A question of perception: how quality investing evolves over time

Asset management

In the 1980s, most equity managers were defined as either growth or value; quality was merely a niche. Today however, quality is now a distinct and popular approach for a compelling reason: it has worked. Over time the definition of quality has broadened and become subject to a variety of interpretations, with sometimes significant divergence in the performance of quality strategies depending on market conditions. Four Vontobel investment experts explore the nuances of quality, and what investors can expect from a quality approach in 2024.

Is there an academic definition of quality and how has it evolved?

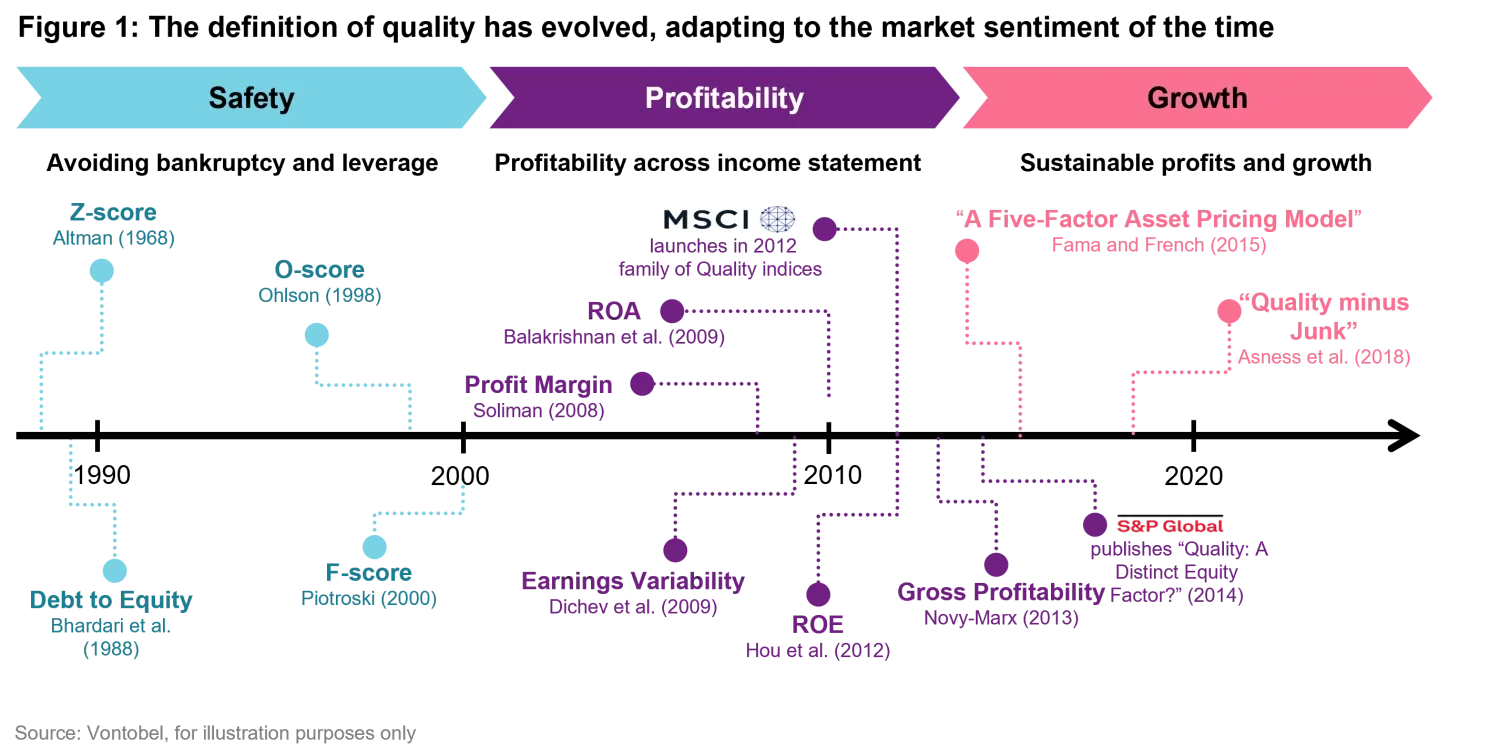

Andrea Gentilini, Head, Vescore Boutique: Yes, and the definition has evolved because specific aspects of quality became more relevant for investors over different time periods. In the early days, investors focused on measures such as the debt-to-equity ratio to gauge a company’s leverage. The quality lens then evolved to profitability across the income statement and most recently it morphed into growth and elements of stability, with much of today’s academic literature focused on persistence (Figure 1: “Quality minus Junk"). Going forward, we expect quality measures to shift toward impact on the planet and society, with some recent research on the correlation between quality and ESG factors illuminating this trend.

