Embracing net zero targets the right way

Conviction Equities Boutique

Key takeaways

- The United Nations Climate Change Conference COP 27 reminds us that developing economies bear most of the negative effects of emissions mainly produced in industrialized nations.

- If western companies are the cause of most greenhouse gas emissions and the depletion of natural resources, the onus is on them to go “net zero”.

- One common yardstick to measure a company’s progress in this area is the carbon footprint method, but we think this is too narrow a measure.

- We think the more encompassing “potential avoided emissions” (PAE) method propagated by Vontobel’s impact investing team brings out the real environmental benefits of a company’s product.

Another United Nations Climate Change Conference (COP) is nearly over, so what’s the news? Apart from producing headlines regarding reaffirmed or fresh targets to cut emissions, the summit in the Egyptian town of Sharm el-Sheikh in the second week of November has driven home some uncomfortable truths. The fact that, for example, greenhouse gas (GHG) emissions are higher than ever1, and that our emissions are mainly caused by the world’s most industrialized nations, leaving Africa, South America and Asia to bear the brunt of the negative effects.

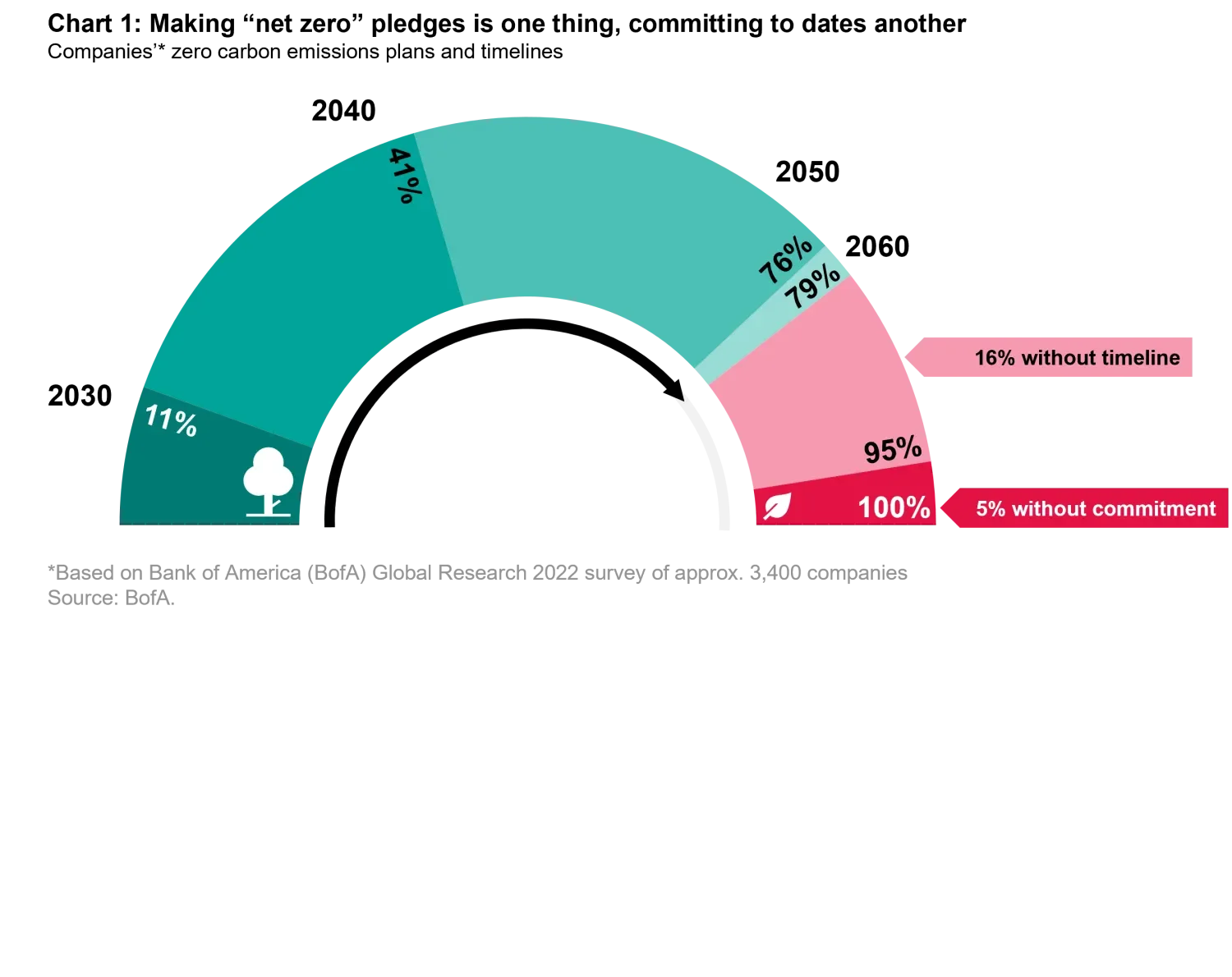

If western companies are the cause of most GHG emissions and the depletion of natural resources, the onus is on them to get things right. One way of doing this is by adopting a strategy to cut carbon emissions, and to act on it. Accordingly, the number of companies with net zero2 commitments increased sharply in 2021 due to tightening regulation, shareholder pressure, or peer action, research by the Bank of America shows (see chart 1). In practice, such a commitment is expressed by management’s consideration of zero carbon emissions as an integral part of their decision-making process.

