Advice from an international manager: avoid non-US equities…?

Quality Growth Boutique

A robust US economy, technological innovation, and accommodative monetary policy have all supported US stocks’ outperformance over their international counterparts over the past two decades. The market’s initial response to Trump's election further bolstered US equities. Despite uncertainties around the new administration’s proposed policies, investors expect US stocks to continue their seemingly unstoppable climb.

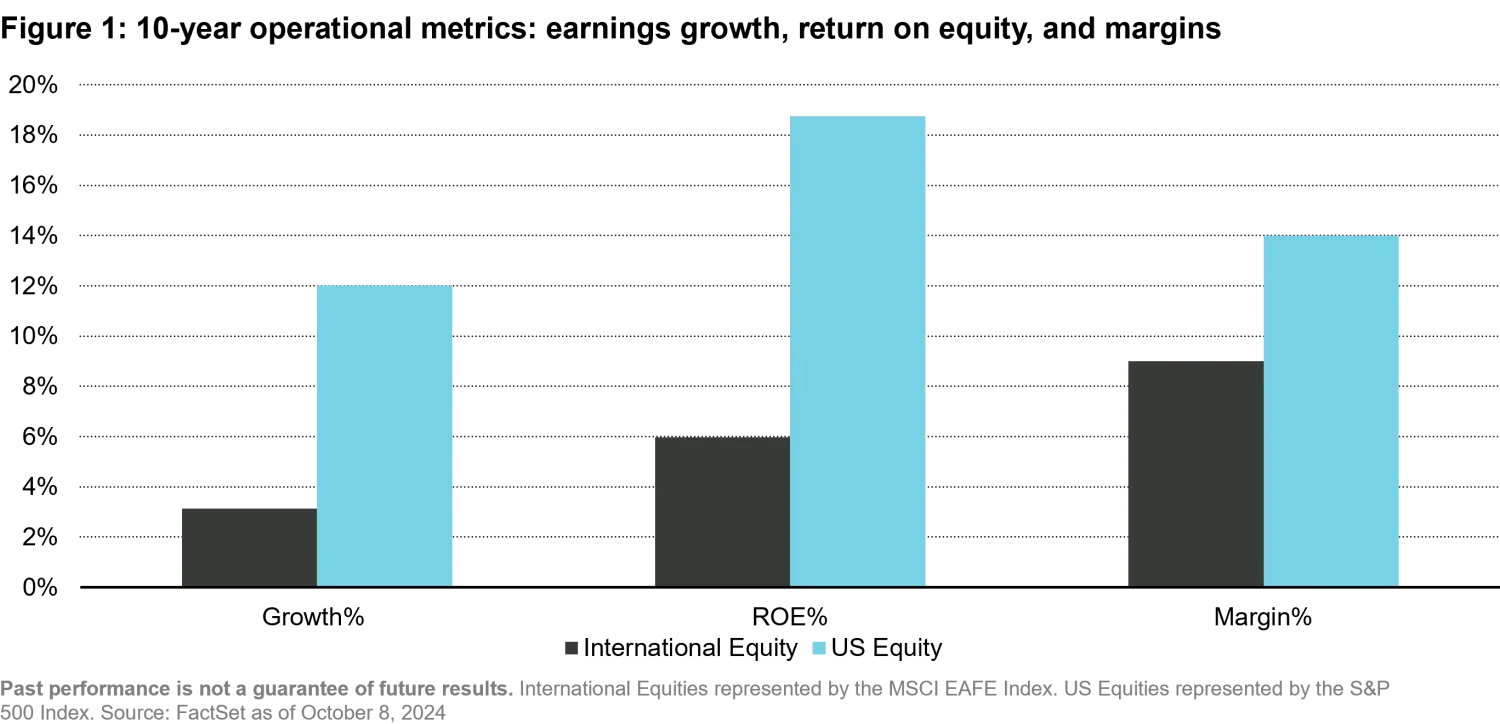

Fundamental metrics also favor US investing. In aggregate, the S&P 500 has delivered higher earnings growth, return on equity, and margins than the international benchmark.

