Quality Growth Boutique

Advice from an international manager: avoid non-US equities…?

Despite US stocks' outperformance over international equities over the past two decades, investing solely in the US benchmark is not without risks. Yet we do not recommend investing indiscriminately in the broad international benchmark. Being selective and actively seeking out quality non-US companies can diversify portfolio risks and offer robust performance.

Quality Growth Boutique

4 key themes to watch in global equity markets in 2025

The new Trump administration’s policies evoke both optimism and apprehension among investors. This uncertainty is exacerbated by the pressures on the US consumer, high market concentration, and potential earnings disappointments. We highlight key themes we believe are worth watching in 2025.

Fixed Income Boutique

What we think changes, what doesn’t, in EM fixed income post-election?

Markets have been on the move since the US presidential election. However, we think lower funding costs thanks to tightening spreads and the prospect of returning flows are proving supportive of EM debt. But there will be winners and losers in the new regime…

Quality Growth Boutique

From journalists to analysts: there’s no substitute for on-the-ground research

Former investigative journalists tap into non-traditional sources to gather unique insights for our Quality Growth research team. This article highlights three case studies that led a portfolio manager to increase a position, sell a stock, and revisit the viability of a previous holding.

Multi Asset Boutique

Architecture and data trump maths

Gain an intuition on how complex AI architectures actually work. You will see that one model cannot fit all kinds of data. The key to solving problems with AI and surpassing mathematical challenges is to use the right model and the appropriate, high-quality data.

Multi Asset Boutique

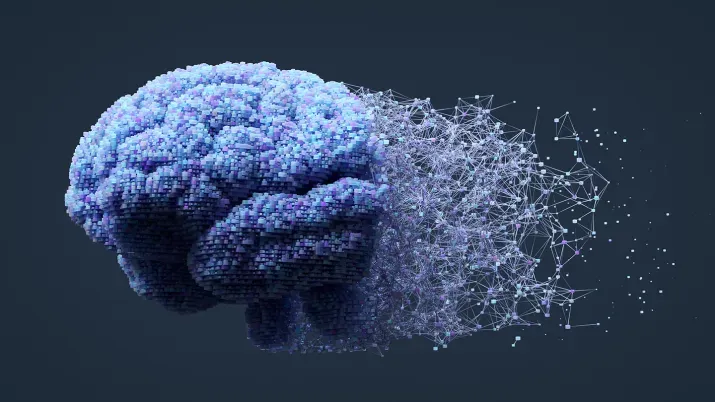

From biological to artificial intelligence

Explore the fascinating parallels between biological intelligence and artificial neural networks. This article dives into how AI mimics the brain’s neuron structures to solve complex problems, revealing the power of neural networks and their potential to reshape our understanding of intelligence and decision-making.

Quality Growth Boutique

Modern mining: Digging deep to find winners on the brink of a technological revolution

The mining industry is entering a green supercycle, driven by demand for metals and minerals needed for decarbonization. Despite increased competition and deeper mining, technological advancements are boosting productivity and reducing emissions. This presents compelling long-term investment opportunities in this evolving industry.

Quality Growth Boutique

Tapping into the power of AI stocks while mitigating risks

The forces driving today’s markets are making it especially hard for investors to find the right balance. How can investors tap into the burgeoning power of AI without taking too much risk? Learn how our Quality Growth team manages risk while maintaining a healthy equilibrium.

Quality Growth Boutique

View short-term, election-related volatility through a long-term lens

How do you manage the impact of market volatility driven by election outcomes? Matthew Benkendorf, CIO of our Quality Growth Boutique, shares ways to help mitigate risks and stay focused on business fundamentals that point to enduring quality.

Conviction Equities Boutique

Global equities reimagined: structural growth, diversification, impact

A cleaner, more resource-efficient path to the future is clear. What's less discussed is the massive growth opportunity this presents for investors seeking to diversify their global equity portfolios. This article encourages global equity investors to rethink the role of environmental impact strategies in their portfolios.

Quality Growth Boutique

Today’s market turmoil: a reminder that investing is a marathon, not a sprint

Investors have been chasing their favorite AI names around the track, without considering how they could sustain their earnings growth for a prolonged period or through a recession. As long-term investors, we aim to remain focused on resilient companies with durable business models, which we believe will finish the race.

Quality Growth Boutique

Judgment Call: Looking behind the numbers to identify real quality

Navigating challenging markets requires assessing earnings and revenue trends and digging into balance sheets. But financial metrics alone can be backward looking. A fundamental understanding of industries, companies, and markets can provide important insights that can help avoid hidden risks and identify overlooked growth drivers.

