Shades of Quality

Quality Growth Boutique

When we started the Quality Growth boutique in 1984, we set out to apply the tried and true approach of great investors, such as Warren Buffett and Charlie Munger, in a way that combines growth with downside management. At the time, most equity managers were defined as either growth or value; quality was a niche. Today, quality is a popular approach for a simple reason – it has worked. Investors now have access to a rainbow of strategies that are considered quality, many of which perform differently depending on the market environment..

Quality attributes – such as pricing power, barriers to entry and strong competitive advantages – can lead to more predictable earnings that compound over time and help provide downside management. Since 2009, the S&P 500 Index accumulated 500%, compounding at 14.5% per year1. Market performance in the previous two decades, at 6% per year, paled in comparison. In a bull market, when a rising tide lifts all ships, a focus on limiting downside capture is underappreciated. We think this may change.

In the exuberance of the COVID recovery and persistent low interest rates, markets were paying more for growth at the start of 2022 than during the tech bubble. Since then, valuations have cooled somewhat. However, they still indicate that equity markets are disproportionately focused on interest rates – namely the expectation that rapid and seismic interest rate reductions will lift and hold asset prices. As we have seen the Federal Reserve hold off on interest rates cuts amid an uptick in inflation, this is an environment in which investors should exercise caution.

We believe this is important for two reasons: First, as earnings growth becomes a larger component of equity appreciation, investors tend to prioritize current business fundamentals in stock selection. We welcome this shift; stock picking is our craft. Second, investors’ mistakes will become more apparent if multiples turn into a headwind. As such, more predictable business models may become fashionable again.

While investors may agree on the basic principles of quality investing, there are many subtleties and nuances in defining a quality company. In this paper, we outline our five quality convictions that may differ from other managers.

1. Promising business models don’t always make quality companies

Investors are always on the prowl for the next big idea. Who will be the next Amazon, Apple, or Google? In the search for riches, people forget that for each Google there are multiple Yahoos. Speculative business models are engines of innovation and progress, and they are an important part of the economy, but do they belong in a strategy that hopes to limit downside risk?

I keep a copy of the book “Lessons From the Top” on my desk and I re-visit it every time I have the urge to do something stupid. The book was published in the late 90’s and it is a series of profiles of the most popular CEO’s at the time. Not by design, but in hindsight, the book turned out to be a “who’s who” list of companies that blew up, or CEO‘s who committed fraud, or both – Bernie Ebbers (MCI WorldCom), Ken Lay (Enron), Steve Case (AOL) to name a few. It gets better, Rajat Gupta, the ex-McKinsey CEO convicted for inside information, wrote the foreword.

The chapter on AOL is illustrative. In the early 90’s, AOL was the most promising internet company. It invested heavily in marketing by seeking to acquire customers through its ubiquitous CDs. Customers would install a CD in their computer to access the service using a dialup modem at a whooping speed of 56 kbps, slow enough to sip a cappuccino while waiting for a web page to download. AOL was an amalgamation of news, email, chat rooms and shopping. The brand was so popular that it became the inspiration for “You’ve Got Mail,” a blockbuster movie starring Tom Hanks and Meg Ryan.

Steve Case, the founder and CEO of AOL, had a clear vision for the business and it is hard to disagree with him even today: “ …we must believe passionately about the possibilities of what could happen, if we had a society where everyone was connected. But at the same time, if we are so focused on the promised land ….we’ll never get there. So we have to strike the right balance between vision and passion….” In fact, Steve Case was so passionate about AOL that in 2000, he convinced the shareholders of Time Warner, one of the largest media companies at the time, to merge in exchange for AOL’s worthless shares. Unfortunately, vision, passion and scale were not enough; AOL is in the corporate graveyard of transformational companies.

To be clear, we are not against investing in technology companies. We are shareholders in some of the largest tech companies today. However, we believe being right is more important than being first. We are adamant about a minimum track record of profitable growth in order to invest. In our opinion, if the company is really transformational, rest assured, the business will not go ex-growth after 5 years or so. For example, if you invested in Amazon in 2010, thirteen years after its IPO and with a 5-year track record of profitable growth, you would still have multiplied your original investment by 25x times2.

2. Value and Quality are Not Necessarily Mutually Exclusive

I am yet to find an investor who looks to buy high and sell low. Investing and value generation are joined at the hip. There is, however, much confusion about the meaning of value. Value, as most people understand it, is to invest in companies that are out of favor, trading at low multiples, with the expectation that the market will eventually value the stock appropriately. By this definition, quality stocks, which generally trade at a premium to the market, are perceived as “expensive.”

We would argue that this is a narrow definition of value investing. In fact, low P/E stocks can be overvalued. For example, in 2001 Costco traded at a premium of 50% to Tesco3(28x vs.19x); however, its premium is even larger today and Costco’s stock is 10x more valuable than Tesco’s. During this time, Costco’s earnings grew by eightfold and Tesco’s declined slightly. In our view, value is the accumulation of capital over time through the compounding of earnings and free cash flow.

