This equity fund aims to provide strong returns over a market cycle with considerably less business risk than the US equity market, and to promote environmental and social characteristics.

The fund invests in US-domiciled domestic and multinational companies. It seeks to invest, at sensible prices and promoting environmental and social characteristics, in a concentrated portfolio of stocks of high-quality growth companies. These should exhibit relatively stable and predictable earnings growth that can be sustained for extended periods.

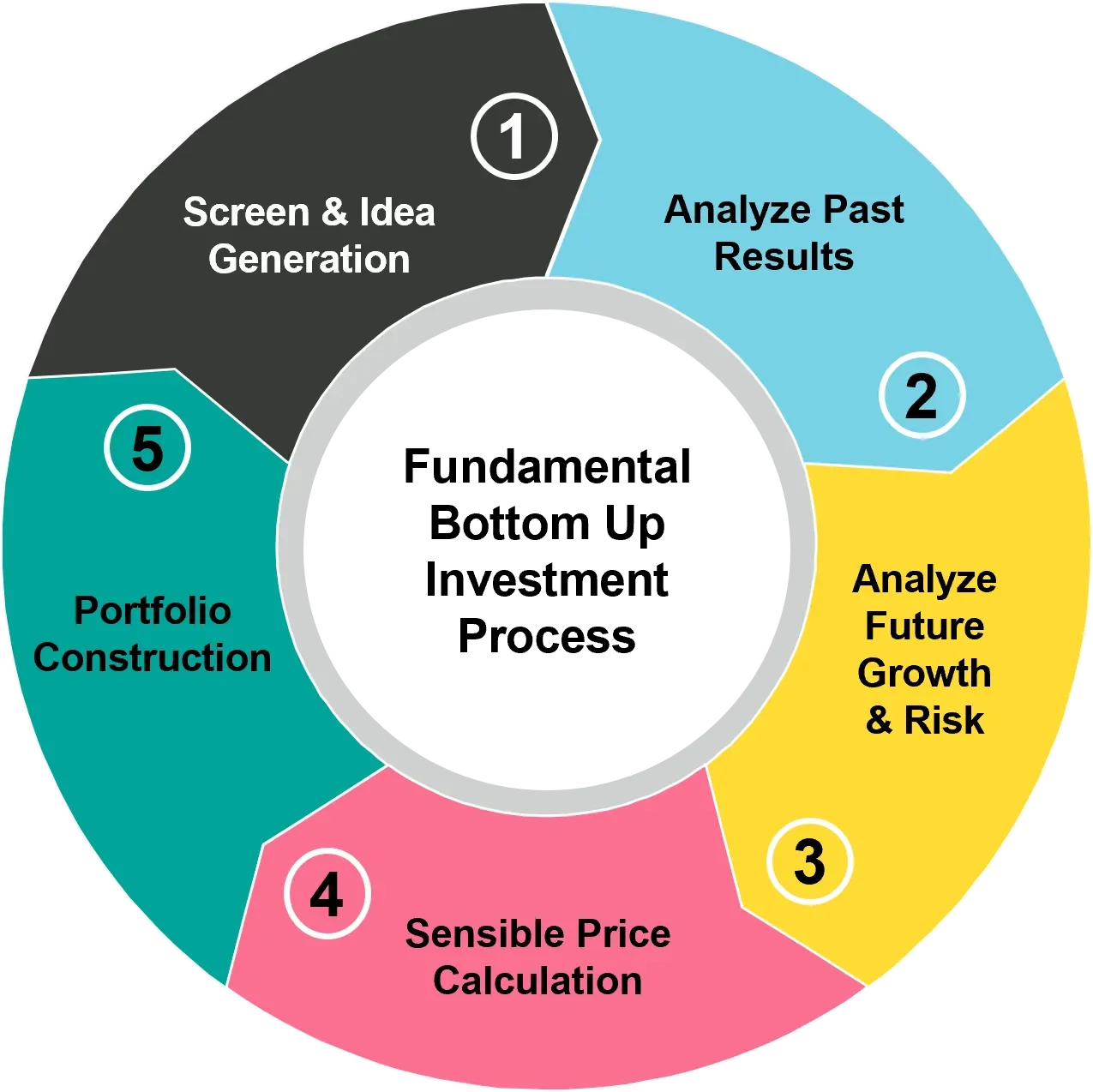

The investment team adheres to a defined bottom-up approach that focuses on in-depth company research. In pursuit of the fund's goal to promote environmental or social characteristics, the team uses an exclusion screen, takes various safeguards, evaluates all investments against sustainability criteria, and oversees corporate governance. To support the goals of the investment style the team follows an active stewardship strategy through direct engagement with companies and a voting policy. The team manages the fund actively, aiming to participate in rising markets and protect capital during declining markets.

