Is the energy transition gridlocked?

Conviction Equities Boutique

On Monday 28th April 2025, many parts of Spain and Portugal were plunged into darkness, experiencing what has since turned out to be one of the most disruptive electricity outages or blackouts in Europe for decades. The media focus was intense, particularly for the sprawling Madrid metropolitan area, with an estimated population of almost seven million people1. The abrupt stoppage of daily life was reported on extensively by global media outlets, with long-distance trains stranded, the metro system ground to a halt and people unable to pay for goods and services as mobile networks/internet connections were not working and ATMs were no longer able to dispense cash. There were also reports of more serious non-financial consequences, with sadly some deaths being potentially linked to the blackout. In our view, the whole episode highlights some very important issues that apply to all countries around the world that are pushing to decarbonize their electricity grid networks.

What caused the blackout?

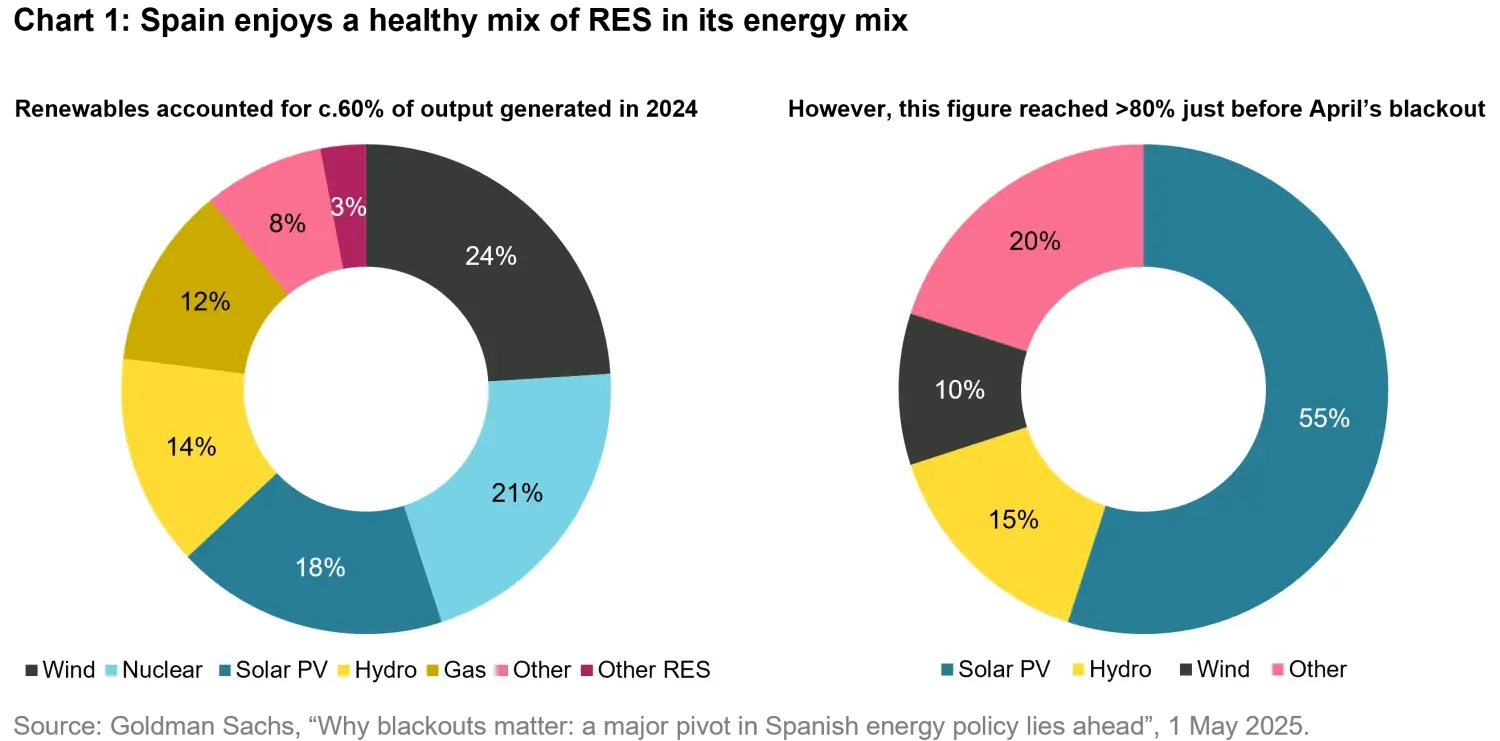

On the 17th June 2025, Spanish investigators released a report that pointed to a surge in voltage and the grid’s inability to control this as a key failure that led to the blackout. Spain’s Energy Minister, Sara Aagesen, confirmed that several factors played a role and she rebuffed any suggestion that the event would change Spain’s approach to renewables.2 Her reason for doing so is significant as there had been speculation that the outage was caused by the high percentage of renewable energy sources (RES) in the energy mix just minutes before the blackout occurred. As can be seen in the below chart, Spain enjoys a healthy level of renewables in its energy mix with approximately 60% of the energy mix in 2024 coming from RES such as wind, solar and hydro. However, just moments before the outage occurred, the percentage of RES in the energy mix soared to >80%. Given the intermittent nature of RES and the extra volatility this brings to the grid network, this prompted many commentators to suggest that this was a likely cause of the outage.

