Will emerging markets shine again?

Quality Growth Boutique

Key takeaways

- For decades, the US has refilled the punch bowl with stimulus measures in a benign inflationary environment. While this has resulted in stable economic growth, the valuation gap for US equities relative to the rest of the world, particularly emerging markets (EM), has increased to historic levels.

- EM GDP growth remains higher than the rest of the world and is projected to continue, many EM central banks have been more proactive than developed markets in managing inflationary pressures, and the US dollar’s precipitous rise this year has had a greater impact on developed country currencies vs. emerging markets.

- In our view, India and Indonesia have the strongest potential growth outlook, and investors should remain more selective in China. From a sector perspective, we view consumer staples businesses as resilient as they can have growing market share and strong pricing power.

- While there are risks of a prolonged global recession, active managers can construct concentrated portfolios with exposure to structural growth opportunities that exist in EM, but at acceptable risk levels to help mitigate the downside.

EMs: faster growth without the stimulus overhang

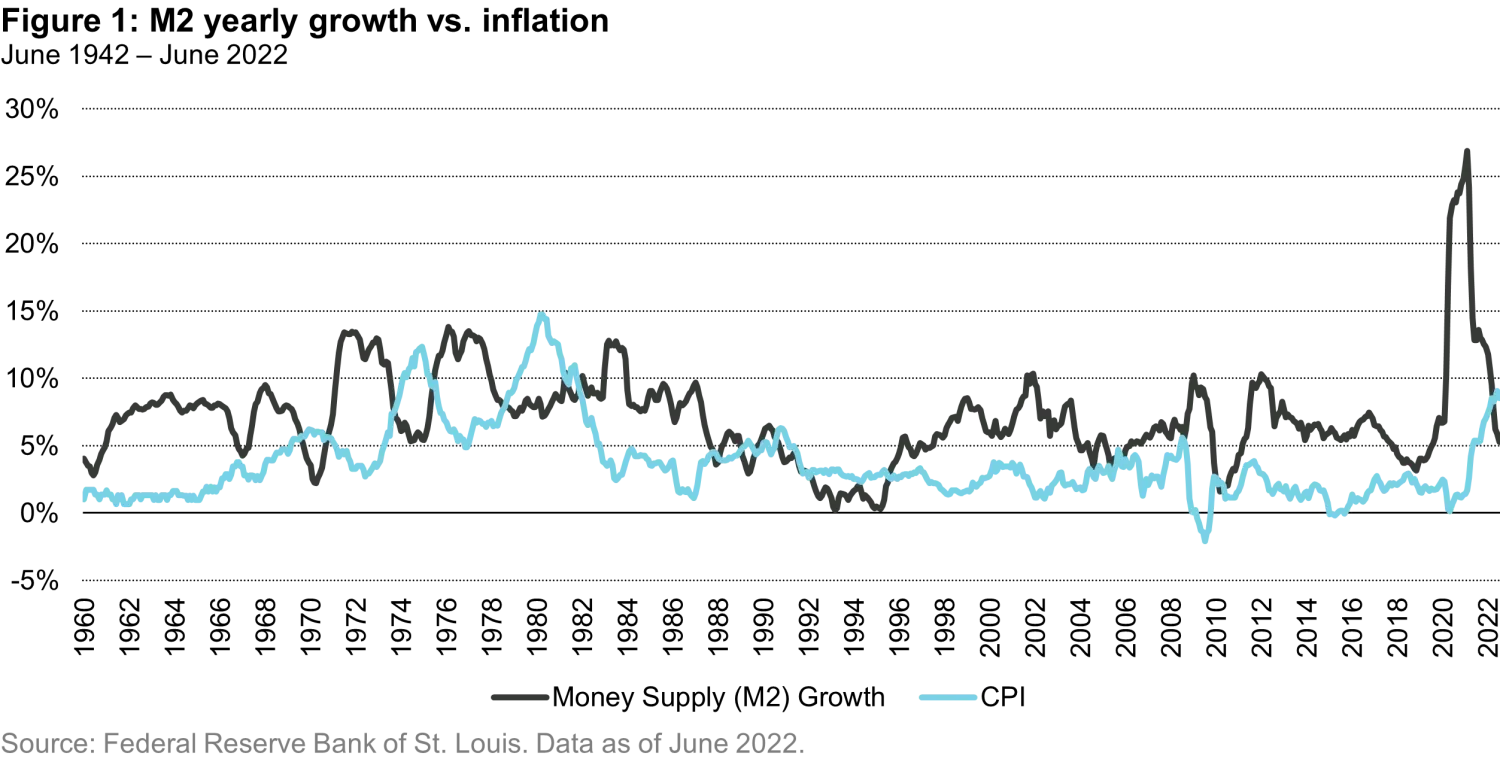

As the world wrestles with higher inflation and a slowdown in growth, many investors have flocked to the US market and the US dollar for stability, leaving behind ex-US markets in 2022. This was the case over the last several years, particularly after the Global Financial Crisis. For the past few decades, the US has continually refilled the punch bowl with stimulus measures in a benign inflationary environment. Money supply has grown at a pace well exceeding inflation (see figure 1).

