What's ahead for Global Equities in 2024?

Conviction Equities Boutique

Key takeaways

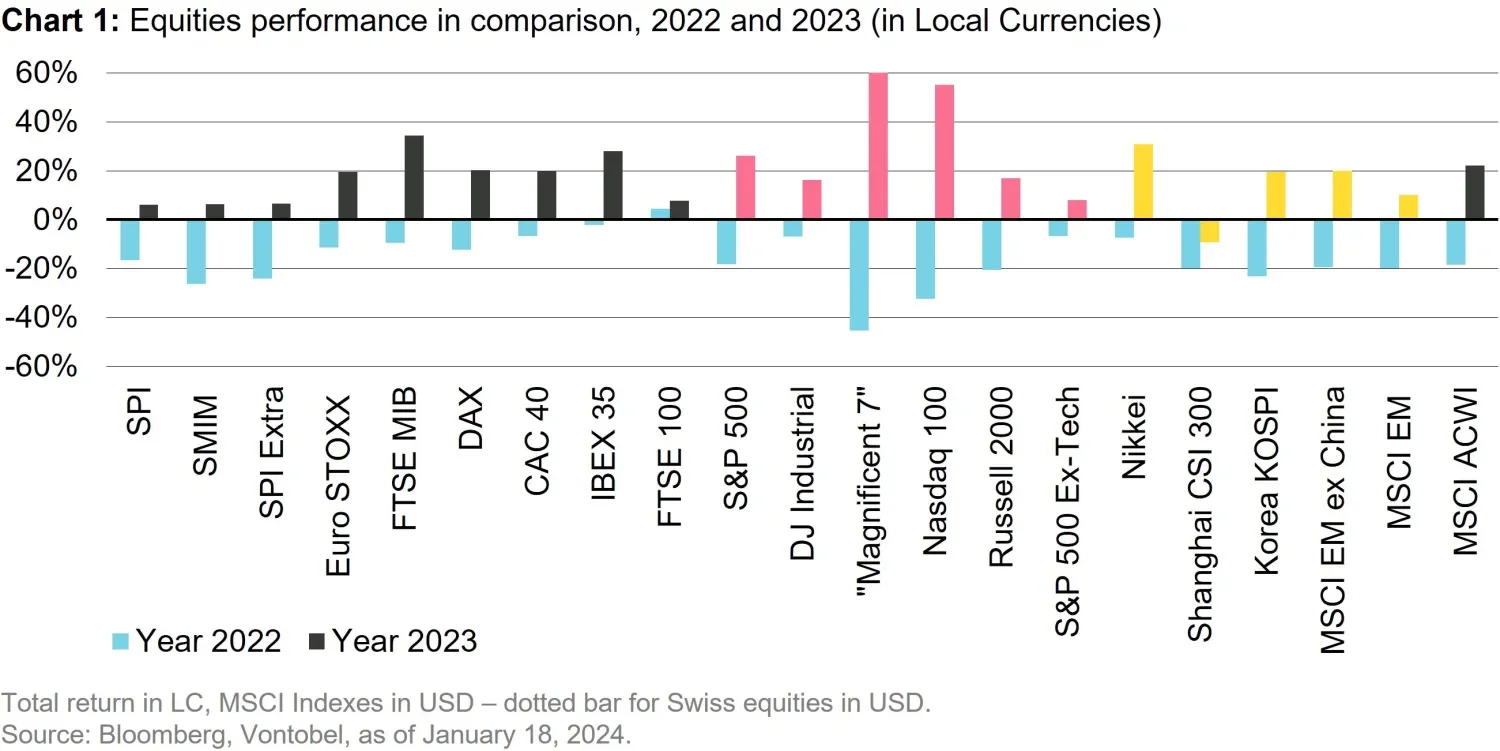

- Last year’s rally in major equity indices proved very volatile, characterized by rapid and frequent sector rotations and extreme unevenness between markets, key equity factors, and, ultimately, individual securities (see chart 1).

- More importantly, it has been experienced on the back of continued depressed investors’ sentiment. This high level of skepticism also explains why in 2024 equity markets have room to go higher, provided macroeconomic conditions, policy stances, and political and geopolitical developments don’t further depress investors’ perceptions nor significantly derail companies’ earnings from current forecasts.