But for all its benefits, investing solely in the US benchmark is not without its risks. Market concentration intensified in 2024, with the Magnificent 7 stocks contributing nearly half of the entire S&P 500 return this year, largely driven by advancements in AI. They now represent over 30% weight (27% volatility) in the broad benchmark (18% volatility).1

So, should investors consider international equities?

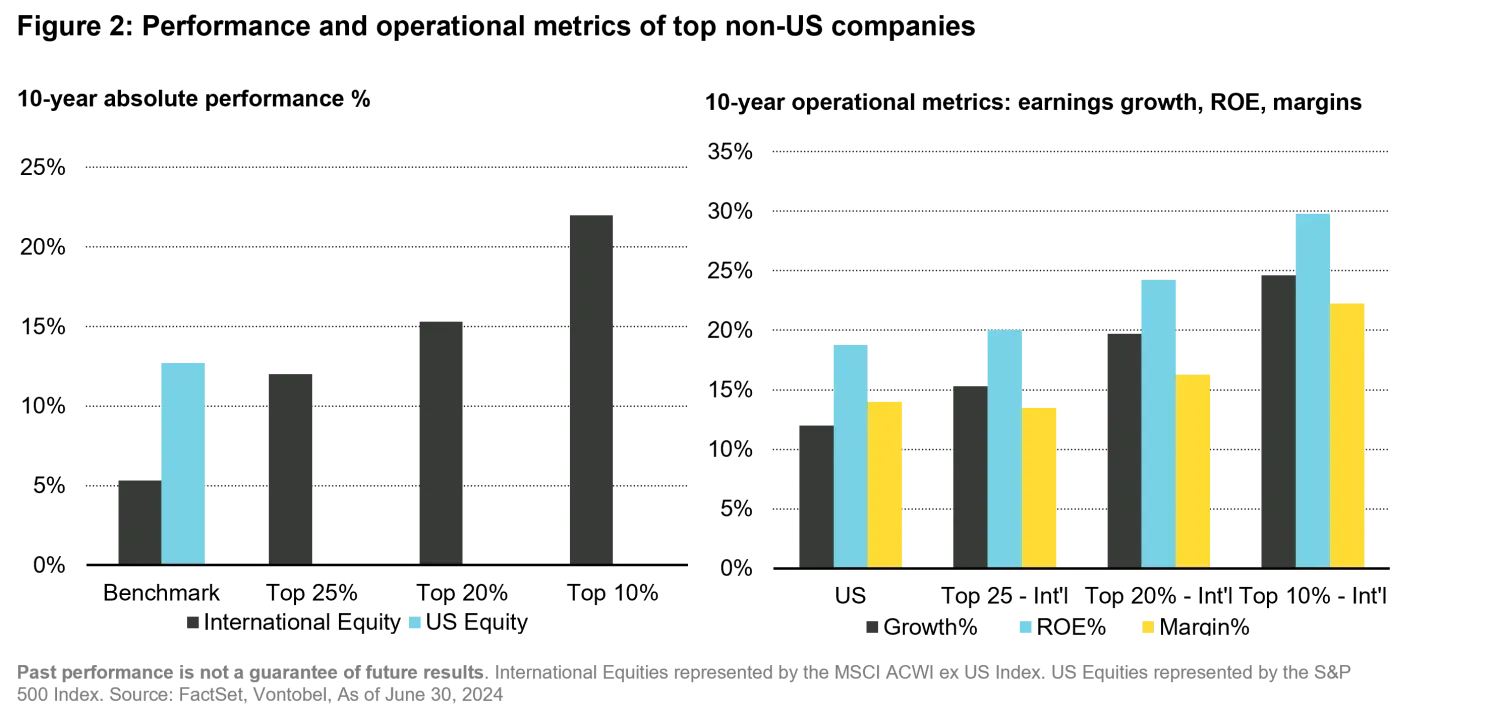

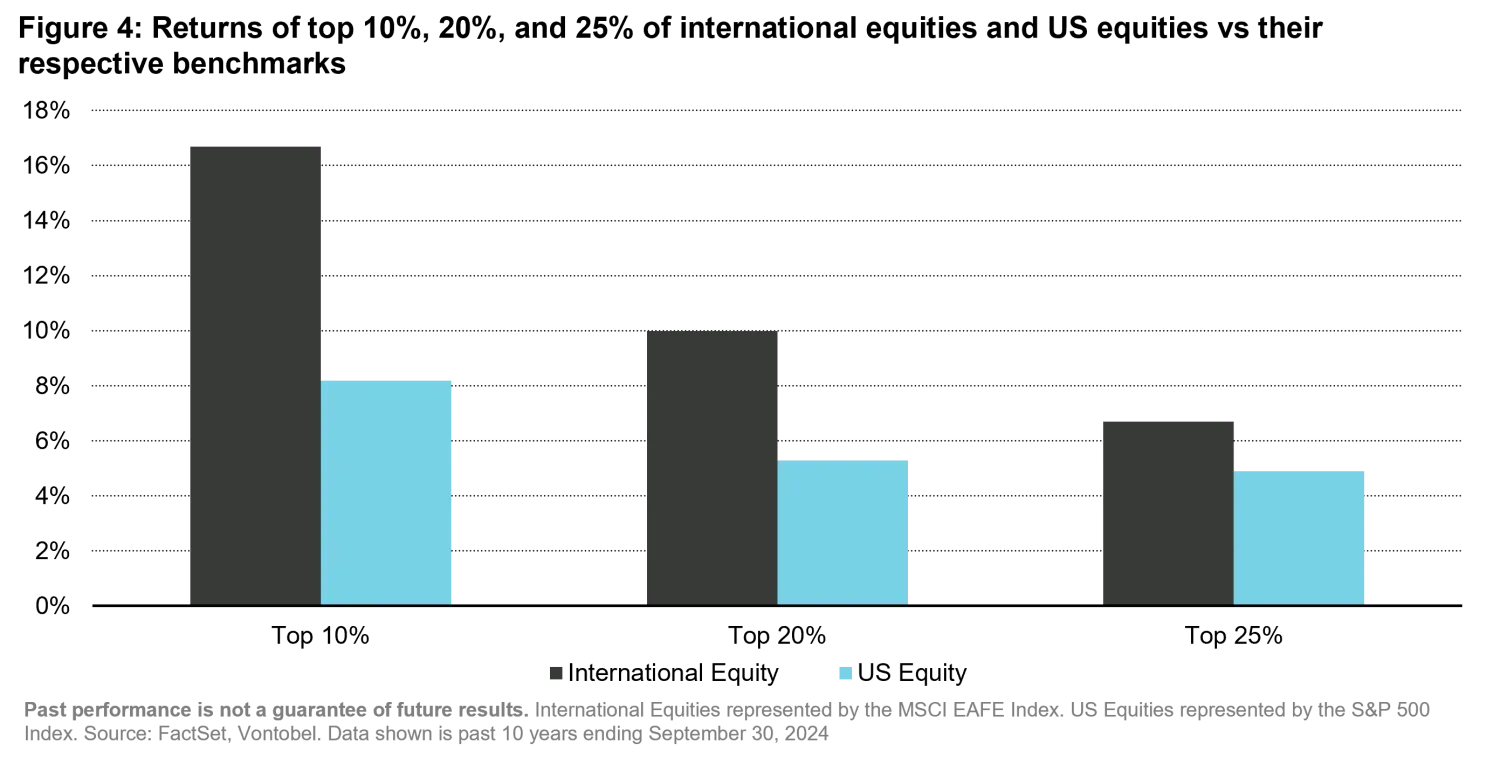

No, we do not recommend investing indiscriminately in the broad international benchmark. But we do recommend being selective and actively seeking out companies that are leaders in their industries, sometimes without a US equivalent. The advantage is that investors can diversify their risk in the US markets by investing in a basket of quality non-US franchises. Another benefit is performance: the top quartile of international companies (a large sample of 1,000’s of stocks) has either matched or exceeded the S&P 500. We believe this performance is sustainable, as it is rooted in strong fundamentals.

