4 key themes to watch in global equity markets in 2025

Quality Growth Boutique

4 key themes to watch in global equity markets in 2025

US equities delivered strong gains so far in 2024, outperforming most markets around the world. As we step into 2025, with the dust of the US election settling behind us, the landscape is riddled with uncertainty.

Can stocks continue to ride the crest of the AI wave? Can market returns broaden in the face of a potentially weakening economy? What are the implications of shifting trade policies?

Amid the twists and turns of change, our guiding principles remain the same: we invest in quality companies with predictable earnings growth and trading at attractive valuations. We highlight a few key themes that we believe are worth watching as we continue to focus on capital preservation and a robust compounding of returns over the long term.

1. Pressure on the US consumer

The US consumer remained strong in 2024, continuing the trend from 2023, outpacing spending growth in Europe and China and driving global economic growth. This was partly due to excess savings created by fiscal stimulus during the COVID pandemic. However, these pandemic savings, which had supported consumer spending for a couple of years, have now been depleted.

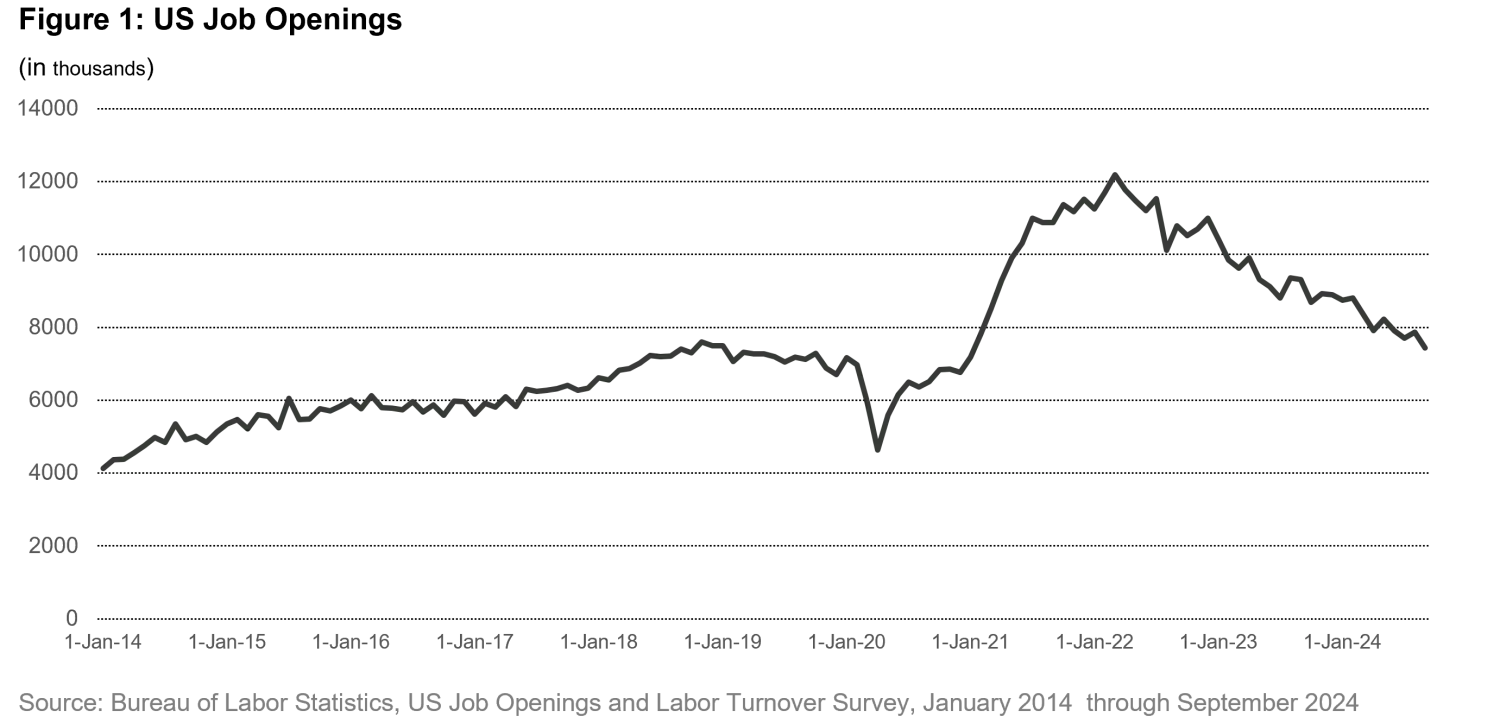

As we look to 2025, we expect consumer spending will be a function of the employment landscape. Even though the labor market has been cooling, it has not yet resulted in a meaningful rise in unemployment. A key reason for this is the imbalance between labor supply and demand that prevailed post-COVID. But under the pressure of monetary tightening, the number of job vacancies has steadily fallen from its peak (Figure 1) and has finally aligned with labor supply. Going forward, a further decline in job vacancies would have a more pronounced impact on unemployment, which, in turn, would affect consumer spending.