- Ultimately, beyond a few weeks/months of persistent volatility and factor rotations, 2024 looks poised to deliver a good year for equities. Sectors set for a particularly good rally include utilities, materials, healthcare (Biotech and Medtech), and some other segments of technology (such as cloud computing, data servers, and related semi-conductors). On the other hand, consumer discretionary and some of the past cheered themes (such as EVs) could face increased cyclical or specific headwinds.

Jean-Louis Nakamura, our Conviction Equities Boutique head, collaborated with Impact and Thematic Investing, mtx and Swiss Equities to form the argument that markets seem poised to deliver a good year for equities in 2024.

1. The net impact of macro, policy, and political developments in 2024 should be overall supportive for stock markets.

As we look at the year ahead, we believe 2024 will mark another step towards a return to the prior “low growth/low inflation” regime following the large swings in demand and inflation seen in 2021 and 2022. Those were largely caused by the Covid-19 pandemic and the extraordinary policies it triggered. While the destination looks clear, the journey itself might continue to prove chaotic, subject (mainly) to US macro developments, central banks’ (predominantly the US Federal Reserve’s) guidance and eventual pivot, as well as political and geopolitical events.

On the US macro side, 2023 was characterized by rapid disinflation, surprisingly resilient consumer demand, and a strong labor market. This contrast suggests that most of the inflation spike in 2020-21 was driven by bottlenecks in supply. As those bottlenecks disappeared and, in some cases, reversed, inflation receded without a sharp deterioration in demand. Having said that, a last bout of disinflation is necessary, especially in the sheltered/service segments, to bring core personal consumption expenditures (PCE) below 2 percent. That will probably require a further slowdown in consumption. As the US economy is already teetering on the brink of a mild recession (in the manufacturing sector) and slow growth (in the services sector), the room to escape a contraction of overall economic activity might shrink further.

