This bond fund aims to generate steady income and achieve above-average investment returns over a full credit cycle, while promoting environmental or social characteristics and respecting risk diversification.

The fund invests worldwide mainly in corporate bonds in different currencies with various maturities of issuers of good quality (investment grade), focusing on paper whose credit spreads offer adequate compensation for the risks involved. The fund seeks to promote environmental or social characteristics.

The investment team applies a research-driven process, combining a top-down approach to evaluate geographies and industries with bottom-up analysis. The team considers ESG (Environmental, Social, Governance) standards by applying exclusion criteria and selecting issuers with strong or improving environmental or social characteristics. The team takes high-conviction investment decisions, striving to benefit from global diversification and actively exploit market inefficiencies, such as relative-value opportunities, across market segments.

"Our robust process, supported by advanced tools, helps the team exploit inefficiencies in the global corporate-bond market to capture value."

Our investment process begins with a top-down review of the global corporate bond market, where we look at the development of key macro- and microeconomic data, considering technicals, such as new issuance and asset flows into or out of the asset class.

Then, with the use of our proprietary tools, we zoom in and finally identify around 200 attractive issuers from a benchmark universe of more than 2,400 names. Our ESG-risk concept excludes issuers that derive a certain percentage of their revenues from products/activities referenced under “exclusion approach” in the fund’s legal documentation – such as weapons, thermal coal, or tobacco, those we deem the most controversial, those that are in violation of certain global norms and standards the fund seeks to promote, and those not aligned with the United Nations Global Compact Principles.

Once we have determined potential issuers to invest in, we conduct a thorough bottom-up analysis on each potential security, resulting in a fundamental company view that also considers ESG characteristics. By bringing this together with our overall market valuation, we come to a buy/hold/sell decision on each issuer.

