Measured growth wins races: compounding capital in tougher conditions

Quality Growth Boutique

Key takeaways

Low-quality companies can temporarily grow earnings by utilizing more debt, sacrificing long-term investments. They can also temporarily benefit from exogenous factors or ride a cyclical recovery. However, these types of short-term growth are not sustainable.

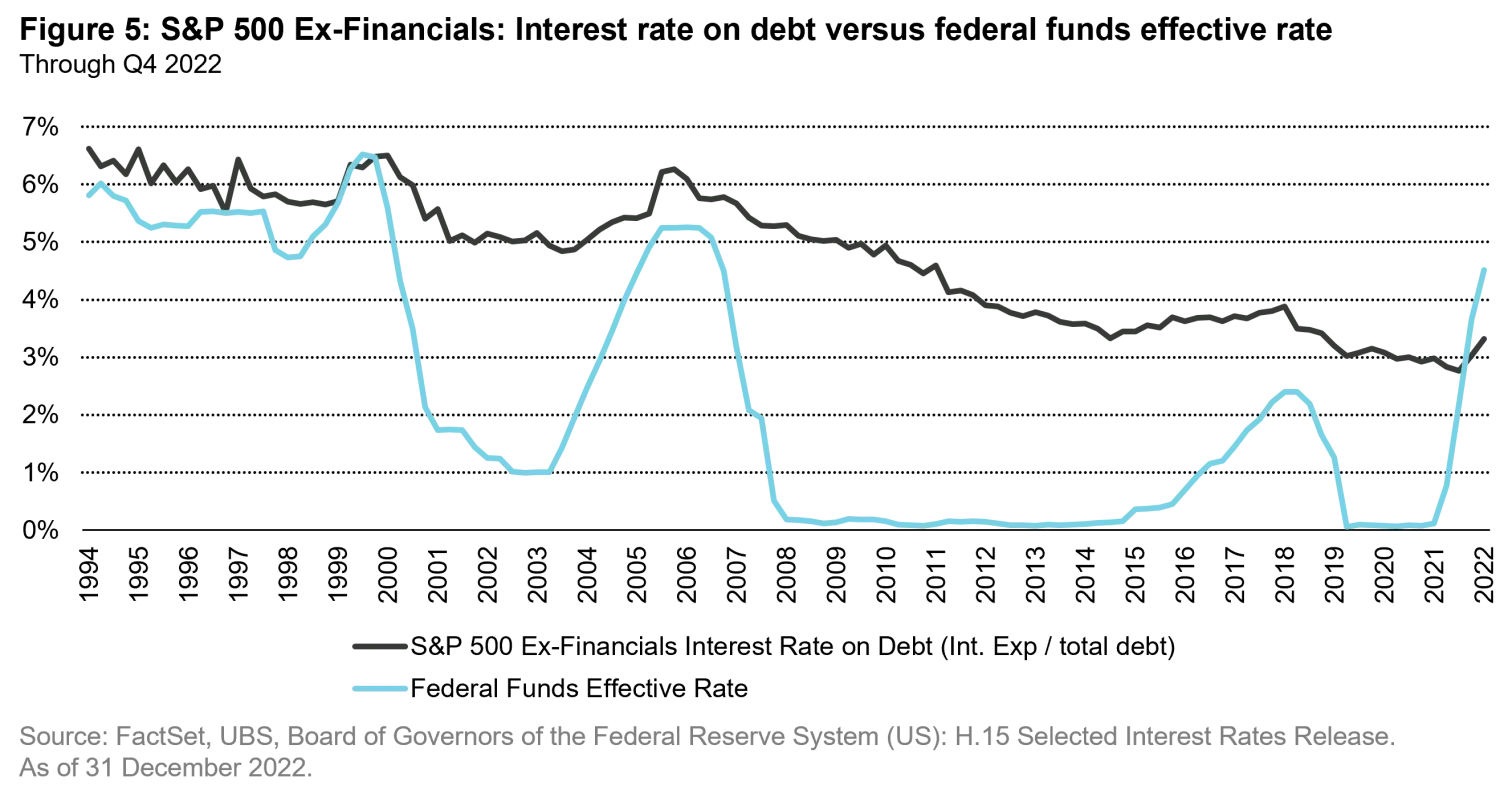

The low-interest rate environment that persisted for well over a decade following the global financial crisis was a significant contributor to net margin expansion. As rates rise, pressure on companies will play out over time as the majority of corporate debt of US large cap companies is fixed rate, with only 10% of the borrowing of S&P 500 companies maturing this year.