3. Earnings growth is not synonymous with quality investing

As we discussed above, value increases with the compounding of earnings, to a large extent, yet the inverse is not always true. Earnings growth does not always create value. This is a subtle but important point. Value creation depends not just on earnings growth but also on a company’s rate of return.

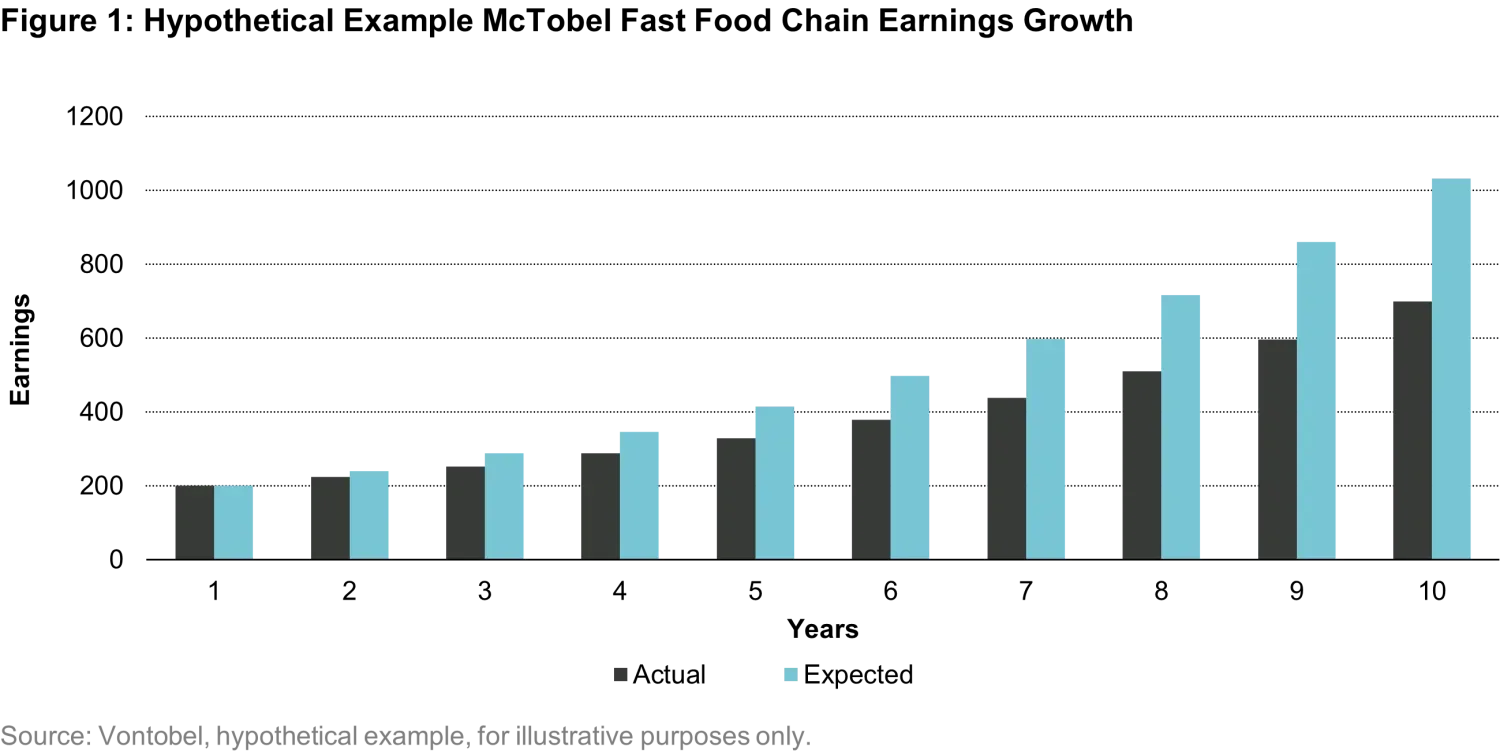

Let’s imagine you start a chain of fast food restaurants, “McTobel”, and you decide to expand across the country. A new restaurant costs $1 million to open and you expect it to generate $100k in profits after a year. You are an ambitious entrepreneur and you plan to quintuple your restaurants in the next 10 years. You raise $2 million from friends and family to start the business, enough to open the first two new restaurants with a plan to finance the expansion with internal cash flow. After 2 years, the business is making $200k and you realize that at this pace, it will generate just enough cash flow to open 5 stores, well-short of the original plan of 10 stores.

You decide to borrow the capital shortfall of $5 million at 10% per year from your local bank. You meet the original target, yet at the board meeting you find yourself explaining to shareholders why profits were 30% short of the original forecast. Ultimately, you realize that to expand the business with internal cash flow only, you must improve returns to at least match the rate of expansion. Otherwise, you will have to keep accessing external capital, either with debt or equity, to finance the cash flow shortfall, and earnings will continue to be short of expectations.

This simple tale illustrates the challenge of investing in growth stocks. In the excitement of finding the next big idea, such as home appliances in the 50’s, internet routers in the late 90’s or renewable technologies today, investors confuse top-line with earnings growth.

