Is a golden era for quality investing upon us?

Multi Asset Boutique

Key takeaways

- Quality investing, centered on selecting high-quality companies with strong financial fundamentals and sustainable competitive advantages, is an investment strategy that may offer the potential for consistent, improved risk-adjusted returns.

- Quality can perform well during economic downturns, provide stability during market exuberance, and offer a hedge against inflation.

- While valuations and interest rate fluctuations may impact short-term performance, the long-term focus on financial stability and sustainable growth positions quality investing as an attractive approach for investors seeking resilient portfolios.

“It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” Warren Buffet’s famous words in a 1989 letter to shareholders encapsulate the essence of quality investing, a strategy that seeks to identify high-quality, profitable companies with strong financial fundamentals, sustainable competitive advantages, and the potential for consistent growth.

After a decade of robust growth, the world finds itself in an economic environment that is vulnerable to inflation and geopolitical risks, as seen during and in the aftermath of the Covid-19 pandemic, the war in Ukraine, and the recent conflict in the Middle East. As we believe the uncertain market conditions are likely to linger, we believe the golden era for quality investing has just begun.

The fallout of such economic uncertainties can take time to trickle through to companies’ earnings. And once they do, that’s when the stability and resilience of quality investing may come to the fore, providing a chance to mitigate the risk of losses and benefit from the long-term value that fundamentally strong businesses create. By focusing on firms with stable balance sheets, reliable earnings, and robust cash flows, quality investors aim to build resilient portfolios capable of navigating market cycles and delivering attractive risk-adjusted returns.

But what exactly is quality investing, and how does it differ from growth and value styles?

Quality vs. value vs. growth1

While picking quality companies seems intuitive and indispensable to investors’ success, this particular investment style isn’t as popular and doesn’t garner the same attention as growth and value styles. And yet, quality investing has outperformed both value and growth in global markets for decades. On top of that, when considering the risk-return ratio, quality has also historically delivered higher annualized returns and a lower annualized standard deviation than value and growth, as well as the broader market.

So, the obvious question is, why the benchwarmer status? The answer boils down to investors’ differing, often subjective, views on which elements in quality investing really drive returns over the long term. The MSCI Quality Indexes that follow this investment strategy, for instance, consider three single factors linked to financial productivity, low leverage, and stability. We use a broader quality scoring system, which examines additional factors that we believe are underrepresented or excluded from MSCI’s methodology.

What we look for

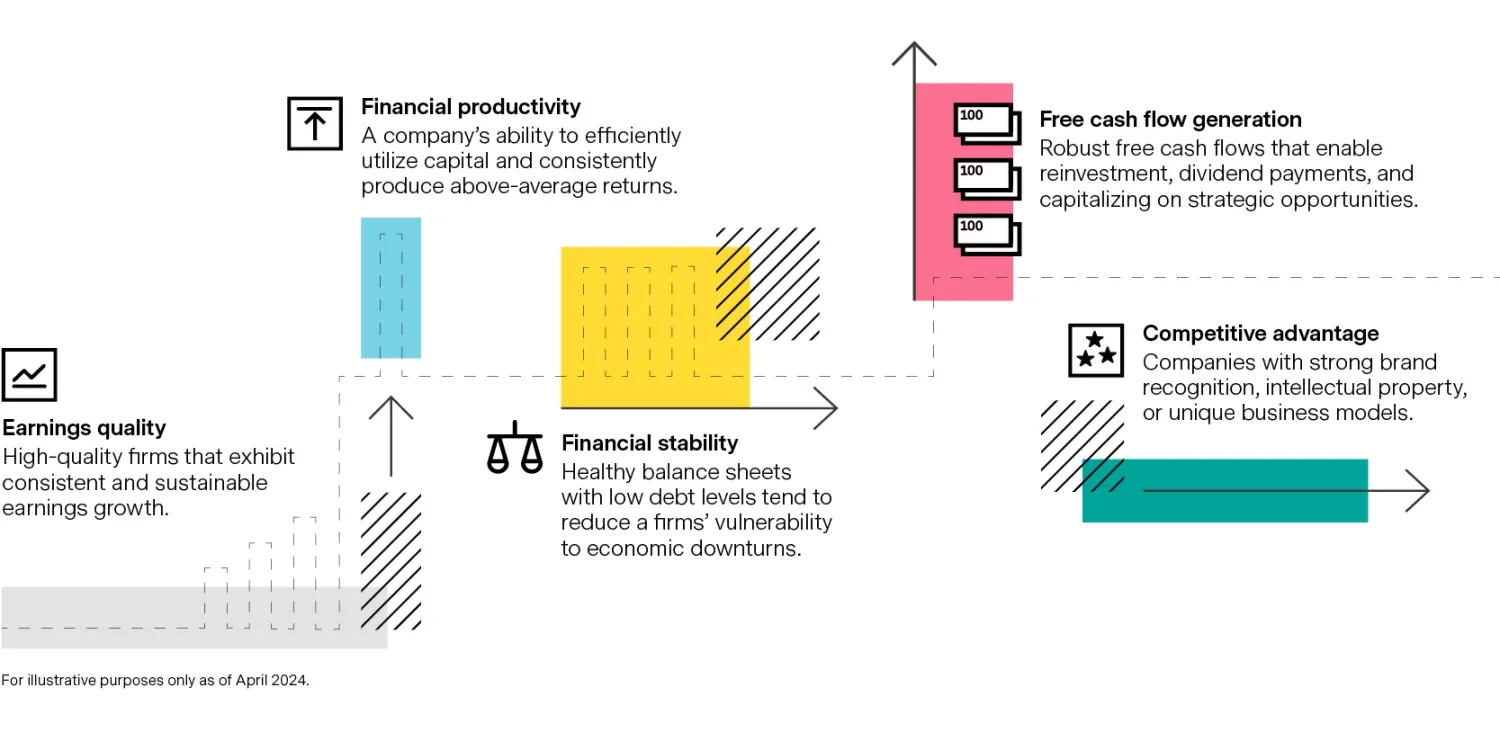

Earnings quality: High-quality firms should exhibit consistent and sustainable earnings growth, driven by their competitive positions, effective management, and ability to adapt to evolving market conditions. They should have a track record of generating stable profits and be less susceptible to earnings volatility.

