Emerging market equities: What follows the lost decade?

Conviction Equities Boutique

Key takeaways

- Long-term GDP potential growth of emerging markets relative to developed markets should increase again.

- There is a significant and growing number of highly specialized and market-dominating companies in North Asia’s emerging markets.

- These 2 factors should allow investors to look forward to emerging market corporates increasing their earnings and profitability.

Comparing the earnings trajectory of emerging market to developed market corporates over the last ten years, it is understandable that many consider this a lost decade for emerging market equities. Are emerging market stocks now set to bounce back?

Shifting perceptions on emerging market stocks

A weak US dollar and expectations regarding the recovery of the Chinese economy following the lifting of zero-Covid restrictions has prompted shifts in the perception of emerging market stocks. This can be seen in the MSCI EM index, which outperformed the MSCI World index by +12.5% for the period 10/31/2022 - 01/31/2023 (in USD). Furthermore, after 39 weeks of outflows, active global emerging market mutual funds have seen net inflows since the beginning of 2023.

These shifts look positive for emerging market equities, but are they the sign of a trend that’s here to stay? The question is: What will it take for emerging market stocks to become – and remain – an enhanced portion of an investor’s asset allocation? In answering, let’s start by understanding what has driven performance over the last decade, identifying and characterizing the different phases of performance seen in emerging market stocks.

