International Equities: A compelling growth story unfolds

Quality Growth Boutique

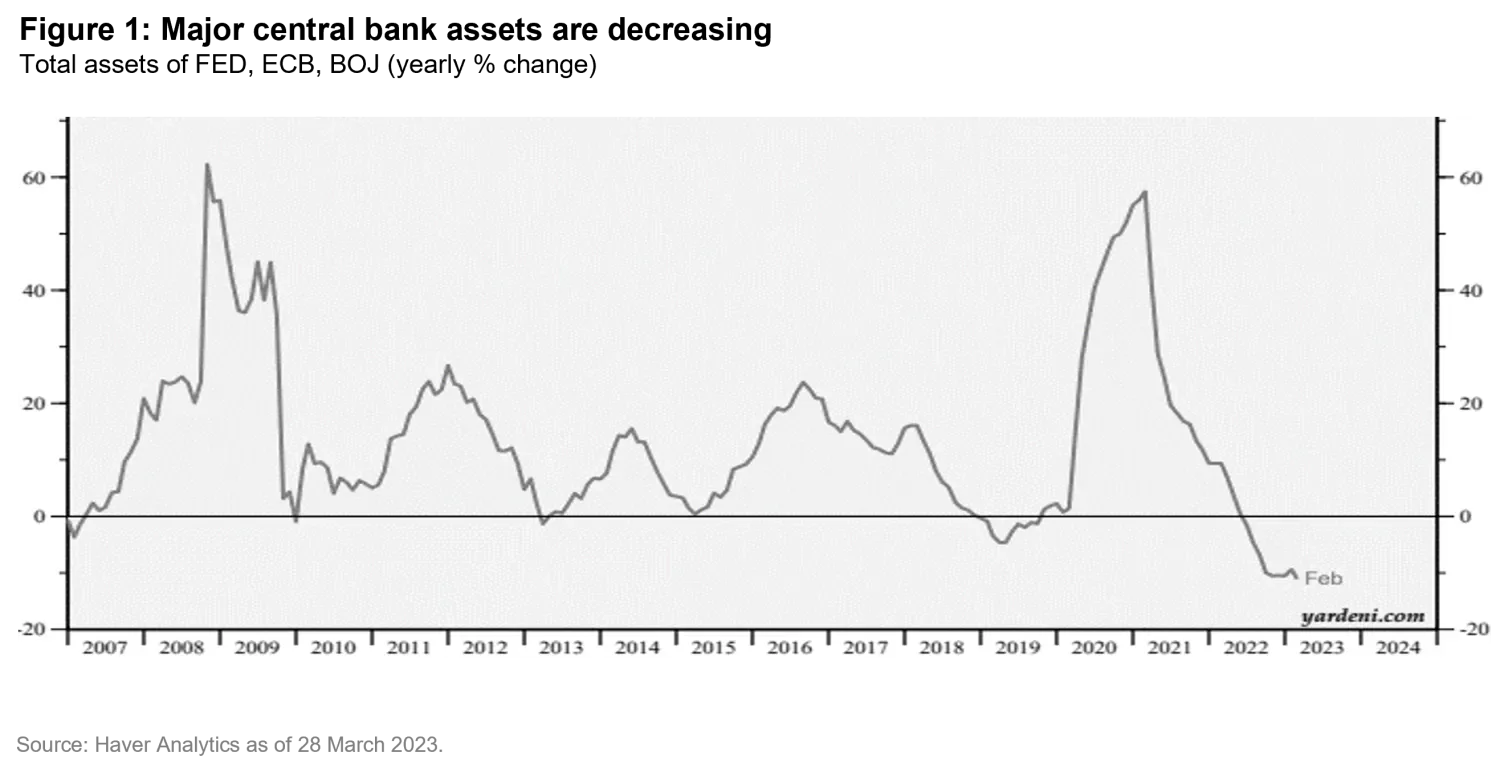

The impact of Quantitative Tightening (QT) on financial markets is difficult to predict even under stable conditions. But as major central banks wind down outsized balance sheets in today’s volatile landscape, QT may push market conditions to a breaking point. Multi-decade-high inflation, steep interest rate hikes, and rising recession risks have all created a fragile environment.

