Ready for takeoff? Are corporate bonds set for a smooth climb?

Fixed Income Boutique

Key takeaways

- Institutional investors are now turning to investment-grade corporate credit as a first step back into fixed income.

- Investing in high-grade corporate credit means investing in businesses that are better placed to weather any possibility of recession.

- We remain very optimistic about our investment-grade markets in both the European Area and the US as rate volatility abates -- and given current valuations.

After the “great repricing” of 2022 – the worst year on record for bonds – is corporate credit ready for takeoff?

Having shunned bonds for most of last year, institutional investors are now turning to investment-grade corporate credit as a first step back into fixed income after last year’s upheavals and as central banks seem to be nearing the finish line in terms of hikes. This should translate into lower rate volatility and increased credit spread stability.

Investing in high-grade corporate credit means investing in businesses that are better placed to weather any possibility of recession – although it should be noted that the economic growth momentum slightly deteriorated in March due to the turmoil in the banking sector.

That said, it remains to be seen what sort of slowdown in growth momentum materializes. Both the US and European Area economies still demonstrate quite healthy employment markets that should cushion any slowdown.

Credit spreads have also cheapened again and are, in some cases, displaying near-recessionary spread levels, offering a second layer of protection.

In addition, investors should bear in mind that since the outbreak of the Covid-19 pandemic in 2020, corporates have been shoring up their balance sheets and are in much better shape as a result.

We remain constructive about corporate bonds, as they should continue to provide very attractive carry returns. We should avoid a full-blown financial crisis as the Fed should now apply its brakes, as tighter lending conditions could have the equivalent effect of one rate hike or perhaps more, as suggested by Fed Chair Jerome Powell.

In Europe, the ECB should no longer be required to raise rates quite as high and as widely expected, considering that the Swiss banking turmoil should take some air out of the European Area economy.

All in all, more prudent central banks should provide investors with good relative-value opportunities in our markets, especially if they missed the beginning-of-year rally.