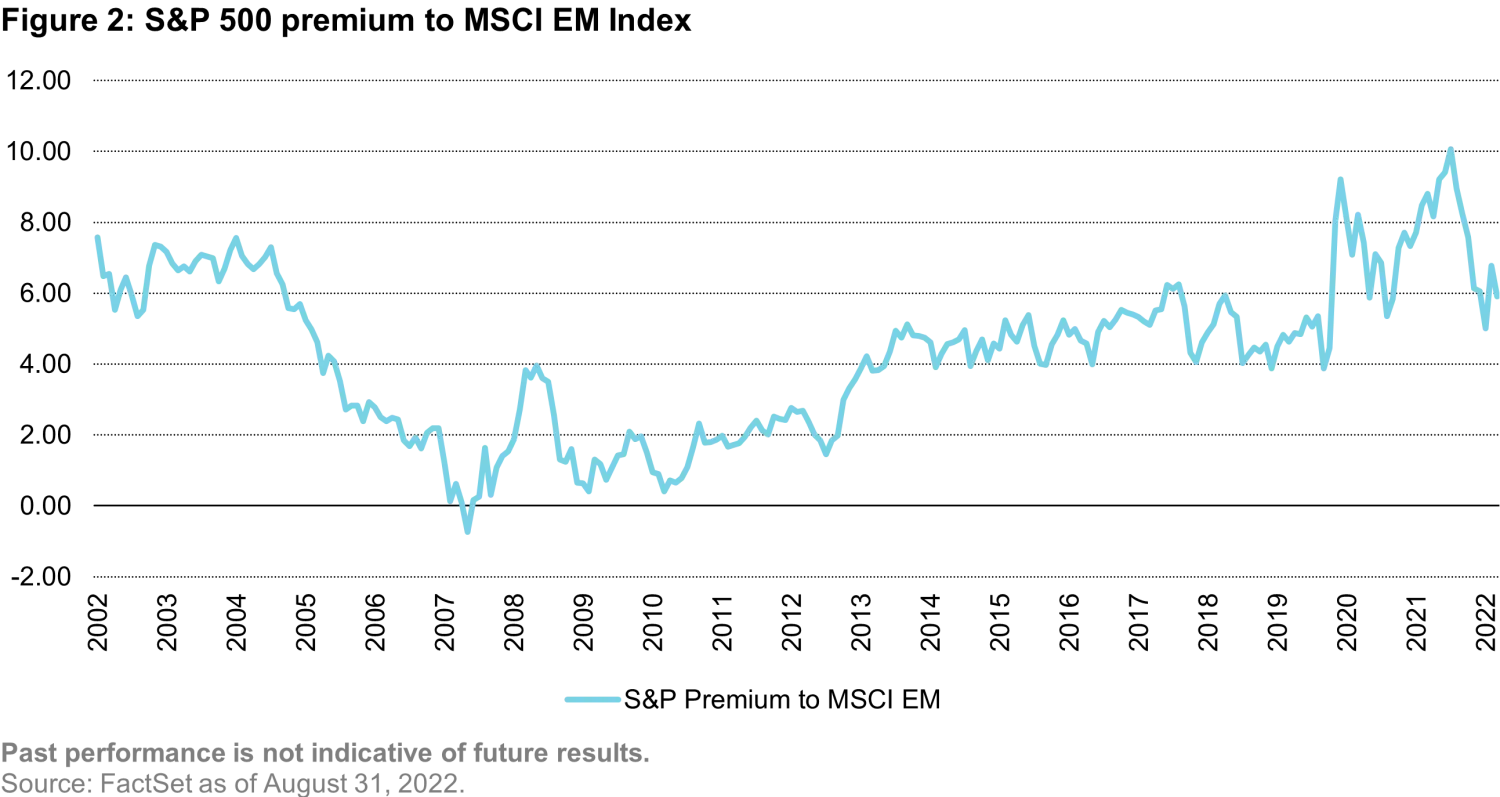

While this has resulted in stable economic growth, it has consequences. For instance, the valuation gap for US equities relative to the rest of the world, particularly EM, has increased to historic levels. As shown in Figure 2, the premium (based on P/E ratio) is at levels approximately in line with where they were some 20 years ago, prior to the S&P’s lost decade and EM’s strong decade of performance.

Can this type of monetary support continue? We think it’s unlikely in a period of higher inflation, which could remain extended given supply side pressures. Following are a few points to make for those still going back for refills of the same flavor.

Emerging markets economic growth remains higher than the rest of the world and is projected to continue. As of July 2022, the International Monetary Fund forecasts that GDP growth for 2023 for EM and developing economies will be 3.9% vs 1.4% for advanced economies and 2.9% for the global economy.