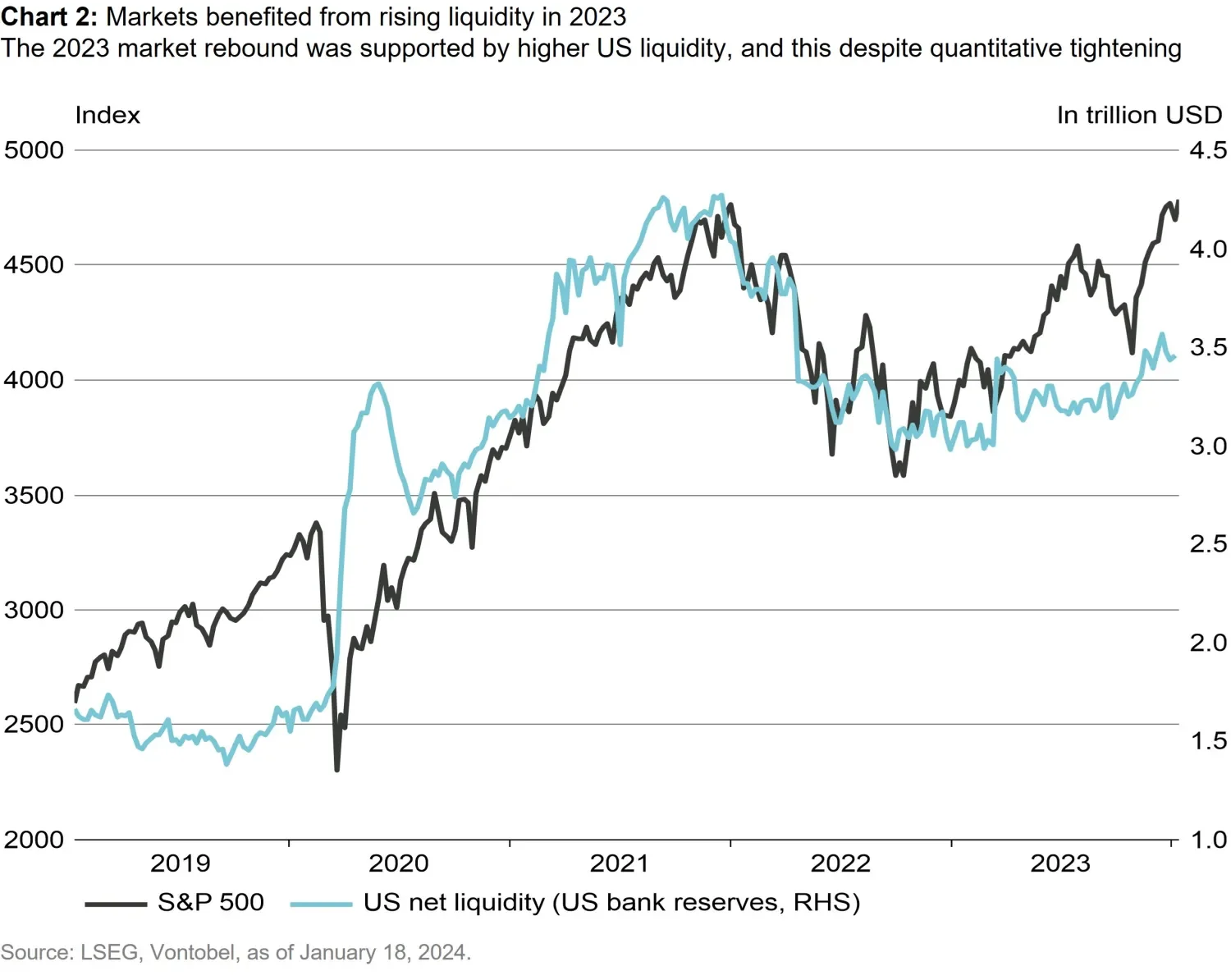

The US regional banks stress experienced last spring stopped short of spreading on a nationwide scale, thanks to the Fed’s rapid decision to reinject liquidity. In parallel, lower reverse repo facility (RRP) reserves from money market funds translated into a USD 1.5 trillion liquidity boost (i.e., an increase in banks’ reserves) that more than offset the Fed’s balance sheet tightening (see chart 2). This dynamic has probably proved decisive in preventing a credit crunch or financial meltdown-induced recession. In other words, while (highly) restrictive in terms of policy and market rates (but with a slow impact on actual growth), monetary policy has been more supportive in terms of liquidity (with immediate benefits). Looking into 2024, a full normalization of the RRP market would involve an additional boost in banks’ reserves of close to USD 1 trillion.

This also illustrates why we don’t need to wait for a rate cut to see financial conditions ease and markets rebound. Clearer guidance combined with adequate liquidity provision would be enough to support markets and, indirectly, economic conditions. This has possibly two concrete implications: firstly, markets’ corrections driven by doubts about the actual pace of future disinflation should prove short-lived and relatively small, as the Fed will have to balance market-induced tightening in financial conditions with more accommodative forward guidance. We should therefore continue to experience the succession of short-term corrections and rallies at work since early 2023 until a more definitive “monetary regime change.”

Secondly, this exit scenario has more chance to be on the upside than on the downside, as the probability of seeing rate cuts is much higher than rate hikes. But for the Fed to clearly lay out that path to markets, we need either a further drop in inflation rates or an explicit recession (that will almost guarantee a further drop in inflation). In this regard, the usual relationship between economic leading indicators and stock performance might be altered this time, as we wouldn’t need to wait for the former to bottom to enjoy a strong rebound in equities, driven by multiple expansions more than offsetting (relatively mild) margin contractions.

Elsewhere, a look at the world’s second-largest economy shows that China continues to struggle with a situation well described in economic textbooks. The country is in a stalemate, suffering from a capital “overhang” following two decades of capital deepening, in a context of persistent excess savings and inadequate consumption. Its past ways to recycle excess savings (exports, infrastructure, and real estate) are not available anymore, at least not to the same extent. Both Chinese and Western economists have called for an obvious remedy: a massive stimulus plan “à la 2008”, but authorities, on behalf of their fight against moral hazard and “disorderly expansion of capital”, are still reluctant to proceed. Their latest decision to cut the Reserve required ratio for banks by 50 bps, while moving into the right direction, is unlikely to fix the structural problems described above.