When sources of unsustainable growth recede, the distinction between structural growth and growth driven by temporary factors will become apparent. Quality companies designed to succeed in all conditions will benefit from continued compounding of capital, while those only focused on straight-line speed may be more susceptible to tougher environments.

"The greatest drivers were distinguished by their supreme ability to handle any kind of situation, any car, any driving condition, any kind of race."

Investing can often seem like a high-octane race. Any car can be the fastest over short stretches of time. But the best cars are designed to deliver good results whatever the racetrack throws at them, not just to hit top speed on a clear straight. For investors, this means achieving consistent earnings growth over the long term by owning a collection of businesses that have the best quality engines and are driven by the most talented management teams.

Getting ahead requires a long-term mindset

Sometimes investors can be taken in by short-term company actions to boost earnings. For instance, low-quality companies can temporarily grow earnings above their underlying return on equity by utilizing more debt. This, however, increases the business’s financial risk. Companies can also seek to meet near-term earnings targets by sacrificing long-term investments, such as R&D in the pharmaceuticals industry, or cutting brand-building expenses, such as brand advertising in consumer staples. Both can come at the expense of sustainable growth. Low-quality companies can also temporarily benefit from exogenous factors, like the stimulus packages to counter the effects of COVID-19, or ride a cyclical recovery, such as rising energy prices.

In the short run, markets tend to reward narratives over facts. Valuations for fast-growing companies stretched in 2020 to 2021, even for businesses burning cash and yet to demonstrate profitability. But market excitement that is not backed by solid financial performance will ultimately lead to disappointment.