Navigating the path ahead with our bond cockpit

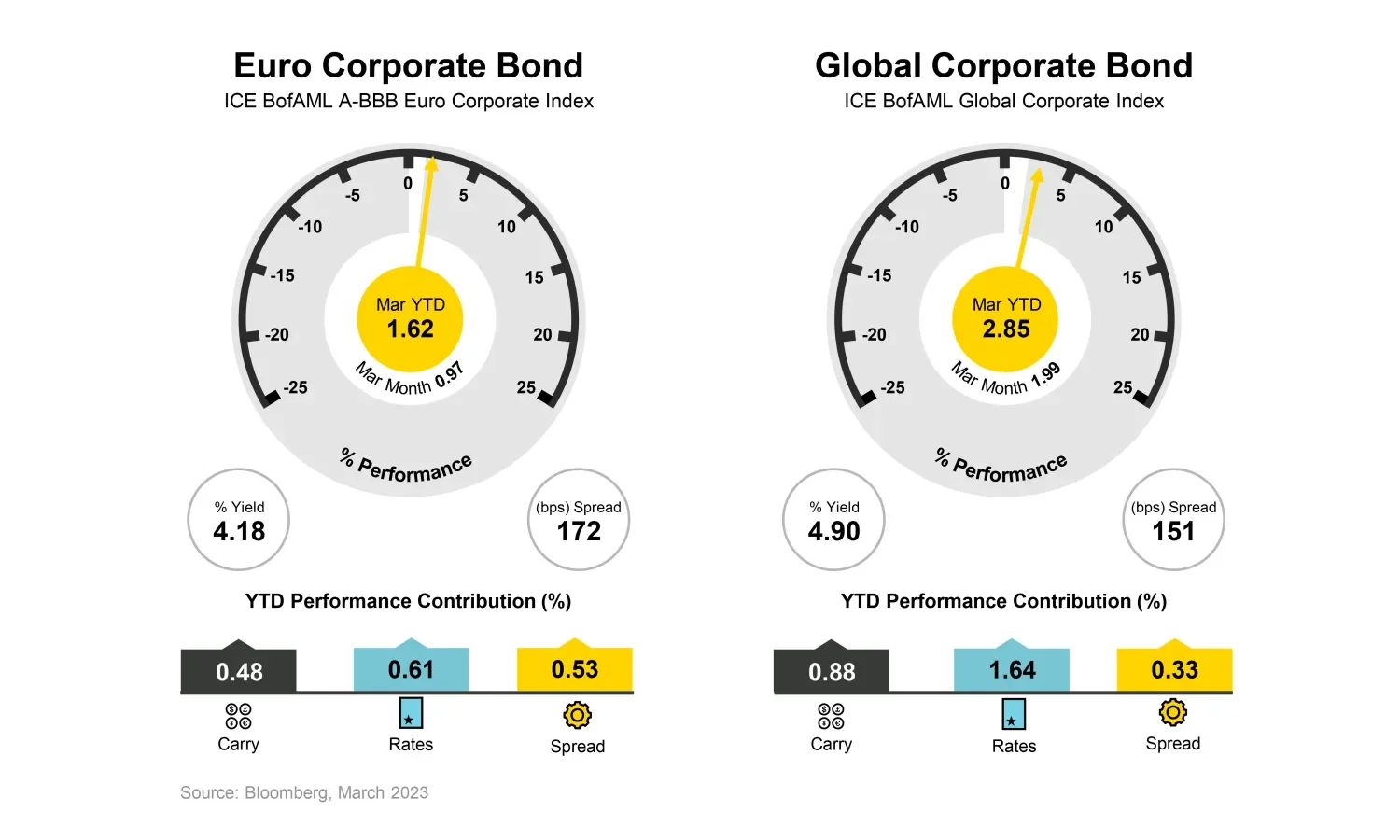

The figure below uses the analogy of an aircraft cockpit to show the three engines of bond returns for euro and global corporate bonds, based on the reference indices.

The engines are performing as they should in times of slightly higher spread volatility. Indeed, we have said that 2023 would be different from 2022, and it is refreshing to observe that the credit spread/benchmark government yield correlation has moved more negative.

Unlike in 2022, the spread widening in March was cushioned by tighter government yields. This partly offset the credit spread widening, still ensuring positive total returns.

Opportunities abound in European credit

In our European segment, we are proceeding cautiously and would stand ready to increase our existing small hedges – such as treasury futures and crossover – should darker clouds gather over the growth momentum. However, our market almost prices in recessionary spread levels. They stand to perform well from an all-in yield and total-return perspective. Spreads at 180 basis points on average are also seen as stabilizing, and potentially narrowing about 40 basis points from their current level in a scenario of very weak growth in the European Area.

Numerous attractive relative value opportunities exist. The senior European banks sector is approaching its widest point near 200 basis points, while telecoms, utilities and transportation remain appealing at around 150 basis points. The latter are more attractive than cyclical BBBs, where the cyclical premium is historically low.

At the subordinated and AT1 level, we remain very optimistic and expect spreads to continue recovering from the low valuations observed in March. They have tightened 80 basis points at the time of this writing.

This is especially true as banks, such as Deutsche Bank, have announced the call of one of their Tier 2 bonds on March 23 at uneconomical terms. Unicredit also confirmed an upcoming call and received ECB approval for a share buyback exceeding EUR 3 billion. Such actions will help restore confidence in the AT1 segment and keep the spread recovery on track. As for industrial hybrids, we anticipate they will indirectly benefit from the AT1 volatility experienced in March and the fallout from Credit Suisse, as they may now be viewed as preferable alternatives to AT1s for certain investors.

Demand for global high-grade bonds remains strong

Global investment-grade corporate bonds from developed markets had a phenomenal start to 2023 as investors poured record sums into high-grade corporate bonds.

This trend has slowed down to some extent, given the woes in the US regional banking segment. Overall, though, we think the whole US banking sector should be able to weather the volatility seen in March. Once volatility is well digested, the wider credit spreads should attract renewed interest in global credit. Issuance volumes of corporate bonds have been materially lower during the month of March but are likely to pick up again in the coming weeks.

With yields and spreads at elevated levels, we believe the market offers increased dispersion. Credit spreads have recently started to trade outside of the ninetieth percentile trading range for almost the last 10 years, and some sub-sectors, such as financials versus non-financials, do trade at a multi-year wide. Overall, this should attract interest in the asset class in the short term before we get more clarity regarding the most recent macro data.

Finding value in the BBB rated global credit

We believe credit investors can find great value and high all-in yield income with global investment-grade bonds.

Our favorite spot in investment-grade portfolios is the BBB segment. Here, investors tend to get an attractive risk premium while knowing that companies are usually keen to keep their rating stable to improving.

A downgrade from investment grade to the high yield territory typically comes with a significant increase in refinancing costs. Corporates tend to avoid this risk whenever they can, and it is on us to make sure we are not running into a “fallen angel” credit situation. This is one of the risks that investors need to be aware of. However, we do not see huge M&A activities now, which are typically a major driver for rating downgrades.

Besides, higher rates and yields are not a major risk for high-grade companies now as the so called “interest coverage” ratio – the ability to pay coupons on outstanding debt – is at an all-time high.