Our US Equity Fund is a concentrated portfolio of our best ideas across US-domiciled local and multinational companies. Our approach is based on returns being driven by a long-term investment in companies with relatively stable and predictable earnings growth that can be sustained for extended periods of time. The strategy draws on the expertise of our exclusive 23 strong investment team. ESG is integral to our approach given our focus on relatively stable and predictable ‘quality’ earnings growth combined with long-term holding periods. The fund seeks to promote environmental and social characteristics by employing an exclusion screen, as well as a number of safeguards, and evaluating all investments against sustainability criteria while also providing governance oversight. Additionally, the fund follows an active stewardship strategy through direct engagements with companies and a voting policy to support the goals of the investment style. While the strategy is benchmark agnostic, performance is shown relative to the S&P 500 Index.

“Our strategy is tied to the long-term structural growth stories of businesses that have market power, strong brands and management teams that take calculated risks.”

Many asset managers follow a high quality growth style, but what sets the Quality Growth team apart? We have spent decades building our team and distinct investment approach. Director of Research Igor Krutov discusses the philosophy and mechanics behind our process.

All data is as at 30 Sep 2024 unless otherwise indicated.

| 1M | YTD | 1Y | 3 yrs p.a. | 5 yrs p.a. | Since Inception | |

|---|---|---|---|---|---|---|

| H (hedged) EUR | 0.5% | 12.0% | 21.5% | 5.9% | 8.9% | 276.0% |

| Index | 2.1% | 22.1% | 36.4% | 11.9% | 16.0% | 546.1% |

| 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | |

|---|---|---|---|---|---|---|---|---|---|---|

| H (hedged) EUR | 21.3% | -19.3% | 16.6% | 13.2% | 25.6% | -4.5% | 22.2% | 7.0% | 5.9% | 7.8% |

| Index | 26.3% | -18.1% | 28.7% | 18.4% | 31.5% | -4.4% | 21.8% | 12.0% | 1.4% | 13.7% |

| Portfolio | |||||

|---|---|---|---|---|---|

| Volatility | 14.9% | ||||

| Sharpe Ratio | 0.2 | ||||

| Information Ratio | negative | ||||

| Tracking error | 5.1% | ||||

| Jensens Alpha | -4.3% | ||||

| Beta | 0.8 | ||||

| [3 years annualized] | |||||

All data is as at 31 Oct 2024 unless otherwise indicated.

| Portfolio Manager | Matthew Benkendorf/Chul Chang |

|---|---|

| Fund Domicile | Luxembourg |

| Fund Currency | USD |

| Share Class Currency | EUR |

| Risk Level | 6.00 (7 Oct 2024) |

| Year End | 31 August |

| Index | S&P 500 - TR |

| Share Class Launch date | 10 Jan 2006 |

| Distribution Type | Accumulating |

| SFDR Classification | Article 8 |

| Fund Registrations | AT, CH, DE, ES, FI, FR, GB, IE, IT, LI, LU, NL, NO, PT, SE, SG |

| Share Class Registrations | AT, CH, DE, ES, FI, FR, GB, IT, LI, LU, NL, NO, SE, SG |

| Highest since launch | 377.08 |

|---|---|

| Lowest since launch | 55.33 |

| Share class size in mln. | EUR 179.42 |

| Management fee | 1.65% |

|---|---|

| TER* | 2.04% (29 Feb 2024) |

| OCF | 2.01% (7 Oct 2024) |

| ISIN | LU0218912151 |

|---|---|

| Valor | 2143008 |

| Bloomberg | VONUVAH LX |

| SEDOL | B86VDG9 |

| WKN | A0EQYN |

| Depository | State Street Bank International GmbH (Luxembourg Branch) |

|---|---|

| Management Company | Vontobel Asset Management SA, Luxembourg |

| Swiss Paying Agent | Bank Vontobel AG |

| Swiss Representative | Vontobel Fonds Services AG |

| Share class | Currency | ISIN | Distrib. | Type | Launch date | Management fee | TER* |

|---|---|---|---|---|---|---|---|

| A | USD | LU0035763456 | Distributing | Retail | 21 Nov 1991 | 1.65% | 1.98% (29 Feb 2024) |

| AI | USD | LU1506584975 | Distributing | Institutional | 28 Oct 2016 | 0.82% | 0.97% (29 Feb 2024) |

| AN | USD | LU1683485764 | Distributing | Retail | 10 Oct 2017 | 0.82% | 1.15% (29 Feb 2024) |