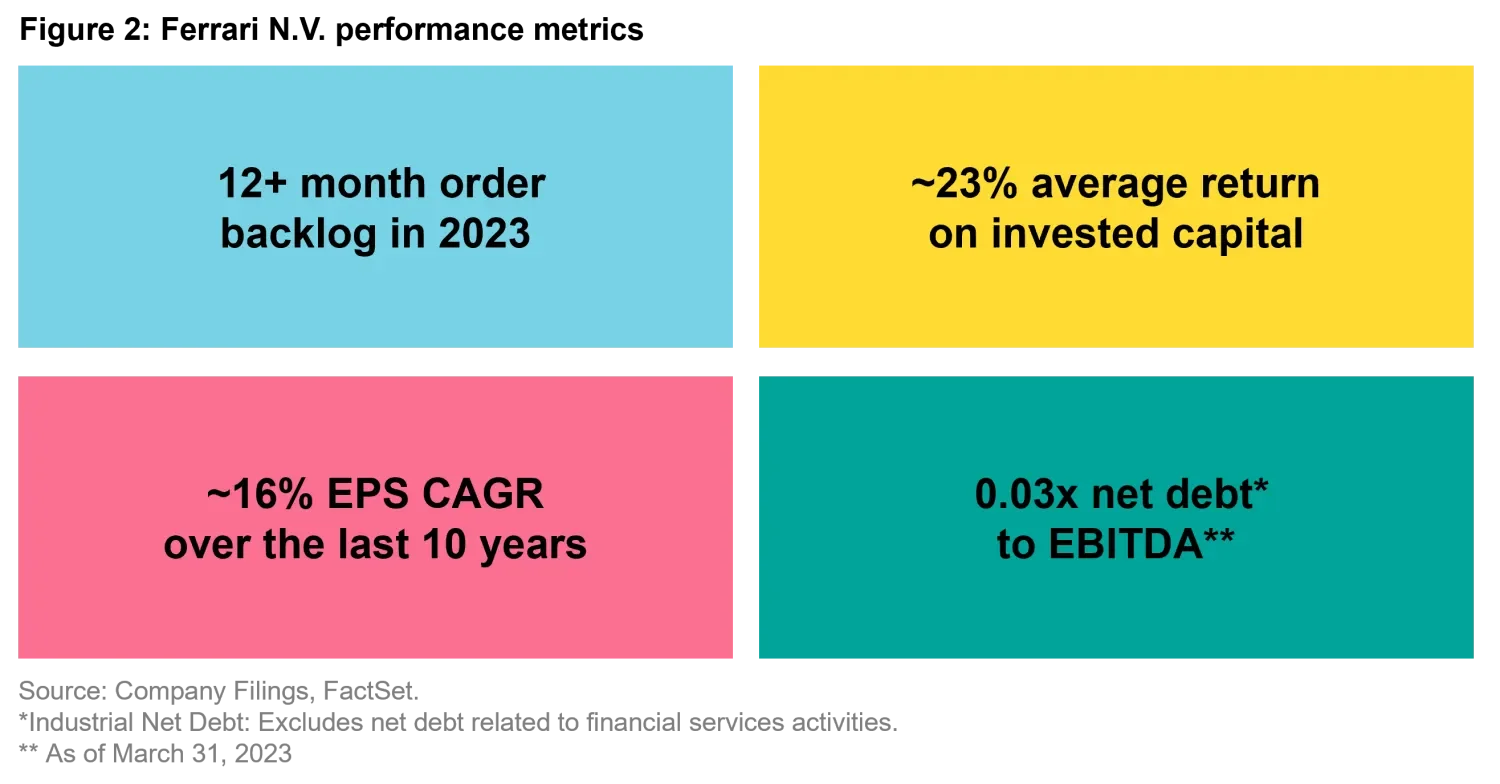

Great companies will not deliver the highest earnings growth in the market every year. But they do focus on maintaining their competitive advantages. For example, Italian luxury automaker Ferrari N.V. intentionally pursues a low production volume strategy to maintain a brand reputation for exclusivity and scarcity among customers, resulting in superior margins and returns on capital. Combined with consistent performance and technology upgrades, Ferrari was able to steadily increase prices over the long run. This approach has paid off.

Challenges of Earnings Normalization

When assessing the sustainable earnings power of a company, investors will attempt to adjust for obvious temporary factors that have impacted the company’s short-term performance. To arrive at an adjusted earnings estimate, analysts typically assess the following:

- Average growth trends, i.e., through-cycle growth rates

- Average profitability ratios, e.g., average operating margins

- Adjustments for non-operating income/expenses, e.g., exchange rate gains/losses