How do you find quality companies across industries and geographies?

Matthew Benkendorf, CIO Vontobel Quality Growth Boutique: As an active manager, we implement quality by consistently looking for business models with elements of safety, profitability, and growth throughout the cycle. Looking back to the internet bubble, some argued that ‘eyeballs’ (website visits) should replace earnings as a profitability yardstick. Today, some argue that investing outside a strategy’s stated objective, i.e., style drift, is a viable strategy. We disagree and stick to our distinct quality discipline over time.

In seeking quality, we require a minimum track record of profitable growth before investing. In our view, a transformational company will continue to show earnings and growth potential after 5 years. If you invested in Amazon in 2010, thirteen years after its IPO and with a 5-year track record of profitable growth, your original investment would have multiplied by 17 times today. Active managers can add value by identifying companies with not only historical track records of competitive advantages, but those that can also be sustained into the future.

Jean-Louis Nakamura, Head of Vontobel Conviction Equities Boutique: Quality companies tend to have strong industry positions and the ability to invest in future growth. However, we do look at different quantitative metrics when assessing quality between industries, not only at the company level, but in the context of the industry itself. For instance, in heavy asset industries such as energy and mining, we look more closely at a company’s ability to consistently deliver profits, whereas in the biotechnology segment of the health care industry, we look more closely at a company’s ability to reinvest in R&D, as well as its innovation process. By geography, we may use similar factors when evaluating quality in our Swiss universe compared to emerging markets, but our qualitative analysis, which includes meetings with management, will certainly be different.

Matt: Quality companies can prove more enduring in developed markets and, given a greater understanding of quality approaches, they are more likely to be broadly used there. The picture is a little different in emerging markets – as a style, quality is not as well established there and it’s evolving more rapidly. Quality is cheaper in EM because of the inherent risks and it also requires more patience, while valuation is becoming a more important element in developed markets.

Jean-Louis: We constantly refine how we assess industry positioning, which can be challenging in today’s regulatory environment and competitive playing field. It’s a delicate balance to be forward-looking while not deviating too much from our definition of quality, which is why a solid academic framework is important.

Will quality stand the test of time?