Given that Spain has ambitions to grow to 81 percent renewable energy in its electricity generation by 20303, this begs the question of whether its grid network is adequately prepared for such an uplift. It’s important to stress that this question is relevant for all countries with similar aspirations. In fact, Spain should be admired for its already high levels of RES in its electricity generation mix and its ambitions to increase even further. In comparison, the revised European Union (EU) Renewable Energy Directive is looking to achieve at least 42.5 percent from renewable energy sources by 2030, with an aspiration to achieve 45 percent.4 According to the European Commission, achieving this target would result in “almost doubling the existing share of renewable energy in the EU”.5 For its part, the UK has ambitious plans to produce at least 95 percent of its power from clean sources by 2030, with an aim to reach 100 percent by 2035.6

With these ambitions set in legislation across European nations, we believe there is an opportunity to learn from the potential issues associated with April’s outage and for countries to start making the necessary investments in their grid networks. This way they can ensure that their grid networks have greater resilience as the share of more volatile renewable sources steadily increases. Such a conversion of the power mix causes inevitable challenges that are technical, economic, and regulatory in nature, and managing them is crucial to maintaining grid reliability, efficiency, and stability. The grid investments and design must allow addition of new electricity generation that is open for different new technologies from RES to small modular nuclear reactors, while still integrating remaining legacy power plants.

When it comes to the Spanish grid network for example, transmission and distribution (T&D) investments have not been at a level that is required to modernize a network of power grids that are approximately 40 years old.7 This sentiment was echoed in our recent engagements with the Spanish utility company, Iberdrola, in which they advocated that a close collaboration between government, grid operator and the power utilities is essential to develop the grid to meet all future requirements. Once again, this is not unique to Spain and is a European wide problem, with investment plans across Europe’s grid operators estimated to total approx. €1.8 trillion between 2024 and 2050, which is below the European Commission’s estimate of investment needs, which ranges between €2 and €2.3 trillion.8