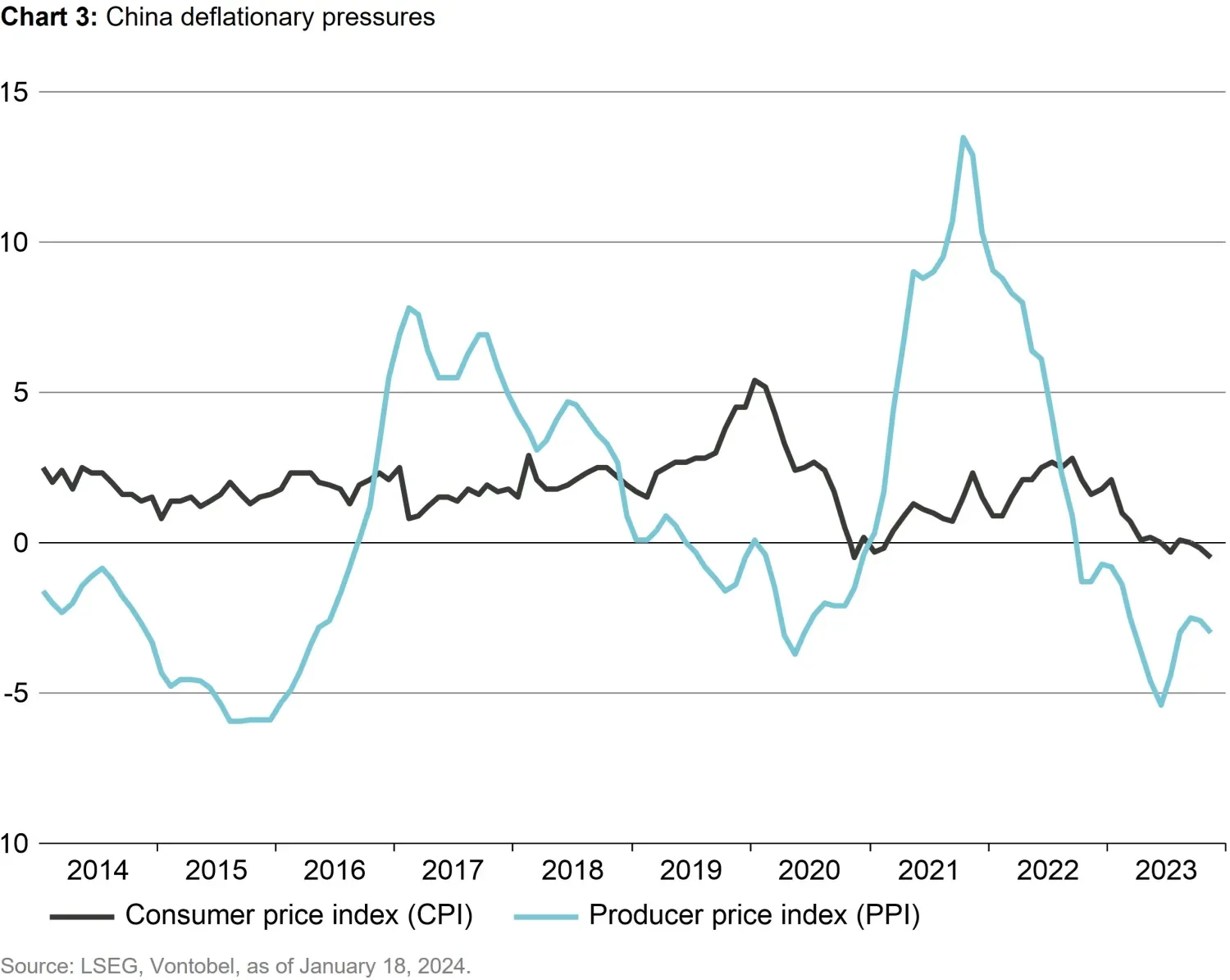

The current priority of China’s leadership is to upgrade the country’s industrial capacity and autonomy, not to rescue investors nor real estate speculators. The paradox is that by trying to solve past imbalances, Chinese authorities are creating new ones by accumulating resources and monetary and fiscal incentives in the same manufacturing sectors (Electric Vehicles , semi-conductors, solar panels) that are at high risk of overcapacity and depressed margins. This also further drives deflationary dynamics, not only in China but also in Western import prices (see chart 3). While the risks of a financial crisis in a still-closed-capital-account economy are usually overrated, the prospects of a sizeable and sustainable recovery look very limited at this stage.