4. Downside management is not an afterthought

It takes money to make money. If your investment is down 50%, it will have to double before you recoup your losses. The world is too complex for us to make directional bets, either because of too many known unknowns (e.g., macro risks) or unknown unknowns (e.g., pandemic). For this reason, in addition to sticking to our approach in seeking quality companies, we also aim to build portfolios with downside management in mind. In In The Not So Secret Sauce of Portfolio Construction we explain our investment approach, which is to essentially find a balance between maximizing total return and minimizing downside risk.

Ideally, we would like to invest in stocks that have both characteristics; in reality, most of the time great businesses do not come cheap and valuation is part of our risk assessment. Just like we do not enjoy paying insurance premiums, minimizing risk in a portfolio requires finding the right balance between higher growth/higher multiple stocks and lower growth/lower volatility stocks. In a momentum market, when the wind is at your back, it is easy to downplay the risks and to focus solely on maximizing growth, but when your house is on fire, you will be happy to have paid those premiums.

5. Frogs don’t turn into princes

Sometimes companies that look good on paper can ultimately struggle. For those paying close attention, the warning signs are there. Through good judgment, investors can weed out companies that may lose their ability to earn excess profits in the future.

A good example is the case of sporting goods and apparel company Under Armour4. Between 2010 and 2014, the company had an impressive average return on invested capital of 38%, average revenue growth of 29%, and net debt to equity of only 10%. From a purely mechanical standpoint, Under Armour was a standout performer with the quantitative hallmarks of quality. However, from 2014 to 2017, the company’s profitability and growth steadily collapsed. What appeared to be a prince was actually a frog, due to a multitude of reasons.

As a fashion company, Under Armour, by definition, is subject to fluctuations in style preferences. The rapid growth it experienced, hitting $4 billion in revenue and a mid-single-digit market share, was difficult to sustain. Its growth slowed due to intensifying competition from other sportswear brands, including market leaders like Nike, Adidas, as well as emerging brands such as Lululemon. There were also question marks over management competence as Under Armour entered footwear and fitness apps, taking focus away from its core apparel business. Lastly, signs of aggressive accounting gave us pause as to whether Under Armour could maintain its position as a quality company.

Conclusion

Our value proposition is simple. To consistently compound our clients’ wealth over the long-run, we seek to invest only in quality companies, those with a track record of growth and high returns. We agree, though, that past performance is no guarantee of future performance and sometimes we will make mistakes. Nevertheless, our approach has aimed to historically offer lower risk and help manage on the downside as well.

There are many types of quality strategies, and while some will perform better than others in different parts of the cycle, we will stick to our discipline. We do not approach investing as a beauty contest with the goal of maximizing inflows. We are here to help our clients reach their financial goals, which requires a thoughtful and consistent process. Vontobel Quality Growth may not be for everyone, but we believe it is the right strategy for investors looking to compound wealth and sleep well at night.

1. As of May 2024

2. Assuming stock price as of 31 Dec 2010

3. Past performance is not a guarantee of future results. For illustrative and discussion purposes only as a means of demonstrating our investment management approach and processes. Note: Companies highlighted were previously held in a Quality Growth strategy and basis for selection is these are comparable retail companies which illustrate the thesis discussed. Source: Vontobel

4. Past performance is not a guarantee of future results. For illustrative and discussion purposes only as a means of demonstrating our investment management approach and processes. Note: Company highlighted was not Quality Growth strategy holding and presented as an example of a company that would not meet our investment criteria. Source: Vontobel.

Important Information: Past performance is not indicative of future results. Companies discussed herein are for informational purposes only to elaborate on the subject matter under discussion. Information provided should not be viewed as a certainty or indication of similar or future outcomes in connection with our investment management approach and processes. The reader should not assume that an investment in any securities identified was or will be profitable or that investment recommendations or investment decisions we make in the future will be profitable. The selection criteria for case study examples is not based on performance. References to holdings and/or other companies for illustrative purposes only. Information provided should not be considered a recommendation to purchase, hold, or sell any security nor should any assumption be made as to the profitability or performance of any company identified or security associated with them. There is no assurance that any securities discussed herein will remain in the portfolio at the time you receive this communication or that securities sold have not been repurchased. Securities discussed do not represent the entire portfolio and, in the aggregate, may represent only a certain percentage of the portfolio’s holdings. Further, investments discussed herein are not a reliable indicator of the performance or investment profile of any composite or client account. Any projections or forward-looking statements regarding future events or the financial performance of countries, markets and/or investments are based on a variety of estimates and assumptions. There can be no assurance that the assumptions made in connection with such projections will prove accurate, and actual results may differ materially. The inclusion of forecasts should not be regarded as an indication that Vontobel considers the projections to be a reliable prediction of future events and should not be relied upon as such. The views and opinions herein are those of the individuals mentioned above and do not reflect the opinions of Vontobel Asset Management or the Vontobel Group as a whole. The views may change at any time and without notice.