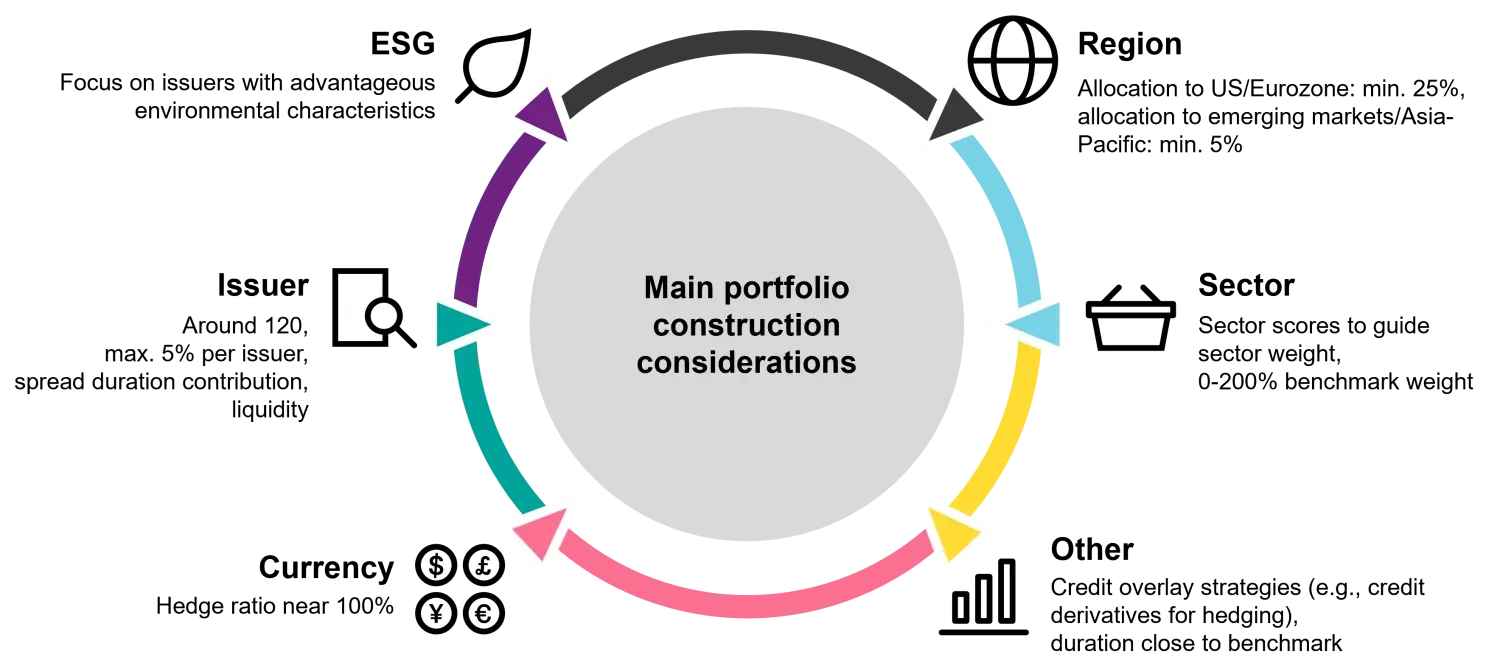

We then construct our portfolio based on our considerations of the aspects region, sector, issuer, ESG, currency, and other, as illustrated in more detail below.

A robust risk-management setup, with control and oversight independent of the primary risk owners, provides a solid cover across our entire investment process.

We aim to select issuers of high credit quality to generate income over the long term. As individual regions are in various stages of the credit cycle and perform differently at any given point in time, a global portfolio provides better diversification than a single-country or regional approach. This can also significantly reduce the impact of local shocks (for example, Brexit or the European sovereign debt crisis) on a portfolio.

Furthermore, bonds from the same issuer, denominated in different currencies, often exhibit price discrepancies allowing us to create relative-value opportunities. By identifying what we consider the most attractive bonds across the main currencies, we can extract value for our investors, with exchange-rate risk fully hedged.

We believe that ESG considerations have an impact on credit risks but also present opportunities for investors. Also, we expect a change of the investment landscape over time, as sustainability will further gain in importance.

One focus theme of our broad ESG assessment is climate change. We adopt a screening methodology based on pre-defined indicators. We favor companies we deem advantageous, in transition, or offering potential to improve their environmental characteristics, for instance firms that are in transition to a lower-carbon economy. Our goal is to have a high allocation to companies that do well in this respect, according to our bottom-up analyses.

"The global corporate-bond market is broad enough to offer active investors numerous opportunities for excess returns with a high degree of diversification."

The global corporate-bond market is slow to react to new trends, and so, presents investment opportunities across regions, industries, structures, currencies, and issuers – an ideal ground for active corporate-bond selectors. In addition, the asset class is very broad, offering good risk diversification potential.

Christian Hantel, Lead Portfolio Manager, and Marc van Heems, Deputy Portfolio Manager, manage the fund. They are supported by the entire Corporate Bonds team, headed by Mondher Bettaieb, and the other teams within Fixed Income.

All data is as at 30 Sep 2024 unless otherwise indicated.

| 1M | YTD | 1Y | 3 yrs p.a. | 5 yrs p.a. | Since Inception | |

|---|---|---|---|---|---|---|

| HN (hedged) EUR | 1.4% | 4.3% | 12.4% | -2.8% | -0.4% | 3.1% |

| Index | 1.4% | 4.2% | 11.2% | -2.5% | -0.5% | 2.5% |

| 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | |

|---|---|---|---|---|---|---|---|---|---|---|

| HN (hedged) EUR | 6.5% | -16.8% | -1.5% | 7.5% | 10.3% | -4.5% | NA | NA | NA | NA |

| Index | 6.4% | -16.3% | -1.6% | 6.6% | 9.3% | -3.6% | NA | NA | NA | NA |

| Portfolio | Index | |

|---|---|---|

| Volatility | 8.3% | 7.6% |

| Active Share () |

All data is as at 31 Oct 2024 unless otherwise indicated.