As a new chapter begins, monetary and fiscal stimulus will no longer support equity returns. Positioning your portfolio to withstand a variety of outcomes and capitalize on dislocations that may arise during periods of market stress is easier said than done. Investing in companies whose business models are resilient to macro factors is a sensible defensive strategy. At the same time, opportunities for growth can be created by businesses that are innovators and leaders in their industries. Many of these companies are listed outside the US, which means a compelling investment story is unfolding in the international markets.

Part 1: European companies are re-inventing the luxury goods experience

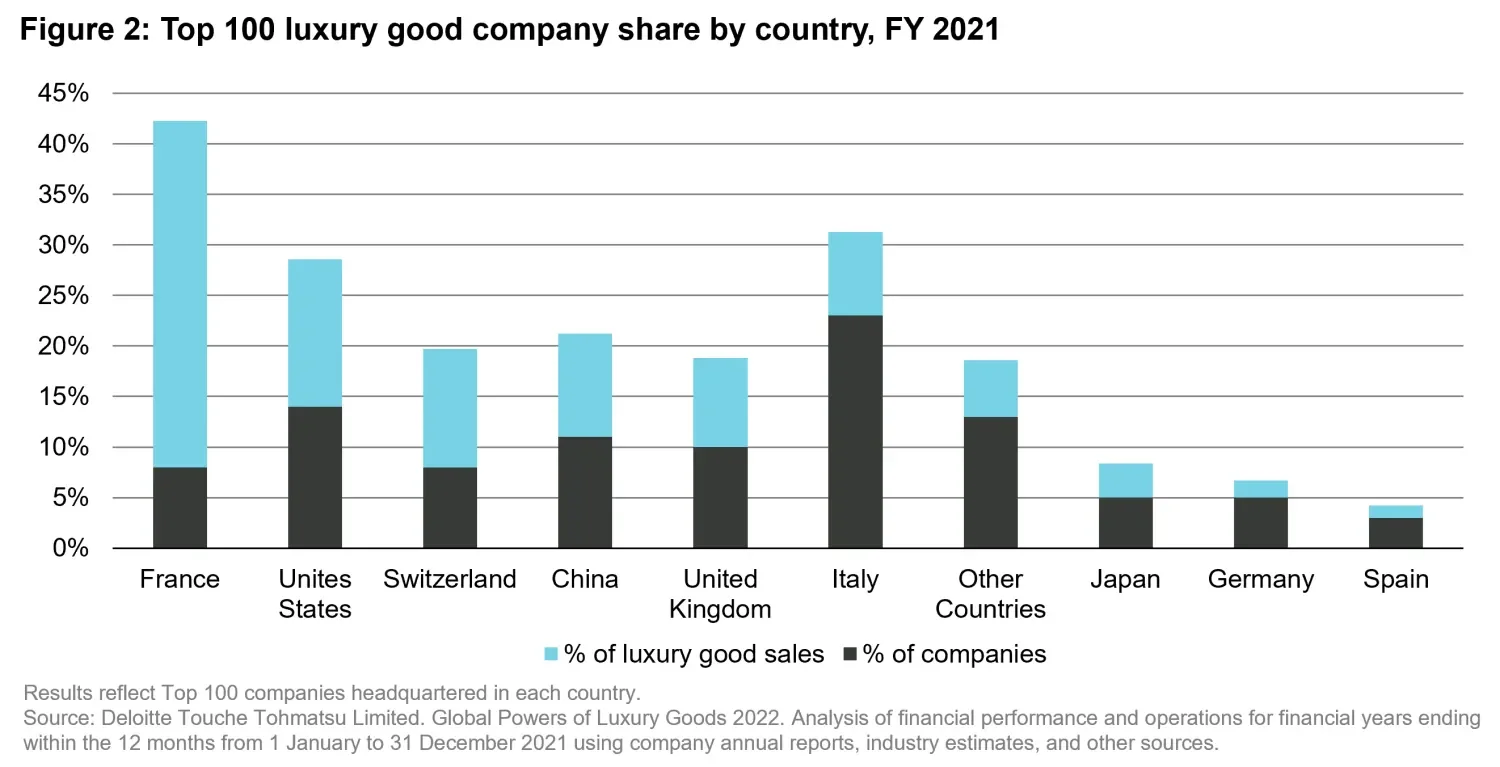

Consumer discretionary companies have historically shown resilience during economic declines. Luxury goods are less impacted by inflation given their pricing power and they tend to fare better than other retail channels during downturns due to their exposure to high-income consumers. Another source of resilience is the industry’s heightened focus on customer-centricity and the multi-touchpoint ecosystem that luxury has developed in recent years. The top 10 luxury companies now account for 56.2% of sales and almost 85% of net profits among the top 100 companies, indicating a concentrated market 1. Importantly, this space is dominated by European companies.

While there are US luxury companies, their brands don’t compare to European companies, which attract higher prices and are more defensive given their longer histories. Even iconic luxury jewelry brand in the US, Tiffany’s, is now owned by French luxury goods leader LVMH, which accounts for 32% of sales of the top 10 companies 1. LVMH transformed Tiffany’s by hiring a more effective management team, developing a winning marketing strategy, and creating a new jewelry collection. The result was a doubling of profits in the past two years and an increase in sales from $4.4 billion in 2019 to $5.65 billion in 2022. The company still has more growth levers to pull with expansion planned in Europe and China.

