The business cycle as the key to successful investment decisions

Quantitative Investments

Most fundamental investors spend at least half their time trying to anticipate the next move in the business cycle, because it is considered the key to successful market timing. However, predicting economic trends is difficult. That's why we developed our proprietary business cycle model “Wave" to capture the current state of the economy and likely future economic trends. Accordingly, it can help improve performance and risk management as part of asset allocation. This is not least because about two-thirds of the gain in timing the business cycle by rebalancing investment portfolios can be attributed to predicting the end of a recession in advance. In doing so, returns can be increased by more than one percentage point for every month the investor is ahead of the business cycle compared to a buy-and-hold strategy with the same level of risk.

The business cycle as a key determinant of returns

All rational investment decisions involve explicit or implicit assessments of the current and future state of the business cycle. Many investors consider the financial market to be a good indicator of the business cycle. However, Nobel laureate economist Paul Samuelson noted as early as 1966 that "declines in stock markets have predicted nine out of the last five recessions."1 Financial markets thus frequently send out false signals that lead to a misjudgment of the economic environment. In this regard, the stock market's tendency to send false signals of an impending recession seems to have intensified since the postwar period.2

The stock index almost always records a decline of at least 8% before or shortly after the beginning of a recession. In the past, this decline was usually less than a month before the peak of the business cycle, so an impending recession was announced with little lead time.3 Moreover, the peak of the stock price can only be recognized in retrospect. That is why a different criterion is needed to assess when a market decline occurs.

