This equity fund aims to achieve the highest possible returns and seeks to promote environmental and social aspects, while considering risk diversification.

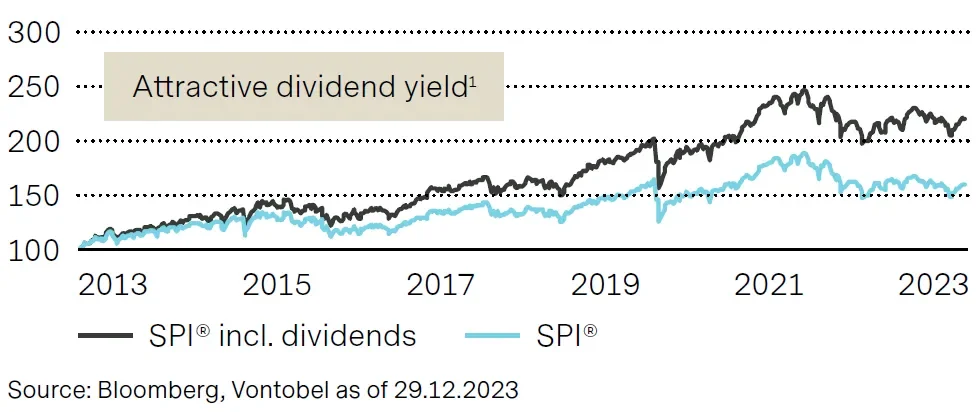

The fund invests primarily in stocks with attractive dividend yield and price potential of Swiss companies represented in the Swiss Performance Index that strive to promote environmental and social practices. In addition, the fund applies a strategy using derivative instruments (covered call options).

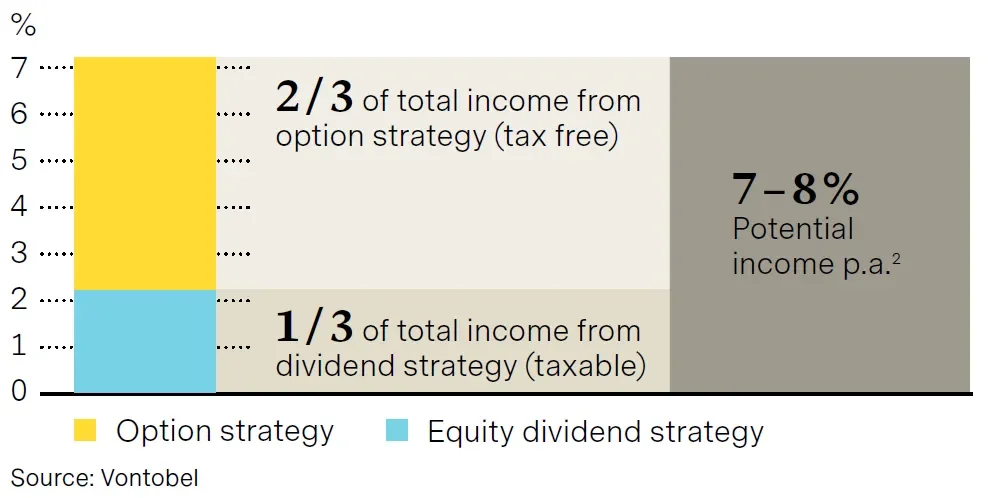

The experienced team of investment specialists selects stocks purely based on in-depth company analyses, applying specific ESG criteria (Environmental, Social, Governance) and excluding controversial sectors with the aim of promoting environmental and social aspects as well as improving the fund's long-term risk/return ratio. The purely rule-based options strategy consists of a permanent and a dynamic component: the former aims to generate regular additional income and the latter to optimally align the options exposure with the economic cycle.

The fund aims to offer enhanced distributable income potential over the economic cycle from high-dividend yielding stocks and tax-free option premia collected by a covered call option strategy.

The use of derivatives has the objective of limiting losses in falling equity markets, whilst participation in positive price performance may be restricted.

The team applies specific ESG³ criteria and excludes controversial sectors from the outset, with the aim of improving the fund’s long-term risk/return profile and promoting environmental and social practices.

This actively managed fund invests in Swiss equities. The fund aims to achieve the highest possible income, subject to the principle of risk diversification, pursuing a derivative strategy while providing some cushion during negative markets in return for limited upside participation during rising markets.

The fund is aimed at Swiss-domiciled investors wishing to gain a diversified, defensive exposure to Swiss equities.

Covered Call Option Strategy — how does it work?4 Writing call options is like selling an “insurance policy”; it involves holding a long position in a stock and selling a call option on the same asset. The seller of the call option receives a premium for the sale, while the buyer receives the right to purchase the underlying stock at a predefined price. Additional income is generated by collecting the (insurance) premium.

“In addition to striving for high income, we add mid-cap stocks to enhance the fund’s large-cap performance potential. We manage our portfolio positions actively and cultivate close relationships with the companies.”

1. Reference index: Swiss Performance Index. The fund is actively managed. Its reference index is used to compare the performance of the fund. The fund manager can, however, make investments for the fund at their discretion and the portfolio of the fund is, therefore, likely to deviate significantly from the composition and performance of the reference which does not take into account ESG criteria.

2. Past performance is not a reliable indicator of current or future performance. Indices are unmanaged and provided for illustrative purposes only. No fees or expenses are reflected, and one cannot invest directly in an index. Source: Vontobel as of December 29, 2023.

3. Environmental, Social, Governance. Up to 10 % of the fund may be invested in issuers that do not meet the sustainability requirements.