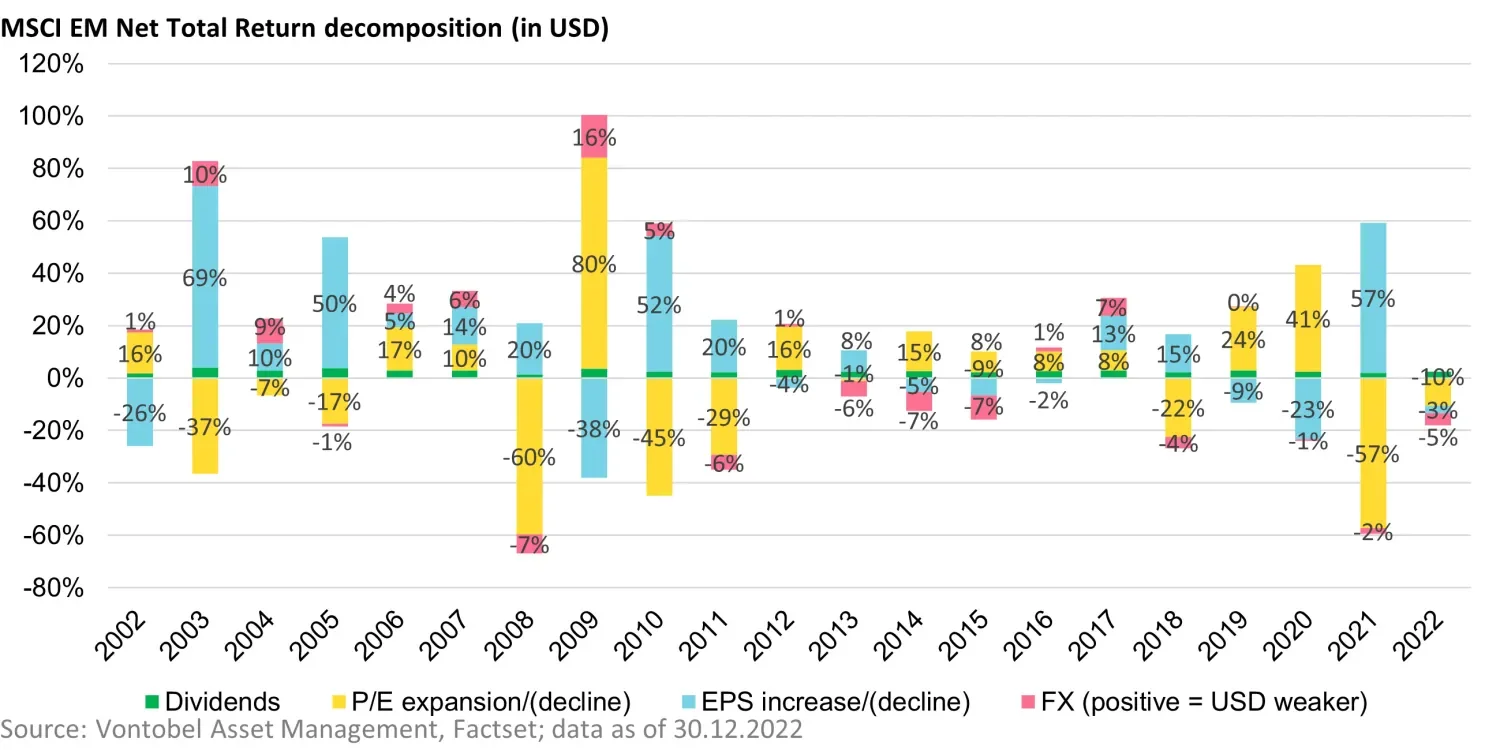

Two decades in review

Figure 1 below shows the net total return of the MSCI EM Index for 2002 to 2022. Each year is broken down to show the drivers of that year’s return, such as dividends and price earnings ratio. It is noticeable that the long-term performance of emerging markets is characterized by two distinct and contrasting phases: a period of earnings growth, as represented by the blue bars in 2002-2010 and 2011-2022, and a period of strong fluctuations in valuation, as shown in the yellow bars over the periods of 2008-2011 and 2020-2021.