- Exclude one-off expenses, e.g., Covid-related expenses

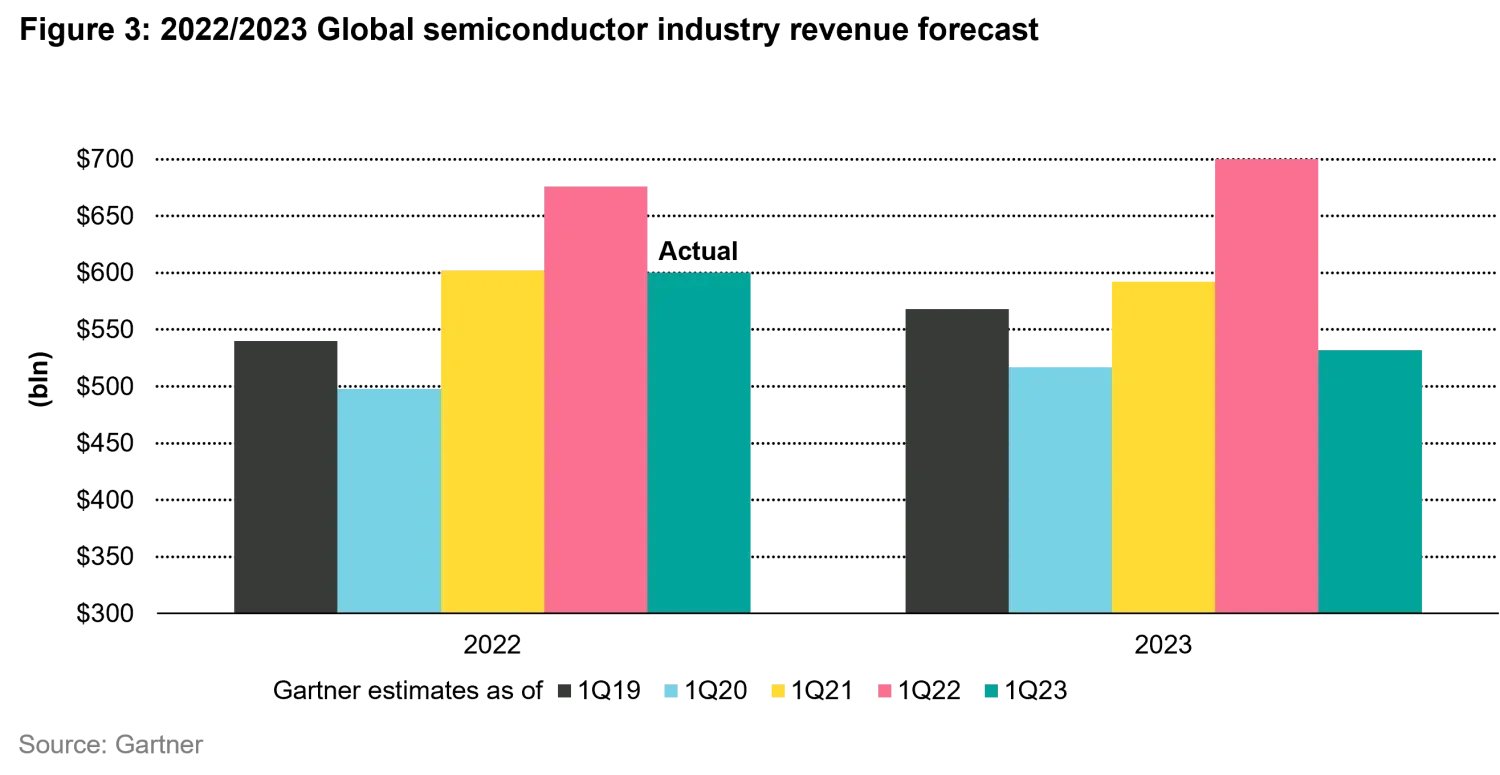

The market was relatively efficient in normalizing the negative earnings impact of COVID on companies. This included adjusting for one-off COVID-related expenses and making comparisons to pre-COVID average growth/profitability ratios. But it was less effective in normalizing the earnings of companies that benefited from COVID, as illustrated by the volatility of semiconductor revenue forecasts from year to year (Figure 3).

Earnings normalization often requires judgment, and persistent anomalies can present particular challenges for investors. The longer an anomaly persists, the more likely that investors will accept it as the norm. As humans we are prone to cognitive biases, thought processes that give us a subjective reality that could be far from the truth. One such bias is known as “anchoring” – when an investor uses a specific target or value as a starting point and subsequently makes decisions based on the anchor number. This can produce erroneous results when the anchor is very different from the true answer.

