The end sprint for 2023: five reasons why investment grade bonds could deliver the extra edge

Fixed Income Boutique

Key takeaways

- While short-term debt can offer attractive yields and low duration risk, it may not be the best strategy for fixed income investors sprinting toward this year’s finish line.

- Investment grade bonds can offer diversification opportunities, less investment risk, high coupon returns, and high convexity.

- We believe that now is the time to switch to investment grade bonds, to get an edge on the falling yields expected in coming quarters.

As all runners know, even the most rigorous and disciplined of training schedules might not deliver the performance required. In that sprint toward the finish line, it’s often a smart strategy that provides an edge over competitors.

Current status on the track

This year, many fixed income investors felt they had their bases covered with short-term government bonds and money-market funds because they appear to offer the potential for attractive yields with low duration risk in a world of sticky inflation and possible rate hikes. As a result, these products attracted billions of inflows as many clients scampered for their perceived “safety”.

While investment grade bonds also recorded inflows overall, they did not reach the same levels. Why then do we suggest that investors should switch to investment grade bonds and gradually increase duration as the end of 2023 gets closer?

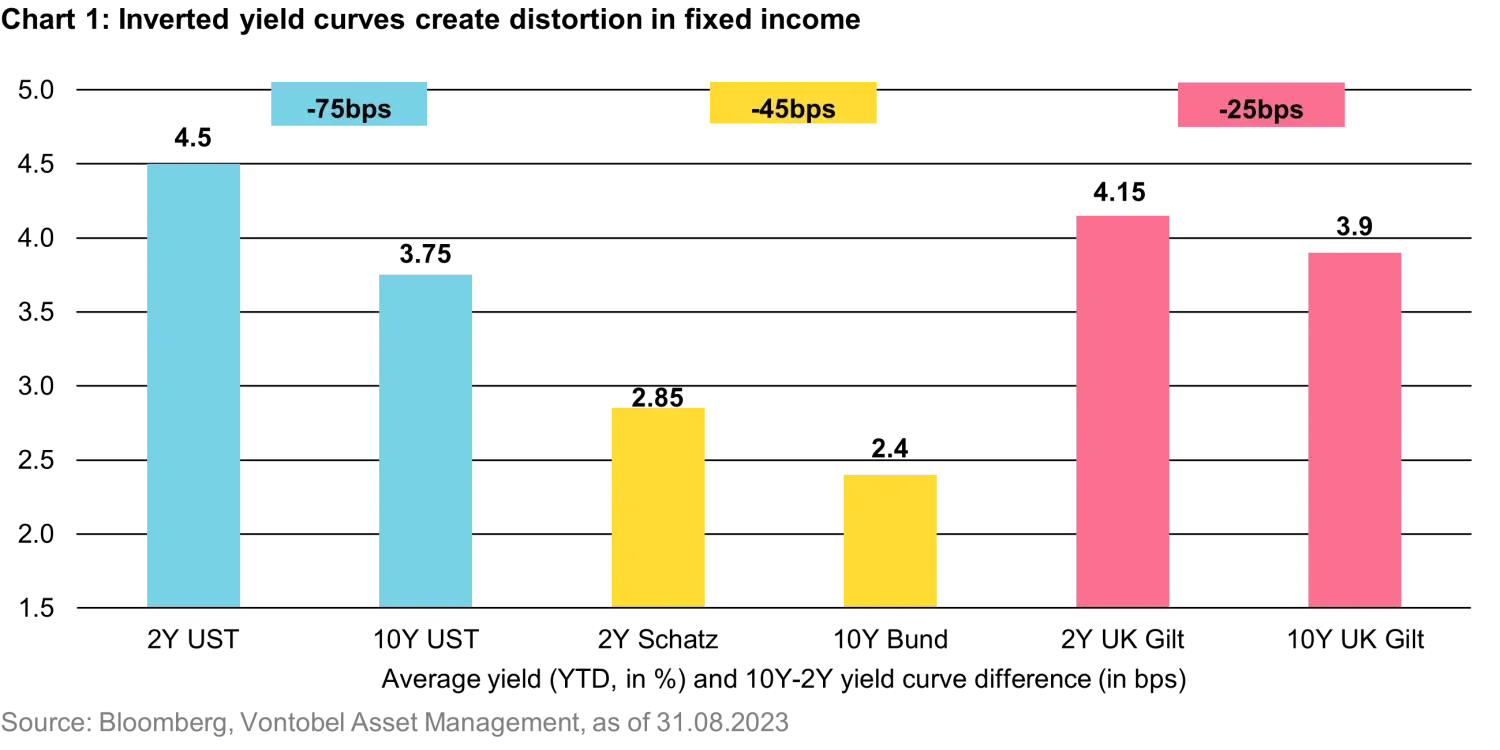

The reason lies with yield curves. Yield curves are currently inverted, meaning that short-term debt offers higher yields than long-term bonds with the same risk profile. In addition, their price sensitivity to interest rates is moderate.

However, inverted yield curves are not here to stay: inflation is trending lower in most countries, economic growth is slowing and there is a consensus in the market that we are closer to the end of the rate hiking cycle than its beginning. For this reason, we believe it’s time to look further ahead and consider adding long duration to your portfolio.