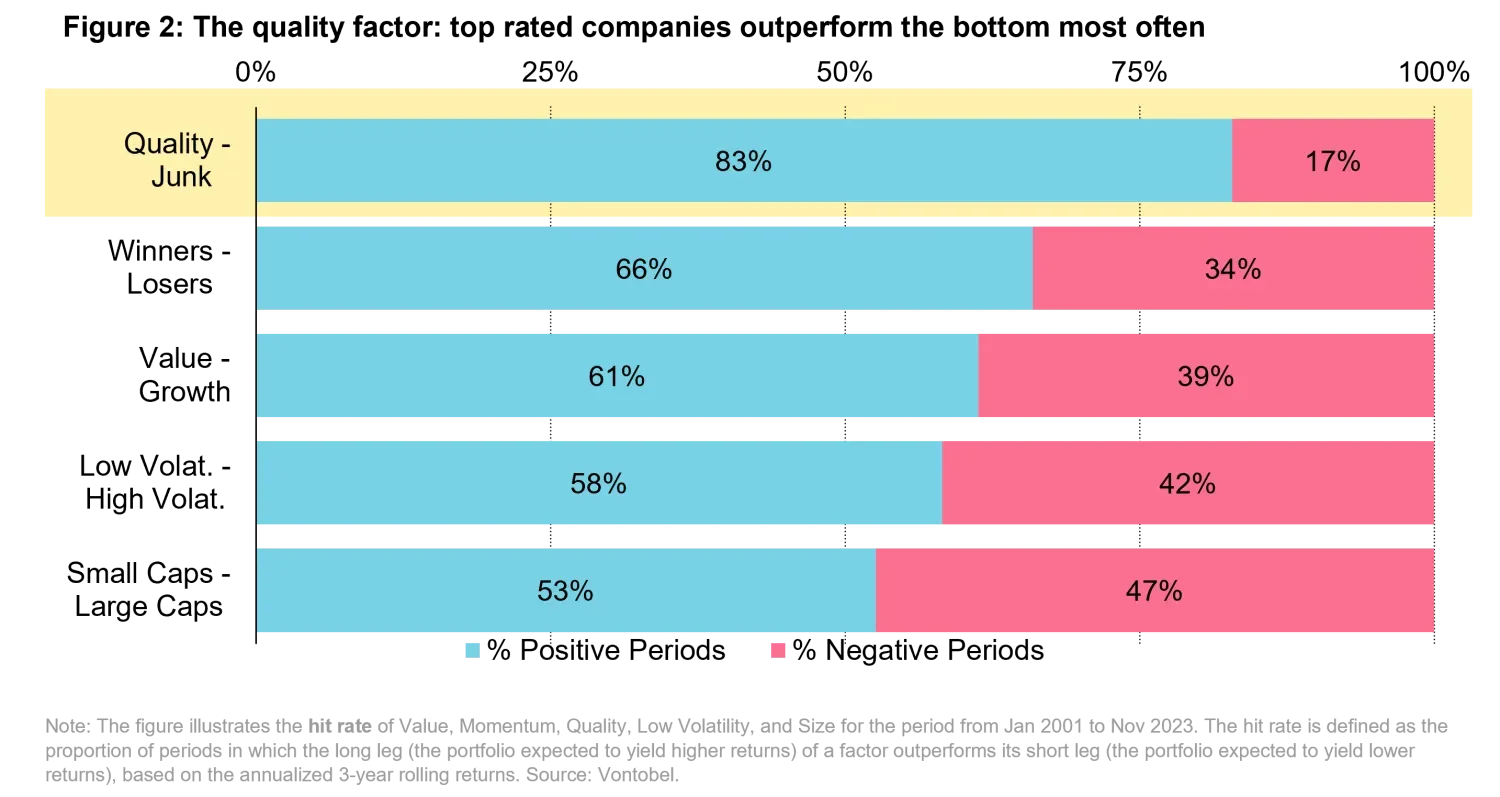

Andrea: Style factors – quality, momentum, value, volatility, and size – help explain performance amid increasingly complex global markets. Understanding how each of these drives returns and risk in a portfolio can help investors choose an optimal mix of strategies. Factor investing ranks companies along a metric (aka the factor), and then observes whether the highest-ranked companies outperform the bottom-ranked. Since 2001, the quality factor has outperformed 83% of the time:

Is quality a tactical or strategic bet?

Dan Scott, Head of Vontobel Multi Asset: Most of our multi-asset returns come from strategic asset allocation (SAA), with only a small amount from tactical asset allocation (TAA). So for us, investing in quality is not a question of timing, rather it’s a strategic decision. This is because losing less in down markets can be the key to successfully compounding wealth over time. The low volatility associated with quality investing also removes the behavioral bias, and investors are less likely to act irrationality e.g., sell low and buy high.

Quality can be expensive, but over the long-term investors can be well compensated for paying what seems like a high price. Take Nestle, for example. A Swiss company perceived as ‘boring,’ yet since 1996 its total return exceeded 12% annually, handily beating the MSCI World Index, which returned 6.9%. Even when dividends are removed, a large portion of Nestle’s returns, it still outperforms.

Is there a correlation between quality and growth?

Jean-Louis: Quality and growth are undoubtedly two distinct factors and should be viewed as such. Many of the metrics that are used to characterize quality are related to fundamentals, such as margins, sales, and revenues. The last decade of accommodative monetary policy was supportive of sales growth and margin expansion, which has led to a success story for many growth companies, some of which are now deemed ‘the magnificent 7’. But that has not been the case for all companies, which is why we believe a clear distinction between quality and growth is important.

Matt: While growth is often interpreted as synonymous with quality, solely focusing on growth to the exclusion of all else can be detrimental. If investors don't get quality right, they miss downside capture and are subject to greater risk because they also lose valuation discipline, which will become more relevant as we journey through 2024.

How do you reconcile a short-term mismatch between a quality company and its long-term returns?

Matt: It requires patience, which is a difficult but crucial element of investing. Consider health care businesses, particularly MedTech – they have the potential to grow predictably for years to come, yet in 2023 the market ebbed and flowed around them, focusing on euphoria in the tech space. This year they may be affected by the election cycle or rhetoric around regulation. Health care is a prime example where patience is required for long-term returns, despite short-term mismatches.

How does quality perform in different macro regimes?