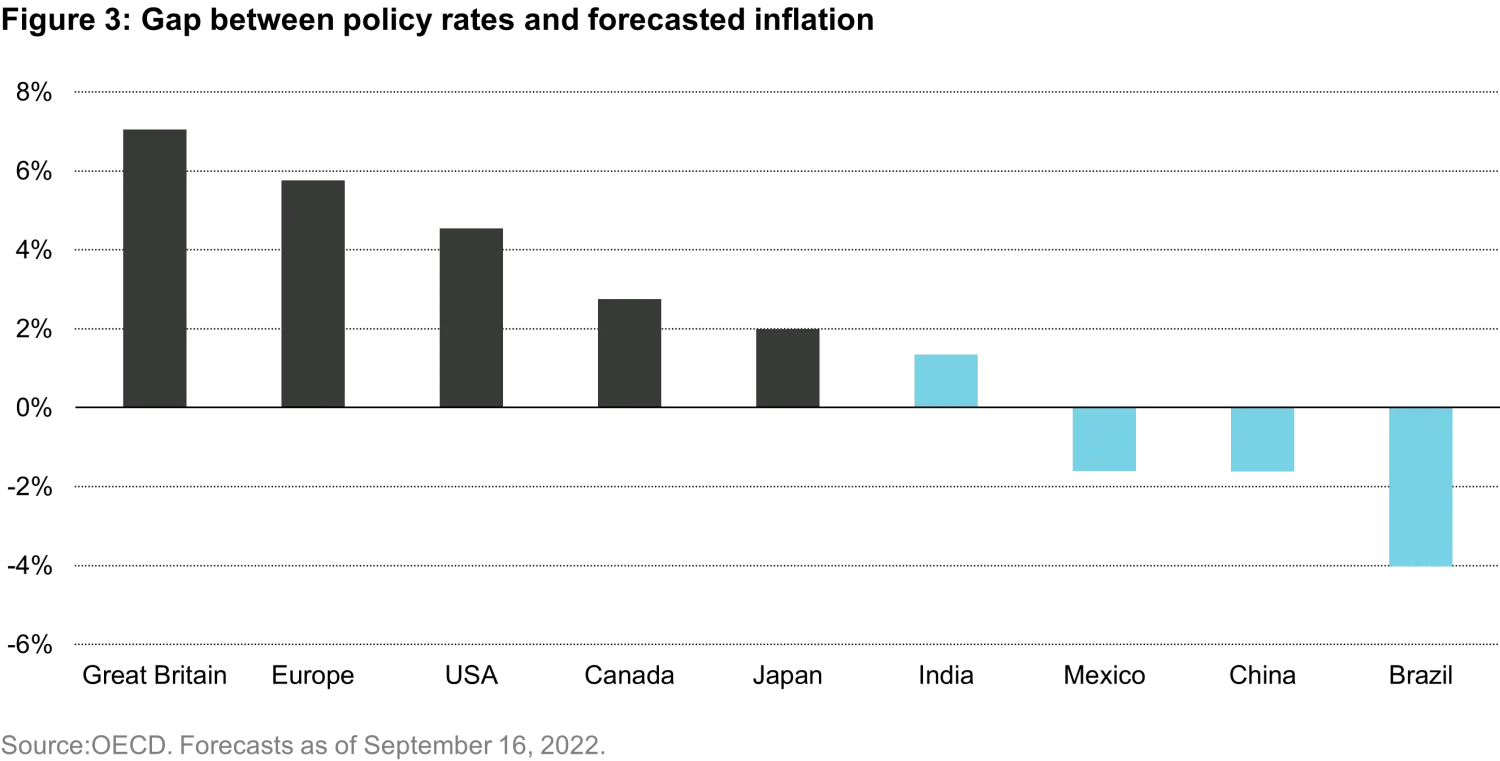

In terms of monetary policy support, in our view, developed country central banks such as the US Federal Reserve, European Central Bank, and Bank of England have a sizeable gap to close between the current level of interest rates and what is needed to rein in inflationary pressures, which remain persistently high. Conversely, many emerging market central banks have been more proactive in managing inflationary pressures, with certainly more practice over the years. Figure 3 illustrates the gap between the current government rate vs. inflation, which is wide for the UK, Europe, the US and Canada relative to India, Mexico, China, and Brazil. Thus, emerging markets seem to be on a fairly solid ground.