Five reasons to change your approach

1. Diversification opportunities – Many investors are tempted to follow their home bias and invest in issues from a single government, such as UK gilts or Italian BTPs. We think investing in only one or few issuers goes against the basics of diversification. Also, as governments like those of the UK, Italy, and others carry credit risks, it’s a mistake to think that government bonds may be risk free. We had a timely reminder of this in 2022, when US Treasuries suffered their biggest slump on record.

On the other hand, the global investment grade bond market offers many more ways to diversify – across over 60 countries and several industries – and is to a large extent made up of large corporations and national champions. For example, the ICE BAML Euro Corporate Bond index has around 800 different issuers and the ICE BAML Global Corporate Bond index above 2400 issuers – both established liquid markets. The number of available developed-market government bonds cannot compete with that. As most companies report earnings every three months, it’s easy to spot the latest business and industry trends. Hence, investors can spread their portfolio to capture the best ideas across global bond markets, instead of betting on a single government investment.

2. Less reinvestment risk – Short-maturity investments bear reinvestment risks as you will need to reinvest your bond proceeds sooner. If inflation and interest rates continue to ease in the next 12-24 months, not only will investors miss a duration-driven rally, but they will likely reinvest the proceeds at a lower yield than now. Most people agree we appear near the end of the hiking cycle and, therefore, close to the upper end of rates. Gradually increasing the duration of your fixed income investments tends to reduce the reinvestment risk.

