Why should fixed income investors take the perceived extra risk with emerging markets?

Fixed Income Boutique

Key takeaways

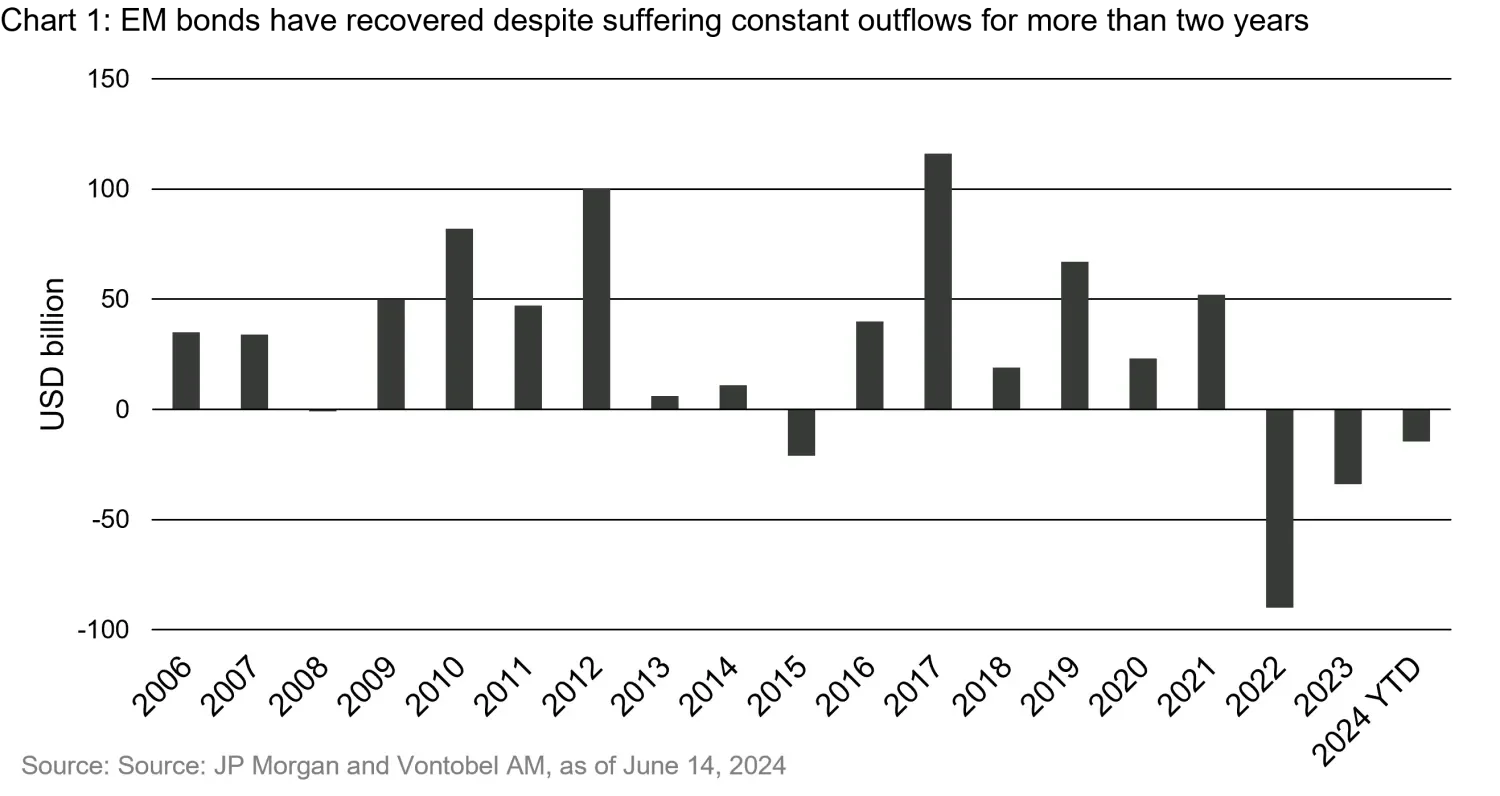

- Emerging market (EM) spreads have compressed despite significant outflows. We see more potential when inflows return to the asset class, and we think it’s a matter of when, not if.

