Are long-duration bonds back?

Quantitative Investments

Right now, long-dated bonds seem like a freshwater fountain in the desert to income-starved investors. Many have gone long duration over the recent months to reap the benefits of higher yields last seen about 15 years ago. However, the question of whether these bonds can prove their value beyond being a mere opportunistic tactical play heavily depends on this year’s tightrope walk between inflation and growth.

In 2022, the short end of the yield curve was the place to be in fixed-income markets. It largely shielded investors from excessive turmoil in bonds as it was quick to absorb most of the bad news of the ongoing rate-hiking cycle. By contrast, longer-dated bonds exhibit more interest rate sensitivity and were therefore left by the wayside.

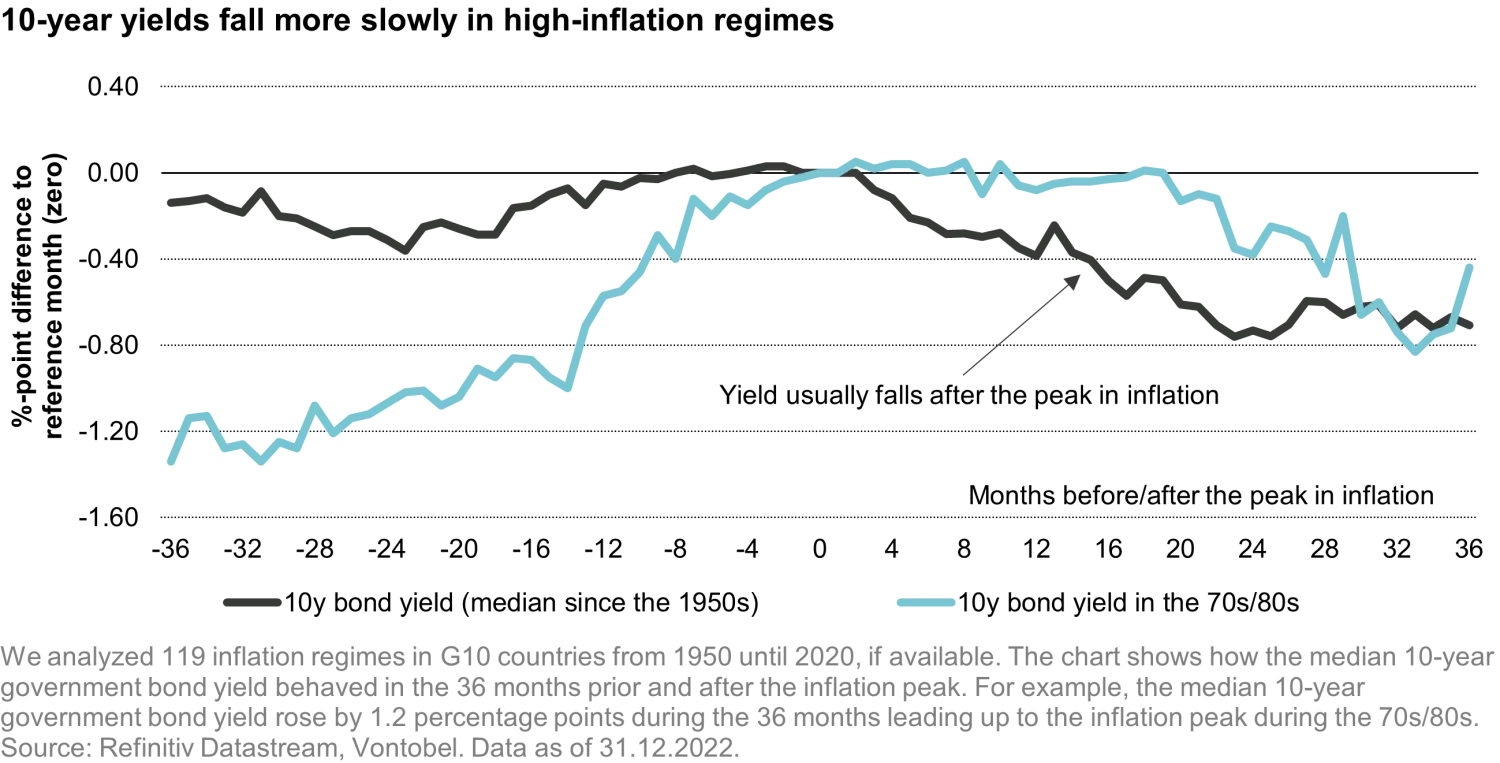

However, ever since markets have breathed a sigh of relief thanks to inflation retreating, fueling the hope of a swift conclusion of the current hiking cycle, going long duration has paid off. Indeed, a look at history shows that, on average, 10-year developed-market yields peak together with inflation and then embark on a downward trend, harboring sizeable capital gains for investors (see chart). However, taking this development for granted this time around could turn out to be a daring venture. There are two reasons for this: Firstly, a historical analysis of the 1970s and 80s shows that in high-inflation regimes, the downward trend of 10-year yields that normally ensues after the inflation peak is much less straightforward as yields tend to stay elevated for longer.

Secondly, the ability of long-dated bonds to deliver value to investors throughout this year and beyond hinges on the question of whether central banks can manage a soft landing coupled with potentially above-target inflation or if they trigger a full-fledged recession. While recession risks have recently eased a bit for Europe, mainly due to falling energy prices thanks to a mild winter so far, the US is not off the hook yet. While the US economy has proven extraordinarily resilient, posting 2.9% growth in Q4 and low unemployment of 3.5%, the Federal Reserve remains committed to wrestling inflation down no matter what, which could break the economy’s neck along the way.

Long-dated bonds shine if a recession hits as investors flock to safety and central banks become more accommodating and resume rate cuts. As a result, the positive correlation between equities and bonds, which wreaked havoc on capital preservation efforts last year, could finally untangle. This would allow bonds to resume their role as portfolio stabilizers, offsetting losses in equities. However, a soft landing with lingering inflation puts long-dated bonds in a pickle for two reasons: Firstly, the Fed would have no reason to resort to rate cuts since the economy would be in good health and the danger of inflation climbing again would be too big. Secondly, right now, the market is counting on continuously falling inflation numbers down to around 3% by the end of this year – an expectation that would likely have to be revised in the case of a soft landing that entails above-target inflation. If inflation expectations are revised up, bonds will re-price, with long-dated ones having to bear the brunt.

The bottom line is: if you want to stay on the safer side, stick with the short end of the bond curve. There, you also receive attractive carry (i.e., 4.2% on the two -year Treasury or 3.1% on the BTP as of late January) and you are less exposed to the volatility that comes with the vagaries of an economy trying to find a way out of inflationary territory. While anyone looking to stabilize their portfolio via duration is likely to be disappointed, long-dated bonds can currently be a beneficial tactical play for income – that is, if your risk tolerance is higher. But then you would be well-advised to keep a close eye on inflation numbers, economic indicators, and central bank rhetoric to make sure you catch the moment when sentiment turns.