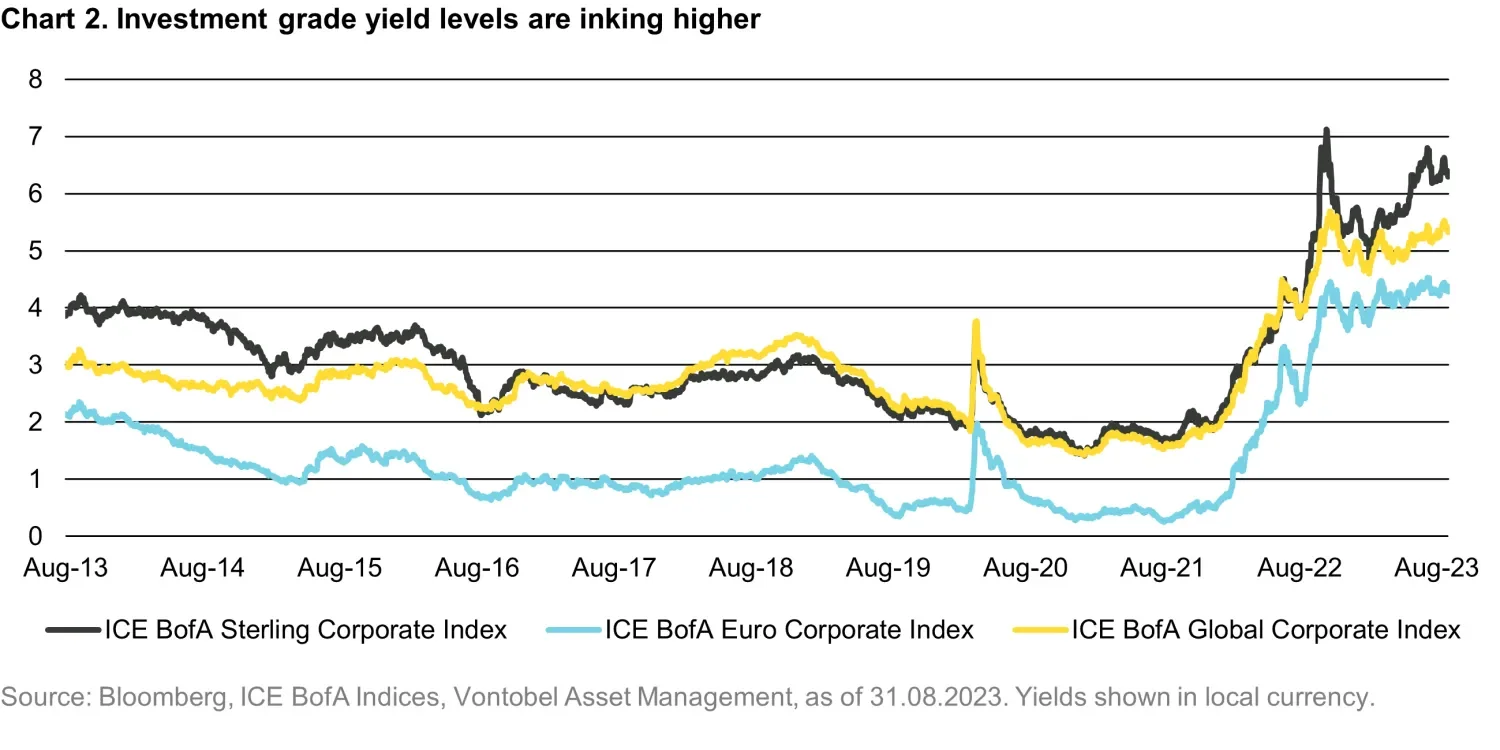

3. Income is back – Corporate bonds offer a diversified source of returns. The income generated by elevated coupons is the most important over the long term, thanks to the credit-spread part that could potentially offer a welcome surplus of return. Coupons of around 5 percent for recently issued investment grade rated corporate bonds in Euros with medium-term maturity are no exception now. Bond issues in US dollars offer an even higher coupon for investors, such as a recent senior unsecured bond from a global leading bank with a coupon close to 6.5 percent. Even more income can be found on a subordinated bond level with coupons north of 9 percent in euros. Therefore, we would say that income is back in fixed income to the benefit of investors.

4. Inverted yield curves are normalizing – As bond yields decline, yield curves will correct, so the inversion of the yield curve is unlikely to stay with us forever. This means duration is no longer your enemy. Locking in higher yields now ensures more income in the long run. Taking history as a guide and going back to 1982, we have also been in a situation with an inverted yield curve at the end of a tightening cycle on five occasions since. Each time, yield curves steepened noticeably within three years, and the US Federal Reserve’s fund rate reverted from its highs. With strong moves in yields, inverted yield curves could swiftly normalize, potentially benefitting longer-dated bonds. We argue that investors should get ready for this scenario and gradually shift their exposure from short- to medium/longer-term duration.

5. Convexity is your friend – Around 40 percent of the global investment grade universe trades below a cash price of 90, making the entire market highly convex. Convexity in bonds is the measure that tells how bond prices change as interest rates move: the higher the convexity, the more sensitive bond prices are to any interest-rate swings. This means that higher-convexity bonds offer the potential for greater returns if yields fall. We know this effect is incorporated in current yield levels. However, we haven’t seen bonds trading below par for many years. They will have to go back to par value over time, unless they default, which rarely happens in investment grade. With the end of the rate hiking cycle in sight, we believe convexity can become your friend, with bonds trading below par potentially benefitting from this.

Why sprint for investment grade bonds now? Assuming the hiking cycle is coming to an end, history shows that now is the time to engage with longer duration. And as the chart below shows, corporate bond yields may have peaked, and offer a great entry point for investors now

In the last decade, most investors didn't accumulate much income from fixed income, and in the last year their financial strategies have been shaped by trying to guess what central banks will do. So, we think it’s time to switch gears in the race to the end of 2023 and move to lock in the good yields that are available now.

Corporate bonds currently provide a high carry, with high coupons as well as a convex risk profile – an opportunity set that we’ve rarely seen before.