Plant now and harvest in the future: What gardening and bond managers have in common

Fixed Income Boutique

The year 2020 has been special, in particular for gardening. This year, we have all had to find new ways of not just working, but also how to spend our leisure time as well. So it was that I found myself in an unusual setting, the local gardening center, to take on the challenge by planting a few trees in our garden.

It seems like the Covid-19 pandemic has created a new generation of enthusiasts who are finding that gardening is good for the soul. According to the Financial Times, gardening is now the second most popular planned leisure-time activity, ahead of reading, cooking and exercise. What comes first? Watching TV of course – Netflix for the win.

But back to my tree problem. What I initially thought would be an easy enough endeavor, planting a few trees, turned out to be much more complex. Lucky for me, there was a knowledgeable (and patient) tree specialist on hand to advise me.

As he talked me through my options, I discovered that gardening and corporate bond investing have much in common. In order to enjoy the sight of a beautiful tree in the future, you have to make some important decisions before planting, such as selecting your tree from a multitude of available seedlings and understanding what sort of conditions you should provide for it to grow.

As with trees, there are also plenty of issues to consider before building up your bond portfolio. An Indonesian proverb says, “The firm tree does not fear the storm”; neither should a robust bond portfolio. So, based on my experience as a new and enthusiastic hobby gardener and professional corporate bond manager, here is my quick “GACS” guide on how to plant the seeds for a stable corporate bond portfolio that will continue to grow despite the changes in weather:

- Global – Pick your bonds from a global opportunity set as it provides the greatest scope to diversify risks and generate income

- Active – Be an active investor, adjusting to changing conditions quickly

- Confident – Be selective in what to pick and be a high-conviction investor

- Simple – Keep your approach simple in order to focus on the most relevant topics and don’t get distracted

Be global – finding stability and income

Bond investors are all too familiar with the volatility that came to the fore in March 2020 with the onset of the Covid-19 epidemic. The solution to tackling volatility is diversification, a term well known to bond investors and often touted by portfolio managers. As countries, sectors and companies are in differing stages of the economic cycle, diversification across geographies and sectors is the only way to make your portfolio more robust.

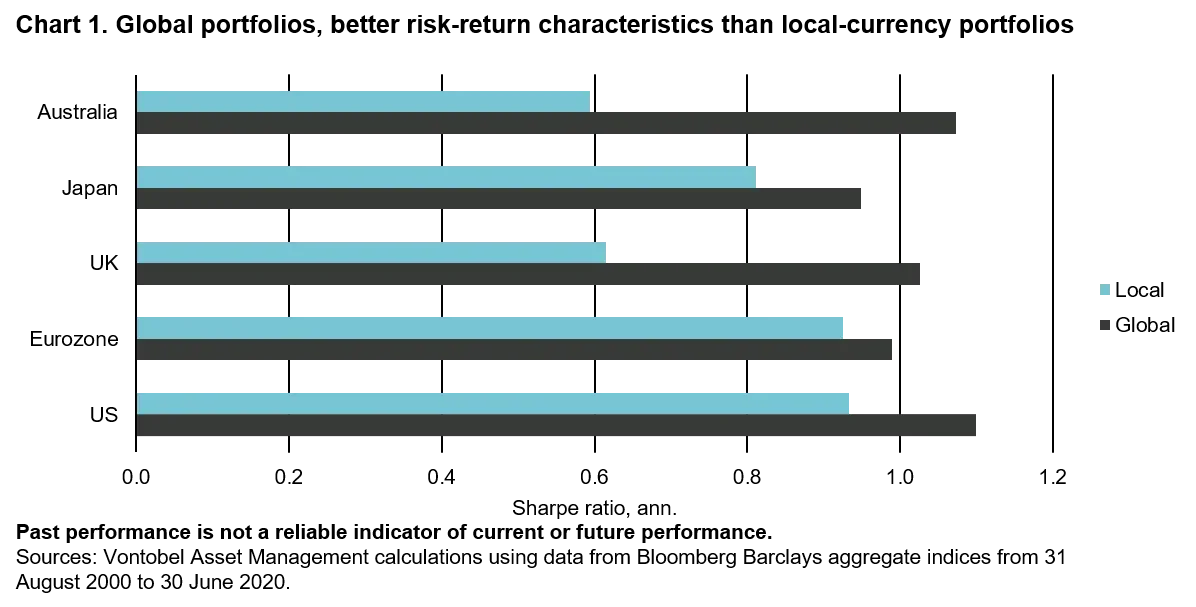

In order to prove this point, we looked at the Sharpe ratios of global bond portfolios as compared to local ones (the Sharpe ratio is an indicator of risk-adjusted returns, in which the higher the ratio the better the risk-adjusted returns, see chart 1). We found that global portfolios stood out to have higher Sharpe ratios, which indicates that investors who choose a well-diversified and global approach to corporate credit are likely to generate better returns while their portfolio enjoys a smoother ride over the long term.

Be active and adjust if needed

Trees last for a long time, often living longer than those who planted them. Throughout their lives, trees go through various environmental and societal events. As a gardener would prepare and protect his tree for changing weather conditions, the same applies to your corporate bond portfolio when there is a need to reduce the risk buckets or increase them accordingly. We, as bond investor have had sunny days when our trees grow nicely, but we can also have some storms and have to ensure stability. The level of risk in a portfolio should, therefore, change over time depending on market conditions. This also requires sell discipline and good timing of decisions, which typically is the hardest part, also for us.

