Tapping into the power of AI stocks while mitigating risks

Quality Growth Boutique

Key takeaways

- In our view, investing in companies with predictable earnings is a good way to seek to mitigate risks associated with the exuberance around AI.

- We believe companies that have developed concrete ways to monetize AI by using it to enhance their core businesses are a safer bet than those primarily driven by AI itself.

The current enthusiasm for AI has triggered a rush to invest in new applications. This is partly driven by ways of improving efficiency and productivity, and partly a competitive response to innovation by peers. Yet in many cases, the prospects of a return on investment for AI-related spend remains uncertain. Over a three to five-year period, there is a risk of capital expenditure on hyperscale capacity chips in anticipation of revenues that may not materialize.

We believe investing in companies with predictable earnings is a sound way to mitigate this risk. Core demand levels for technology companies outside of AI should be supportive, and AI-related demand should provide incremental upside. For example, tech giants Microsoft and Adobe have developed clear and concrete ways to monetize AI by using it to enhance their core businesses. This provides for predictable revenue streams, making these companies a safer bet than those that are primarily driven by AI itself.

Microsoft’s strategy is to package AI features as separate premium priced AI SKUs, which have been branded “Copilot” and emphasize the assistive nature of the technology. Office Copilot represents the biggest potential AI lever, with features such as drafting or editing a memo, responding to an email, creating a PowerPoint presentation based on existing files, or using Excel to analyze data and create charts. Office Copilot should also act as a natural language-based interface that allows users to take advantage of Office’s full capabilities. Copilot’s penetration may be more modest at first, as it will take time for companies to figure out how AI driven tasks drive efficiency across a broader white-collar workforce and how much of that actually accrues to the company. Overall, AI revenues for Microsoft could add up to approximately $25 billion, compared to $245 billion in total revenues in FY24. This would represent an incremental 10% of revenues today, though the initial pace of adoption could be gradual as customers familiarize themselves with a new type of product. Assuming 4-5 years to ramp up, AI could contribute approximately 2% to revenue growth and approximately 3% to EPS growth over the period.

Adobe has been investing in AI and machine learning for a while now, with the 2016 introduction of Sensei, its AI tool for digital marketing as a prime example of the fruits of its labor. By last year, most of Adobe’s customers were using Sensei to speed up and simplify workflow. The recent excitement around generative AI is more evident in Adobe’s digital content creation business. While advanced photo editing capabilities have always been table stakes, Adobe’s new Firefly feature that generates images based on text is quickly becoming a core capability. Adobe’s priority on user experience is driving the discussion on the scale and speed of monetization of AI. Adobe is currently focused on increasing the number of users and expanding the ecosystem. Whether helping with idea generation or delivering more content, AI is helping users become more productive and ultimately more reliant on Adobe solutions.

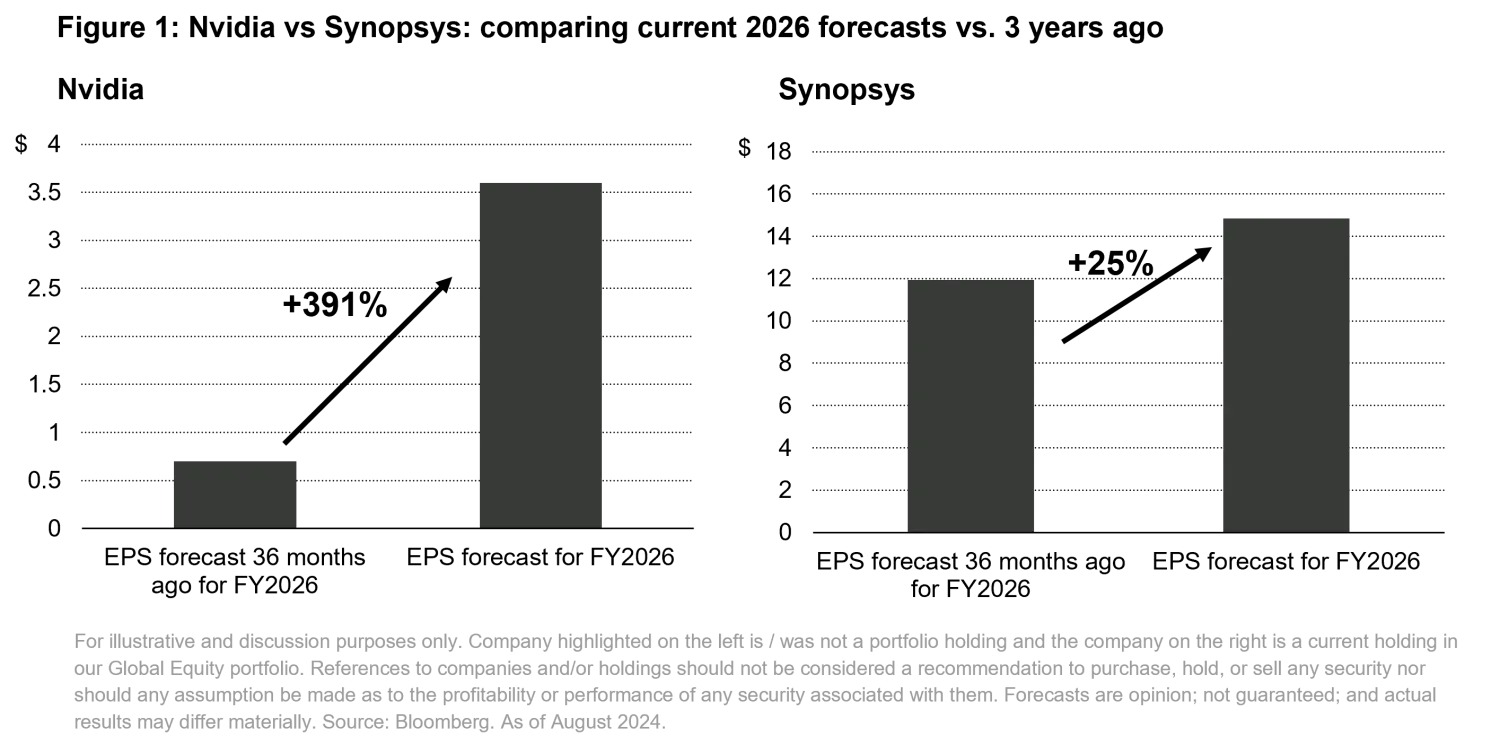

While Microsoft and Adobe monetize AI through software and cloud offerings and have seen steady growth trajectories, Nvidia is an AI-focused chipmaker. We believe it is difficult to determine the predictability of Nvidia’s revenues due to uncertainty surrounding future demand of its chips. Nvidia’s growth has been extraordinary, but it has also been extraordinarily volatile. In our view, other companies offer exposure to growth potential with lower risk. One example is Synopsys, which provides tools to semiconductor manufacturers for design and verification, and which we believe offers more predictability.

In a nutshell: focus on realistic and measurable financial returns

When assessing the impact of generative AI, we focus on readily addressable use cases versus dreaming about the long-term possibilities. Enthusiasm for companies that can benefit from generative AI should be coupled with strict valuation discipline. The estimated AI-driven earnings boost should occur over the next few years. However, we believe that the eventual share price impact will depend on companies’ ability to use AI to enhance earnings. As investors, we favor firms that exhibit higher predictability and are positioned to benefit from the structural growth within this sector, ensuring more realistic and measurable financial returns.