Quality Growth Boutique

Strategies to tackle the top 3 risks in global equity markets

Uncertainty and volatility in today’s environment have highlighted the benefits of our disciplined Quality Growth philosophy, focused on proven businesses with inherent resilience and durability. Given the narrow tailwinds from the prior two years, select quality companies are attractively valued given their defensive growth characteristics.

Quality Growth Boutique

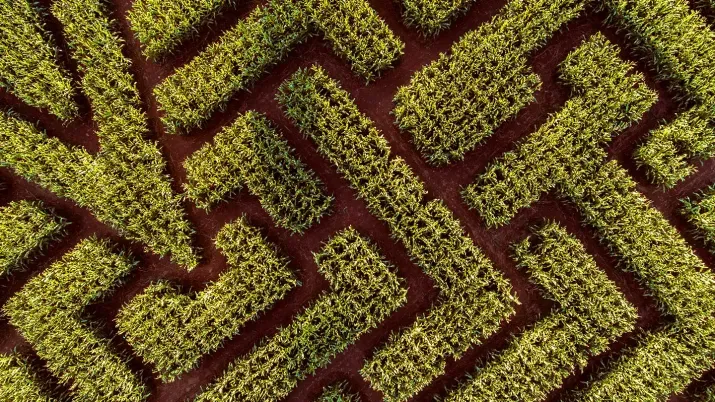

Finding resilient growth amid tariffs and AI volatility

As the exuberance we’ve seen over the past few years fades, our Quality Growth team looks to find resilience in industries that are shielded from the effects of tariffs and the volatility around AI.

Conviction Equities Boutique

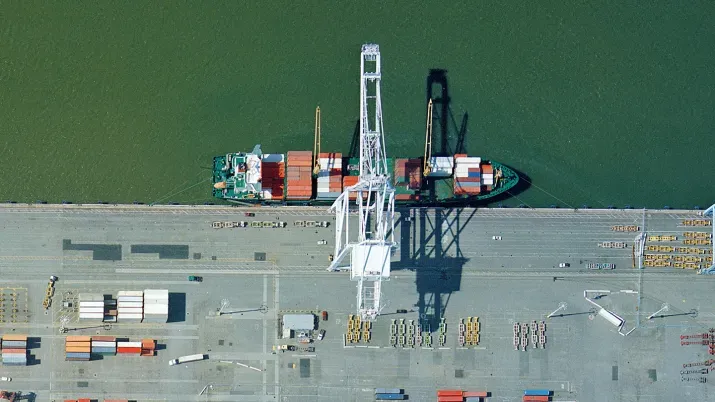

Emerging market equities are more domestic than you think

Emerging market (EM) equities are more domestically driven than commonly assumed. Companies in the MSCI EM Index derive over 60% of revenues in their home markets. And they could further reduce their dependence on exports in the future. We illustrate the reasons.

Quality Growth Boutique

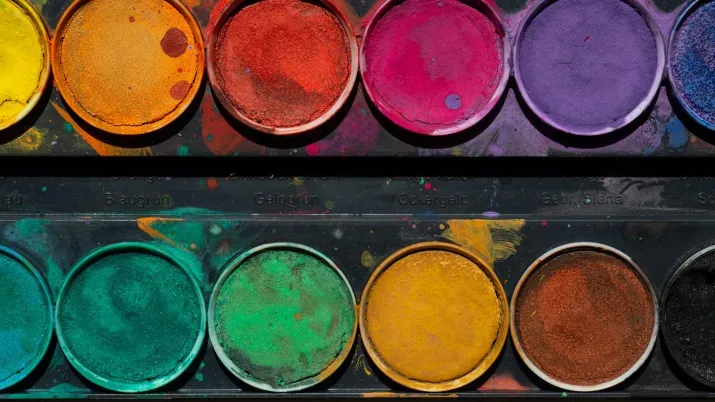

The Not So “Secret Sauce” of Portfolio Construction

How do you build the perfect portfolio? Portfolio construction is a little like gourmet cooking, where quality ingredients are combined to create a balanced meal. Portfolio Manager David Souccar reveals our view on what’s at the heart of that delicate balance between risk and return.