2. Challenges to broadening of market returns

Market concentration intensified in 2024, with the Magnificent 7 stocks contributing nearly half of the entire S&P 500 return this year, largely driven by advancements in AI. They now represent over 30% weight in the broad benchmark1. Aside from the uncertainty about the return on invested capital and pricing power of early AI products (which would have implications for the Magnificent 7), in order to sustain the market rally, stock returns would need to expand beyond a handful of companies. And this requires a favorable economic backdrop.

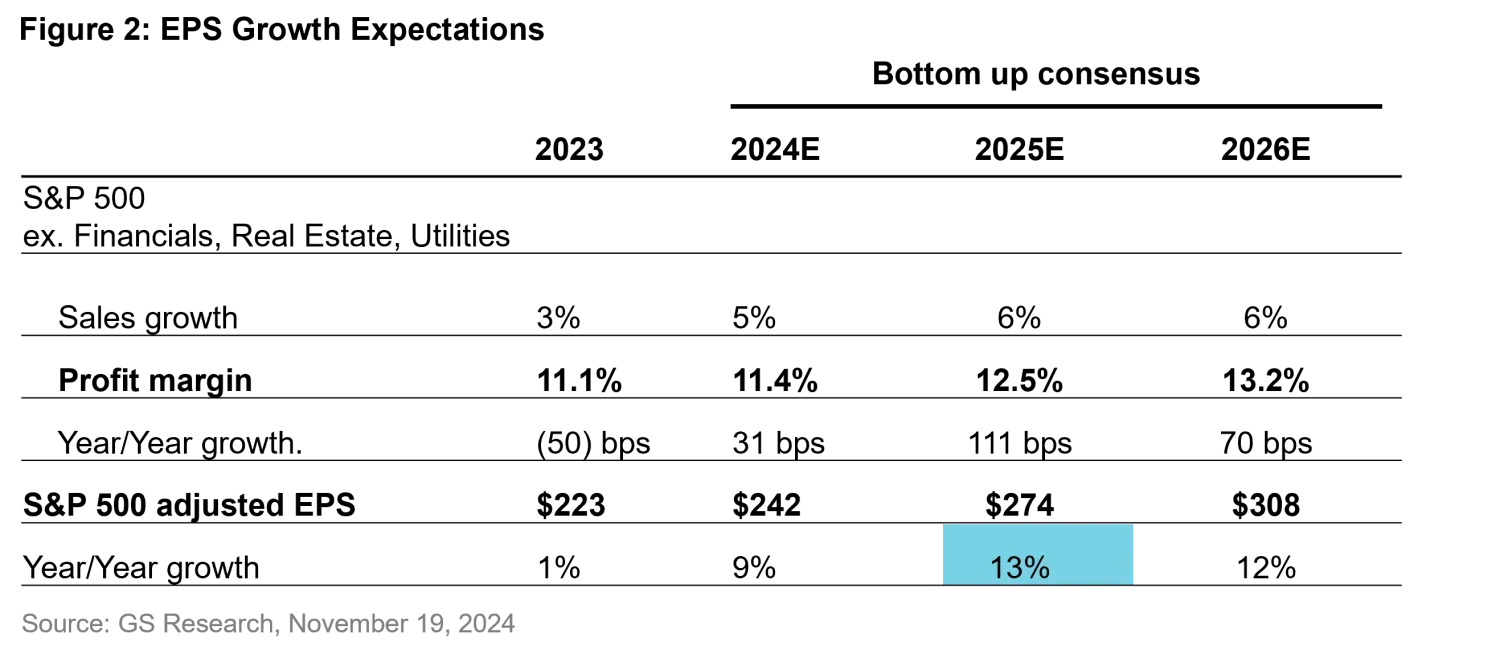

Yet, as previously noted, there is risk to the outlook for consumer spending. Even a soft landing, which most investors consider the base case, still implies below-trend economic growth and an uptick in unemployment. In that scenario, in our view, the current EPS growth expectations of 13% for S&P 500 companies for 2025 seem aggressive (Figure 2), given that EPS growth has historically averaged 7-8%. And a contraction in consumer spending (in a hard landing scenario) would result in much lower EPS than currently forecasted. It’s difficult to see the rally broadening if aggregate earnings growth disappoints.