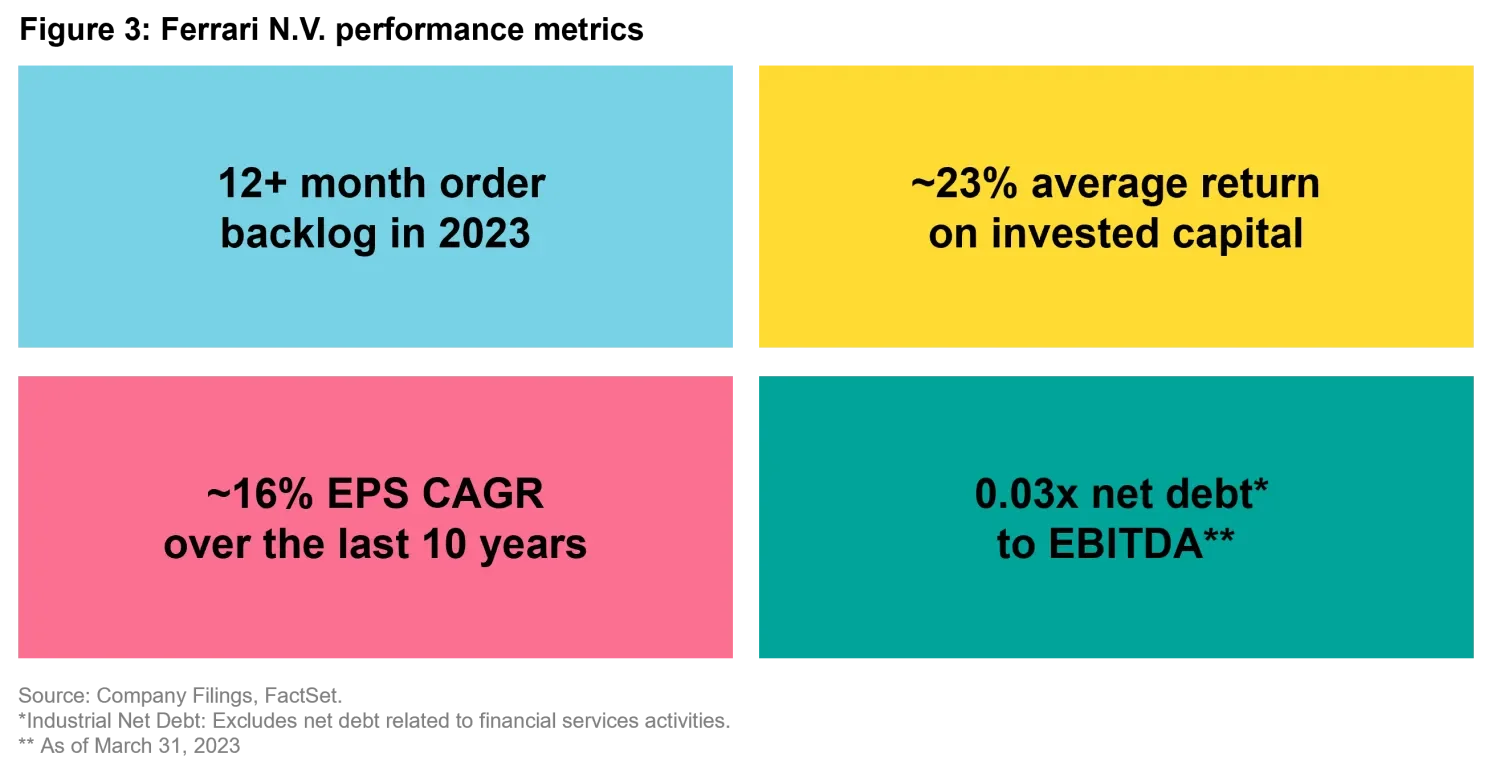

Another example is Italian luxury automaker Ferrari N.V., which intentionally pursues a low-production-volume strategy to maintain a brand reputation for exclusivity and scarcity among customers. This has resulted in superior margins and returns on capital. Combined with consistent performance and technology upgrades, Ferrari was able to steadily increase prices over the long run. The performance metrics illustrate how this approach has paid off.

The growth story of European luxury companies goes far beyond iconic brands and exclusive products. Luxury companies are innovating and embracing sustainability by offering a secondary market for products and using environmentally friendly materials. Further, some are finding new opportunities by engaging customers in the digital world – or metaverse.

Part 2: European companies leading rapid growth in pharmaceuticals outsourcing

Even before COVID, health care demonstrated its potential for resilience in volatile markets thanks to powerful secular drivers. One major trend is the shift toward outsourcing in the pharmaceutical industry led by contract development manufacturing organizations (CDMOs), companies that provide medication development and manufacturing services to the sector. Outsourcing helps smaller companies that lack manufacturing capabilities and allows larger companies to focus more on core activities, while compressing timelines for drug development processes overall. The CDMO market is projected to more than double to $278.98 billion by 2026 from $130.8 billion in 20183. The market’s rapid growth is driven by rising incidence of chronic diseases and an expanding geriatric population, as well as increased demand for novel therapies. This development is fueling European companies that are emerging as leaders in the space.

Lonza Group AG is a Swiss CDMO that focuses on biologic drugs, which are seeing solid secular growth as they become an increasing proportion of overall drug industry production. We believe Lonza is a market leader that has traditionally focused on more challenging and differentiated drug substances, leaving it well positioned to consolidate what is still a relatively fragmented CDMO industry.