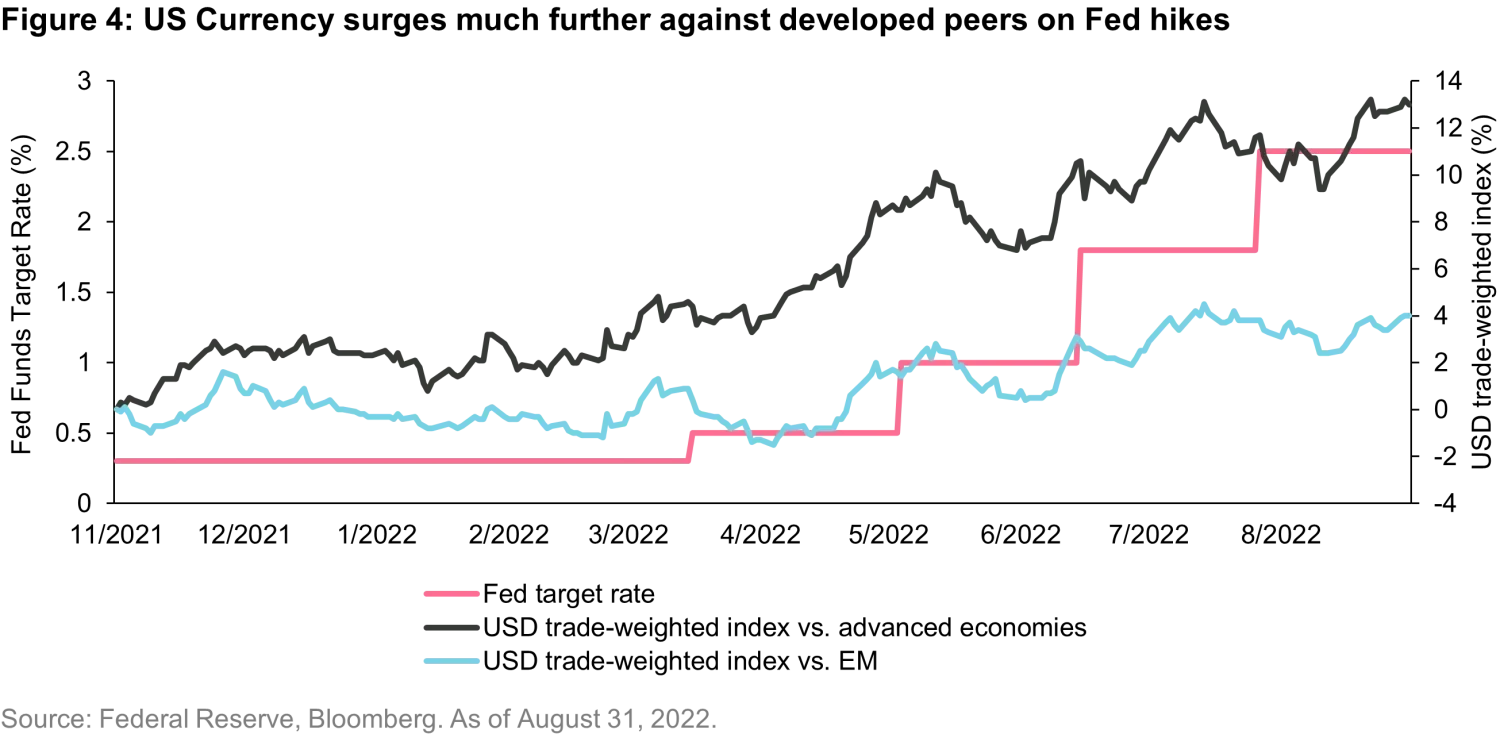

It is interesting to note that the dollar’s precipitous rise this year has had a greater impact on developed country currencies vs. emerging markets as shown in Figure 4.

While it is overlooked by many, judging by the outflows particularly from actively managed funds in the asset category, emerging markets have shown resilience from an economic growth and currency perspective in 2022. However, this year they were saddled with Russia’s abrupt -100% return and exodus from the benchmark in just a few weeks after the Ukraine invasion, and crippling economic sanctions on Russia. Ongoing COVID shutdowns and continued property market weakness have been a headwind for China, its largest market. EM investors who did not have exposure to Russia were able to minimize this risk. Regarding China, we believe investors should be thoughtful around their positioning, seeking relatively lower exposure than the benchmark, and should aim to avoid cyclical and lower quality areas such as financials, energy, materials, and real estate, which comprises greater than 8% of the MSCI EM Index’s total exposure.

As an active manager, we seek to benefit from the structural growth opportunities that exist in EM, with acceptable risk levels. The binding element across all of our businesses is that we believe they can grow at attractive rates and generate high returns, even in a slower economic growth environment. In emerging markets:

- We think India and Indonesia have the strongest potential growth outlook. Both economies are recovering from deep Covid impacts and were prudent with fiscal stimulus over the last two years. The structural reforms in India, such as GST implementation, the bankruptcy law, and the cleaning up of the weaker financial institutions were important, but a headwind to growth in the last five years. With the benefit of these reforms and a much cleaner banking system, we are now seeing accelerating credit and consumption growth, with Indian GDP growth forecast to be 6-7% in the coming 12 months.

- We believe investors should remain more selective in China with a focus on consumer staples companies that possess qualities such as strong pricing power like Chacha Food, players in e-commerce that may benefit from regulation such as JD.com, and leading industrial businesses such as Wuxi Lead, which is leveraged to the surge in global EV battery demand.

- We view consumer staples businesses as resilient as some are in underpenetrated categories, which have leading and growing market shares, and strong pricing power.