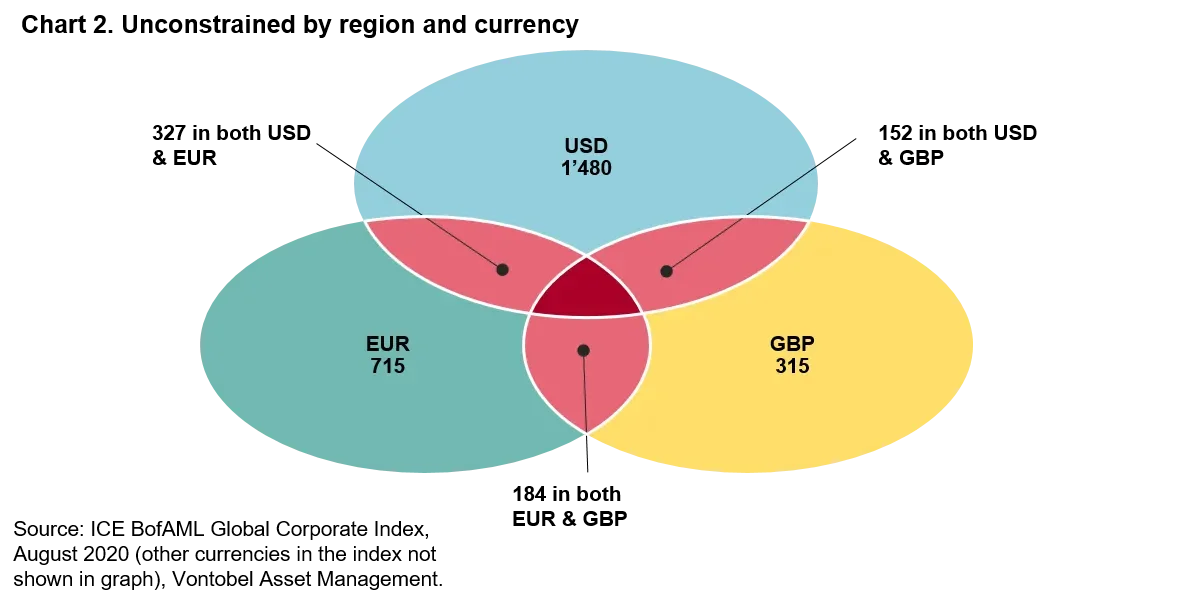

On top of the changing conditions, as active global investors, we have more opportunities to benefit from. I would like to illustrate a specific type of opportunity in chart 2 below, where you can see that most companies issue their bonds in different currencies. The number in the oval area represents the number of issuers in the global universe who issue bonds in a respective currency, while intersections represent issuers issuing in two currencies. Regional investors tend to focus on the blue, yellow, or green circle only, whereas an active global investor can benefit from all the circles. Of particular interest are the red areas. This is where we find the inefficiencies as bonds in different currencies from the same issuer tend to trade at different prices (always hedging the currency risk). Comparing to our garden, one tree can be particularly popular in one region, while it may not enjoy the same level of popularity in the other, which then affects the price tag of the tree.

Be selective in what you pick

We believe that credit selection should be driven by company fundamentals. As a result, we aim to focus on the most interesting credit stories and limit the number of holdings to a reasonable amount. We are convinced that fundamentals win out over the long term and, therefore, concentrating on fundamentals will maximize your harvest. Such a disciplined and long-term approach should reward you better than just replicating an existing investment universe. It also helps make your life easier, which leads me to the last point on our list.

Keep it simple

The global corporate universe is rich in opportunities, but this does not imply a large and complex portfolio. Global credit market is a bond picker’s market. We favor a simple and carefully selected portfolio. This will pay out not only in terms of risk management (you remember the changing weather conditions) but also when it comes to explaining what kind of tree you planted and why. In portfolio manager terms, a simple and transparent approach helps to explain your current positioning and performance.

As we are approaching the winter season, let’s take a quick look at the current conditions and also how to benefit from the prevailing market environment. Similar to a gardener wanting to make sure the plants are ready to withstand snow and the cold.

Prosperous outlook for global corporate bonds

With the Covid-19 pandemic, the long-lasting credit cycle came to an abrupt end and we entered the recovery stage of the cycle, which is generally the sweet spot for corporate bond investors. Companies raised cash (see chart 3), extended bond maturities, started to buy-back expensive outstanding bonds (bond tenders) and, most importantly, are focusing on de-leveraging and increasing cash flows, all in favor of bondholders. During a recovery stage in the credit cycle, corporate bonds tend to perform strongly with spreads typically tightening. This is what we expect for the months to come.

In addition, rating downgrades have largely dried up, while the technical factors remain supportive for global corporate bonds, as demand for credit remains high. A phenomenon, which is not new but is reinforced as global yields continued to drop and some investors are running out of investment ideas.

Coming back to gardening: fall and springtime are considered the best times of year to plant new trees. Global corporate bond investing knows no seasons, but the current environment should be an especially fruitful one. If you want to branch out into global corporate bonds, we remain at your disposal and could even offer a cup-of-tea conversation about gardening.