A wolf in sheep’s clothing: equity risk in a changing market environment

Quality Growth Boutique

Key takeaways

- The rising rate environment has impacted the profitability of companies who have relied on cheap sources of financing to fuel growth, buy back shares, or acquire competitors.

- The changing market landscape has also impacted the performance of active equity managers. Strategies that have exhibited lower risk in a world of low interest rates may in fact exhibit higher risk as interest rates have returned to normal levels – a wolf hiding in sheep’s clothing.

- One way to protect from risks ahead is to refrain from focusing on growth to the exclusion of all else. While this approach may exclude some of the fastest-growing companies, we believe investing in growth for the sake of growth is not a great strategy. Profitable growth is.

A wolf in sheep’s clothing: equity risk in a changing market environment

With the benefit of hindsight, investing in US equities during the depths of the Global Financial Crisis (GFC) was an easy trade to make. The S&P 500 Index returned an astounding 699% (cumulative) or 15% (annualized) from March 31, 2009 through December 31, 2023. Indeed, one of the greatest bull markets in history was chock full of bumps along the way. But a persistent force prevailed throughout the period: the unrelenting monetary support of central banks, most notably the US Federal Reserve. At least until recently.

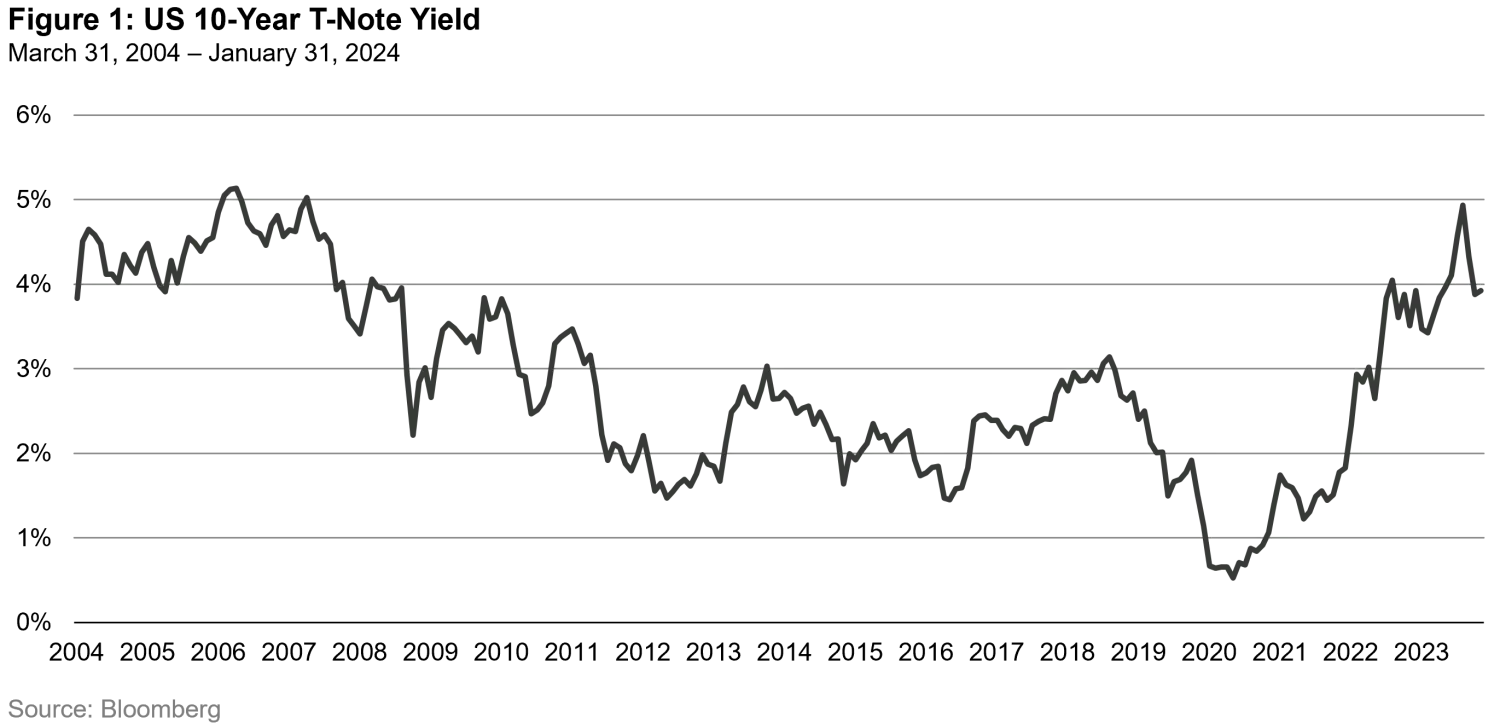

