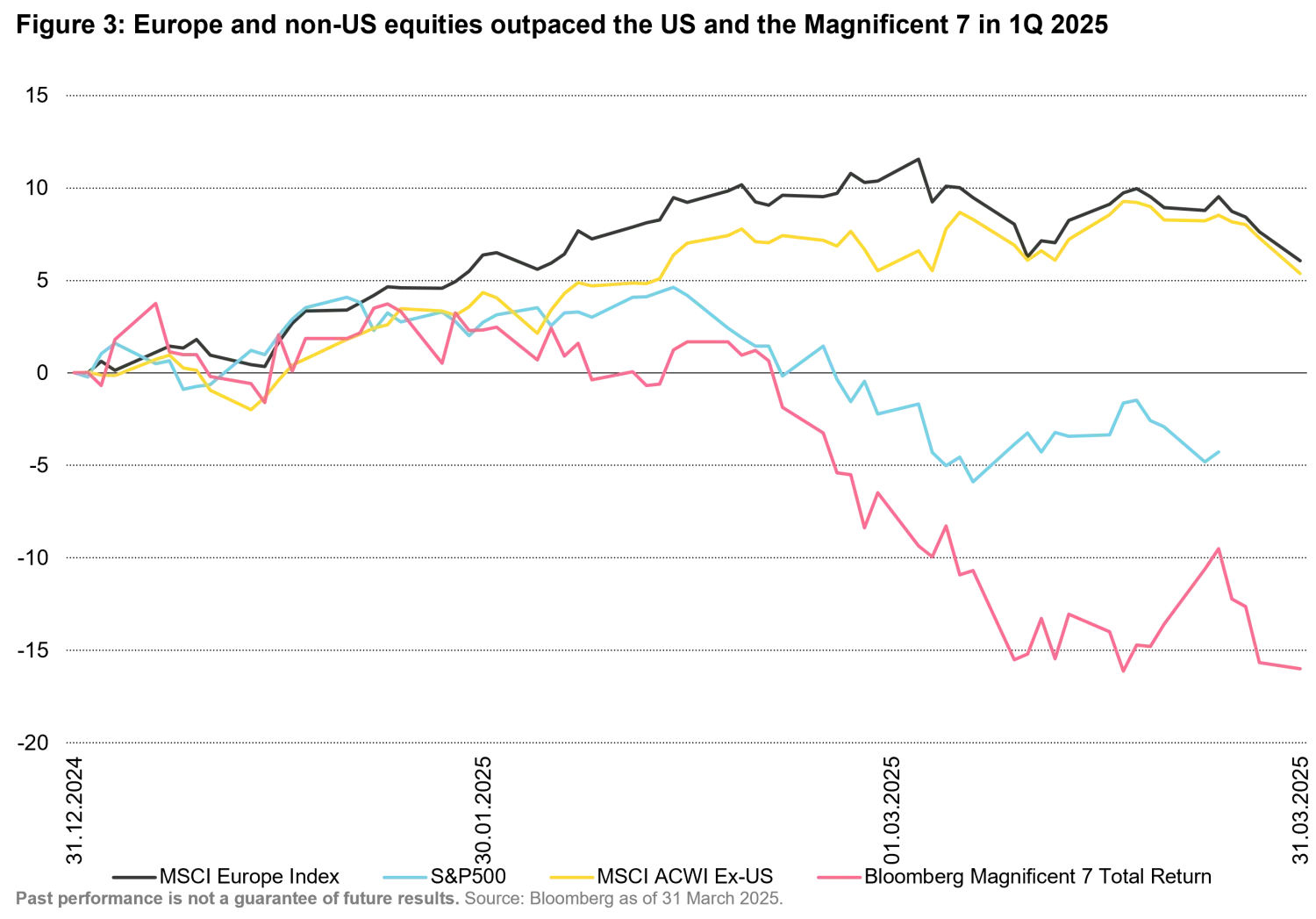

As exuberance faded, investors started to gravitate toward some of the under loved areas of the market, which resulted in a shift in market leadership with ex-US outperforming the US for the first time in over a decade. The Magnificent Seven (as measured by the Bloomberg Magnificent 7 Total Return Index), the strongest basket of stocks in the prior two years, was among the worst-performing groups of names, and European stocks (as measured by the MSCI Europe Index) were one of the best-performing. Companies in more defensive areas of the market attracted capital flows as investors feared the prospect of an economic slowdown or a recession.

Built for resilience

Our approach aims to deliver outperformance over the market cycle, and while we cannot predict the twists and turns of the markets, we believe that our emphasis on predictability, durability, and resilience will drive attractive risk-adjusted performance over the long term. And while this may mean relative performance can trail in strong equity market rallies, our value proposition of minimizing downside exposure and volatility enables our portfolios to shine brightest in times of uncertainty or turbulent environments, such as the one created by Trump 2.0.