In EM, we believe selectivity and avoiding risks in the benchmark is critical

While there is a margin of safety in terms of growth and valuation with EM equities today, there are clearly risks of a prolonged deep global recession. It is also a tougher space to navigate with lower levels or profitability than the S&P5001. For example, the MSCI EM Index has lower levels of return on equity (16.8% vs 25.9%) lower net margins (17.2% vs 19.9%) and higher prevalence of companies with negative earnings (7.12% vs 4.35%) than the S&P 500 . Thus, it can be more susceptible to sharp slowdowns in global growth.

Active managers have an advantage in being able to construct concentrated portfolios that can give exposure to structural growth opportunities that exist in EM but at acceptable risk levels to help mitigate the downside. Investors should look to strike a balance between faster secular growth and defensive growth names, which can protect through slower economic growth with higher levels of profitability than the Index. We believe in a benchmark agnostic approach that seeks to only focus on businesses that meet high hurdles for quality, predictability, and growth.

Below are two examples of unique businesses that are hard to find in mature developed markets. We believe these companies highlight a focus on both quality and growth across cyclical and defensive segments.

On the secular growth side, Eicher Motors has a competitive advantage in the premium motorcycle segment with the iconic Royal Enfield brand. Eicher represents 90% market share of new bikes sold despite threats from competition. The category remains underpenetrated as Eicher represents only 4% of bikes on the roads in India. Eicher has significantly expanded distribution over the last two years by doubling its point of sales to 2000 stores, while also deepening its lower tier and rural presence. Further, it has launched one new or refreshed product every quarter, and we are already seeing improved demand for recent launches.

An underappreciated element of the Eicher story is exports, which we think can double over the next five years. Eicher has been seeding export markets over the last nine years in Southeast Asia, Latin America, and even the United States and Europe. Its positioning as a value for money but distinctive cruiser bike is already gaining traction, and exports have doubled over the last two years to close to 20% of sales.

On the defensive growth side, Raia Drogasil (RD) is the largest drugstore chain in Brazil with 14% market share and is the only player that has successfully developed formats across segments in both premium and value. Its format and distribution advantage means it’s the only player that can expand nationally in Brazil and continue to take share from the independent drug stores which still comprise some two thirds of the market.

We believe RD can grow retail space at some 8-10% per annum on its existing base of 2600 stores over the next 5 years at a ROIC of 25% on new stores, which is the among the strongest of any retail format we know in EM. Further, the company has good pricing power as the regulations in Brazil allow it to increase drug prices by the rate of inflation in the previous year. Volumes are also supported by the tailwind of an ageing population in Brazil with the over 60s segment expected to double over the next 20 years to 20% of the population. We believe RD has also successfully developed a profitable online model serviced from its store network, which is now 10% of sales and growing at over 40%.

We think a combination of defensive growth can provide good downside protection, combined with secular growth, which allows investors to participate in up markets, is the formula that’s required to navigate these challenging markets and aim to beat the benchmark with lower volatility.

1. As of 31 Aug 2022

Disclaimer

Any investments discussed for illustrative purposes only as means to provide additional information regarding our investment management processes and views concerning certain companies within emerging markets. There is no assurance that the adviser will make any investments with the same or similar characteristics as discussed herein. These companies are presented for discussion purposes only and are not a reliable indicator of the performance or investment profile of any composite, fund, or client account. Further, the reader should not assume that any investments identified were or will be profitable or that any investment recommendations or that investment decisions we make in the future will be profitable. References to holdings and/or other securities should not be considered a recommendation to buy, hold, or sell any of the companies discussed herein. It should also be noted the companies discussed do not represent all of the securities purchased, sold, or recommended during the period referenced.

Certain of the information contained in this presentation is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. VAMUS believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, there is no assurance that estimates or assumptions regarding future financial performance of countries, markets and/or investments will prove accurate, and actual results may differ materially. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions. Past performance is not a reliable indicator of current or future performance.