The unsung heroes of non-US markets

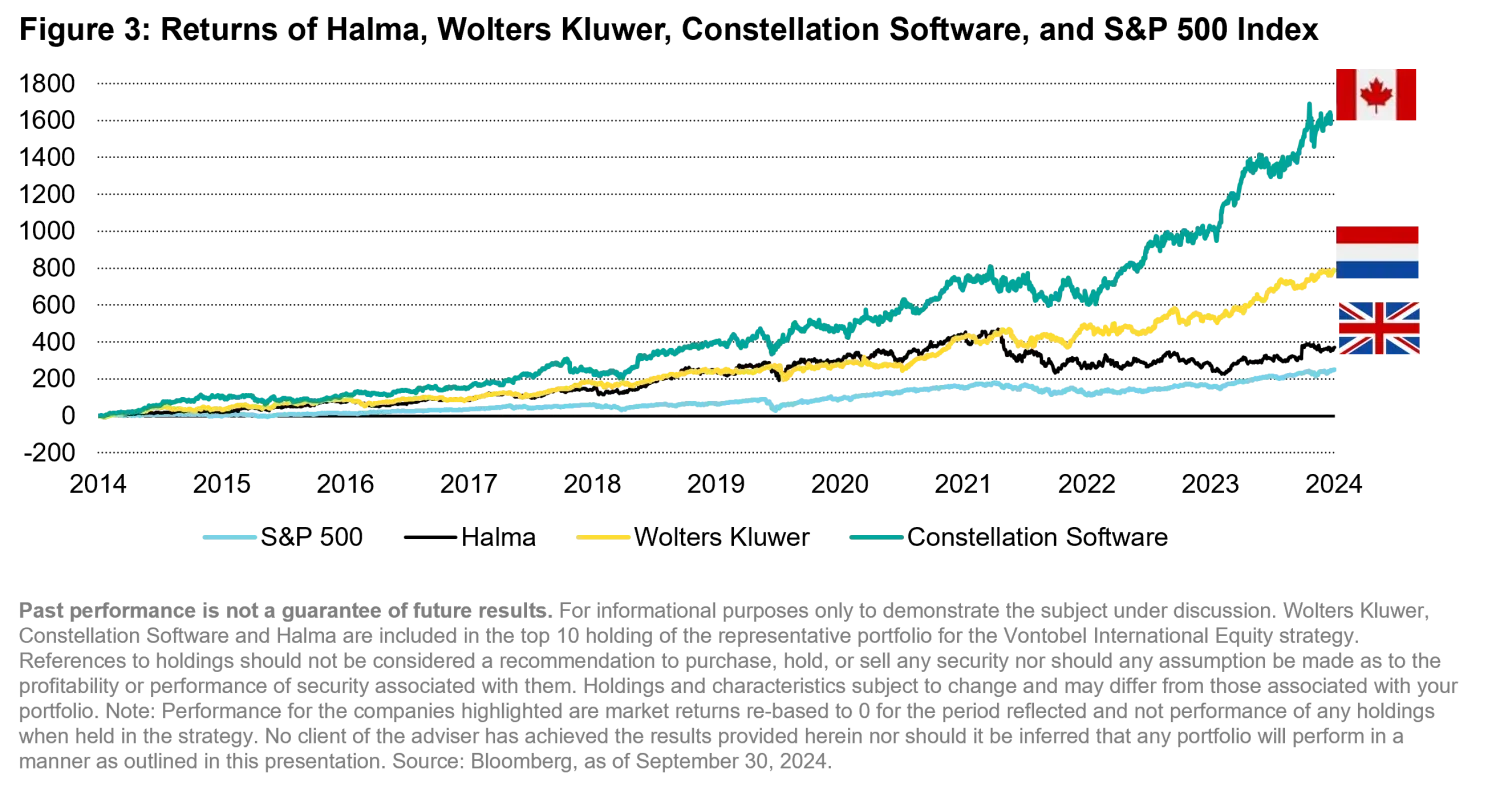

Lesser-known companies domiciled outside the US are overshadowed by their larger, more well-known US competitors, particularly in the technology sector, but have delivered impressive returns for investors. Canadian-based Constellation Software, for instance, has seen its shares rise, a testament to its successful track record in mergers and acquisitions. Specializing in vertical market solutions, the company provides back office and operational software across health care, law, and public transit. Its growth is driven by strategic acquisitions in a still fragmented industry, and its business model is predictable, with customers paying annual maintenance fees and rarely switching to competitors.

