Three reasons to invest in emerging market equities

Asset management

After a decade of underperformance, we believe emerging market equities are set for a brighter next chapter and any further short-term pain will be outweighed by the opportunity for longer-term gain. Here are three reasons why:

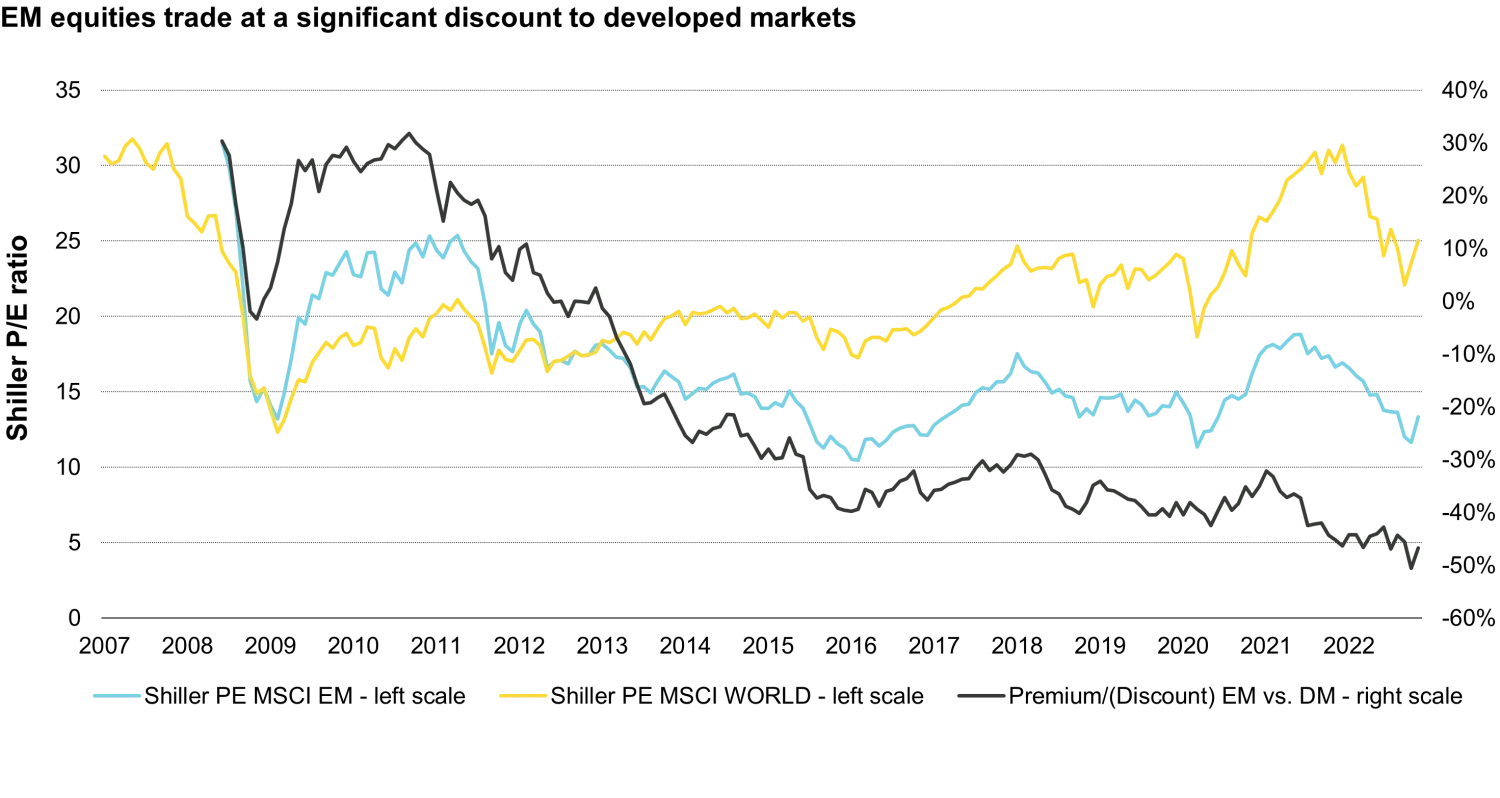

1. Compelling valuations in emerging market equities

It is hard to believe that emerging market equities once traded at a significant premium to developed markets, but that was exactly the case at the end of the commodities super cycle from 2000-2011. That premium has since evaporated, and the asset class now trades at a 44% discount to developed market equities based on the Shiller P/E – the cyclically adjusted price-to-earnings ratio which adjusts ten years of earnings for inflation.

While the Shiller P/E holds no predictive power for returns over the short term, the ratio can be a powerful indicator of long-term returns and as such should not be ignored.