Quality Growth Boutique

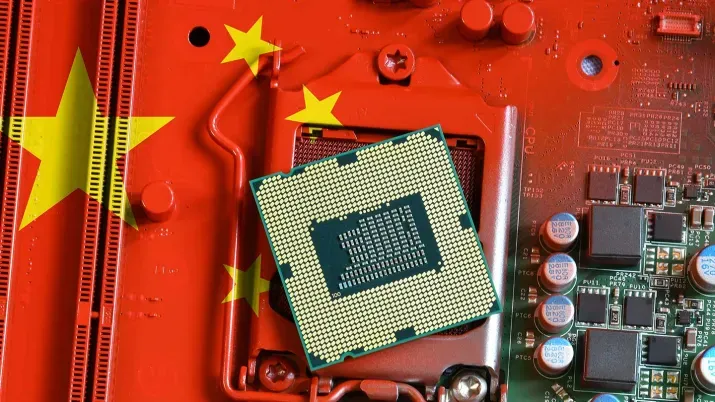

Fierce competition and unclear monetization of AI models in China

Investigative analyst Zhen Li recently attended the Shanghai’s second Global Developer Conference. Zhen’s on-the-ground research reveals concerns about the viability and sustainability of DeepSeek’s model given the intense competition in China's AI sector and lack of clarity around monetization of AI models.

Conviction Equities Boutique

Does the China stock market rally have legs?

The driving force behind this performance is the Chinese tech sector, fuelled by hopes that a larger adoption of AI could boost earnings. A confirmation of improved earnings, the resurgence of consumption confidence and sequential stabilization of the overall economy will be needed to solidify and extend the recent rally.

Conviction Equities Boutique

Simpler and cleaner: profitable opportunities from efficiency

Energy and resource efficiency is often underappreciated, but it has played a pivotal role in driving global emissions lower. Explore how we can benefit from the diverse opportunity set that efficiency brings, and why we believe its importance is set to continue.

Quantitative Investments

Good old factors

Factor investing has long explained market behavior, but its flaws—timing dependencies, rigid linearity, and backward-looking assumptions—limit predictive power. Can AI overcome these? This Expl(AI)ning episode dissects factor evolution, their pitfalls, and how machine learning enables dynamic models. Dive into quantitative investing’s future.

Quality Growth Boutique

Lessons from the past: Navigating difficult times with conviction and moral clarity

People and organizations demonstrate their moral compass in challenging conditions. In 1999, portfolio manager Ed Walczak made a tough call to stick to his investment principles. Despite the pressure to conform to the market trend, he chose to invest in undervalued insurance companies, a decision that paid off when the internet bubble burst.

Conviction Equities Boutique

Three trends key for thematic investing in 2025

Artificial intelligence (AI) is transforming our world at breakneck speed to boost its users’ productivity gains in various industries. The associated need for innovation, resources, and infrastructure investments, reinforced by politics and demographics, positions the providers of convincing solutions as potential future winners.

Quality Growth Boutique

Navigating the tech market steamroller: Will DeepSeek’s efficiency gains prompt a reversal?

Is the tech market’s bull run, much like a steamroller, starting to reverse course? Efficiency gains recently announced by DeepSeek have raised questionsabout the commoditization of LLMs and the potential overinvestment in data centers, shifts that could significantly impact the industry and investors.

Quality Growth Boutique

Companies poised for growth amid DeepSeek and other AI advancements

The massive efficiencies achieved by DeepSeek’s recently launched Large Language Model have prompted investors to reevaluate the power, data center, and chip requirements for the development of AI models. As AI becomes more widely adopted, we identify companies poised to benefit.