UK-based Halma is another example of a lesser known technology company. It develops, produces, and sells very necessary hazard and life protection products. Operating across Process Safety, Infrastructure Safety, Medical, and Environmental and Analysis, Halma offers products that protect people and assets at work and ensure safety in infrastructure.

An example of a company that performs well in volatile markets is Netherlands-based industrials company Wolters Kluwer, a global information services and solutions provider. It caters to professionals in the health, tax and accounting, governance, risk and compliance, and legal and regulatory sectors. Over the past five years, the company has increased its revenues from high-growth businesses from 40% to 51%, and we expect it to continue to generate strong earnings and free cash flow in the coming years.

Active management can add more alpha

We believe the inefficiency of international equity markets compared with the US means the outperformance of top quartile stocks versus their respective benchmarks is larger. In other words, active management can create more value in international stocks than in US stocks.

Avoid the international benchmark, but embrace a select group of non-US stocks

With its impressive roster of leading global companies, the S&P 500 has become synonymous with stellar returns. Yet we argue that the allure of US markets should not overshadow the potential of international companies. A select group of international companies can be best-in-class in their industries and can provide valuable diversification benefits to a US portfolio. US stocks continuing to outperform international stocks is not a foregone conclusion, but a challenge to be met with active management.

1. As of October 2024

Important information: Past performance is not a guarantee of future results. For informational purposes only as a means of demonstrating the Quality Growth (“QG") investment management processes and to further illustrate the subject under discussion. Halma, Constellation Software, and Wolters Kluwer are among the top 10 holdings of the representative portfolio for the International Equity strategy, a portfolio within a composite that Vontobel has deemed the most representative of the composite strategy. To evaluate the outcome of the strategy, please refer to the long-term performance contained in the relevant strategy profile. References to holdings should not be considered research, a recommendation to purchase, hold, or sell any security nor should any assumption be made as to the profitability or performance of security associated with them. Holdings and characteristics subject to change and may differ from those associated with a client portfolio. The information herein reflects judgements of the QG team, which are subject to change without notice, as of the date of this document. In preparing this document, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources. Opinions and estimates involve assumptions that may not prove valid. This document also contains projections and other forward-looking statements regarding future events, targets, or expectations. Such statements are based in part on current market conditions, which will fluctuate and may be superseded by subsequent market events or other factors. Historical market trends are not reliable indicators of future market behaviour or the future performance of any particular investment and should not be relied upon as such. There is no assurance, as of the date of publication, that the securities referenced remain in the strategy or that securities sold have not been repurchased. Additionally, it is noted that securities discussed do not represent all of the securities purchased, sold, or recommended for the periods referenced. Investments involve risks. The value of equities (e.g., shares) and equity-related investments may vary according to company profits and future prospects as well as more general market factors. In the event of a company default (e.g., insolvency), the owners of their equity rank last in terms of any financial payment from that company Foreign investments involve additional risks, including currency fluctuation, political and economic instability, lack of liquidity and differing legal and accounting standards. Diversification does not ensure a profit or protect against a loss. The MSCI EAFE Index is an equity index which captures large and mid cap representation across 21 Developed Markets countries* around the world, excluding the US and Canada. With 731 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country. References to benchmarks are provided for your information only and do not apply that a portfolio will achieve similar results. Benchmarks do not have associated advisory fees, which reduce the returns of securities within client accounts. Clients and investors cannot invest directly in a benchmark. Past performance is not a guarantee of future results. Forward-looking statements regarding future events or the financial performance of countries, markets and/or investments are based on a variety of estimates and assumptions. There can be no assurance that the assumptions made in connection with the projections will prove accurate, and actual results may differ materially. The inclusion of forecasts should not be regarded as an indication that Vontobel considers the projections to be a reliable prediction of future events and should not be relied upon as such. Vontobel reserves the right to make changes and corrections to the information and opinions expressed herein at any time, without notice.