Other emerging economies are at a crossroads. They might face a further slowdown in global economic conditions and global trade but have (much) greater room than in the previous business cycle to cushion it due to their early interest-rate tightening and rapid disinflation. They should also be the main beneficiaries of an ultimate sizeable depreciation of the US dollar, should the Fed ultimately pivot as expected. Interestingly, capital flows have rebounded very significantly in emerging markets ex China in the final two months of 2023. Other developed economies might be in a slightly less comfortable situation, in which they face muted domestic growth, low or contracting demand from the US and China, and central banks unwilling to ease ahead of the Fed.

It’s also worth noting that nearly half of the world’s population will cast their votes for their respective country leaders in 2024.1 Political developments usually have a rather low impact on markets unless they could potentially trigger a significant shift in macro or structural policies. With India’s Bharatiya Janata Party winning three out of the four key state elections in late 2023, the risk of ending Prime Minister Narendra Modi’s era of political stability and economic reform seems to be disappearing. In Europe, EU Parliament elections usually have little market impact as the economic policy implications are diluted and long-term. This leaves the focus almost entirely on the US elections, with markets likely to move somewhere between the late summer and the days following the elections in case of extremely tight results. While the scope of possible outcomes is still extremely wide, a Donald Trump comeback would have bold market implications, both on the US dollar and US equity market.

2. While quality large caps may still be in a better position to buffer volatility in the short-term, 2024 could ultimately provide a good setting for high-growth, mid-sized companies capable of monetizing rapidly tech innovations and AI-induced productivity gains.

Considering the main macro and policy assumptions, the global equity markets’ dynamic could be shaped into two to three successive stages over the next 12 to 18 months:

- A persistent, volatile succession of short-term corrections and rallies in which defensive, large caps, and quality stocks should muddle through the best.

- A more sustainable rally in growth, tech and long-duration equities may benefit from a further EPS upshift once central banks initiate the move towards a different monetary regime.

- Even more uncertain, the possibility of a Trump re-election – if confirmed – might have strong implications in terms of style, themes, and industries dynamics, at the very least in the US dollar and US equity market.