| Portfolio Manager | Christian Hantel |

|---|---|

| Fund Domicile | Luxembourg |

| Fund Currency | USD |

| Share Class Currency | EUR |

| Year End | 31 August |

| Index | ICE BofAML Global Corporate Index (EUR hedged) |

| Share Class Launch date | 11 Dec 2017 |

| Distribution Type | Accumulating |

| Swing pricing | Yes |

| SFDR Classification | Article 8 |

| Fund Registrations | AT, CH, DE, ES, FI, FR, GB, IT, LU, NL, NO, PT, SE, SG |

| Share Class Registrations | CH, ES, LU, SG |

| Highest since launch | 113.85 |

|---|---|

| Lowest since launch | 88.24 |

| Share class size in mln. | EUR 2.28 |

| Management fee | 0.31% |

|---|---|

| TER* | 0.49% (29 Feb 2024) |

| ISIN | LU1734078667 |

|---|---|

| Valor | 39472008 |

| Bloomberg | VOCBHNH LX |

| WKN | A2H9P1 |

| Depository | State Street Bank International GmbH (Luxembourg Branch) |

|---|---|

| Management Company | Vontobel Asset Management SA, Luxembourg |

| Swiss Paying Agent | Bank Vontobel AG |

| Swiss Representative | Vontobel Fonds Services AG |

| Share class | Currency | ISIN | Distrib. | Type | Launch date | Management fee | TER* |

|---|---|---|---|---|---|---|---|

| A | USD | LU1395536086 | Distributing | Retail | 9 May 2016 | 0.82% | 0.98% (29 Feb 2024) |

| AH (hedged) | EUR | LU1395536243 | Distributing | Retail | 9 May 2016 | 0.82% | 1.01% (29 Feb 2024) |

| AH (hedged) | CHF | LU1395536169 | Distributing | Retail | 9 May 2016 | 0.82% | 1.01% (29 Feb 2024) |

| AHG (hedged) | CHF | LU2550874015 | Distributing | Institutional | 21 Nov 2022 | 0.29% | 0.43% (29 Feb 2024) |

| AHN (hedged) | CHF | LU1683488198 | Distributing | Retail | 12 Oct 2017 | 0.31% | 0.49% (29 Feb 2024) |

| AHN (hedged) | EUR | LU1683488271 | Distributing | Retail | 12 Oct 2017 | 0.31% | 0.49% (29 Feb 2024) |

| AN | USD | LU1683487976 | Distributing | Retail | 12 Oct 2017 | 0.31% | 0.46% (29 Feb 2024) |

| B | USD | LU1395536599 | Accumulating | Retail | 9 May 2016 | 0.82% | 0.98% (29 Feb 2024) |

| G | USD | LU1309987045 | Accumulating | Institutional | 29 Oct 2015 | 0.29% | 0.40% (29 Feb 2024) |

| H (hedged) | AUD | LU2546262952 | Accumulating | Retail | 17 Nov 2022 | 0.82% | 1.01% (29 Feb 2024) |

| H (hedged) | CHF | LU2269201377 | Accumulating | Retail | 18 Dec 2020 | 0.82% | 1.01% (29 Feb 2024) |

| H (hedged) | EUR | LU1395536755 | Accumulating | Retail | 9 May 2016 | 0.82% | 1.01% (29 Feb 2024) |

| HG (hedged) | CHF | LU1831168353 | Accumulating | Institutional | 29 Jun 2018 | 0.29% | 0.43% (29 Feb 2024) |

| HG (hedged) | EUR | LU1291112750 | Accumulating | Institutional | 29 Oct 2015 | 0.29% | 0.43% (29 Feb 2024) |

| HI (hedged) | CHF | LU1395536912 | Accumulating | Institutional | 9 May 2016 | 0.35% | 0.49% (29 Feb 2024) |

| HN (hedged) | CHF | LU2269201450 | Accumulating | Retail | 18 Dec 2020 | 0.31% | 0.49% (29 Feb 2024) |

| HN (hedged) | AUD | LU2546263091 | Accumulating | Retail | 17 Nov 2022 | 0.31% | 0.49% (29 Feb 2024) |

| HN (hedged) | EUR | LU1734078667 | Accumulating | Retail | 11 Dec 2017 | 0.31% | 0.49% (29 Feb 2024) |

| HS (hedged) | CHF | LU2398925581 | Accumulating | Institutional | 28 Oct 2021 | 0.00% | 0.14% (29 Feb 2024) |

| I | USD | LU1395537134 | Accumulating | Institutional | 9 May 2016 | 0.35% | 0.46% (29 Feb 2024) |

| N | USD | LU1683487893 | Accumulating | Retail | 12 Oct 2017 | 0.31% | 0.46% (29 Feb 2024) |

Subject to change, without notice, only the current prospectus or comparable document of the fund is legally binding.