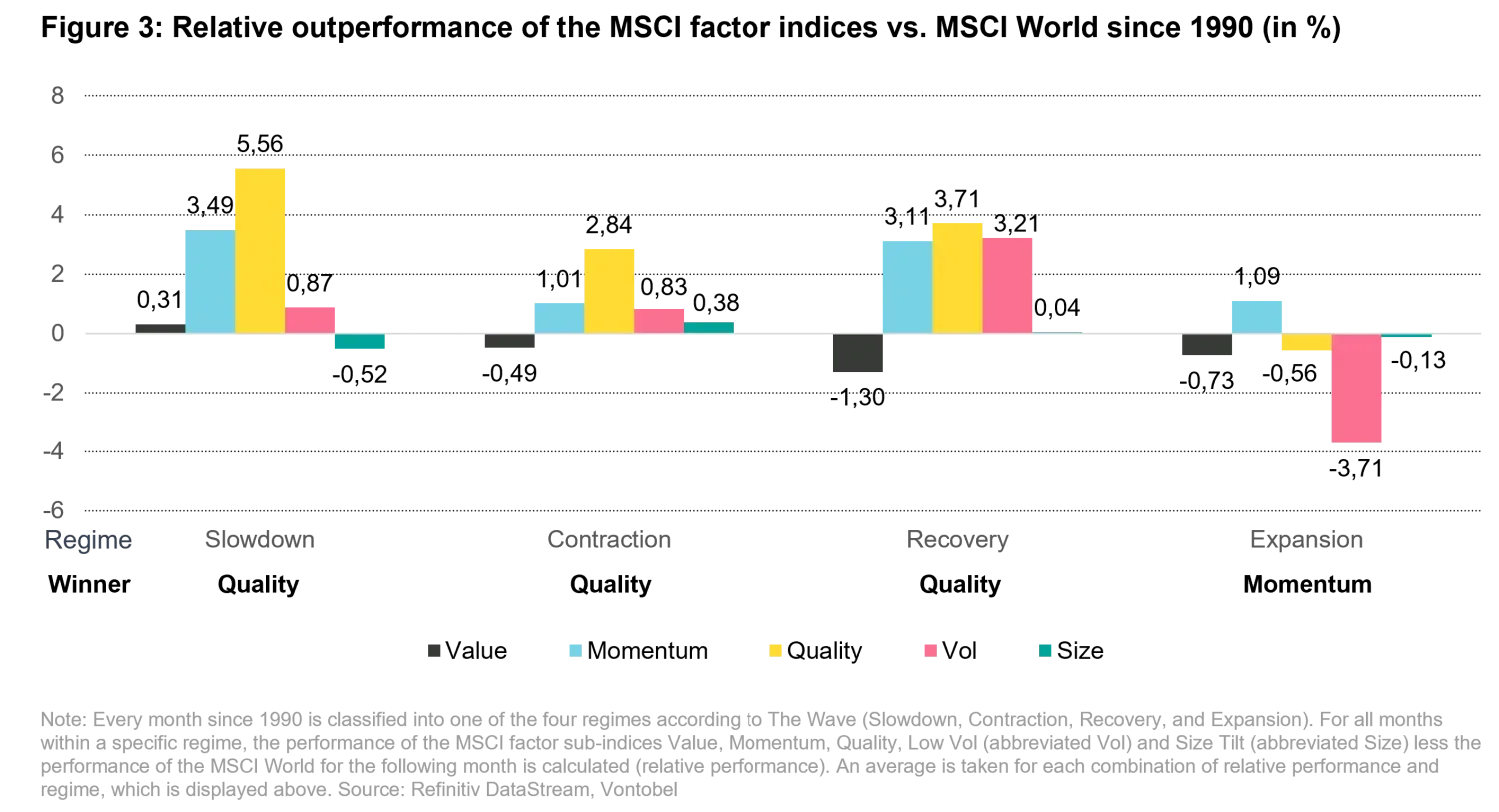

Andrea: Among the five factors, it is true that momentum performs well in all regimes, but in those where quality performs well, it does markedly better. How we view the future regime is important – most investors don’t expect the rampant, liquidity-fueled bull market of the past decade to continue into the next one. With an expansion regime unlikely, quality is a good bet.

Is now the time for quality?

Dan: We expect true quality companies are well poised to deliver returns going forward where the cost of capital will be higher and GDP growth will likely be lower than what we’ve become accustomed to in the zero-interest rate environment of the past. Avoiding losses over time is part of a sound investment process, and as the landscape becomes more volatile investors’ focus will shift to a company’s quality of earnings, its ability to generate return on invested capital, and the efficiency with which it manages its capital. That said, in our view, investing in quality is not really an issue of timing since the bedrock elements of quality should remain a constant in any balanced portfolio.

Important Disclosure: Advisory services for the Vescore Boutique strategy and the Conviction Equities Boutique are offered through a Participating Affiliate structure between Vontobel Asset Management, Inc., Vontobel Asset Management AG, and Vontobel (Hong Kong) Limited. Where applicable, certain investment staff may be deemed as Associated Persons, and therefore subject to SEC requirements as part of the Participating Affiliate structure. The Multi-Asset strategy is not available to U.S. investors.