| ANG | USD | LU1550199050 | Distributing | Retail | 27 Jan 2017 | 0.55% | 0.69% (29 Feb 2024) |

| B | USD | LU0035765741 | Accumulating | Retail | 21 Nov 1991 | 1.65% | 1.98% (29 Feb 2024) |

| C | USD | LU0137005913 | Accumulating | Retail | 16 Jul 2007 | 2.25% | 2.58% (29 Feb 2024) |

| G | USD | LU1428951294 | Accumulating | Institutional | 13 Jun 2016 | 0.55% | 0.65% (29 Feb 2024) |

| H (hedged) | EUR | LU0218912151 | Accumulating | Retail | 10 Jan 2006 | 1.65% | 2.04% (29 Feb 2024) |

| HI (hedged) | CHF | LU0469626211 | Accumulating | Institutional | 23 Mar 2016 | 0.82% | 1.03% (29 Feb 2024) |

| HI (hedged) | EUR | LU0368557038 | Accumulating | Institutional | 10 Jun 2008 | 0.82% | 1.03% (29 Feb 2024) |

| HN (hedged) | EUR | LU1683485848 | Accumulating | Retail | 10 Oct 2017 | 0.82% | 1.21% (29 Feb 2024) |

| I | USD | LU0278092605 | Accumulating | Institutional | 16 Mar 2007 | 0.82% | 0.97% (29 Feb 2024) |

| N | USD | LU0897674072 | Accumulating | Retail | 11 Mar 2013 | 0.82% | 1.15% (29 Feb 2024) |

Subject to change, without notice, only the current prospectus or comparable document of the fund is legally binding.

* TER includes performance fee where applicable

All data is as at 30 Sep 2024 unless otherwise indicated.

