How to invest when the world is on the brink?

Conviction Equities Boutique

“We can. We will”. This is the message coming out of New York right now, as world leaders and experts convene for Climate Week. It’s the same rallying cry for urgent climate action that conferences, studies, and reports the world over have been issuing for years. And the alarm bells are ringing louder than ever.

Global warming marches on, making itself felt with ever greater ferocity. We've seen some of the hottest temperatures ever recorded in various areas of the northern hemisphere this summer. In addition, waste management is out of control. We are approaching the point at which, taken by weight, there will be more plastic in the world’s oceans than fish. And global biodiversity – vital to sustaining life on earth and economically valued at an estimated USD 44 trillion (roughly twice the GDP of the US ) – is facing what the UN refers to as a “nature apocalypse” .

While the global community is taking various actions to address these crises, our world continues to teeter on the brink. Individual countries like Brazil have recently achieved some success in cutting deforestation rates, but we still saw carbon dioxide levels comparable to India’s annual fossil fuel emissions released into the atmosphere due to rainforest destruction in 2022. That occurred despite the 2015 Paris Agreement to cut greenhouse gases by 80 to 95 percent and the commitment to putting a stop to deforestation at the COP26 summit almost two years ago.

Can investors make a big difference …

Can we make the required impact in time? To succeed, the international community needs a plan to address the challenges urgently. And that plan will require massive funding.

As capital allocators, investment firms have a clear role to play. We believe that investors are moving increasingly towards sustainability, displaying growing awareness of and a focus on sustainability, including for investment decisions. The United Nations Conference on Trade and Development (UNCTAD), for instance, estimates that funds dedicated to investment in sustainable development have now reached USD 1.3 trillion globally . Over the next 10 years, the “decade of delivery” for the SDGs, such sustainability-linked products are expected to grow significantly.

This is why Vontobel’s approach to impact investing aims to offer clients what we call the “double dividend”: the opportunity to generate financial returns while at the same time making a positive and measurable impact on our planet and society. Our approach is to address the world’s most pressing problems by investing in companies with innovative and scalable products and services.

… and benefit from growth needs? Think structural opportunities

Some investors may associate impact investing with being forced to give up on returns. Aside from our contribution through our expertise in the investment process, there is actually a more structural element to the potential for making returns in impact investing.