4. Due to the use of flexible options please note that from the day of the launch, eight weeks are needed in order to fully replicate the strategy as defined in the investment process.

All data is as at 1 Nov 2024 unless otherwise indicated.

| Portfolio Manager | Marc Hänni/Robert Borenich |

|---|---|

| Fund Domicile | Switzerland |

| Fund Currency | CHF |

| Share Class Currency | CHF |

| Year End | 28 February |

| Index | Swiss Performance Index (SPI) |

| Share Class Launch date | 14 Mar 2024 |

| Distribution Type | Distributing |

| SFDR Classification | Article 8 |

| Fund Registrations | CH |

| Share Class Registrations | CH |

| Highest since launch | 105.77 |

|---|---|

| Lowest since launch | 96.65 |

| Share class size in mln. | CHF 13.96 |

| Management fee | 1.30% |

|---|

| ISIN | CH1303570100 |

|---|---|

| Valor | 130357010 |

| Bloomberg | VSWEQTA SW |

| WKN | A3E16E |

| Depository | State Street Bank International GmbH |

|---|---|

| Management Company | Vontobel Fonds Services AG, Zürich |

| Swiss Paying Agent | Bank Vontobel AG|Raiffeisen Schweiz Genossenschaft St. Gallen |

| Share class | Currency | ISIN | Distrib. | Type | Launch date | Management fee | TER* |

|---|---|---|---|---|---|---|---|

| A | CHF | CH1303570100 | Distributing | Retail | 14 Mar 2024 | 1.30% | |

| AE | CHF | CH1303570092 | Distributing | Retail | 14 Mar 2024 | 0.38% | |

| AI | CHF | CH1303570142 | Distributing | Institutional | 14 Mar 2024 | 0.65% | |

| AN | CHF | CH1303570126 | Distributing | Retail | 14 Mar 2024 | 0.65% | |

| B | CHF | CH1303570118 | Accumulating | Retail | 14 Mar 2024 | 1.30% | |

| I | CHF | CH1303570159 | Accumulating | Institutional | 14 Mar 2024 | 0.65% | |

| N | CHF | CH1369534040 | Accumulating | Retail | 10 Sep 2024 | 0.65% |

Subject to change, without notice, only the current prospectus or comparable document of the fund is legally binding.

* TER includes performance fee where applicable

All data is as at 30 Sep 2024 unless otherwise indicated.

View all documents View latest documents

| Document | Date | DE | EN | ES | FR | IT |

|---|---|---|---|---|---|---|

| Factsheets & Commentaries | ||||||

| Factsheet | Sep 2024 | |||||

| Factsheet | Aug 2024 | |||||

| Factsheet | Jul 2024 | |||||

| Factsheet | Jun 2024 | |||||

| Factsheet | May 2024 | |||||

| Factsheet | Apr 2024 | |||||

| Factsheet | Mar 2024 | |||||

| Portfolio Update | Aug 2024 | |||||

| Quarterly Commentary | Sep 2024 | |||||

| Quarterly Commentary | Jun 2024 | |||||

| View more Factsheets & Commentaries View less Factsheets & Commentaries | ||||||

| PRIIPs KIDs | ||||||

| Key Information Document (KID) | Jul 2024 | |||||

| Legal Documents | ||||||

| Sales Prospectus | Jul 2024 | |||||

| Financial Reports | ||||||

| Annual Report | Feb 2024 | |||||

| Semi-Annual Report | Aug 2024 | |||||

| Semi-Annual Report | Aug 2023 | |||||

| View more Financial Reports View less Financial Reports | ||||||

| Dealing Information | ||||||

| Holiday Calendar 2024 | Jan 2024 | |||||

| List of Active Retail Share Classes | Mar 2024 | |||||

| Policies | ||||||

| Shareclass Naming Convention | Jan 2022 | |||||

RISKS

Subject to change, without notice, only the current prospectus or comparable document of the fund is legally binding.

Limited participation in the potential of single securities

Success of single security analysis and active management cannot be guaranteed

It cannot be guaranteed that the investor will recover the capital invested

Derivatives entail risks relating to liquidity, leverage and credit fluctuations, illiquidity and volatility

Price fluctuations of investments due to market, industry and issuer linked changes are possible

Investments in mid and small cap companies may be less liquid than investments in large cap companies

With the use of a covered call options strategy the participation in the potential positive price development of the underlyings is limited.

There is no guarantee that all sustainability criteria will always be met for every investment. Negative impact on subfund's performance possible due to pursuing sustainable economic activity rather than a conventional investment policy

Information on how sustainable investment objectives are achieved and how sustainability risks are managed in this Sub-Fund may be obtained here.

Neither the Sub-Fund, nor the Management Company nor the Investment Manager make any representation or warranty, express or implied, with respect to the fairness, correctness, accuracy, reasonableness or completeness of an assessment of ESG research and the correct execution of the ESG strategy.

Morningstar rating: © 2024 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

ANY INDEX OR SUPPORTING DATA REFERRED TO HEREIN IS THE INTELLECTUAL PROPERTY (INCLUDING REGISTERED TRADEMARKS) OF THE APPLICABLE LICENSOR. ANY PRODUCT BASED ON AN INDEX IS IN NO WAY SPONSORED, ENDORSED, SOLD OR PROMOTED BY THE APPLICABLE LICENSOR AND IT SHALL NOT HAVE ANY LIABILITY WITH RESPECT THERETO. Refer to vontobel.com/terms-of-licenses for more details.