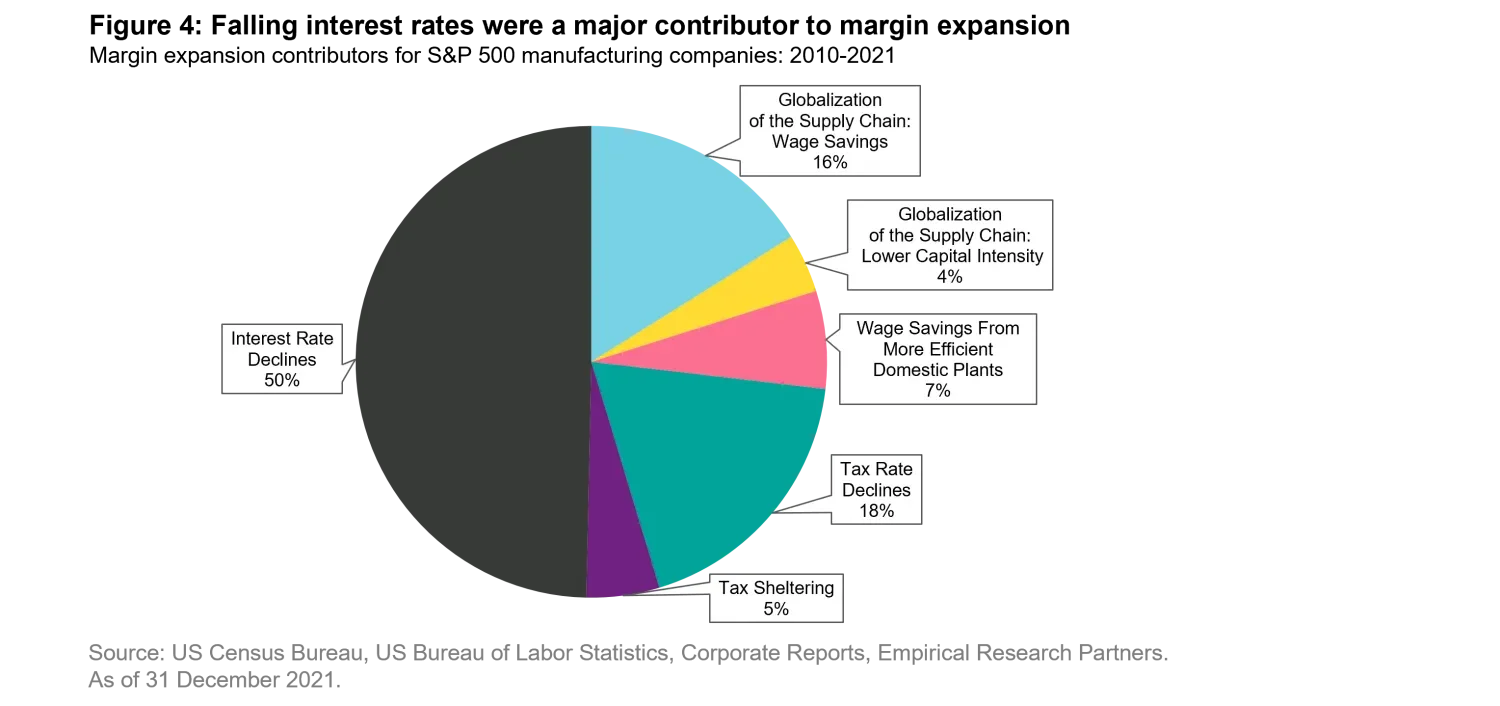

One of the most obvious examples is the effect of the low-interest rate environment that persisted for well over a decade following the global financial crisis. During that period, net margins grew sharply for S&P 500 manufacturing companies, peaking at nearly 18% in 2022.1 The question for investors is whether this represents a new normal or an anomaly to which they have become “anchored”.

Falling interest rates were the largest contributor to manufacturers’ net margin expansion from 2010 and 2021.2 Other contributors were falling tax rates and wage savings from outsourcing.

The burden of rising rates is yet to impact large US companies

The low interest rate tailwind over the past decade will become a headwind for companies as rates rise. But this pressure will only play out over time due to the structure of corporate debt: the majority of corporate debt of US large cap companies is fixed rate, with only 10% of the borrowing of S&P 500 companies maturing this year. However, as fixed rate debt comes due, new loans and bonds will be issued at significantly higher rates. Pain will be felt gradually as corporate debt matures and is refinanced.

Tougher conditions ahead

For more than a decade, low interest rates reduced debt servicing costs and drove up margins. Falling tax rates and constrained wages were other tailwinds that will not continue to persist. But investors should not mistake those conditions for the norm, nor underestimate the potential disruption on companies as they readjust to a new status quo.

Just as heavy weather and tougher track conditions test the endurance of race cars and the skills of drivers, so the volatile business environment will expose weaknesses in investor portfolios. When sources of unsustainable growth recede, the distinction between structural growth and growth driven by temporary factors will become apparent. Quality companies designed to succeed in all conditions will benefit from continued compounding of capital, while those only focused on straight-line speed may be more susceptible to tougher environments.

1. Broadly defined here as companies in the S&P 500 that make something

2. Source: Corporate Reports, Empirical Research Partners

Important Information: Companies discussed herein are portfolio holdings and for illustrative purposes only to elaborate on the subject matter under discussion. Investments referenced should not be considered as a reliable indicator of the performance or investment profile of any composite or client account. Further, the reader should not assume that any investments identified were or will be profitable or that any investment recommendations or that investment decisions we make in the future will be profitable. Information provided should not be deemed a recommendation to purchase, hold or sell any security. No assumption should be made as to the profitability or performance of any company identified or security associated with them.

Forward-looking statements regarding future events or the financial performance of countries, markets and/or investments are based on a variety of estimates and assumptions. There can be no assurance that the assumptions made in connection with the projections will prove accurate, and actual results may differ materially. The inclusion of forecasts should not be regarded as an indication that Vontobel considers the projections to be a reliable prediction of future events and should not be relied upon as such. Vontobel reserves the right to make changes and corrections to the information and opinions expressed herein at any time, without notice.