Not so many corporate heroes with net zeros

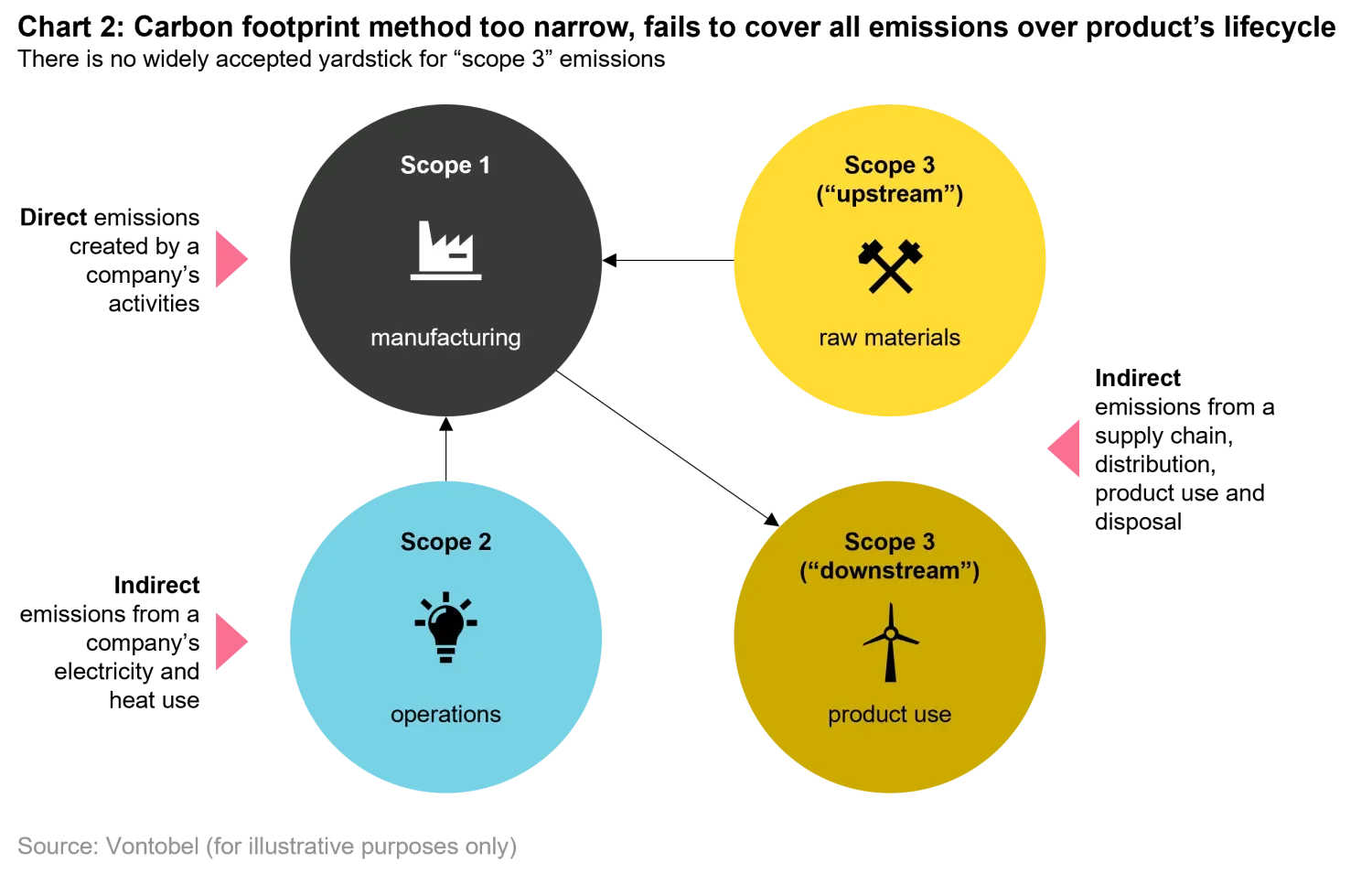

However, net zero targets aren’t beyond doubt. The New York Times, for one, says such goals could lead to empty promises and even obstruct efforts to stop climate change with too many companies kicking the can dawn the road.3 Moreover, most only address scope 1 and 2, i.e. carbon emissions generated during the manufacturing process, leaving out so-called scope 3 emissions that take stock of the entire value chain and lifecycle of the product (see chart 2). Another sore point is the reliance on immature technologies like carbon capture for emission mitigation. The NYT points out that to date, only 19 plants exist globally, which is hardly enough to remove the annual emissions of 700 Americans. The publication also questions the practice of hiding behind “nature-based solutions”, i.e. planting trees, to offset emissions.

Carbon footprint vs potentially saved emissions

Even so, the corporate world’s initiative to bring carbon emissions down is commendable, we think. But what does it mean for investors, and how can they support net zero emission goals?

A widely used starting point is the carbon footprint, with investors preferring portfolios of companies with a lower footprint than a relevant peer group. Yet in our opinion, this measure is too narrow in that it usually only considers a company’s scope 1 and 2 carbon emissions (see definition above), thus missing part of the effect its products and services have on the real world. For instance, tech companies like the so-called FAANG stocks (Facebook, Amazon, Apple, Netflix and Google) or their Chinese equivalents (Baidu, Alibaba, or Tencent) have a low carbon footprint relative to their revenues or market capitalization, but their businesses do little to reduce society’s climate footprint.

What is a possible way forward? As active managers with the ability to look at each portfolio candidate in depth, we drew on the skills of the ISS ESG climate experts to develop a method called “potential avoided emissions”, or PAE. By covering the emissions of the entire value chain, it allows an assessment of a company’s potential contribution to achieve climate change mitigation, lending itself to a solution-oriented capital allocation. To gauge the sustainability credentials of existing portfolio holdings or possible new additions, we ask company management to provide data to calculate avoided emissions4 relative to a standard product or an industry reference.