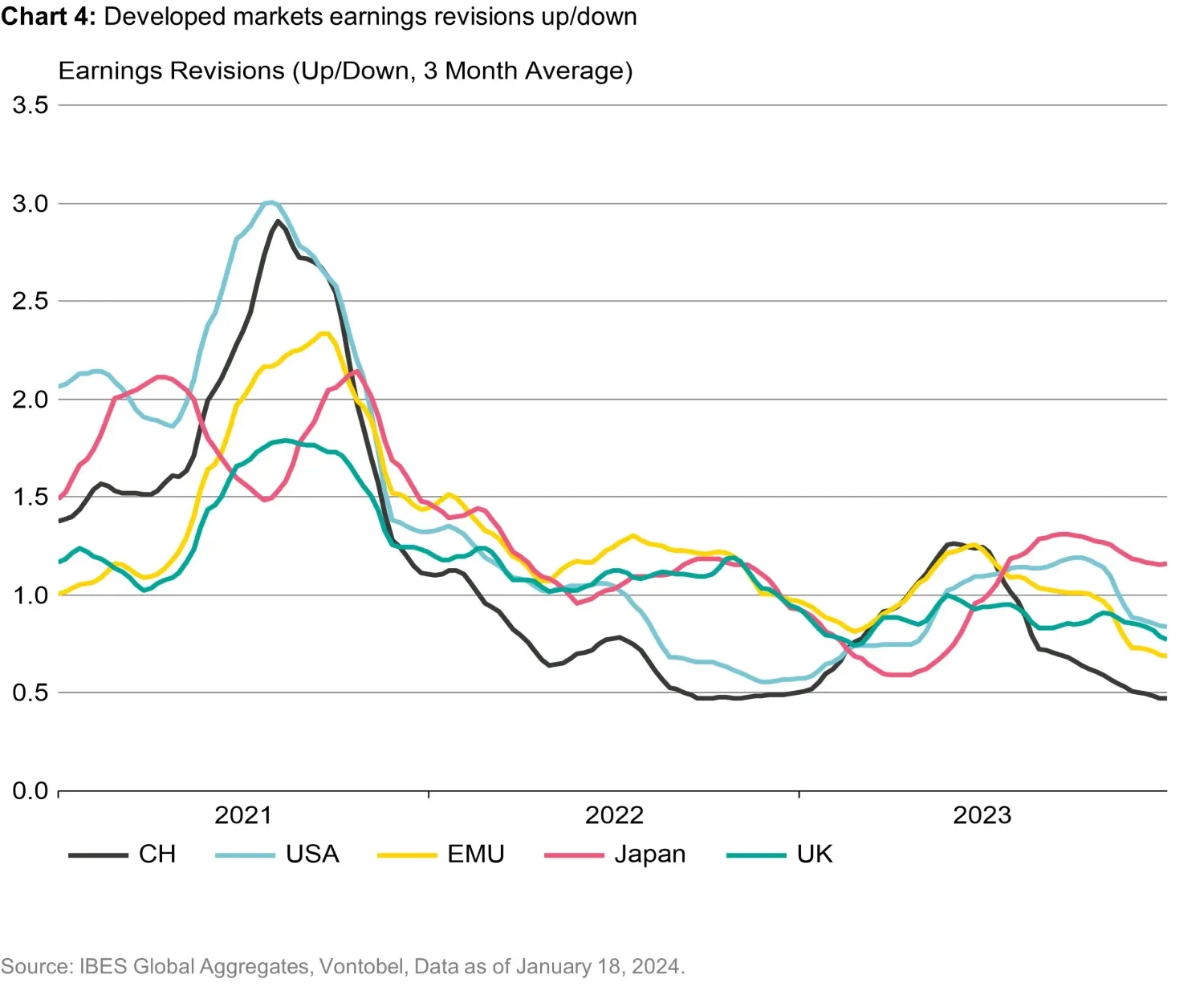

Until a new significant macro catalyst emerges, quality, large caps, and rather defensive stocks from developed markets – especially the US and Switzerland – are more likely to outperform, or at least manage to muddle through the volatility associated with rapid markets’ gyrations better. The Swiss market has a high concentration of such stocks with strong quality characteristics: global market leadership, innovative strengths, corporate culture, and robust balance sheets. On average, Swiss stocks have experienced larger downward earnings revisions than comparable developed equities over the last three years (see chart 4).

Their relative valuation, especially after taking their structurally higher margins into account, looks appealing at this juncture of the cycle. This valuation discount is even higher for Swiss small- and mid-caps. However, we remain more cautious on that segment of the market over the first half of the year, given their more cyclical nature, their sensitivity to demand from Germany or China, the expected persistent strength in the Swiss franc, and their slightly higher refinancing challenges.

In the rest of the world too, large caps with robust quality characteristics and/or are materially exposed to stronger demand than average would most likely outperform. Utilities, with their defensive characteristics, attractive valuations (in line with FY1 average P/E, but with stronger earnings resilience, lower volatility, and a much higher dividend yield), and high sensitivity to a decline in interest rates (over the last two decades, utilities outperformed 68 percent of the time when 10-year rates fell by more than 50 basis points) offer some upside possibilities. Similarly, we expect future healthcare, and especially Medtech, to do relatively well after suffering from significant multiple compressions over the last quarters. The sector has derated amid fears that obesity drugs will heavily impact demand for other Medtech products (like cardiovascular). This fear seems overblown, providing a possible strong buying opportunity. Regarding Biotech, which has underperformed for several years, prospects of renewed M&A activity and additional news flow related to new innovations and pipeline drugs (especially in oncology, radio pharmacy, neurology) may act as a catalyst for a rebound, albeit subject to confirmation of more supportive interest-rate conditions.

Semiconductors and IT equipment should continue to do well, supported by AI/cloud/industrial robotics spending structural tailwinds. Inventory correction, especially in memory, is likely to bottom in 2024. Technological changes in the chip manufacturing process should increase capital intensity further, adding a secular component to the more cyclical recovery. Edge AI (i.e., the usage of AI applications on smartphones and other IoT devices) could boost chip demand further through a revived smartphone market. Large US, Taiwanese, and Korean advanced chipset and memory manufacturers should do well again, but overcapacity accumulated during the Covid-19 pandemic by Chinese sovereign producers in less advanced chips (especially consumer-centric DRAM) may continue to weigh on margins in this segment of the market.