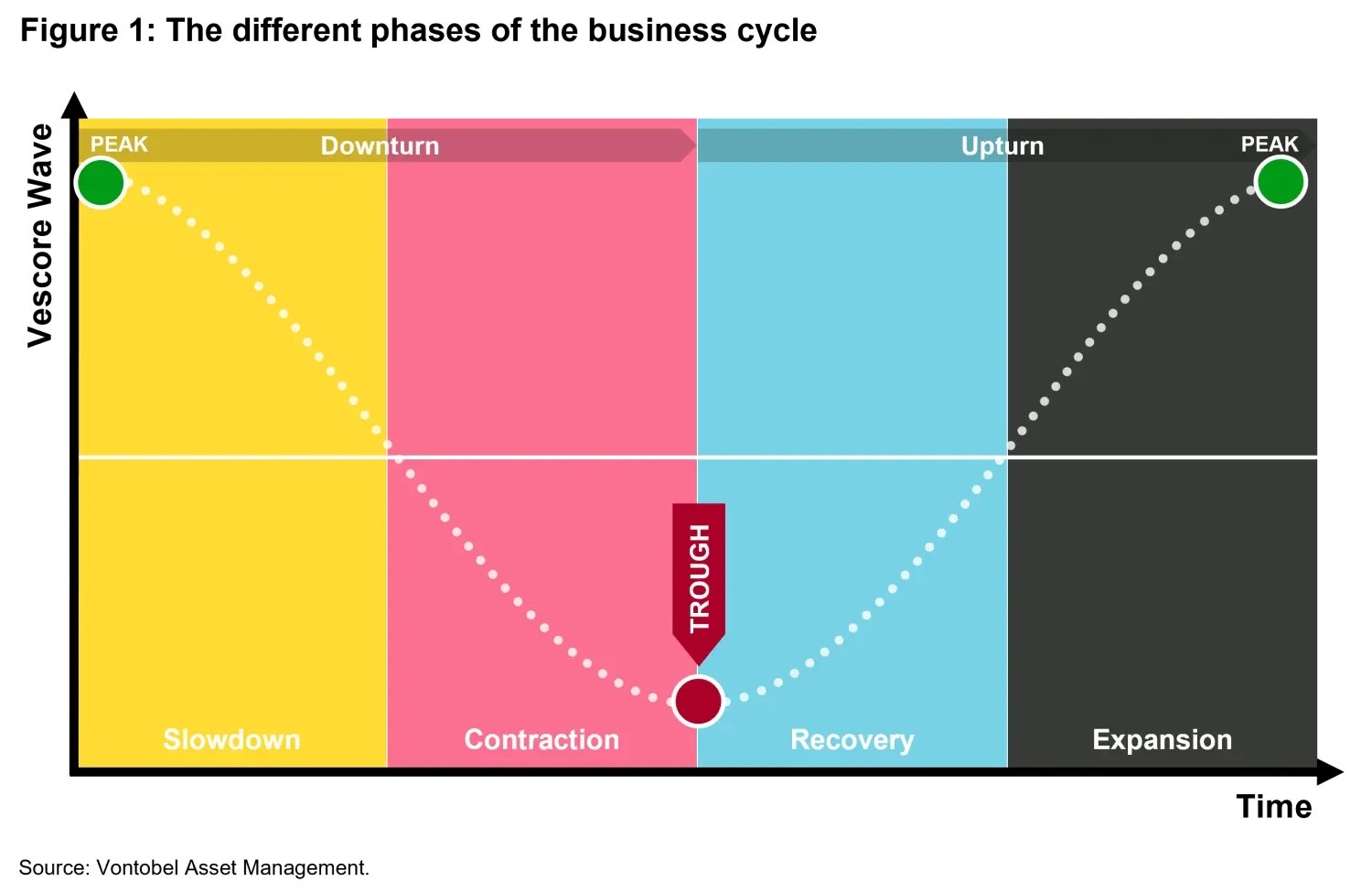

In this context, the business cycle, which encompasses the cyclical fluctuations of an economy over many months or a few years, can be a key determinant of asset market returns and the relative performance of different asset classes. This is not least because the strategy of switching between bonds and equities depending on the business cycle can gain up to 30 basis points in average annual return for each week (up to four months) that the investor is able to predict the business cycle turning points.4

Why is the economy so important for asset allocation?

Economic growth forms the basis for corporate profits and thus also for the earnings and dividends that flow to shareholders. Accordingly, expected stock returns vary with economic conditions, with future cash flows and profitability positively linked to the business cycle.5 Thus, the risk premia demanded by investors also change with the business cycle, with expected stock returns being countercyclical.6

Stock prices are also determined by supply and demand, which change over the business cycle. This is partly due to the behavior of market participants, who take economic fluctuations very seriously, which is also reflected in their behavior on the financial markets.7 Depending on the economic environment, the risk aversion of market participants is therefore also subject to countercyclical changes: It is particularly high in bad times but declines in boom times.8

The right timing is crucial

Empirical studies show that the Markowitz risk-return profile can be significantly improved by adjusting the proportions of assets in a portfolio based on cyclical turning points.9 Average equity returns can usually be increased substantially by shifting from equities to bonds before the peak of the business cycle and, more importantly, by reinvesting in equities before the trough. Especially if the next phase of the business cycle is anticipated when adjusting asset allocation, before the economy actually enters that phase.10 In other words, it is a matter of recognizing cyclical turning points early on and adjusting asset allocation accordingly or shifting the allocation between cyclical stocks, growth stocks and defensive stocks.

Most investors' approach is to change asset class weightings or to time purchases and sales with the business cycle in mind, not to time it right.11 Trying to time the cycle, however, can prove costly if the investor overestimates. Most commonly, though, investors make the mistake of forgetting or denying that the business cycle exists. Yet the key to successful investment decisions is to know early on the current phase of the business cycle (slowdown, contraction, recovery, and expansion) and the most likely transition to the next phase (transition probability)

Standard economic indicators, by contrast, provide unsatisfactory results for assessing the various phases of the business cycle, as they each paint a different picture of the current and expected state of the economy. Downward revisions are often made too late, moreover, because forecasts tend to become less accurate as a downturn or recession approaches.12 Consequently, condensing the information into a consistent economic trend13 is difficult or impossible.

The Wave

With our in-house business cycle model Wave 14, we have developed a solution to this problem. The model not only captures the current state of the economy, but also its likely future development. Wave takes advantage of technological advances and the available volume of data by using systematic big data analysis to examine the macroeconomic development of 50 countries worldwide. At the highest aggregate level, the Global Wave, it currently processes over 1,200 economic time series15 and condenses them into precise facts and data.