The high tide of liquidity is now being pulled from the system at the quickest pace in decades. There is no better illustration of this than the massive rise in US interest rates, as depicted by the US 10-year treasury yield (Figure 1), which has reached levels not seen since before the GFC. While the Fed may be nearing the end of its hiking cycle, a return to the previously calm environment of low inflation, positive economic growth, and declining and stable interest rates seems increasingly unlikely.

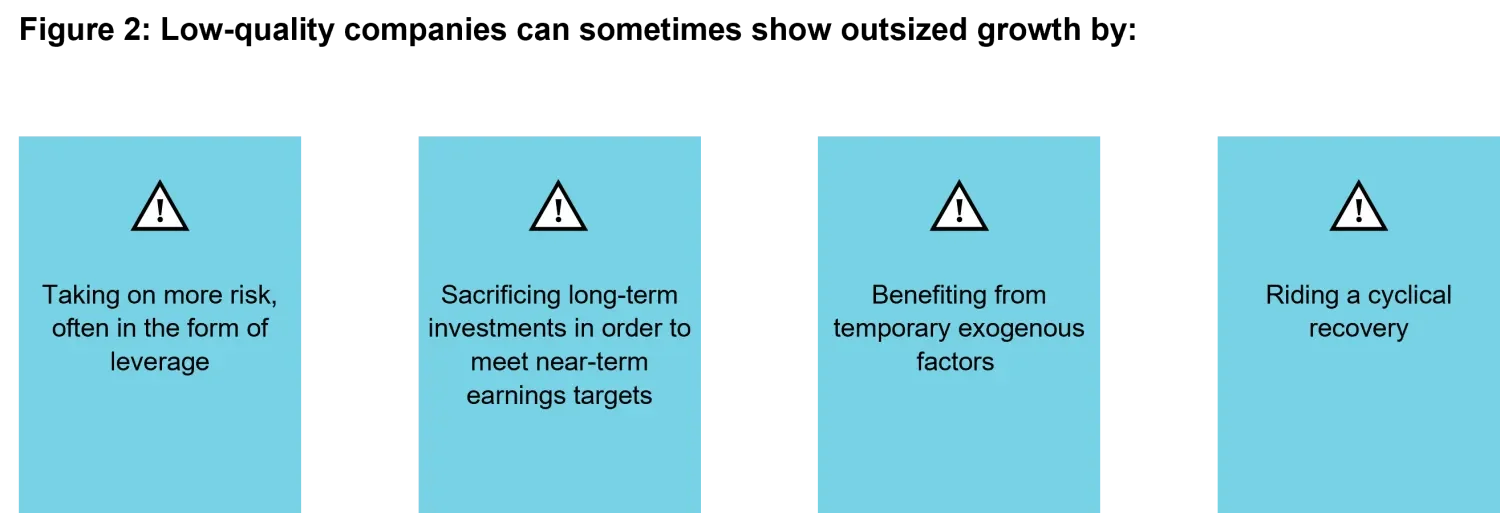

Many investors disproportionally benefited from holding a portfolio concentrated in hyper growth companies that were supported by unusual and persistent tailwinds for an extended period. For example, a broad swath of average and lower quality companies enjoyed margin expansion regardless of their risk profiles. These abnormal market conditions made it difficult to discern between temporary and persistent quality factors. For a variety of reasons, some hyper growth companies exhibited outsized growth over the short-term (Figure 2). As a result, investors may not actually be holding true quality companies they perceived to be in their portfolios. If the market regime is indeed changing in a seismic way, investors may now be exposed to risks that were previously disguised.

Diversifying into a true, differentiated, and time-tested high-quality growth at sensible prices approach may be the right strategy for the volatile times ahead.