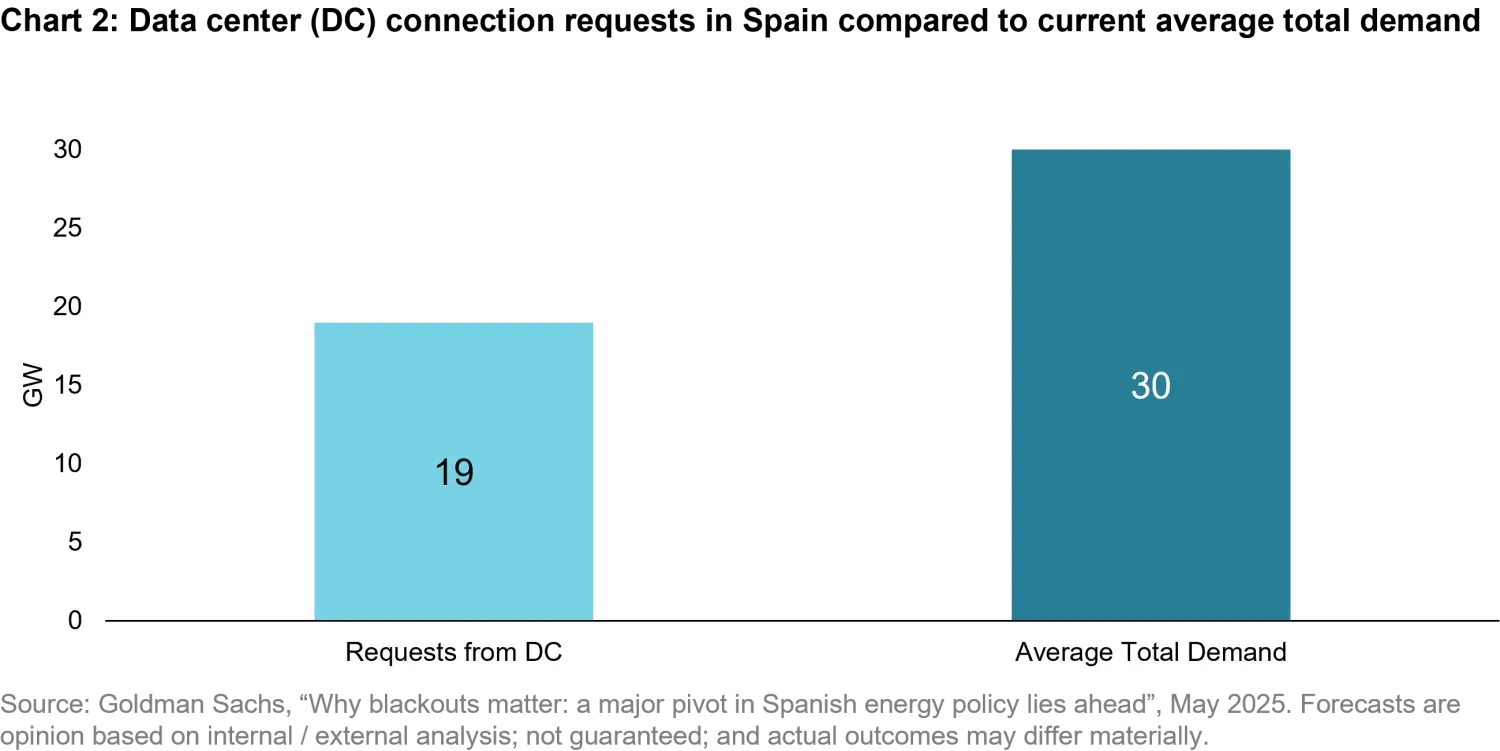

In addition, there is the demand side of the equation that needs to be considered, particularly with the rise of AI and the need for speed. Going back to the Spanish example, there is currently 19 gigawatts (GW) of connection requests from data centers in Spain, which represents over 60 percent of the current average total electricity demand in the country. Once again, this is not unique to Spain, with data center demand across the major European hubs of Frankfurt, London, Amsterdam, Paris and Dublin (or FLAPD as Europe’s data centre hubs are known) significantly outstripping supply.9