* TER includes performance fee where applicable

All data is as at 30 Sep 2024 unless otherwise indicated.

View all documents View latest documents

| Document | Date | DE | EN | ES | FR | IT |

|---|---|---|---|---|---|---|

| Factsheets & Commentaries | ||||||

| Factsheet | Sep 2024 | |||||

| Factsheet | Aug 2024 | |||||

| Factsheet | Jul 2024 | |||||

| Factsheet | Jun 2024 | |||||

| Factsheet | May 2024 | |||||

| Factsheet | Apr 2024 | |||||

| Factsheet | Mar 2024 | |||||

| Factsheet | Feb 2024 | |||||

| Factsheet | Jan 2024 | |||||

| Factsheet | Dec 2023 | |||||

| Factsheet | Nov 2023 | |||||

| Factsheet | Oct 2023 | |||||

| Factsheet | Sep 2023 | |||||

| Factsheet | Aug 2023 | |||||

| Factsheet | Jul 2023 | |||||

| Factsheet | Jun 2023 | |||||

| Factsheet | May 2023 | |||||

| Factsheet | Apr 2023 | |||||

| Factsheet | Mar 2023 | |||||

| Factsheet | Feb 2023 | |||||

| Factsheet | Jan 2023 | |||||

| Factsheet | Dec 2022 | |||||

| Factsheet | Nov 2022 | |||||

| Factsheet | Oct 2022 | |||||

| Factsheet | Sep 2022 | |||||

| Factsheet | Aug 2022 | |||||

| Factsheet | Jul 2022 | |||||

| Factsheet | Jun 2022 | |||||

| Factsheet | May 2022 | |||||

| Factsheet | Apr 2022 | |||||

| Factsheet | Mar 2022 | |||||

| Factsheet | Feb 2022 | |||||

| Factsheet | Jan 2022 | |||||

| Factsheet | Dec 2021 | |||||

| Factsheet | Nov 2021 | |||||

| Factsheet | Oct 2021 | |||||

| Factsheet | Sep 2021 | |||||

| Factsheet | Aug 2021 | |||||

| Factsheet | Jul 2021 | |||||

| Factsheet | Jun 2021 | |||||

| Factsheet | May 2021 | |||||

| Factsheet | Apr 2021 | |||||

| Factsheet | Mar 2021 | |||||

| Factsheet | Feb 2021 | |||||

| Factsheet | Jan 2021 | |||||

| Factsheet | Dec 2020 | |||||

| Factsheet | Nov 2020 | |||||

| Factsheet | Oct 2020 | |||||

| Factsheet | Sep 2020 | |||||

| Factsheet | Aug 2020 | |||||

| Factsheet | Jul 2020 | |||||

| Factsheet | Jun 2020 | |||||

| Factsheet | May 2020 | |||||

| Factsheet | Apr 2020 | |||||

| Factsheet | Mar 2020 | |||||

| Factsheet | Feb 2020 | |||||

| Factsheet | Jan 2020 | |||||

| Factsheet | Dec 2019 | |||||

| Factsheet | Nov 2019 | |||||

| Factsheet | Oct 2019 | |||||

| Factsheet | Sep 2019 | |||||

| Factsheet | Aug 2019 | |||||

| Factsheet | Jul 2019 | |||||

| Factsheet | Jun 2019 | |||||

| Factsheet | May 2019 | |||||

| Factsheet | Apr 2019 | |||||

| Monthly Commentary | Sep 2024 | |||||

| Monthly Commentary | Aug 2024 | |||||

| View more Factsheets & Commentaries View less Factsheets & Commentaries | ||||||