In the long term, it has been shown that the Wave performs better on average in forecasting economic phases and anticipating turning points in the business cycle than the usual leading indicators, which it runs roughly one month ahead of. This makes it a useful tool for accurately tracking the business cycle and making better-informed investment decisions.

Many investors regard the Purchasing Managers Index (PMI)16 as an important leading indicator of economic development and a reliable forecasting tool. Over the past 50 years, this index has on average anticipated the economic trough two to three months in advance. Our proprietary economic model, on the other hand, predicted the trough more than a month earlier than the PMI.

If we consider that the average annual return can be increased with each week that the investor succeeds in predicting the business cycle tipping point, investors whose analyses are based on the PMI16 may be missing out on a not inconsiderable amount of money. Accordingly, the Wave has the potential to generate higher stock market gains when used for tactical asset allocation.

Conclusion

The medium-term performance of investments is often largely determined by cyclical factors related to the state of the economy. The business cycle can therefore be a key determinant of asset market returns and the relative performance of different asset classes. In practice, however, market timing is very difficult because each business cycle varies in both length and severity. As a result, investors often recognize business cycle turning points too late or change the weighting of their investments only within certain limits for fear of buying too early or selling too late.

The Wave helps investors forecast business cycle phases and anticipate turning points early. Many other economic models use only a few key factors to determine the future course of the economy. The Wave, on the other hand, processes a variety of different indicators to identify business cycle turning points based on their changes. As a result, the model can improve potential analysis of the business cycle by providing a broad measure of 50 different countries and a separate measure of the most likely future course of the economy.17

1. Samuelson, P. (1966). Science and Stocks. Newsweek, 19. September, Seite 62. 2. Siegel, J. J. (1991). Does it pay stock investors to forecast the business cycle? The Journal of Portfolio Management, 18(1), 27-34.

2. Siegel, J. J. (1991). Does it pay stock investors to forecast the business cycle? The Journal of Portfolio Management, 18(1), 27-34.

3. Siegel, J. J. (1990). The behavior of stock returns around N.B.E.R. turning points: an overview. The Journal of Portfolio Management: a publication of Institutional Investor, 18(1), 27-34.

4. Siegel, J. J. (1991). Does it pay stock investors to forecast the business cycle? The Journal of Portfolio Management, 18(1), 27-34.

5. DeStefano, M. (2004). Stock Returns and the Business Cycle. Financial Review, 39(4), 527–547.

6. In particular, the risk premia for equities appear to be higher during recessions than during peak periods of the business cycle, see Fama, E. F. & French, K. R. (2002). The Equity Premium. Journal of Finance, 57, Seiten 637-659; Ferson, W.E. & Harvey, C.R. (1991). The Variation of Economic Risk Premiums. Journal of Political Economy, 99(2), 385-415.

7. Campbell, J. Y. (1999). Asset prices, consumption, and the business cycle. Handbook of macroeconomics, 1, 1231-1303.

8. Campbell, J. Y. & Cochrane, J.H. (1999). By Force of Habit: A Consumption-Based Explanation of Aggregate Stock Market Behaviour. The Journal of Political Economy, 107, 205-251.

9. Brocato, J. & Steed, S. (1998). Optimal Asset Allocation Over the Business Cycle. The Financial Review, 33 (3), 129-148.

10. Siegel, J. J. (1991). Does it pay stock investors to forecast the business cycle? The Journal of Portfolio Management, 18(1), 27-34.

11. Calverley, J. (2003). Investor’s guide to economic fundamentals. New York: John Wiley & Sons.

12. The Economist (2018). Economists still lack a proper understanding of business cycles. Retrieved from

https://www.economist.com/finance-and-economics/2018/04/19/economists-still-lack-a-proper-understanding-of-business-cycles

13. This trend can be interrupted by unforeseen macroeconomic events or shocks.

14.

https://am.vontobel.com/insights/the-vescore-wave-a-superior-business-cycle-model

15. When available, going back to the 1950s.

16. The basis for the monthly index is provided by more than 430 purchasing managers, who use a standardized questionnaire to give their assessment of the level of economic activity by means of various key figures.

17. For more details on how the Wave works, click here:

https://am.vontobel.com/insights/the-vescore-wave-a-superior-business-cycle-model