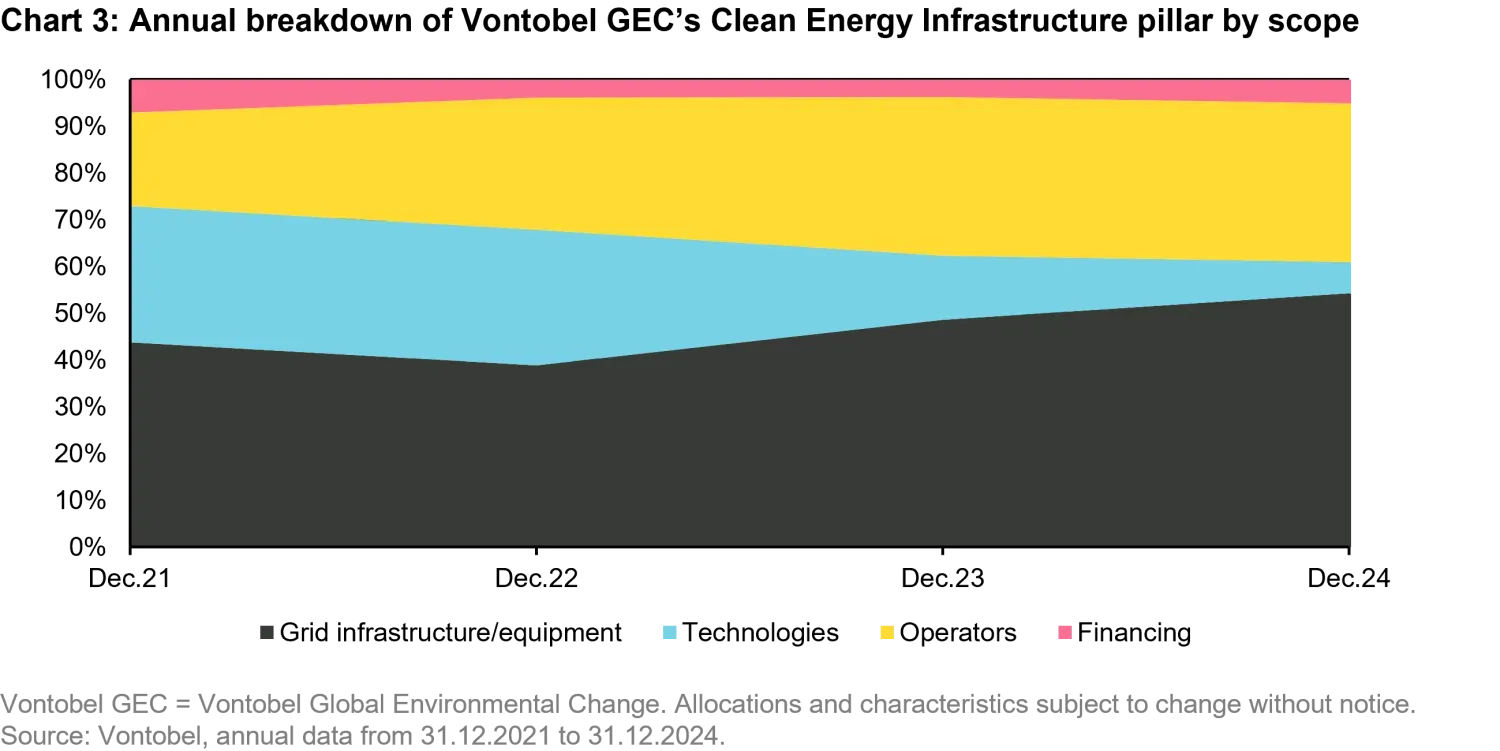

While this need to invest in the grid network has been highlighted by the recent Spain and Portugal experience, it is something that has been part of our thinking in the Global Environmental Change (GEC) strategy for some time. This is best illustrated within our Clean Energy Infrastructure pillar, where we have been significantly allocating to grid infrastructure and equipment companies for many years (see Chart 3). As at the end of December 2024, these companies made up just under 50% of our allocation to the pillar, which has come primarily at the expense of clean energy technology companies such as solar and wind producers. From our perspective, this growing allocation to grid enablers has been driven by a recognition that these companies are producing technologies and solutions that are structurally necessary if we are achieve our goals of a net zero world, which makes them appealing from a forward-looking fundamental perspective.