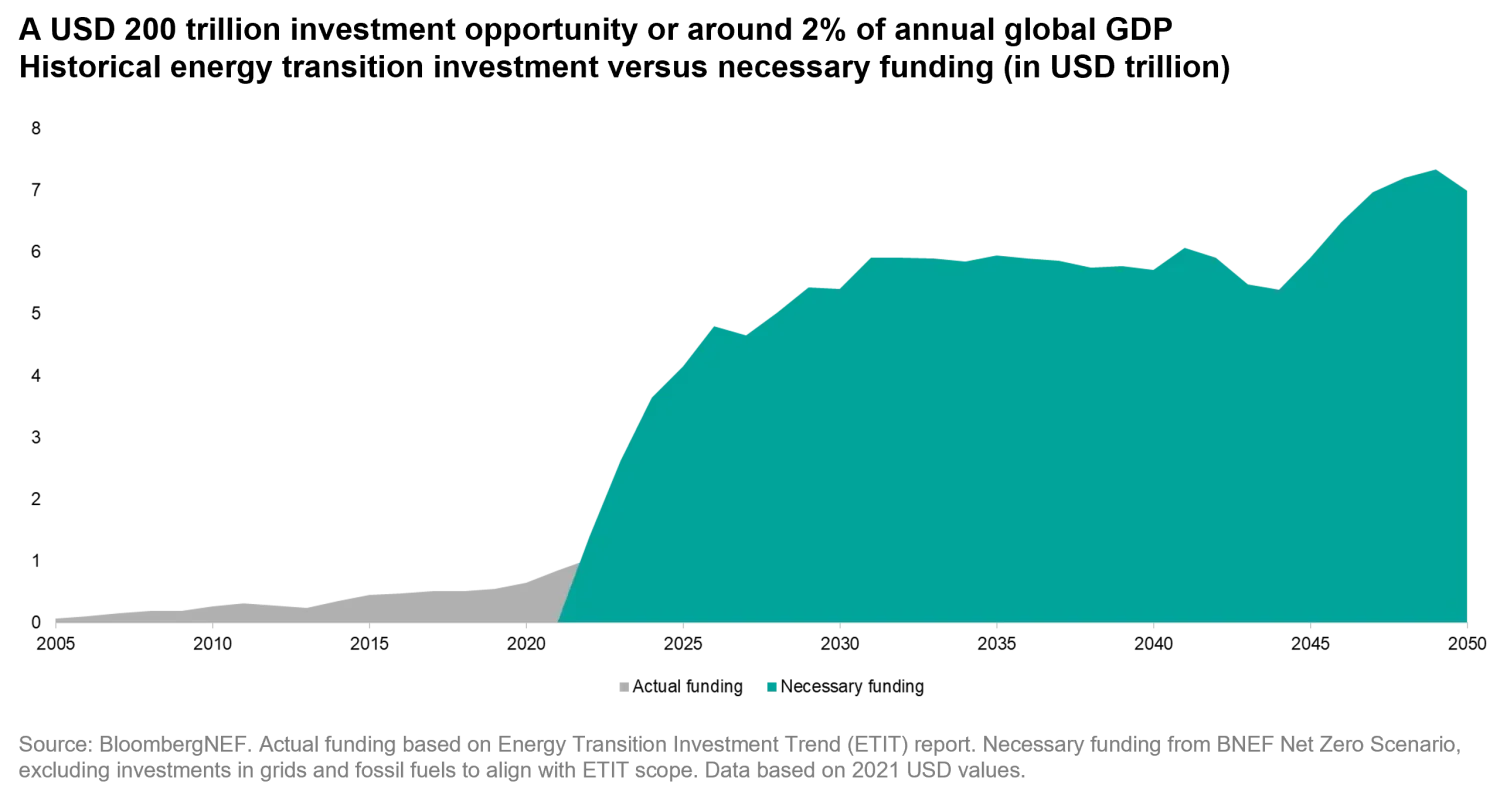

BloombergNEF has quantified the investment opportunity at USD 200 trillion, as efforts in the energy transition need to surge in order for the world to reach its net-zero targets by 2050. That implies roughly USD 6.5 trillion of annual spending, compared with the USD 2 trillion in 2021. Or, put another way, an average of about 2 percent of global GDP (and roughly what NATO allies spend on military budget).

Areas like wind power, electric vehicles and heat pumps will need to grow dramatically. Taking wind power in the US as an example, capacities are going to have to increase from a mere 100 gigawatts currently to 4,200 gigawatts by 2050, according to Bank of America Global Research. Or just think of the ramp-up of hundreds of thousands of electric vehicle charging stations amid the shift to battery-powered road transport.

All these sectors will need to see their markets grow by multiples of 40 to nearly 200 times their current size, and that growth will require capital. BloombergNEF estimates that roughly USD 110 trillion will be required to transform how we consume energy – so think of heat pumps, electric vehicles, and sustainable recycling. The remaining USD 90 trillion would be directed to energy supply assets, which include grid infrastructure and carbon capture.

Incentives have started to become more robust in the US and Europe, and in fact, energy transition investments are already on the brink of overtaking those in fossil fuels – a trend that is poised to accelerate quite dramatically over the next few years. Companies with a competitive edge in this space are exactly the type of investments we’re eyeing, as they’re set to benefit from an influx of capital, often offering cheaper solutions and the opportunity to grow faster.

But even without policy support and subsidy programs, these trends are set to persist as strong long-term drivers and structural tailwinds for companies providing viable solutions to the environmental threats we face. Investments in technologies that advance energy efficient buildings, green road transport and alternatives to carbon-intensive processes are just as crucial as the build-up of renewables like wind and solar farms. That’s why we believe our portfolio holdings across various impact pillars are well positioned to benefit.

What does this all mean for investors? The bottom line is that investors have the potential to engage in impact investing to capture long-term growth opportunities within the overall global equity bucket, while at the same time supporting scalable solutions to tackle climate change and challenges in other environmental and societal areas. This provides a potential opportunity to reap the financial benefits of companies that are coming up with solutions to the world’s problems and to sow the seeds for a better tomorrow.

The rallying cries are being heard

The appetite for such investments is clearly there. Our own proprietary research reveals considerable interest among professionals in adopting impact investment strategies and suggests that there is still tremendous untapped potential within the market.

In fact, more than half of the investors questioned in our 2023 Impact Investing Survey of institutional and professional investors told us that their appetite for impact investing was driven by the desire to make both financial and non-financial returns. And 70 percent reported that they were planning to increase their impact allocations in public equities within the next three years.

Regulatory pressures are likely to play their own part in further whetting investors’ appetite for impact investments. The White House recently announced that President Biden’s aim is to halve US emissions from 2005 levels, a near doubling of the target originally set by the Obama administration. EU lawmakers have agreed in principle to increase their target for emissions reduction from 40 percent to 55 percent against 1990 levels. This will exert additional pressure on companies to join the fight against climate change.

The alarm bells are ringing so loud, it’s deafening. But for humanity, dropping everything and making a run for the exit is no option. We have to redouble our efforts, and investors will be crucial to us turning things around. The time to act is not tomorrow, next week or next year. It is now.

This document is for information purposes only and nothing contained in this document should constitute a solicitation, or offer, or recommendation, to buy or sell any investment instruments, to effect any transactions, or to conclude any legal act of any kind whatsoever. Decisions based on information contained in this document are the sole responsibility of the reader. You must not rely on any information contained in this document in making an investment or other decision. This document has not been based on a consideration of any individual investor circumstances. Any projections, forward-looking statements or estimates contained in this document are speculative and due to various risks and uncertainties, there can be no assurance that the estimates or assumptions made will prove accurate, and actual events or results may differ materially from those reflected or contemplated in this document. Opinions expressed in this document are subject to change based on market, economic and other conditions. Information in this document should not be construed as recommendations, but as an illustration of broader economic themes. Past performance is not a reliable indicator of current or future performance. The return of an investment may go down as well as up, e.g. due to changes in rates of exchange between currencies. The value of the money invested in a fund can increase or decrease and there is no guarantee that all or part of your invested capital can be redeemed.