| PRIIPs KIDs | ||||||

| Key Information Document (KID) | Oct 2024 | |||||

| Legal Documents | ||||||

| AGM EGM invitation | Jan 2024 | |||||

| AGM EGM invitation | Jan 2023 | |||||

| AGM EGM invitation | Jan 2022 | |||||

| AGM EGM invitation | May 2021 | |||||

| AGM EGM invitation | Jan 2021 | |||||

| AGM EGM invitation | Jan 2020 | |||||

| Articles of Association | Apr 2016 | |||||

| Notification to Investors | Oct 2024 | |||||

| Notification to Investors | Sep 2024 | |||||

| Notification to Investors | Jun 2024 | |||||

| Notification to Investors | May 2023 | |||||

| Notification to Investors | Nov 2022 | |||||

| Notification to Investors | Jan 2022 | |||||

| Notification to Investors | Sep 2021 | |||||

| Notification to Investors | Jul 2021 | |||||

| Notification to Investors | May 2021 | |||||

| Notification to Investors | Mar 2021 | |||||

| Notification to Investors | Feb 2021 | |||||

| Notification to Investors | Apr 2020 | |||||

| Notification to Investors | Nov 2019 | |||||

| Sales Prospectus | Oct 2024 | |||||

| View more Legal Documents View less Legal Documents | ||||||

| Sustainability Related Disclosures | ||||||

| Periodic Disclosure | Aug 2023 | |||||

| Pre-contractual Disclosure | Jul 2024 | |||||

| Statement on principal adverse impacts of investment decisions on sustainability factors | Jun 2024 | |||||

| Sustainability Related Disclosures | Jul 2024 | |||||

| Financial Reports | ||||||

| Annual Distribution | Nov 2023 | |||||

| Annual Report | Aug 2023 | |||||

| Distribution Dates | Jan 2024 | |||||

| Quarterly Distribution | Sep 2024 | |||||

| Quarterly Distribution | Jun 2024 | |||||

| Quarterly Distribution | Mar 2024 | |||||

| Semi-Annual Report | Feb 2024 | |||||

| Semi Annual Distribution | Apr 2024 | |||||

| Semi Annual Distribution | Apr 2023 | |||||

| View more Financial Reports View less Financial Reports | ||||||

| Dealing Information | ||||||

| Holiday Calendar 2024 | Jan 2024 | |||||

| List of Active Retail Share Classes | Mar 2024 | |||||

| Policies | ||||||

| Sanctioned Countries | Oct 2022 | |||||

| Shareclass Naming Convention | Jan 2022 | |||||

RISKS

Subject to change, without notice, only the current prospectus or comparable document of the fund is legally binding.

Limited participation in the potential of single securities

Success of single security analysis and active management cannot be guaranteed

It cannot be guaranteed that the investor will recover the capital invested

Derivatives entail risks relating to liquidity, leverage and credit fluctuations, illiquidity and volatility

Interest rates may vary, bonds suffer price declines on rising interest rates

Investment universe may involve investments in countries where the local capital markets may not yet qualify as recognised capital market

Investments in foreign currencies are subject to currency fluctuations

Mid-yield bonds may be more speculative investments than bonds with a higher rating due to higher credit risk, higher price fluctuations, a higher risk of loss of capital deployed

High-yield bonds (non-investment-grade bonds/junk bonds) may be subject to greater market fluctuations, risk of default or loss of income and principal than higher-rated bonds

The structure of ABS/MBS and the pools backing them might be intransparent which exposes the subfund to additional credit and prepayment risks (extension or contraction risks) depending on which tranche of ABS/MBS is purchased by the subfund

Information on how sustainable investment objectives are achieved and how sustainability risks are managed in this Sub-Fund may be obtained here.

Neither the Sub-Fund, nor the Management Company nor the Investment Manager make any representation or warranty, express or implied, with respect to the fairness, correctness, accuracy, reasonableness or completeness of an assessment of ESG research and the correct execution of the ESG strategy.

Morningstar rating: © 2024 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

ANY INDEX OR SUPPORTING DATA REFERRED TO HEREIN IS THE INTELLECTUAL PROPERTY (INCLUDING REGISTERED TRADEMARKS) OF THE APPLICABLE LICENSOR. ANY PRODUCT BASED ON AN INDEX IS IN NO WAY SPONSORED, ENDORSED, SOLD OR PROMOTED BY THE APPLICABLE LICENSOR AND IT SHALL NOT HAVE ANY LIABILITY WITH RESPECT THERETO. Refer to vontobel.com/terms-of-licenses for more details.