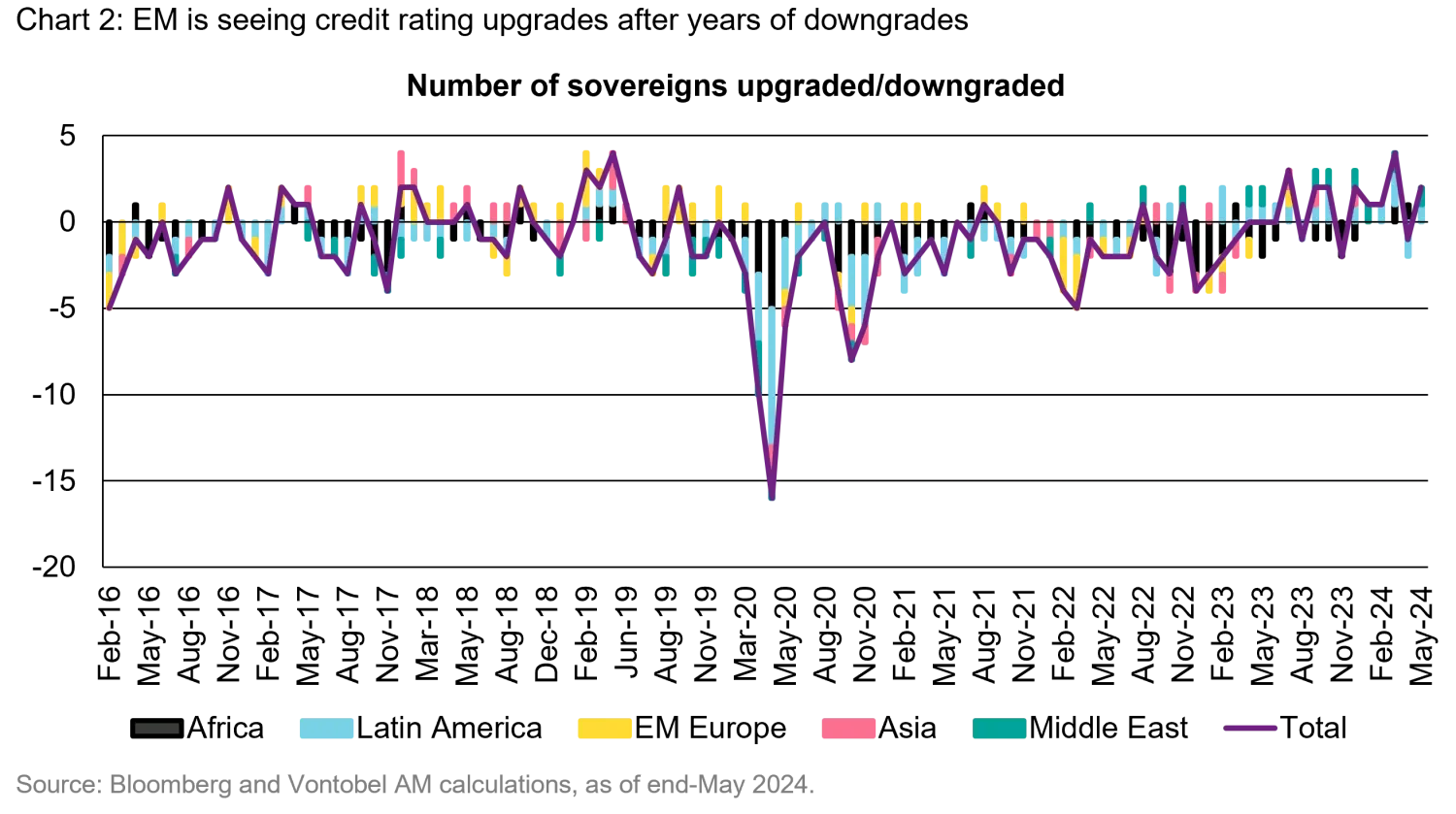

- Lower risks justify reduced risk premia. Several countries are enacting positive economic reforms, and tighter spreads have allowed high-yield issuers to regain market access, greatly reducing default risks. The trend of credit-rating downgrades seems to be over, and an upgrade trend may be starting.