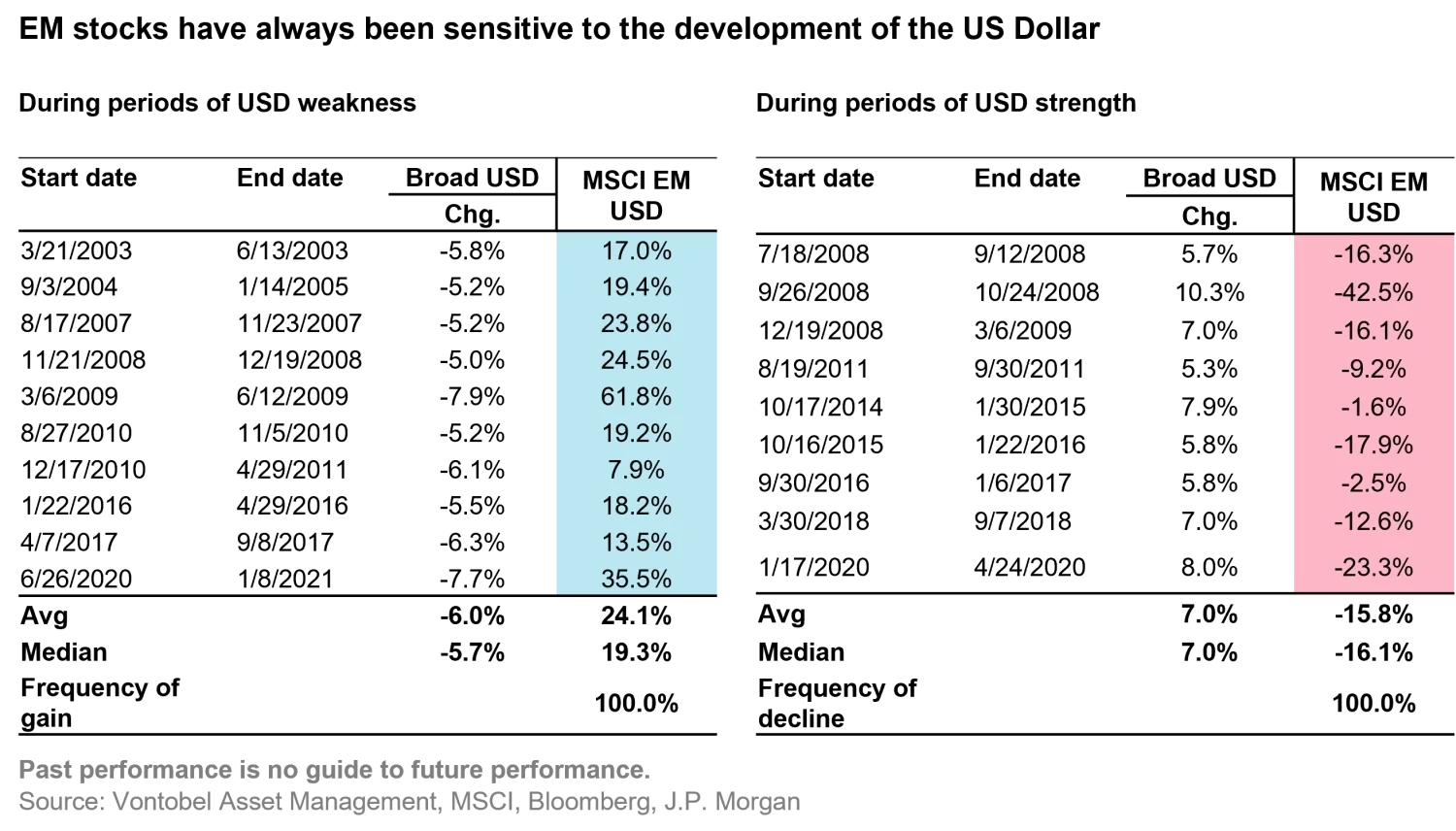

2. US Dollar could soften now that the Fed has completed most of its heavy lifting

Given the speed at which the US Federal Reserve has increased interest rates this year, it is no surprise that the greenback has strengthened significantly. US Dollar strength tends to negatively impact EM equities. However, with the latest CPI figures in October indicating a slowing in the rate of US inflation, the Fed may be able to start taking its foot off the pedal in terms of future rises.

With investor allocations to EM equities 2.5% below their long term average of 9%, an uptick in sentiment could signal large flows into the asset class. To put this opportunity into context, JP Morgan estimates inflows of approximately $750 billion would provide a return to the average long-term allocation of 9%.

3. Many emerging market central banks have managed inflation better than developed market peers

In terms of monetary policy support, developed country central banks such as the US Federal Reserve, the European Central Bank, and the Bank of England have quite a gap to close between the current level of interest rates and what is needed to rein in inflationary pressures.

Conversely, emerging market central banks have been more proactive in managing inflationary pressures, with certainly more practice over the years. The chart below illustrates the gap between the current government rate vs. inflation, which is wide for the UK, Europe, the US and Canada relative to India, Mexico, China, and Brazil. Thus, emerging markets seem to be on rather solid ground.