Storage can help provide even more stability

In addition to the necessary investment in the grid network, increasing grid storage capacity can also help with providing more stability as the share of renewables increases. RES are intermittent in nature and the ability to store excess energy during particularly fruitful periods (such as very windy or sunny days) could be key to providing extra stability. This of course also provides an opportunity to release some of this stored energy on days when RES are not as effective, reducing the need to switch on carbon emitting sources such as gas. Take the UK for example. A recent report outlined just how costly it can be when the grid cannot cope with the excess energy generated from RES and having to switch on fossil fuels such as gas instead. This approach to balancing the grid was estimated to have cost the UK economy more than £500m (approx. €590m) alone this year.10

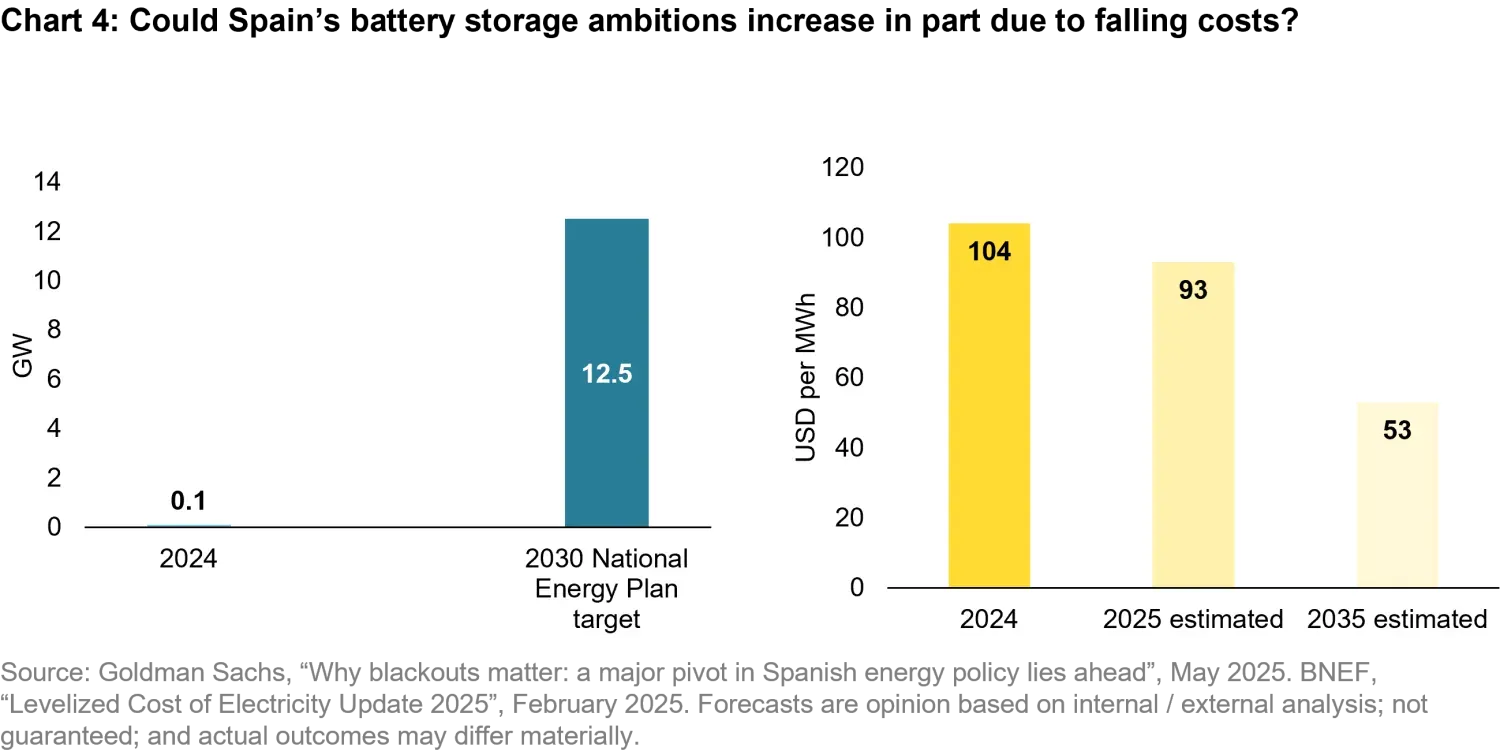

It must be remembered that storage solutions are not new, with pumped storage hydro for instance being around for decades. In the UK for example, there are currently four pumped storage or hydroelectric power stations in operation with an additional five plants planned to be operational by 2030.11 What is more of a recent move is adding battery storage capacity to the grid. Going back to the Spanish example, the country has ambitions to significantly grow its battery storage capacity by 2030, which is also something we see across many other countries. The good news from this perspective is that prices have been falling and are predicted to fall even further. This fall in prices is down to many factors, including lower cost solutions like lithium iron phosphate batteries, economies of scale and oversupply/sluggish demand in other segments such as EVs. This trajectory perhaps provides governments with the opportunity to increase their storage capacity targets in the coming years. In this context, regulators should also think about a reform of electricity markets to also include capacity payments, ancillary payments or real-time pricing.

Unlocking the potential of the grid

Electrification lies at the heart of the energy transition, however, grid networks around the world have typically experienced insufficient levels of investment for many years and need to be modernized to be become more resilient and flexible. This is particularly important as renewables form an increasing proportion of our energy mix in the coming years. In our view, increased levels of investment and addition of greater storage capacity can move us from a position of potential gridlock to one where we can unlock the potential of the grid.