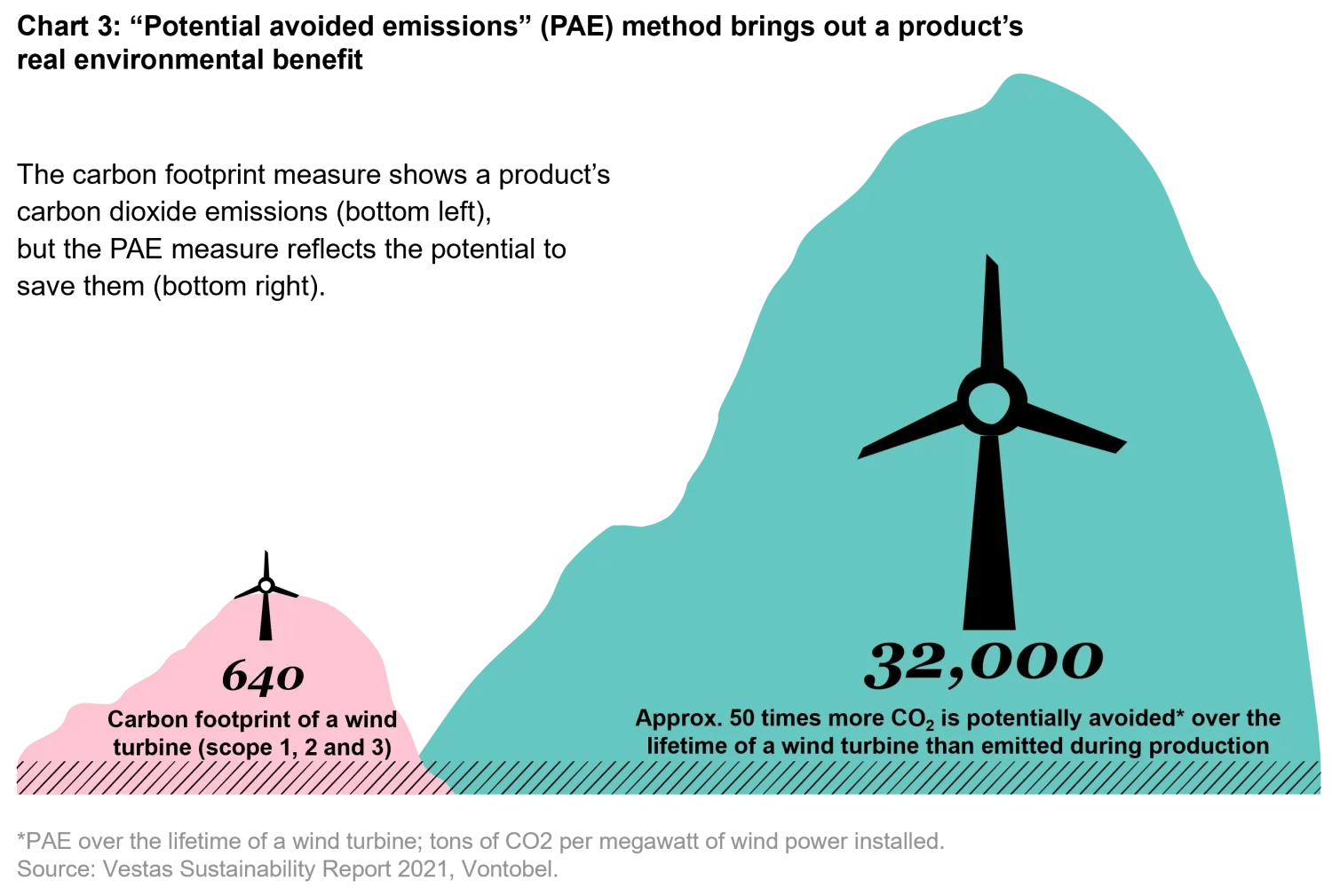

To illustrate the difference in methods, let’s look at a concrete example. If we include all emissions of a wind turbine’s entire value chain (producing, installing, and decommissioning5), it emits approximately 640 tons of carbon dioxide per megawatt of power installed. By contrast, if we consider the amount of CO2 emissions a wind turbine “avoids” relative to a fossil fuel power plant, we arrive at a multiple of 50 (see chart 3). There are many other examples highlighting the advantage of the more complete method. In our view, it’s a PAE perspective that brings out, for instance, the environmental benefit of train versus car travel, or the edge of energy-efficient buildings over those without insulation.

To conclude: There are a few companies that excel in terms of low carbon footprint, but a closer look reveals that their achievements don’t always stand up to scrutiny. We believe a focus on the “real” champions as suggested by the holistic PAE method is much more rewarding, albeit much more demanding in terms of research.

Important Information:

The companies discussed herein for illustrative purposes only to help elaborate on the subject matter under discussion. Presented for discussion purposes only and should not be considered as a recommendation to purchase, hold or sell any security. No assumption should be made as to the profitability or performance of any security associated with them.

Certain information herein based upon forward-looking statements, information and opinions, including descriptions of and expectations of future activity. We believe that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, there is no assurance that estimates or assumptions regarding future financial performance of countries, markets and/or investments will prove accurate, and actual results may differ materially. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