View all documents View latest documents

| Document | Date | DE | EN | ES | FR | IT |

|---|---|---|---|---|---|---|

| Factsheets & Commentaries | ||||||

| Factsheet | Sep 2024 | |||||

| Factsheet | Aug 2024 | |||||

| Factsheet | Jul 2024 | |||||

| Factsheet | Jun 2024 | |||||

| Factsheet | May 2024 | |||||

| Factsheet | Apr 2024 | |||||

| Factsheet | Mar 2024 | |||||

| Factsheet | Feb 2024 | |||||

| Factsheet | Jan 2024 | |||||

| Factsheet | Dec 2023 | |||||

| Factsheet | Nov 2023 | |||||

| Factsheet | Oct 2023 | |||||

| Factsheet | Sep 2023 | |||||

| Factsheet | Aug 2023 | |||||

| Factsheet | Jul 2023 | |||||

| Factsheet | Jun 2023 | |||||

| Factsheet | May 2023 | |||||

| Factsheet | Apr 2023 | |||||

| Factsheet | Mar 2023 | |||||

| Factsheet | Feb 2023 | |||||

| Factsheet | Jan 2023 | |||||

| Factsheet | Dec 2022 | |||||

| Factsheet | Nov 2022 | |||||

| Factsheet | Oct 2022 | |||||

| Factsheet | Sep 2022 | |||||

| Factsheet | Aug 2022 | |||||

| Factsheet | Jul 2022 | |||||

| Factsheet | Jun 2022 | |||||

| Factsheet | May 2022 | |||||

| Factsheet | Apr 2022 | |||||

| Factsheet | Mar 2022 | |||||

| Factsheet | Feb 2022 | |||||

| Factsheet | Jan 2022 | |||||

| Factsheet | Dec 2021 | |||||

| Factsheet | Nov 2021 | |||||

| Factsheet | Oct 2021 | |||||

| Factsheet | Sep 2021 | |||||

| Factsheet | Aug 2021 | |||||

| Factsheet | Jul 2021 | |||||

| Factsheet | Jun 2021 | |||||

| Factsheet | May 2021 | |||||

| Factsheet | Apr 2021 | |||||

| Factsheet | Mar 2021 | |||||

| Factsheet | Feb 2021 | |||||

| Factsheet | Jan 2021 | |||||

| Factsheet | Dec 2020 | |||||

| Factsheet | Nov 2020 | |||||

| Factsheet | Oct 2020 | |||||

| Factsheet | Sep 2020 | |||||

| Factsheet | Aug 2020 | |||||

| Factsheet | Jul 2020 | |||||

| Factsheet | Jun 2020 | |||||

| Factsheet | May 2020 | |||||

| Factsheet | Apr 2020 | |||||

| Factsheet | Mar 2020 | |||||

| Factsheet | Feb 2020 | |||||

| Factsheet | Jan 2020 | |||||

| Factsheet | Dec 2019 | |||||

| Factsheet | Nov 2019 | |||||

| Factsheet | Oct 2019 | |||||

| Factsheet | Sep 2019 | |||||

| Factsheet | Aug 2019 | |||||

| Factsheet | Jul 2019 | |||||

| Factsheet | Jun 2019 | |||||

| Factsheet | May 2019 | |||||

| Factsheet | Apr 2019 | |||||

| Monthly Commentary | Sep 2024 | |||||

| Monthly Commentary | Aug 2024 | |||||

| Quarterly Commentary | Sep 2024 | |||||

| Quarterly Commentary | Jun 2024 | |||||

| View more Factsheets & Commentaries View less Factsheets & Commentaries | ||||||

| PRIIPs KIDs | ||||||

| Key Information Document (KID) | Oct 2024 | |||||

| Legal Documents | ||||||

| AGM EGM invitation | Jan 2024 | |||||

| AGM EGM invitation | Jan 2023 | |||||

| AGM EGM invitation | Jan 2022 | |||||

| AGM EGM invitation | May 2021 | |||||

| AGM EGM invitation | Jan 2021 | |||||

| AGM EGM invitation | Jan 2020 | |||||

| Articles of Association | Apr 2016 | |||||

| Notification to Investors | Oct 2024 | |||||

| Notification to Investors | Sep 2024 | |||||

| Notification to Investors | Jun 2024 | |||||

| Notification to Investors | May 2023 | |||||

| Notification to Investors | Nov 2022 | |||||

| Notification to Investors | Jan 2022 | |||||

| Notification to Investors | Sep 2021 | |||||

| Notification to Investors | Jul 2021 | |||||

| Notification to Investors | May 2021 | |||||

| Notification to Investors | Mar 2021 | |||||

| Notification to Investors | Feb 2021 | |||||

| Notification to Investors | Nov 2019 | |||||

| Sales Prospectus | Oct 2024 | |||||

| View more Legal Documents View less Legal Documents | ||||||

| Sustainability Related Disclosures | ||||||

| Periodic Disclosure | Aug 2023 | |||||

| Pre-contractual Disclosure | Jul 2024 | |||||

| Statement on principal adverse impacts of investment decisions on sustainability factors | Jun 2024 | |||||

| Sustainability Related Disclosures | Jul 2024 | |||||

| Financial Reports | ||||||

| Annual Distribution | Nov 2023 | |||||

| Annual Report | Aug 2023 | |||||

| Distribution Dates | Jan 2024 | |||||

| Quarterly Distribution | Sep 2024 | |||||

| Quarterly Distribution | Jun 2024 | |||||

| Quarterly Distribution | Mar 2024 | |||||

| Semi-Annual Report | Feb 2024 | |||||

| Semi Annual Distribution | Apr 2024 | |||||

| Semi Annual Distribution | Apr 2023 | |||||

| View more Financial Reports View less Financial Reports | ||||||

| Dealing Information | ||||||

| Holiday Calendar 2024 | Jan 2024 | |||||

| List of Active Retail Share Classes | Mar 2024 | |||||

| Policies | ||||||

| Sanctioned Countries | Oct 2022 | |||||

| Shareclass Naming Convention | Jan 2022 | |||||

RISKS

Subject to change, without notice, only the current prospectus or comparable document of the fund is legally binding.

Limited participation in the potential of single securities

Success of single security analysis and active management cannot be guaranteed

It cannot be guaranteed that the investor will recover the capital invested

Derivatives entail risks relating to liquidity, leverage and credit fluctuations, illiquidity and volatility

Price fluctuations of investments due to market, industry and issuer linked changes are possible

Information on how sustainable investment objectives are achieved and how sustainability risks are managed in this Sub-Fund may be obtained here.

Neither the Sub-Fund, nor the Management Company nor the Investment Manager make any representation or warranty, express or implied, with respect to the fairness, correctness, accuracy, reasonableness or completeness of an assessment of ESG research and the correct execution of the ESG strategy.

Morningstar rating: © 2024 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

ANY INDEX OR SUPPORTING DATA REFERRED TO HEREIN IS THE INTELLECTUAL PROPERTY (INCLUDING REGISTERED TRADEMARKS) OF THE APPLICABLE LICENSOR. ANY PRODUCT BASED ON AN INDEX IS IN NO WAY SPONSORED, ENDORSED, SOLD OR PROMOTED BY THE APPLICABLE LICENSOR AND IT SHALL NOT HAVE ANY LIABILITY WITH RESPECT THERETO. Refer to vontobel.com/terms-of-licenses for more details.