Conviction Equities Boutique

DeepSeek’s strong new AI model – AI’s Sputnik moment?

Shares in Nvidia and ASML have plummeted due to concerns that Chinese AI startup DeepSeek's new model could disrupt the current AI business model. DeepSeek's R1 model, released on January 20, exhibits performance similar to top US large language models (LLMs), but at a fraction of the cost.

Conviction Equities Boutique

Global equities in 2025: Balancing structural drivers with opportunistic exposures

2025 is poised to be another positive yet complex year for equities. Balancing core positions in industries driven by secular trends – like semiconductors, AI hyperscalers, and the energy transition – with opportunistic exposures that can benefit from cyclical or policy-induced rebounds can help navigate the challenges ahead.

Quantitative Investments

Will AI ever crack investing?

AI has dominated games like chess and Go, but the markets are far more complex. In our latest Expl(AI)ning article, we explore why investing’s complexity remains unmatched, where AI stands today, and what’s next for finance.

Conviction Equities Boutique

Republican sweep's aftermath: revamping environmental impact strategies

Watch the replay of our webinar featuring Jean Louis Nakamura, Head of Conviction Equities, Sarah Murray, Financial Times Contributor, and Marco Lenfers, Client Portfolio Manager, as they discuss key topics at the intersection of geopolitics, sustainability, and investment opportunities.

Quality Growth Boutique

Advice from an international manager: avoid non-US equities…?

Despite US stocks' outperformance over international equities over the past two decades, investing solely in the US benchmark is not without risks. Yet we do not recommend investing indiscriminately in the broad international benchmark. Being selective and actively seeking out quality non-US companies can diversify portfolio risks and offer robust performance.

Quality Growth Boutique

4 key themes to watch in global equity markets in 2025

The new Trump administration’s policies evoke both optimism and apprehension among investors. This uncertainty is exacerbated by the pressures on the US consumer, high market concentration, and potential earnings disappointments. We highlight key themes we believe are worth watching in 2025.

Quality Growth Boutique

From journalists to analysts: there’s no substitute for on-the-ground research

Former investigative journalists tap into non-traditional sources to gather unique insights for our Quality Growth research team. This article highlights three case studies that led a portfolio manager to increase a position, sell a stock, and revisit the viability of a previous holding.

Quantitative Investments

Architecture and data trump maths

Gain an intuition on how complex AI architectures actually work. You will see that one model cannot fit all kinds of data. The key to solving problems with AI and surpassing mathematical challenges is to use the right model and the appropriate, high-quality data.

Conviction Equities Boutique

Empowering change: Impact Report 2024

Discover how our Impact Investing team navigates economic shifts and political uncertainty to help drive sustainable change. In our sixth annual Impact Report, we reveal our strategies, methodologies, and results in investing in low-carbon solutions and smart infrastructure.

Quantitative Investments

From biological to artificial intelligence

Explore the fascinating parallels between biological intelligence and artificial neural networks. This article dives into how AI mimics the brain’s neuron structures to solve complex problems, revealing the power of neural networks and their potential to reshape our understanding of intelligence and decision-making.

Quality Growth Boutique

Modern mining: Digging deep to find winners on the brink of a technological revolution

The mining industry is entering a green supercycle, driven by demand for metals and minerals needed for decarbonization. Despite increased competition and deeper mining, technological advancements are boosting productivity and reducing emissions. This presents compelling long-term investment opportunities in this evolving industry.

Conviction Equities Boutique

Investing in EM equities in the digital age

Watch our livestream where Jean-Louis Nakamura, Head of Vontobel Conviction Equities, hosts a discussion between Viktor Shvets, Head of Global Desk Strategy at Macquarie and Anthony Corrigan, Client Portfolio Manager, about the role that emerging market (EM) equities play in today’s global equity portfolio and what key factors need to be considered when building a resilient EM equity portfolio.