Environmental, social and governance (“ESG”) investing and criteria employed may be subjective in nature. The considerations assessed as part of ESG processes may vary across types of investments and issuers and not every factor may be identified or considered for all investments. Information used to evaluate ESG components may vary across providers and issuers as ESG is not a uniformly defined characteristic. ESG investing may forego market opportunities available to strategies which do not utilize such criteria. There is no guarantee the criteria and techniques employed will be successful.

This material does not constitute specific tax, legal, or investment advice to, or recommendations for, any person. The views and opinions herein are those of Vontobel and may change at any time and without notice. Vontobel reserves the right to make changes and corrections to the information and opinions expressed herein at any time, without notice.

1. Greenhouse Emissions Rise to Record, Erasing Drop During Pandemic, International Monetary Fund blog post, June 30, 2022.

https://www.imf.org/en/Blogs/Articles/2022/06/30/greenhouse-emissions-rise-to-record-erasing-drop-during-pandemic

2. “Net zero” has come to signify the ability of a country or a company to remove the same amount of carbon out of the atmosphere as they emit. Should this be achieved, global warming would theoretically stop.

3. Net Zero Global Warming – just a flaw? New York Times:

Opinion Video

, July 2022

4. Avoided emissions are emissions that would have been released if a particular action or intervention had not taken place. Also see Potential Avoided Emissions (PAE): Dataset & Bespoke offering, ISS ESG, April 2022.

5. To compare like-for-like, we have included scope 1, 2 and 3 for the calculation of the carbon footprint as well.