Financial productivity: A company’s ability to efficiently utilize capital and consistently produce above-average returns on shareholder equity often indicates a competitive advantage over its peers. The longevity of this advantage can sometimes be underestimated by the market, and this creates opportunities. Historically, companies with higher returns on equity and on invested capital have outperformed their peers.

Financial stability: Healthy balance sheets with low debt levels tend to reduce a firms’ vulnerability to economic downturns and allow them to pursue growth opportunities.

Free cash flow generation: Robust and consistent free cash flows enable companies to reinvest in their businesses, pay dividends, and capitalize on strategic opportunities. This characteristic typically provides stability and enhances their capacity to navigate market uncertainties.

Competitive advantage (high margins): Companies with strong brand recognition, intellectual property, or unique business models potentially have durable competitive advantages, which gives them the ability to maintain or increase their high profit margins due to the barriers of entry.

Favorable characteristics…

If history is any guide, quality companies tend to exhibit resilience during economic downturns. Their strong financial stability, sustainable earnings, and robust cash flows can enable them to weather challenging market conditions. That usually makes them better equipped to navigate through economic contractions, and hence reduces the risk of losses for investors.

Quality investing typically offers lower volatility compared to other investment styles. Quality companies often have less fluctuations in earnings, resulting in smoother stock price movements. This stability can provide investors with a sense of security and help mitigate the stress associated with volatile market swings and resist the temptation to make impulsive and reactionary investment decisions based on short-term market volatility. The focus on firms exhibiting stable earnings and strong fundamentals can instill confidence and encourages a long-term perspective.

The stable and predictable free cash flow quality companies generate alongside their lower volatility can lead to lower risk premiums, which in turn leads to lower cost of capital. As a result, these firms may have higher valuations. In addition, their competitive advantages and ability to generate robust free cash flow enable them to invest in research and development, expand into new markets, and pursue long-term growth opportunities. Over shorter time frames, quality companies’ market leadership is often not as pronounced; however, the longer the rolling period, the more frequently they outperform.

… And the tradeoff

Of course, there are exceptions. It’s important to note that no investment style is guaranteed to outperform consistently over every business cycle. Different market conditions may call for other investment styles to perform better. Investors should consider their own risk tolerance, investment goals, and time horizon when selecting an investment style or strategy. Rapidly rising interest rate expectations, for example, weigh more on quality companies than on lower-quality firms. Since quality companies usually have higher visibility on longer-term earnings, future cash flows make up a bigger share of their valuation. When interest rates rise, the so-called discount factor increases, which means these future cash flows are discounted back at a higher rate to determine the fair valuation of a company.

And, while quality investing can bring longer-term benefits, it’s important to keep in mind that investing in any kind of equity strategy is accompanied by risk as stocks are particularly sensitive to geopolitical events as well as economic and financial developments that can directly affect market conditions, regardless of which investment philosophy one picks.

Performance in different market regimes

In bull markets, quality companies can keep pace with the market due to their above-average profitability, consistent growth prospects, and the potential for better-than-expected earnings. In bear markets, quality investing shines as investors flock to quality companies as they typically experience smaller drawdowns due to stable earnings and strong balance sheets. In turn, they are more likely to recover quickly when the market rebounds, as they can capitalize on lower cost of capital than their competitors to gain market share and grow faster than their lower-quality peers.

In inflationary environments, quality companies can possess enough pricing power to pass on cost increases to customers, which helps soften the impact of inflation on their profitability. Their strong competitive positions and customer loyalty allow them to maintain margins and protect their earnings.

Quality investing, centered on selecting high-quality companies with strong financial fundamentals and sustainable competitive advantages, is an investment strategy that may offer the potential for consistent, improved risk-adjusted returns. It can perform well during economic downturns, provide stability during market exuberance, and offer a hedge against inflation. While valuation and interest rate fluctuations may impact short-term performance, the long-term focus on financial stability and sustainable growth positions quality investing as an attractive approach for investors seeking resilient portfolios.

1. The value factor includes securities whose prices appear low compared to their intrinsic value, while the growth factor includes securities whose prices are believed to be driven by outsized sales and earnings growth.

The views expressed in this material are the views of Vontobel through the period ended March 31, 2024. Historical analysis and current forecasts do not guarantee future results. The information herein reflects our judgments, which are subject to change without notice, as of the date of this document. In preparing this document, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources. Opinions and estimates involve assumptions that may not prove valid. There is no guarantee that any forecasts or opinions in this material will be realized. There is no assurance that the investment objective will be achieved or that the strategy will be successful. Information should not be construed as investment advice. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. Past performance is not a guarantee of future results. Investments involve risks including possible loss of principal. All information is from Vontobel unless otherwise noted and has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information, and it should not be relied on as such. © 2024 Vontobel. All rights reserved.