Margin expansion may come to a halt

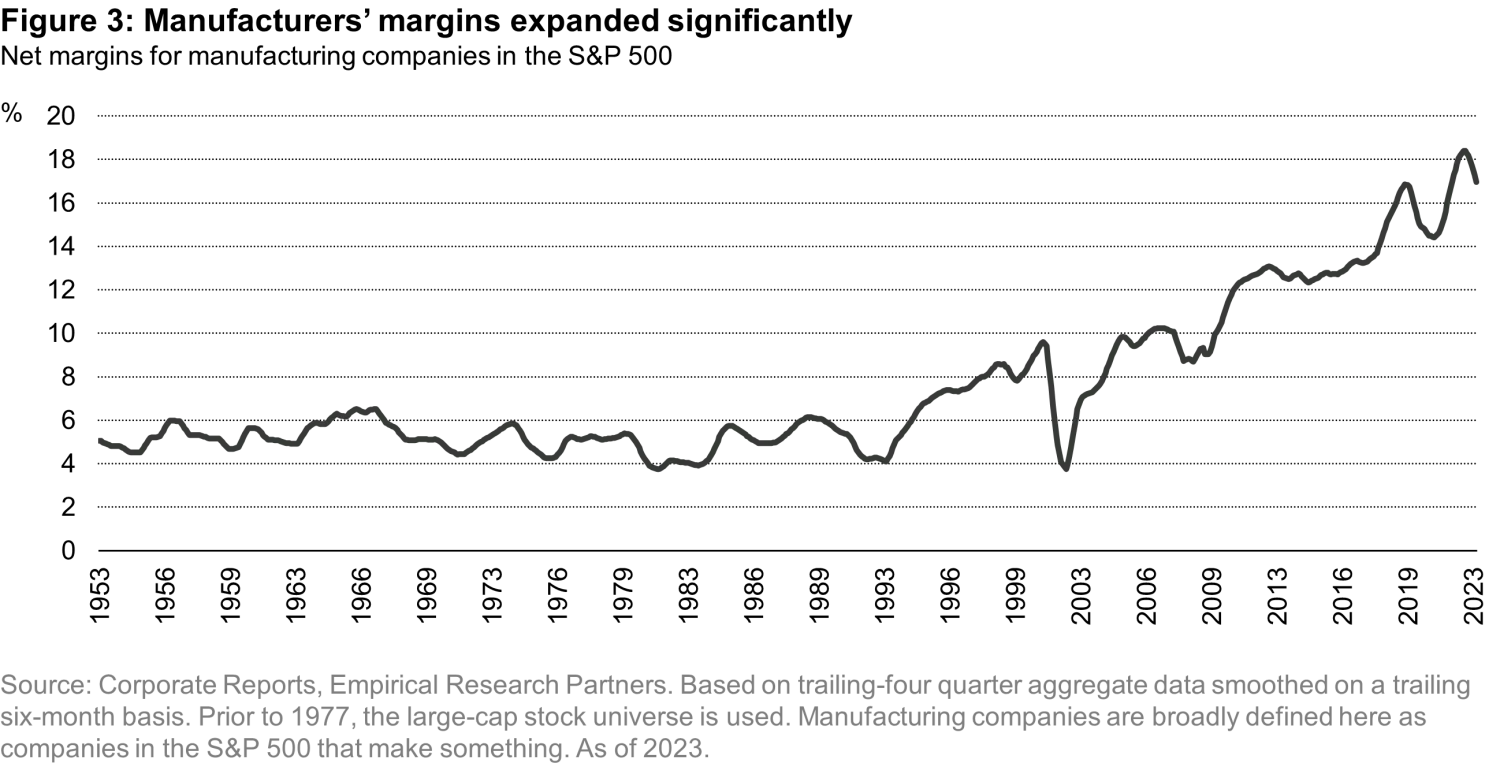

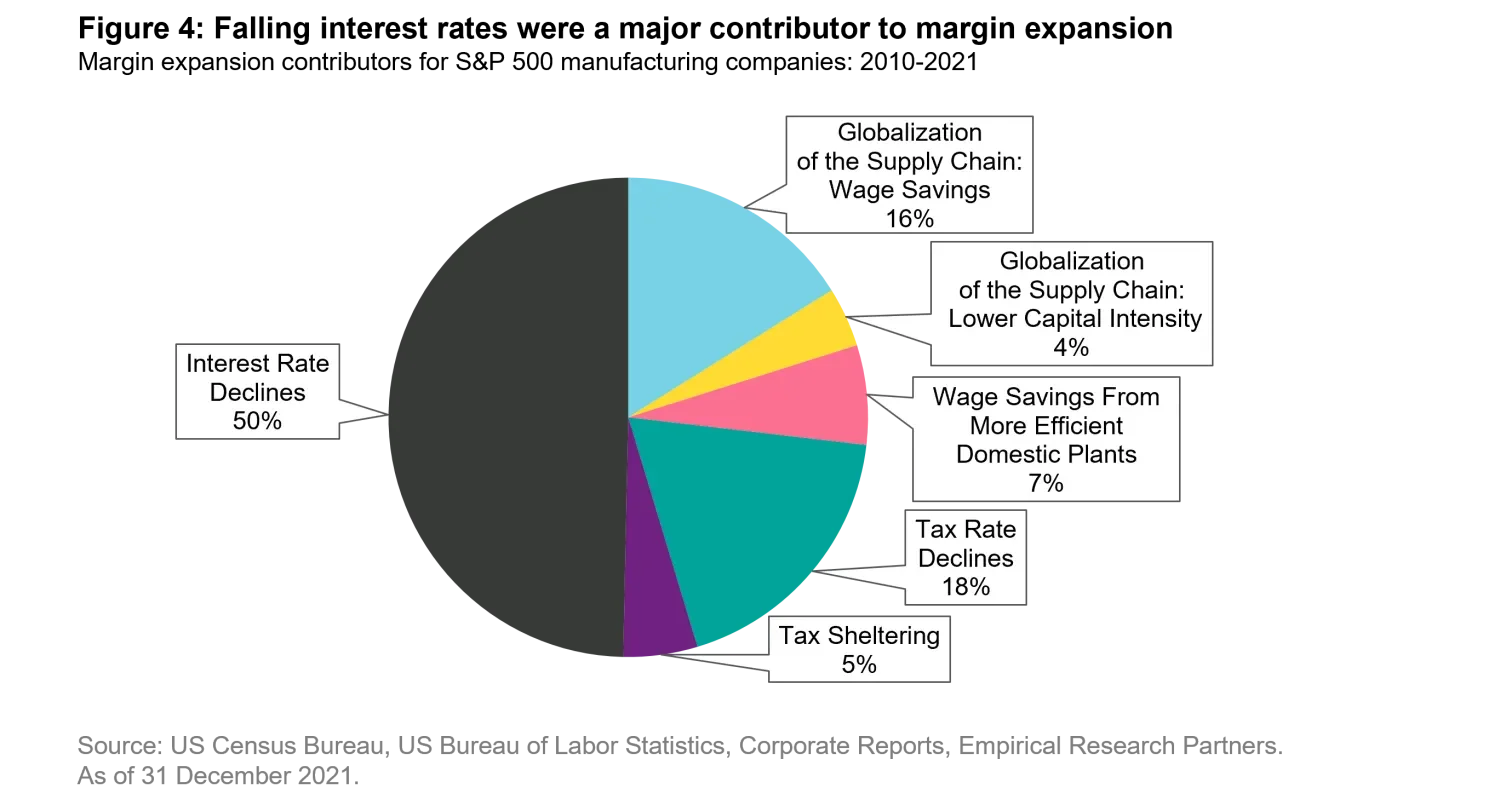

Rising interest rates have clearly impacted asset prices globally. The profitability of companies who have relied on cheap sources of financing to fuel growth, buy back shares, or acquire competitors has also become vulnerable. This impact is illustrated by assessing the long-term margin profile of manufacturing businesses in the US. The stable trend in margins was clear from the 1950’s to 1990’s (Figure 3), but that flatline exploded over the past two decades for reasons illustrated in Figure 4.

From 2010-2021, 50% of the margin improvement of manufacturing companies was due to the fall in interest rates. Whether rates are higher for longer remains to be seen. But the trend has certainly reversed course and companies that benefitted from secular declines in interest rates over the past few decades are unlikely to see that same benefit going forward. One could also argue that some of the other large contributors to margin expansion in the past, such as tax rate cuts (18% of the total) and globalization (16%) are likely to become headwinds rather than tailwinds. Going forward, businesses that truly possess competitive advantages, have pricing power, and can benefit from structural demand should stand out even more than they have in the past.