- Comparisons with U.S. high-yield (HY) overstate EM risk. EMs offer greater diversification, less leveraged companies in the same ratings categories, and include 50-60 percent investment-grade issuers.

Improving fundamentals and reform momentum justify tighter spreads

After a strong start to the year in fixed income, investors should strongly consider emerging markets. EM hard-currency bonds started the year strong, delivering positive YTD returns despite rising US Treasury yields.1 Sovereign (JP Morgan EMBIG Div) and corporate bonds (JP Morgan CEMBI BD) delivered total returns of ~+2.7 percent and ~+3.9 percent respectively, contrasting with the negative -2.1 percent return in global aggregate fixed income (JP Morgan GABI, or -2.6 percent for the Blomberg-Barclays global aggregate fixed income index). This performance is notable given the ongoing outflows from EM bonds (see figure 1).

Why did EM spreads tighten despite ongoing outflows?

EM spreads have declined in tandem with DM credit spreads. EM sovereign spreads stand at 348bps vs ~447bps a year ago (excluding defaulted Venezuelan bonds that distort the picture), while EM corporate spreads stand around ~225bps vs ~319bps a year earlier.

It’s important to address the technicals at play. First, EM flow data typically overlooks cross-over investors, and their increased allocation to EM isn’t reflected in the numbers. When non-EM dedicated funds sell Developed Market (DM) credit to buy EM bonds directly – instead of allocating to an EM-dedicated fund, EM demand rises and spreads tighten. Additionally, despite a vibrant primary market, net new issuance (net of amortizations, coupons, buybacks/calls) has been relatively low for EM sovereigns and outright negative for EM corporates due to larger redemptions and coupons than gross issuance (JP Morgan, June 2024). The much-reduced presence of Chinese corporates in the primary market further exacerbates this supply-demand imbalance. Both factors were major contributors to the tightening trend in EM.

While US Treasury yields have been rising for most of the year, contributing to a strong dollar, and despite persistent outflows, the asset class has defied doomsayers and delivered positive returns. Improving global economic prospects, along with better EM fundamentals and reform momentum, have propelled EM hard-currency bond performance despite global challenges.

Global risk assets have rallied as the chances of a global recession diminished, bolstering corporate earnings EM bond spreads have also tightened alongside the global equity rally. The resilience of the US economy has notably boosted Latin American issuers due to close ties via trade, investments, remittances, and travel. Commodity exporters have also benefitted directly via higher prices (up 7.9 percent YTD). Higher equity valuations also enhance the relative value of EM debt.

In addition, it’s essential to note that high yield (HY) bonds have actually been the main driver of positive returns in the fixed income market, outperforming Investment grade (IG) bonds since mid-July 2022. In the last 12 months, EM HY sovereign and corporate bonds in particular returned over 17.4 percent and 13.4 percent, respectively, compared to just 3.4 percent and 6.6 percent for IG bonds. Lower interest rate sensitivity and reduced default risks due to market reopening have contributed to sovereign HY's outperformance.

Why investors should currently consider diversifying with EM:

1. Spread compression occurred amidst outflows

We see significant potential for further compression when inflows return. Second, lower risks justify reduced premia (see section below). Third, comparisons with US HY overstate EM risk. We see potential for risk reduction through diversification as EM encompasses nearly 80 countries, with almost 60 percent IG issuers for corporates and 50 percent for sovereigns, which subsequently reduces the risks to country or sector-specific shocks. Not to mention that EM corporates and sovereigns are less leveraged even within the same rating bucket.

2. We also observe an EM credit rating upgrade trend following pandemic related downgrades

EM issuers, especially HY sovereigns that lost market access during 2022-23, have been focusing on enacting orthodox economic reforms, which have often been accompanied by multilateral and bilateral support. Examples of such reforms are evident across various regions. In Turkey, an orthodox economic team was appointed after President Erdogan’s recent re-election, leading to upgrades by S&P and Fitch to B+. In Latin America, Argentina elected a pro-market government resulting in five months of consecutive fiscal surplus for the first time in 16 years. This has helped corporates in these jurisdictions to regain market access. In Africa, several countries, including Ivory Coast and Benin, secured new IMF programs, with Ivory Coast upgraded to Ba2 by Moody’s and Benin to BB-.