Conviction Equities Boutique

Trump 2.0: what would it mean for the trend towards net zero?

By the end of this historical election year, nearly half of the world’s population is expected to have gone to the polls to vote for their respective leaders. In the world’s biggest economy, the race has yet to be decided. What might a second Donald Trump term mean for net zero if he were to be re-elected?

Multi Asset Boutique

How do we play covered calls?

In this three-article series, we revisit covered call strategies. In this third article, we give a glimpse into our investment capabilities and provide readers with details on how to potentially capitalize on the opportunity.

Quality Growth Boutique

Shades of Quality

Previously considered a niche strategy, quality investing is popular today for a simple reason – it has worked. While there are many nuances in defining a quality company, we focus on five convictions that we believe separate us from other managers.

Fixed Income Boutique

Why should fixed income investors take the perceived extra risk with emerging markets?

This latest article from Fixed Income explores the potential of Emerging Markets (EM) in the current economic landscape, despite significant outflows and perceived risks. Despite outflows and perceived risks, EMs offer promising opportunities for fixed income investors.

Quality Growth Boutique

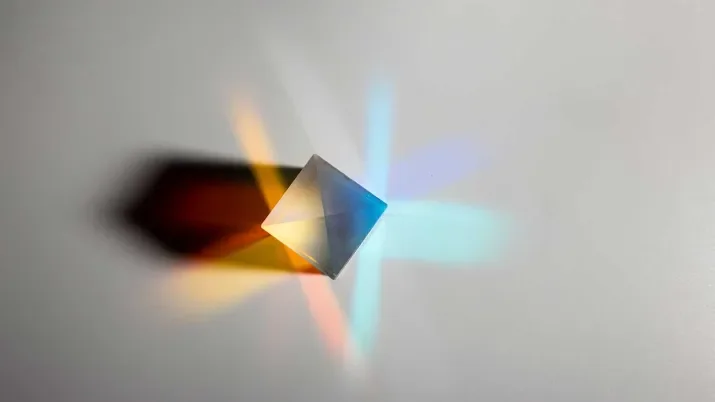

Through the prism: how investigative journalists can enhance equity research

Former journalists are a key part of the Quality Growth approach. Their unique skill set brings fresh perspective and sparks healthy debate during the research process. This has been shown to help identify trends ahead of the market, avoid potentially costly investment mistakes, and test new and existing investment rationales.

Quality Growth Boutique

Supply chain risks in India: can multinationals affect change?

Child labor and imposing unnecessary medical procedures on women were recently identified in the sugar industry in India. While multinationals such as Pepsi and Coca-Cola are not directly linked to poor labor conditions, they can affect change. As active investors, we engage with our portfolio companies on these important issues.

TwentyFour

Finding quality in fixed income

Quality investing in the fixed income sector is as much about making sure that we avoid the losers as it is about trying to pick the winners.

Multi Asset Boutique

Is a golden era for quality investing upon us?

Quality companies can keep pace with bull markets due to above-average profitability and consistent growth prospects. In bear markets, investors flock to quality companies as their stable earnings and strong balance sheets can minimize drawdowns. While now may be the time for quality, this style can perform well in different market regimes.

Asset management

Mind over matter: behavioral finance and quality investing

The beginning of a new year is often when we look to change the way we behave, but how we invest can also influence our behavior. From inspiring confidence to encouraging discipline, our Chief Economist, Dr Reto Cueni examines how investing in quality can have positive effects on investor behavior.

Asset management

World Water Day 2024: Will water scarcity threaten global stability?

Fresh water is an essential but scarce resource, plentiful in some regions and sparse in others. On World Water Day, our Chief Economist Reto Cueni examines the global risk landscape related to water scarcity, and possible solutions to alleviate a growing problem.

Conviction Equities Boutique

Do we need to put a Q in ESG?

Is ESG simply a different label for quality or could quality stand as a less controversial and politically sensitive description of highly sustainable companies? The question of whether ESG characteristics of listed companies form a new independent factor and a distinctive source of returns is an important one to address.

TwentyFour

The opportunity in global credit

The end of rising interest rates in Europe and the US, attractive yields, and lower-than-expected default rates mean investors can get higher income without taking on as much risk as they had to in the past. In our view, less volatile, high quality fixed income products are poised for strong performance in 2024.