By contrast, we would be more cautious or selective on consumer discretionary or industrial companies due to the persistent uncertainties as to the magnitude of the expected slowdown/potential recession. Earnings revisions have remained excessively positive or resilient for automotive, including EVs, lithium batteries, and solar equipment (especially in China). Regarding China solar manufacturers, with module prices down more than 40 percent year-on-year, significant inventory build-up in Europe, and slower than expected demand growth, it appears very unlikely that companies will be able to show positive top- or bottom-line growth. A strong balance sheet to survive this downturn will be key. Within some other emerging markets (such as Brazil), some consumer names could benefit better from a fallout in rates as their domestic consumption base would enjoy faster and larger interest-rate cuts.

3. What could go wrong? A possible, yet unlikely, cocktail of extreme geopolitical escalation, sticky inflation, and policy mistakes.

Many possible positive and negative surprises may derail our central scenario, with implications for overall market direction as well as geographical-, industrial-, or style-relative performances. The worst outcome for global equity markets would come from stagflation: a combination of significant GDP contraction with renewed acceleration in inflation, forcing central banks not only to postpone cuts but to resume with possible additional rate hikes. Such an unlikely re-acceleration in inflation would most likely result from new large-scale bottlenecks, disrupting supply and production chains. Only a new global pandemic or a massive escalation of military tensions in strategic straits (Ormuz, Suez, and Taiwan) would trigger such blockages.

In the context of the recent Taiwanese presidential and general elections, investors have again questioned the possible economic implications of a “hot” war between China and Taiwan or a blockade of the Taiwan Strait by China’s People’s Liberation Army. Bloomberg Economics recently simulated those two scenarios.2 While a Strait blockade scenario would cost the global economy approximately 5 percent of global GDP, slightly less than during the 2008 Global Financial Crisis and the 2020 outbreak of the Covid-19 pandemic, a full-blown invasion would cost double – 10 percent of global GDP – by far the worst economic shock since World War II. In both scenarios, Taiwan and China would be by far the most impacted (with a negative GDP shock of close to 9 percent for China, even in just the “blockade” scenario), but other economies (such as Japan or South Korea) would be dramatically impacted too.

Even after the victory of Lai Ching-te of Taiwan’s incumbent Democratic Progressive Party (DPP) on January 13, a military conflict remains extremely hypothetical. Markets are more likely to move on the prospect of a Trump re-election, especially if it comes with a Republican sweep of the Senate. Such an outcome remains extremely uncertain and is unlikely to significantly shift investors’ expectations before getting more clarity from current legal proceedings, polls, or even the actual results of the presidential ballots. Yet, some segments of the markets (EVs, renewable energy, and power grids) may have started to incorporate some discounts related to this scenario. Its materialization would probably worsen this discount further in the very short term, while the prospects of a renewed fiscal stimulus through tax cuts may temporarily contribute to a comeback of value and cyclical US stocks. Again, at this stage, it seems far too early to extrapolate from what remains a remote and very uncertain possibility.

1.

https://www.bloomberg.com/graphics/2024-global-election-watch-on-economic-market-issues/

2.

https://www.bloomberg.com/news/newsletters/2024-01-09/economy-risks-latest-taiwan-war-would-cost-world-10-trillion

Important Information: Past performance is not a guarantee of future results. Securities and investment activity discussed herein for illustrative purposes only to elaborate on the subject matter under discussion. Investments referenced should not be considered as a reliable indicator of the performance or investment profile of any composite or client account. References to any holdings and/or other securities are not a recommendation to purchase, hold, or sell any security nor should any assumption be made as to the profitability or performance of any company or security associated with them. Further, one should not assume that investments identified were or will be profitable or that any investment recommendations or decisions we make in the future will be profitable. Certain information herein is based upon forward-looking statements, including descriptions of anticipated market changes and expectations of future activity. We believe that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, there is no assurance that any forecasts regarding the future financial performance of countries, markets and/or investments will prove accurate, and actual results may differ materially. Therefore, undue reliance should not be placed on any such statements, information, and opinions. Vontobel reserves the right to make changes and corrections to the information and opinions expressed herein at any time, without notice.