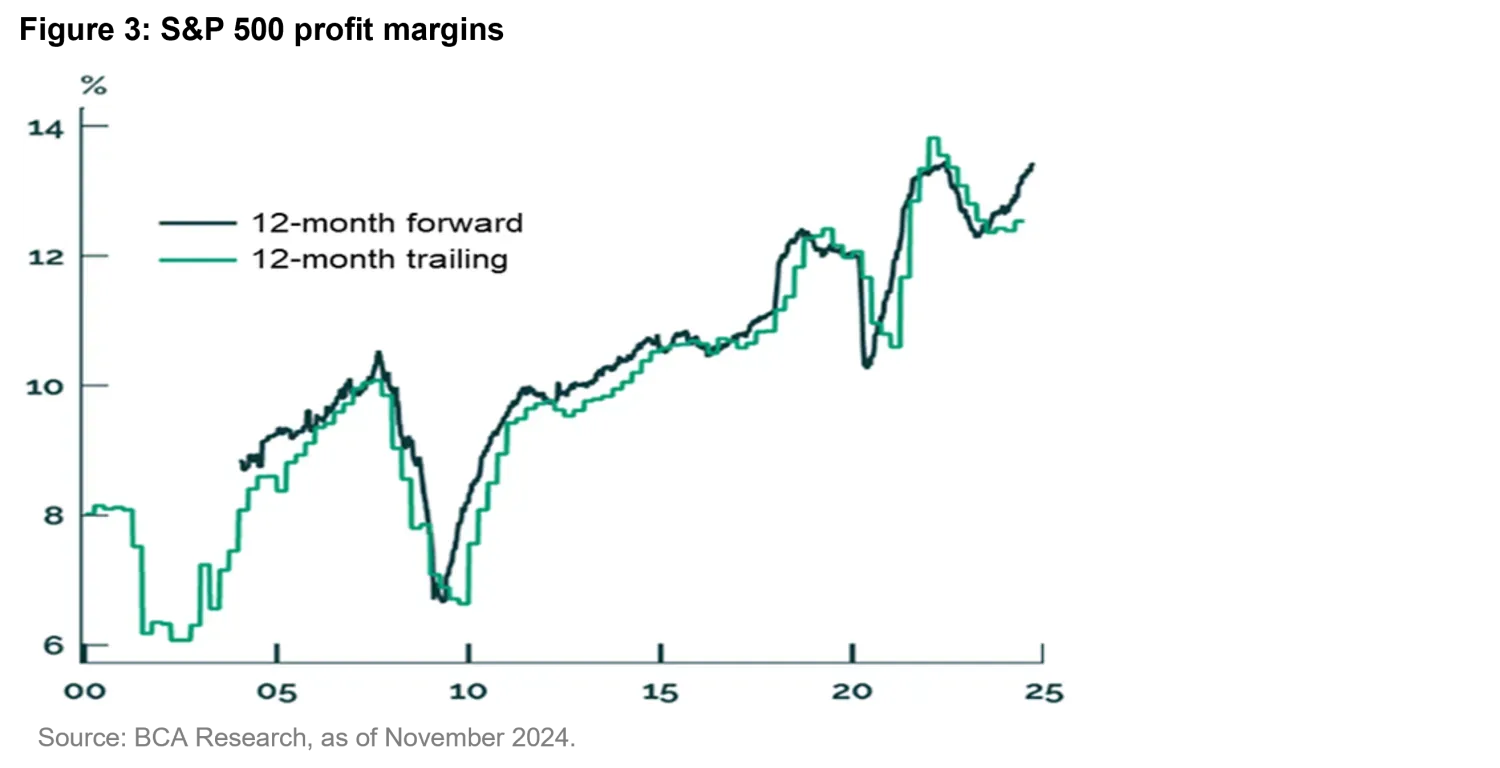

The bottom-up consensus forecast above assumes a significant rise in margins to all-time record levels. As can be seen in Figure 3, the US corporate sector has already benefited from a long-term increase in corporate margins while labor compensation has stagnated. Discontent over this dynamic has in part led to Trump’s election. Given Trump’s electoral base, it’s reasonable to assume that some of his policies, such as tariffs, would attempt to arrest this trend.