Part 3: Geographic and business model diversification

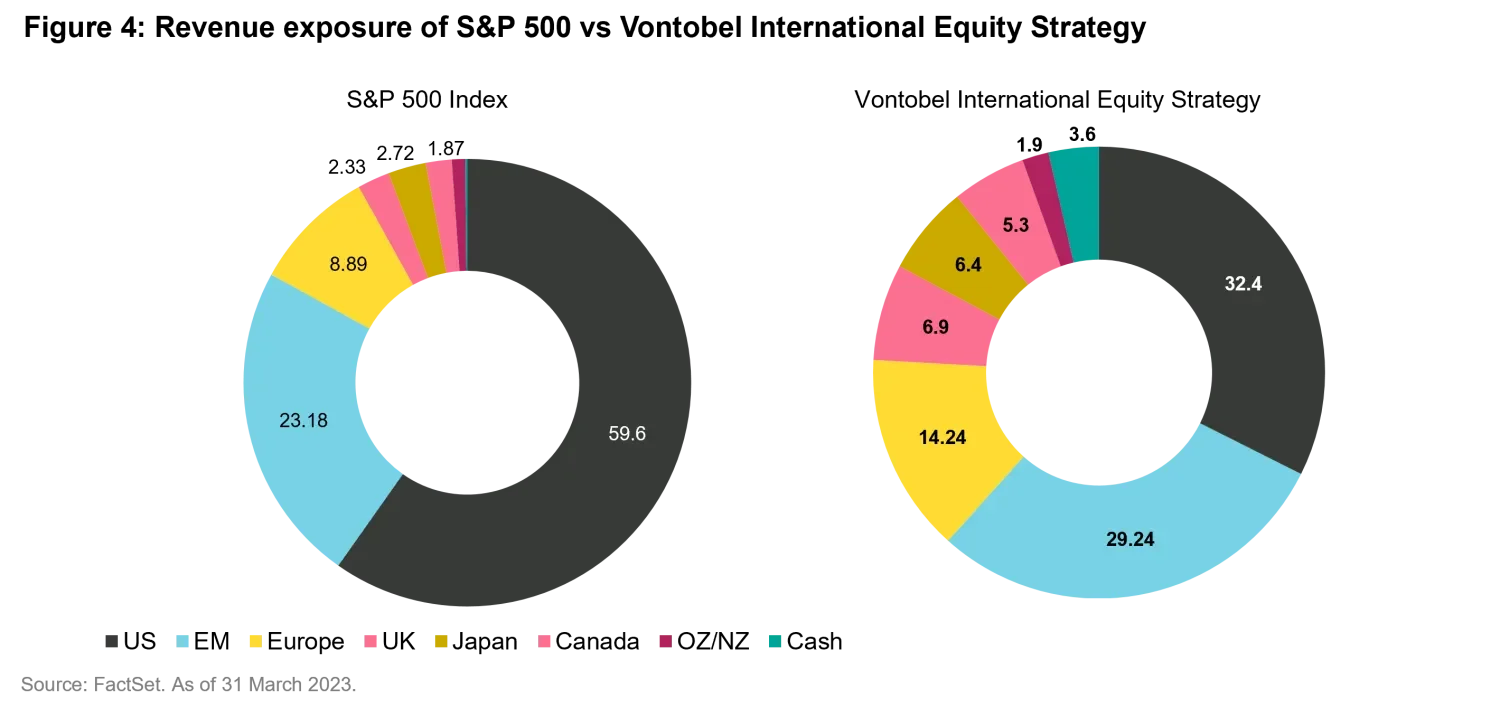

While investors can get exposure to revenues outside the US from S&P 500 index funds and active managers, an international strategy can offer even further geographic diversification. It is also a gateway to globally dominant companies with business models that cannot be found in the US.

Part 4: Multiples have contracted towards historical averages with US at a premium