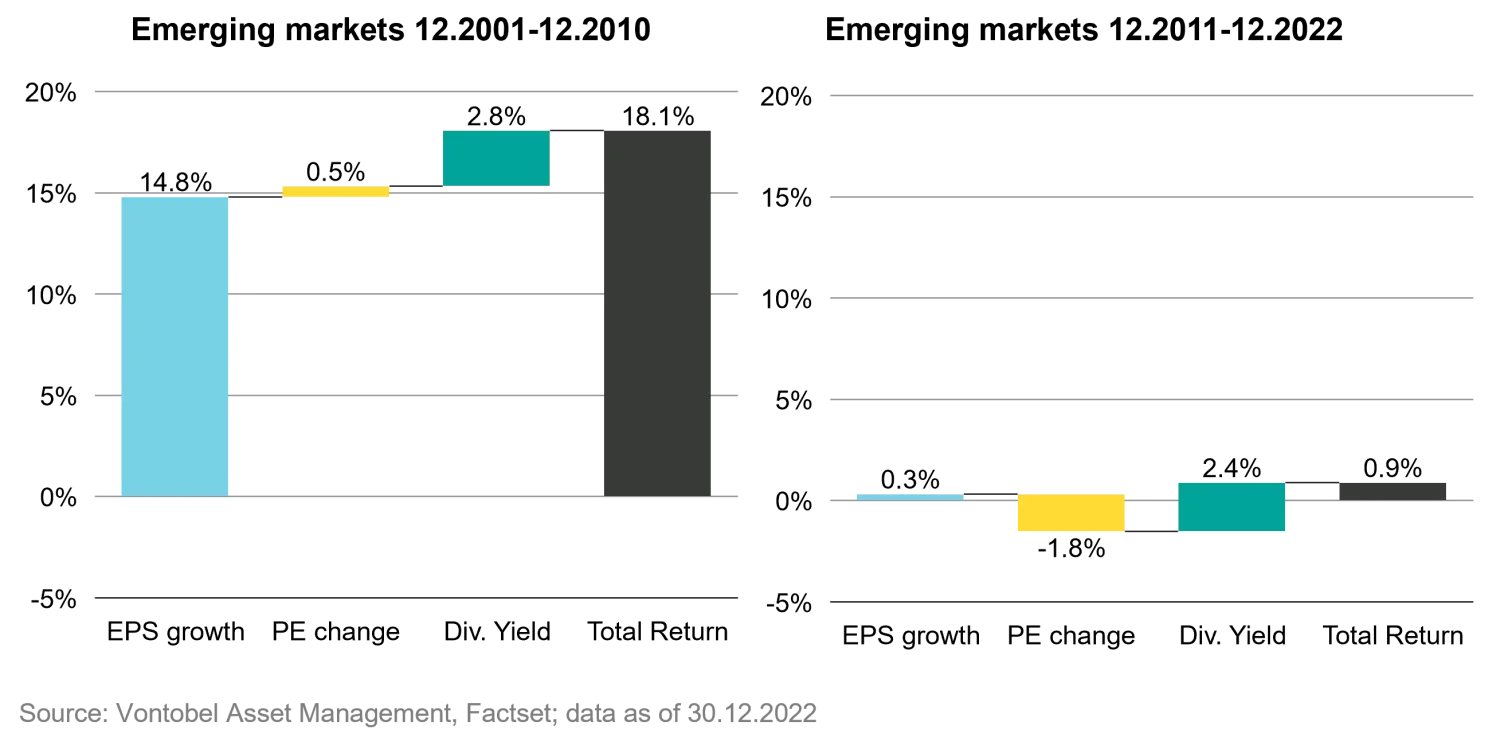

These two distinct phases become even clearer when looking at the figure below showing the long-term performance of emerging markets. As the bar charts show, aggregate earnings growth for the companies represented in the MSCI EM Index has fallen from +14% during the period 2001-2010 to 0% during the period 2011-2022.

What drove poor performance?

Looking at emerging market stocks from this decade-long perspective highlights that the poor performance of recent years cannot simply be explained by increased geopolitical uncertainties. What could some of the reasons be? Were there structural issues that prevented profits from being distributed? Or was it due to lack of development of legal frameworks in emerging markets? The view is that the decline in profit growth can probably best be explained by the following fundamental reasons: lower revenue growth because of slower GDP growth, lower margins due to globally intensified competition, lower interest rates, falling commodity prices and rebalancing effects within the index.

Taking the long-term view

However, as shown in figure 2, emerging markets’ performance over the entire 21-year period is still slightly better than developed markets (8.0% vs. 6.6%) even after the lost decade. What will it take for emerging markets to outperform developed markets in the long run? Logically, based on previous discussions, this can only be higher earnings growth which, in turn, can lead to further multiple expansions.

We believe that this is a realistic scenario. First, the long-term GDP potential growth of the emerging markets should increase again relative to developed countries. In the wake of the global financial crisis from 2008 to 2009 and Covid-19 pandemic, factors such as population growth (except in China), higher productivity gains and rising capital investment should contribute to this normalization.

Secondly, there is a significant and growing number of highly specialized and market-dominating companies, especially in the North Asian emerging markets of China, Korea and Taiwan, such as semiconductor manufacturers or battery producers. Due to their high research and development spending, these global-leading companies should be able to strengthen their market position even further.

This would, in turn, lead to these high-profit and high-growth sectors gaining in importance, and thus potentially increasing profit growth of emerging market corporates relative to the profit growth of developed market corporates.

With the lost decade behind us, what should investors expect next?

Are emerging market equities set to bounce back? From a valuation perspective, we are now at an attractive starting point - with the Shiller P/E ratio of emerging market equities trading at a significant discount (>40%) to that of developed market equities. Will this be sufficient for emerging market stocks to gain attention from investors? We hope so as it is time to look forward to a new decade with emerging market equities taking an enhanced portion of an investor’s asset allocation.

Important Information: Any projections or forward-looking statements regarding future events or the financial performance of countries, markets and/or investments are based on a variety of estimates and assumptions. There can be no assurance that the assumptions made in connection with such projections will prove accurate, and actual results may differ materially. The inclusion of forecasts should not be regarded as an indication that Vontobel considers the projections to be a reliable prediction of future events and should not be relied upon as such. Vontobel reserves the right to make changes and corrections to the information and opinions expressed herein at any time, without notice.

Past performance is not a guarantee of future results. There can be no assurance that investment objectives will be achieved. Investing involves risk, including possible loss of principal. Neither asset allocation nor diversification assure a profit or protect against loss in declining markets. Indices are unmanaged; no fees or expenses are reflected; and one cannot invest directly in an index.

The MSCI data is for internal use only and may not be redistributed or used in connection with creating or offering any securities, financial products or indices. Neither MSCI nor any other third party involved in or related to compiling, computing or creating the MSCI data (the “MSCI Parties”) makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and the MSCI Parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to such data. Without limiting any of the foregoing, in no event shall any of the MSCI Parties have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.