Market concentration has created opportunities in sectors that have been overlooked by momentum-oriented investors, such as consumer staples, health care, and select industrials, where we have historically invested. Should a more rational environment set in, we expect high quality companies with structural growth potential in defensive sectors would benefit.

3. Uncertainty around the impact of Trump tariffs

As the new Trump administration – supported by Republican majorities in both the House and Senate – takes the reins, its policies evoke both optimism and apprehension among investors. While deregulation and tax cuts are generally stimulative, tariffs are potentially disruptive to global trade and global growth.

There is uncertainty around the magnitude and how targeted the proposed tariffs would be, with the general expectation of across-the-board tariffs and higher tariffs on imports from China. Thus, it’s difficult to assess whether at the macro level the positive impact from deregulation and tax reform would offset the potential negative implications from tariffs. In the short term, the sequencing matters as well; in Trump’s first term, he started with tax cuts, but we cannot assume the same order will be repeated in his second term.

From a bottom-up standpoint, we believe that companies with dominant competitive positions and strong pricing power should generally be able to navigate a range of scenarios with tariffs. We saw such companies cope well with challenges during the recent inflationary period. However, in specific cases, it matters whether a tariff is imposed on imported goods where there are domestically produced alternatives. This would advantage some US producers at the expense of their foreign competitors who are now subject to higher tariffs.

4. Shifting dynamics in emerging markets

Following Trump's re-election and clean sweep, a more inflationary outlook is anticipated due to tax cuts and higher tariffs, leading to higher interest rate expectations. This suggests more measured interest rate cuts by the US Federal Reserve and major emerging market central banks, creating potential headwinds. However, pockets of opportunity exist, emphasizing the importance of stock selection.

In 2024, China implemented stimulus measures but refrained from substantial stimulus to boost consumption or buy back excess property market inventory. We expect the Chinese government will hold off on further stimulus until the new Trump administration's trade policy is clear. Meanwhile, valuations remain supportive in the consumer and internet sectors.

The trend of supply chain diversification away from China, initiated under the first Trump administration and accelerated during the pandemic, is likely to persist under more aggressive Trump tariff policies. We foresee continued benefits for Vietnam and Malaysia, and to a lesser extent, Indonesia.

India has been a bright spot in the global economy the past few years. Despite extended valuations in the property and industrial sectors that benefited from infrastructure development policies, some attractively valued businesses can be found in the financial, consumer, and health care sectors.

In Latin America, Brazil's economy is performing better than expected, with robust export markets and government fiscal spending supporting income and employment. However, higher-than-expected inflation has led the central bank to raise interest rates. Companies that are experiencing structural consumption growth in e-commerce, fintech, and retail drug stores present opportunities.

While Mexico has overtaken China in export importance to the US, it may face increased scrutiny due to potential USMCA2 trade deal renegotiations. Given the implications of the left Morena government's sweeping win and uncertainty around Trump tariff policies, defensive businesses are poised for growth.

Staying grounded

We know we cannot accurately predict the future, but we can adhere to an investment philosophy that anchors our feet on the ground during all market conditions, be it extreme ebullience or pessimism. More than 40 years of investing has taught us the merits of patience, looking beyond near-term weakness, and keeping an eye on our long-term goals. This requires an optimistic resolve and a clear investment roadmap. For us, that means investing in high-quality, durable businesses with avenues for predictable earnings growth and that are trading at attractive valuations.

1. As of 31 October 2024

2. United States-Mexico-Canada free trade agreement

Important information: Content provided for informational purposes only to discuss general market and industry trends. Does not constitute investment advice, research, recommendation or an offer or solicitation to buy or sell securities. Reflects judgements of the Quality Growth team, which are subject to change without notice, as of the date of this document. In preparing this document, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources. Forward-looking statements regarding future events or the financial performance of countries, markets and/or investments are based on a variety of estimates and assumptions. Such statements are based in part on current market conditions, which will fluctuate and may be superseded by subsequent market events or other factors; there can be no assurance that the assumptions will prove accurate, and actual results may differ materially. Historical market trends are not reliable indicators of future market behavior or future performance. Investments involve risks. The value of equities (e.g., shares) and equity-related investments may vary according to company profits and future prospects as well as more general market factors. In the event of a company default (e.g., insolvency), the owners of their equity rank last in terms of any financial payment from that company. Past performance is not a guarantee of future results. Vontobel reserves the right to make changes and corrections to the information and opinions expressed herein at any time, without notice.