Conviction Equities Boutique

What's ahead for Global Equities in 2024?

Are stock markets poised for a good year in 2024? Jean-Louis Nakamura, head of the Convictions Equities Boutique takes a comprehensive look at the various factors that indicate it may well be.

Conviction Equities Boutique

mtx perspectives: Mind the gap: Latin America's digital revolution takes shape

Welcome to this year’s first edition of mtx perspectives, which will highlight interesting developments across the world of global emerging markets. We start with a look at the digital revolution in Latin America.

Quality Growth Boutique

Are you a leader, defender, or opportunity seeker?

Portfolio Manager David Souccar identifies three types of quality companies: Leaders have a rare combination of high returns and high predictability, Defenders grow slower but can protect in down markets, and Opportunity seekers can profit in uncertainty but are less predictable. Like a high-performing team, a successful quality portfolio has the optimal combination of all types of players.

Quality Growth Boutique

A wolf in sheep’s clothing: equity risk in a changing market environment

As the landscape shifts, investors may now be exposed to risks that were previously disguised by a prolonged era of accommodative monetary policy. Today, it pays to be wary. A focus on quality can protect in a downturn and provide a smoother ride through the cycle.

Quality Growth Boutique

2024 Global Equity Outlook: Soldiering On

Legendary investor Charlie Munger, who recently passed away, followed a simple philosophy of “soldiering on” – persevering through challenging times while also knowing when to seize opportunities. Munger’s wisdom guides us as we manage key risks and seek to find opportunities in 2024.

Conviction Equities Boutique

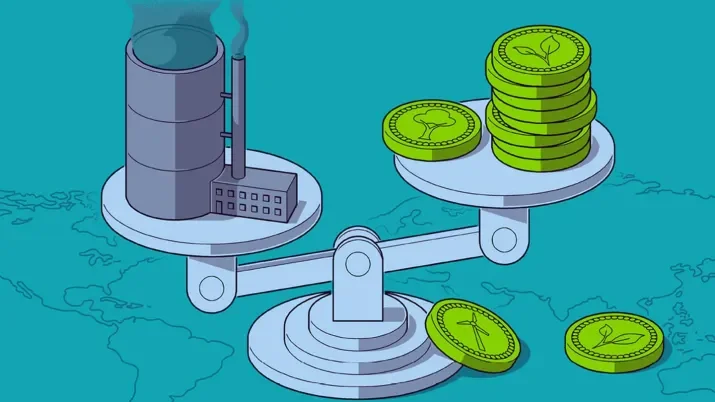

Countdown to net zero: it’s urgent and carries a price tag

For the world to meet net-zero targets, massive energy transition capital is required. Governments can’t fund this alone. Asset allocators have a role to play and impact investing will be key.

Asset management

Can we put a monetary value on nature?

Nature is our source. Challenges to natural capital are prompting the world to rethink its relationship with nature and the value we place on it. This article provides a bird-eye view of why investors should care about the semantics and monetization and regulation of nature.

Asset management

Biodiversity is essential for a strong and sustainable global economy

A healthy and robust economy and society depends on healthy biodiversity. But rapid development has resulted in the dramatic degradation of our ecosystems, which can impede further economic progress while posing an existential threat. How can we better value nature to turn this trend around?

Conviction Equities Boutique

How to get started in impact investing: your questions answered

Asking the right question is a skill in itself. Read the FAQ seasoned investors ask our impact investing experts.

Quality Growth Boutique

Firecracker or eternal flame – which companies will benefit from AI?

Recent advances in generative artificial intelligence have propelled some stocks in the tech space to nosebleed valuations. By failing to distinguish the level of certainty around the long-term benefits of AI, markets have disproportionally rewarded some companies. Is this playing out in a logical way? Or is the market missing something crucial?

Conviction Equities Boutique

Three reasons to invest in positive change

Change rests in our hands. Impact investing is gaining in popularity as investors look for increasing sustainability in all areas of life. We share three reasons that institutional and professional investors told us keep them turning to impact.

Conviction Equities Boutique

Slaying five impact investing myths

Don’t fall prey to the myths surrounding impact investing.