3. After a post-pandemic bump, EM default rates have been declining and are expected to drop further

Contrasting with the gradual uptick anticipated in DM default rates. The default cycles in EM and DM have diverged since the pandemic and are once again moving in opposite directions. In EMs, many issuers with weak fundamentals already defaulted in the last four years. Some sovereigns, like Egypt and Pakistan, have received substantial financial support from bilateral and multilateral partners, enabling them to navigate through challenges. Corporate issuers, especially those in large countries such as Brazil or Indonesia, found alternative financing sources domestically. In 2024, most high-yield issuers have regained market access, significantly reducing default risks. JP Morgan anticipates the EM corporate high yield default rate to decrease from 8.7 percent in 2023 to less than 4 percent in 2024. Meanwhile, JP Morgan forecasts a gradual increase in US HY corporate default rates from 2 percent in 2024 to 3 percent in 2025 and to 4 percent for leveraged loans. In fact, DM markets saw the third highest distressed exchange activity on record in May 2024.

4. EM IG likely to perform better than in the recent past if US Treasury yields decline

EM IG bonds should become positive contributors to the asset class performance going forward, as US Treasury yields should decline over the next 12 months, and duration should become investors’ friend for the first time in more than two years. Once the asset class’s positive performance becomes less dependent on high-risk issuers, then inflows may finally return, would push spreads tighter still even with a slowing economy.

5. EM local-currency bonds have suffered YTD, but their fate is probably bound for a turnaround

In 2023, they delivered an impressive 12.7 percent return, surpassing hard-currency sovereigns (+11.1 percent) and corporates (+9.1 percent). But rising US Treasury yields and a strengthening US dollar (+4.4 percent YTD) have resulted in negative returns of 3.7 percent YTD. Despite this, EM FX has shown resilience on the back of high EM carry. In contrast, global developed market government bonds (ex-US) have dropped by 7.2 percent YTD. If we measure it in euro, investors have seen slightly negative GBI-EM total returns stood of -0.5 percent, while safe haven German bunds are down 1.7 percent YTD. There haven't been any significant negative events specifically affecting EM, global fixed income and FX markets have simply adjusted to prolonged high US interest rates.