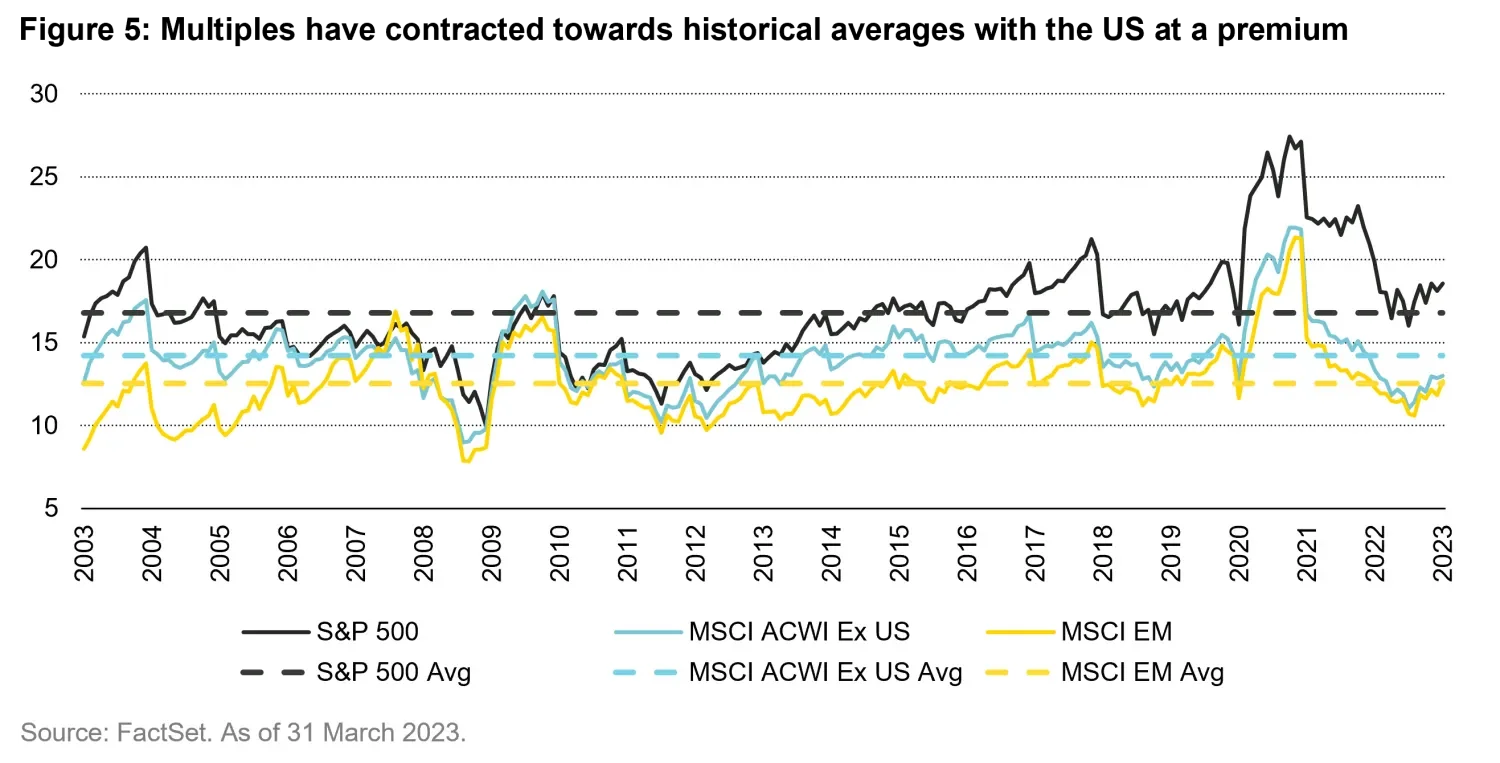

The S&P 500’s price-to-earnings ratio is both expensive and above its long-term average, while multiples for international equities are more attractive than US equities and below their long-term average.

Part 5: A narrative for today’s markets

While investors can get exposure to global businesses and consumers through multinationals listed in the US, a truly international approach – encompassing Europe, Japan and emerging markets – is the best way to access companies that are world leaders and have no equivalent in domestic markets. And with valuations priced at a wide discount to US share prices and below long-run averages, the story in international equity markets is both timely and compelling.

1. Deloitte, The Global Powers of Luxury Goods 2022

Important Information: Companies discussed herein are portfolio holdings and for illustrative purposes only to elaborate on the subject matter under discussion. Investments referenced should not be considered as a reliable indicator of the performance or investment profile of any composite or client account. Further, the reader should not assume that any investments identified were or will be profitable or that any investment recommendations or that investment decisions we make in the future will be profitable. Information provided should not be deemed a recommendation to purchase, hold or sell any security. No assumption should be made as to the profitability or performance of any company identified or security associated with them. Past performance is not a guarantee of future results. Diversification and asset allocation do not ensure a profit or guarantee against a loss.

Forward-looking statements regarding future events or the financial performance of countries, markets and/or investments are based on a variety of estimates and assumptions. There can be no assurance that the assumptions made in connection with the projections will prove accurate, and actual results may differ materially. The inclusion of forecasts should not be regarded as an indication that Vontobel considers the projections to be a reliable prediction of future events and should not be relied upon as such. Vontobel reserves the right to make changes and corrections to the information and opinions expressed herein at any time, without notice.