Conviction Equities Boutique

Towards positive change: Impact Report 2023

The wave of alarming headlines can sometimes seem to dwarf the social challenges the world faces. But Impact investing addresses a wide array of important issues that may be a bit more difficult to grasp. The latest Impact Report for Vontobel’s Global Impact Equities strategy provides case studies to highlight the steps towards positive change.

Conviction Equities Boutique

Gaining traction: Impact Report 2023

The environmental crisis is undeniable, and the world needs an urgent plan. Investment firms have an important role to play. In the latest Impact Report for Vontobel’s Global Environmental Change strategy, the Impact Investing team assesses how its holdings have helped mitigate sustainability challenges, but also delves a bit deeper: find an overview of the sustainable-finance landscape and an in-depth examination of the regulatory environment into selected key developments.

Conviction Equities Boutique

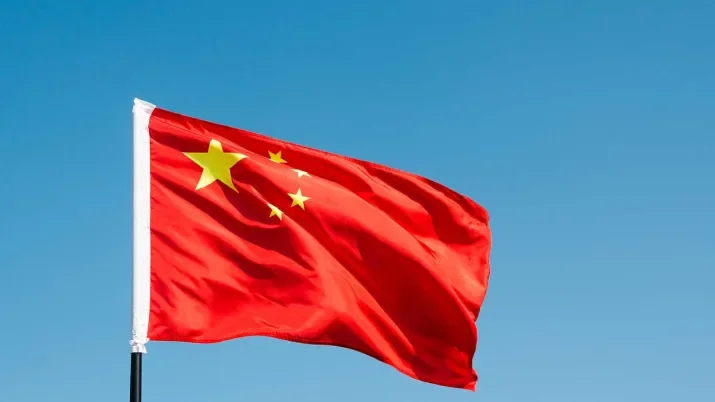

Deciphering China’s revised policy playbook

China’s last few years have presented new economic challenges, and Beijing has completely rewritten its policy priorities and playbook. But looking ahead, this does not mean Chinese investment won’t be rewarded in the future; rather that policy-compliance should be a criterion considered by investors.

Conviction Equities Boutique

Vontobel 2023 Impact Investing Survey

Favored investment approaches, investor motivation, public and private markets, measuring impact, where the main opportunities and challenges lie.

Conviction Equities Boutique

Reap what you sow: seek to harvest your "double dividend"

Financial return and positive impact are equally important in impact investing – but so is measurement.

Conviction Equities Boutique

The China paradox: underrepresented or too dominant in emerging market equities?

After a multi-decade era of significant economic growth, China is now the second largest global economy and dominant in the MSCI emerging market index. How should emerging market equities investors balance this with the potential implications of recent economic and political moves out of Beijing and shifting demographic patterns?

Conviction Equities Boutique

How to invest when the world is on the brink?

We reap what we sow: the “double dividend” concept seeks to offer financial returns and a better tomorrow

Conviction Equities Boutique

Reap what you sow: seek to harvest your "double dividend"

Generating financial returns and making a positive impact on our planet and society are equally important in impact investing – but so is measurement. To effectively measure impact, we use a systematic and repeatable approach with a commitment to full transparency at all times.

Conviction Equities Boutique

Can EM equities play catch-up in the second half of the year? Spoiler alert: we believe so!

Investors can look back at having had to navigate a difficult first half of the year. Emerging-market equities, though posting positive returns, trailed their developed-market counterparts. Could things turn around in the remainder of the year, leading to an outperformance of EM stocks?

Asset management

Fighting the good fight: The role of carbon markets

To say addressing carbon emissions is urgent errs on the side of understatement. Tackling the transition toward decarbonization requires a collective effort, and carbon markets have a key role to play in the climate change fight – though those opportunities also come with some challenges.

Quality Growth Boutique

The fallout of the US banking crisis and how quality can provide resilience

With regional banks in the US concerned about deposit flight, financial conditions are tightening, increasing the probability of a hard landing for the economy. Quality companies that do not rely on leverage and whose earnings tend to be more resilient during times of economic weakness can be an attractive option for investors.

Quality Growth Boutique

International Equities: A compelling growth story unfolds

Multinationals listed in the US can provide exposure to global revenues. But an international approach also offers access to world leading companies that have no equivalent in domestic markets. And with valuations at a wide discount to the US, and below long-run averages, the story in international equities is both timely and compelling.