The end of the “golden era” of hyper growth companies

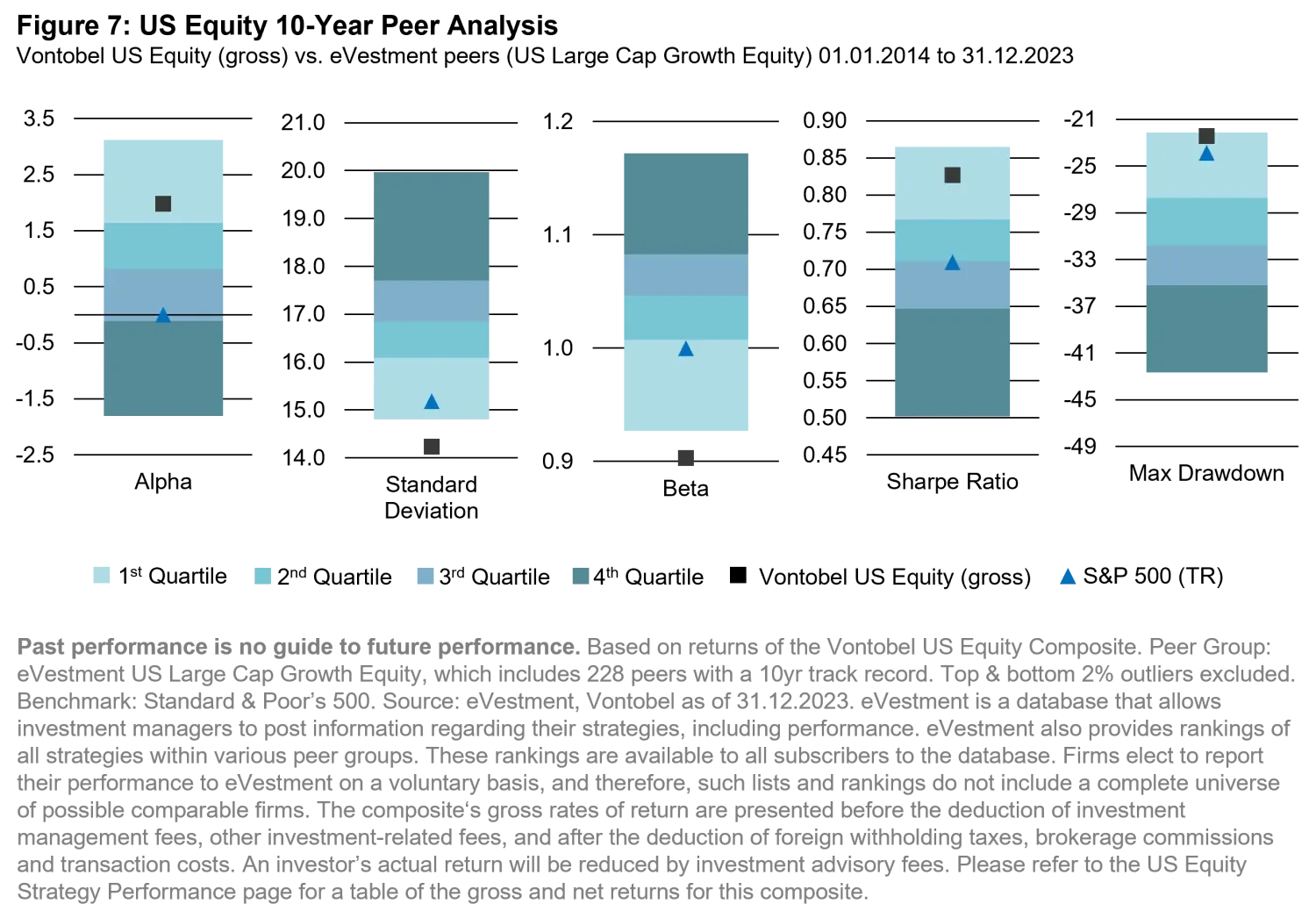

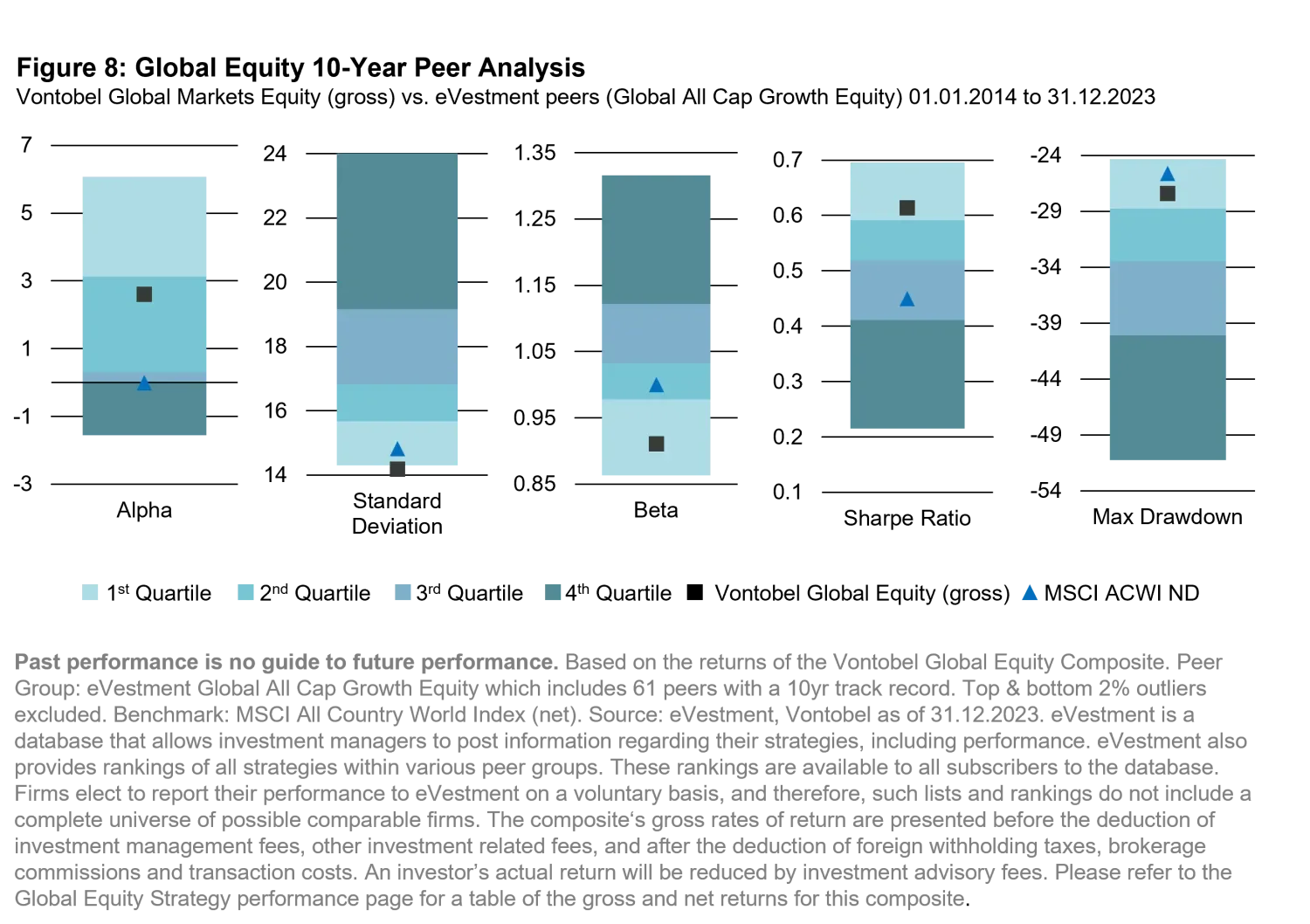

The changing market landscape has also had a correspondingly large impact on the performance of active equity managers. Strategies that have exhibited lower risk in a world of low interest rates may in fact exhibit higher risk in a world where interest rates have returned to normal levels – a wolf hiding in sheep’s clothing.