1. www.idealista.com: “Madrid’s population in 2025: how many people live in Spain’s capital?”, 31 March 2025.

2. https://www.reuters.com/business/energy/investigation-into-spains-april-28-blackout-shows-no-evidence-cyberattack-2025-06-17/

3. https://commission.europa.eu/publications/spain-final-updated-necp-2021-2030-submitted-2024_en

4. https://energy.ec.europa.eu/topics/renewable-energy/renewable-energy-directive-targets-and-rules/renewable-energy-targets_en#the-2030-targets

5. https://energy.ec.europa.eu/topics/renewable-energy/renewable-energy-directive-targets-and-rules/renewable-energy-targets_en#the-2030-targets

6. https://www.gov.uk/government/publications/clean-power-2030-action-plan/clean-power-2030-action-plan-a-new-era-of-clean-electricity-technical-annex

7. Goldman Sachs, “Why blackouts matter: a major pivot in Spanish energy policy lies ahead”, 1 May 2025.

8. https://www.eca.europa.eu/en, “Energetic efforts needed to level up the EU electricity grid”, 1 April 2025.

9. https://www.datacenterdynamics.com/en/news/cbre-data-center-demand-in-europe-outstrips-supply/

10. https://www.bbc.com/news/articles/cdedjnw8e85o

11. https://british-hydro.org/pumped-storage-hydropower/

The views expressed in this material are those of the Conviction Equities boutique and are subject to change without notice, as of the date of this material, and may not be shared by other members of the Vontobel Group. In preparing this material we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources. Opinions and estimates involve assumptions that may not prove valid. Further, this material contains projections and other forward-looking statements regarding future events, targets, or expectations. Such statements are based in part on current market conditions, which will fluctuate and may be superseded by subsequent market events or other factors. Historical market trends are not reliable indicators of future market behavior or the future performance of any particular investment and should not be relied upon as such. References to holdings (past / current) and/or other companies for illustrative purposes only. Information provided should not be considered a recommendation to purchase, hold, or sell any security nor should any assumption be made as to the profitability or performance of any company identified or security associated with them. In the US, advisory services for select strategies are offered through a Participating Affiliate structure between Vontobel Asset Management, Inc. and Vontobel Asset Management AG. Where applicable, certain investment staff may be deemed as associated persons and therefore subject to SEC requirements as part of the Participating Affiliate structure.