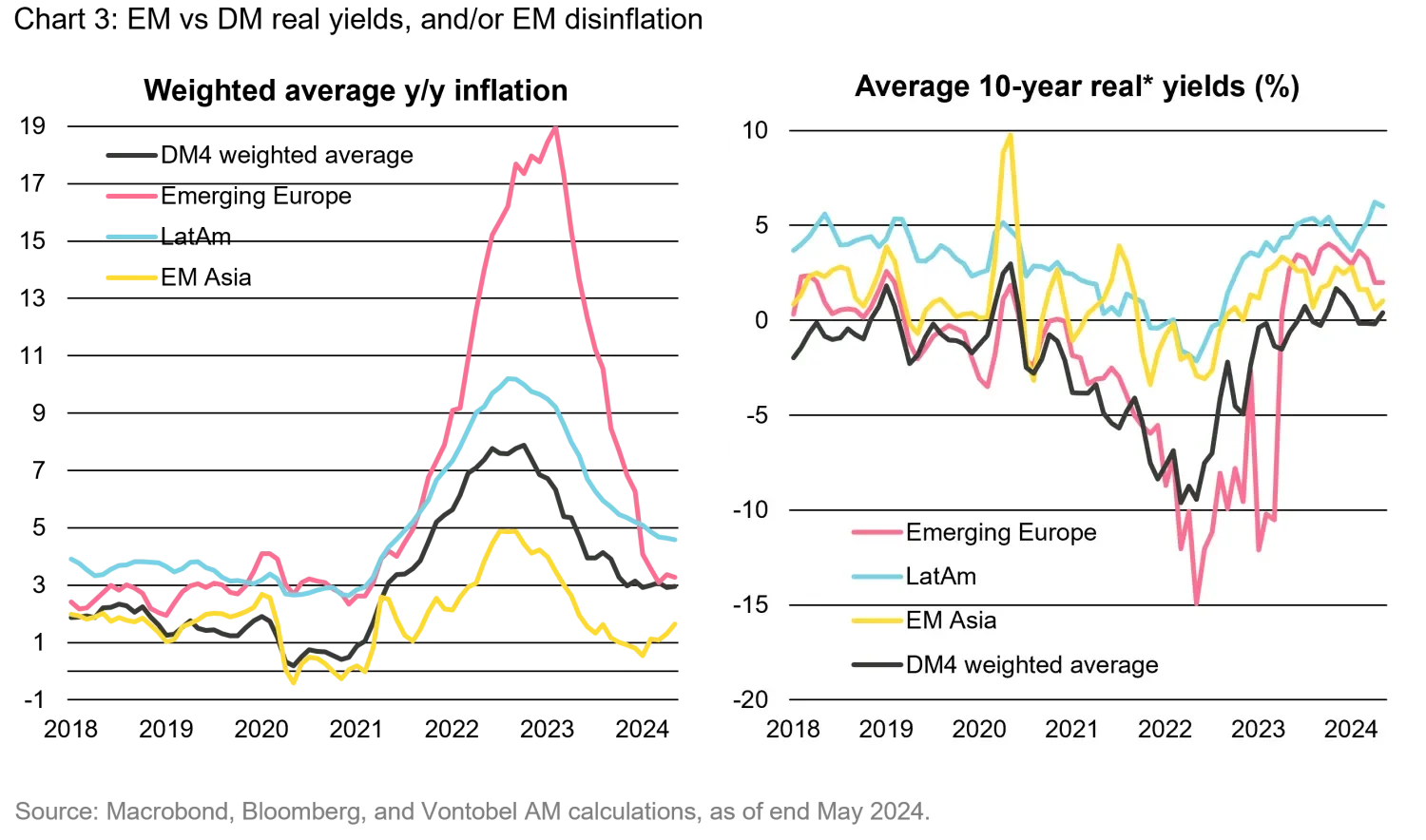

6. Current prices present a favorable entry into EM local-currency bonds compared to the beginning of the year

The yield to maturity of the JP Morgan GBI-EM index has increased by almost 40bps YTD to 6.6 percent, reflecting the rise in US Treasury yields. While this may seem modest, it's noteworthy that while US inflation accelerated in Q1 (and then resumed in the last two months), orderly disinflation has prevailed in Latin America and Europe, with Asia experiencing very low inflation. Consequently, this recent repricing has significantly boosted real yields in EM relative to developed markets, particularly in Latin America.

7. Investors betting on a US economic and inflation slowdown should favor EM local assets

For strategic investors, who may be less concerned about the exact timing of the US business cycle, high real interest rates in EM suggest favorable inflation-adjusted returns compared to developed market government bonds in the medium term.

Overall, with all of the above in mind, we’re optimistic about expectations for total returns over the next 12 months. EM hard-currency sovereign yields stand at 8.3 percent, while EM corporate yields are at 7.0 percent, which are still attractive. In a soft-landing scenario, spreads should remain well behaved and with the help of declining global yields, EM hard-currency bonds should deliver low double-digit returns in the next 12 months. In a scenario of high for longer, total returns would be closer to the current yield to maturities. While in a hard-landing scenario, EM total returns would be lower but likely remain positive because global yields would decline abruptly compensating for upward of 200bps of spread widening.

For EM local-currency, the 6.6 percent yield to maturity of the asset class is not a good indication of 12-month expected returns in dollars given the volatility of the greenback and US Treasury yields. If EM local yields retreat to their end-2023 levels of 6.2 percent and the dollar reverses its year-to-date gains, returns could reach 12.9 percent in the next year. While a continuation of the US exceptionalism would leave total returns vulnerable to a higher USD, there are two reasons why this should not worry us disproportionately. The current real yield spreads to DM provide a comfortable cushion and it’s simply not our central scenario.

1. Figures as of June 20, 2024.

Important Information: Past performance is not a guarantee of future results. Any projections or forward-looking statements regarding future events or the financial performance of countries, markets and/or investments are based on a variety of estimates and assumptions. There can be no assurance that the assumptions made in connection with the projections will prove accurate, and actual results may differ materially. The inclusion of forecasts should not be regarded as an indication that Vontobel considers the projections to be a reliable prediction of future events and should not be relied upon as such. Neither diversification nor asset allocation ensure a profit or guarantee against loss.