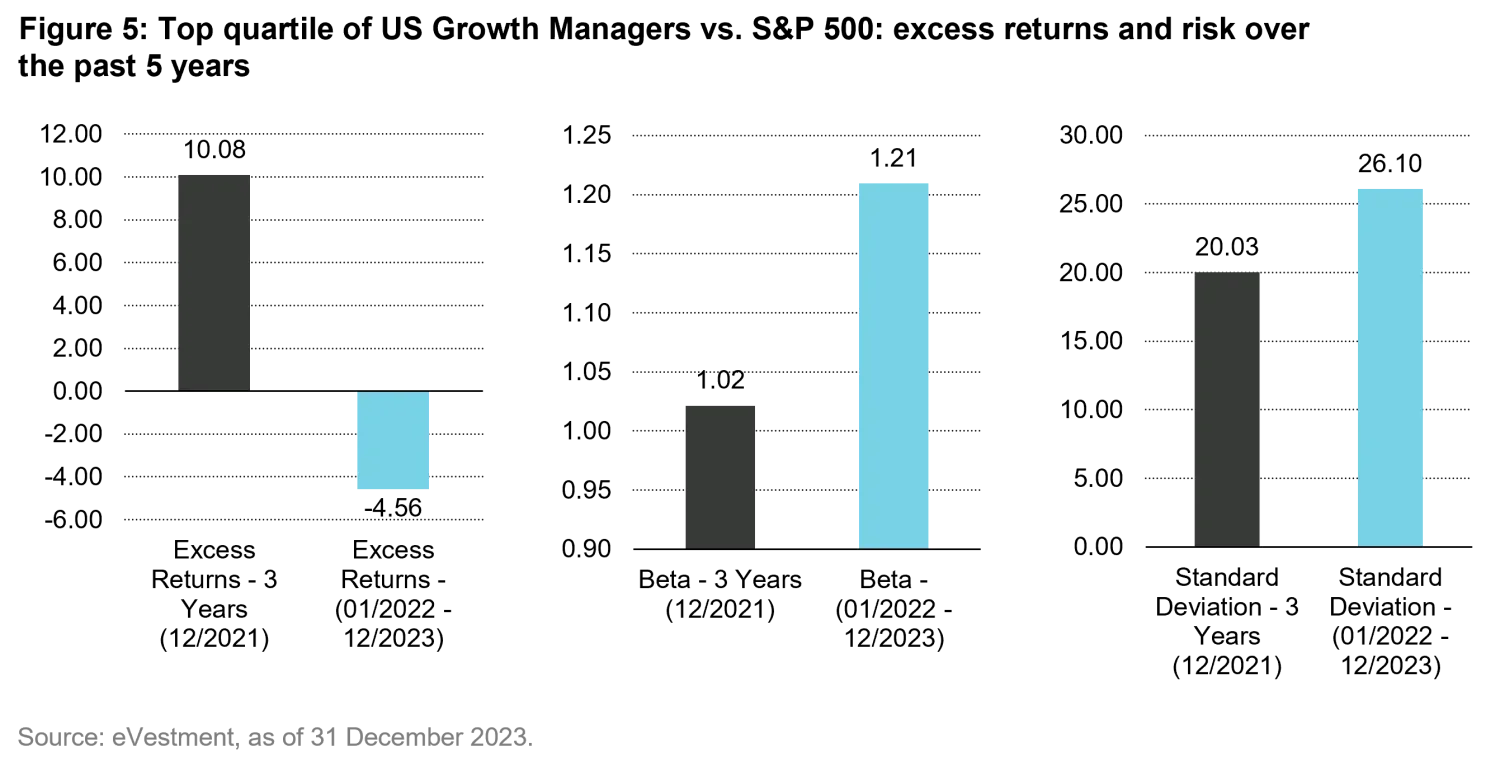

In the 3-year period ending 2021 – a golden era of growth investing – managers who took the most risk were rewarded as loose monetary policy and covid-related information technology winners drove outsized returns. When the performance of US Large Cap Growth managers is unveiled, it becomes clear that the top quartile outperformed the S&P 500 Index by an average of 9.9%. The subsequent 18 months however was not as kind to this group of managers as they largely gave back much of their outperformance, underperforming by -9.0%.

Risk statistics are equally enlightening when analyzing performance of the same set of managers. During that three-year golden period ending in 2021, the top quartile of US managers showcased a beta slightly below the S&P 500 at 1.01. Investors could hardly be blamed for thinking they could have their cake and eat it too. Since then, however, their beta has increased to 1.16. Likewise, standard deviation has jumped from 20.6% to 26.3% (Figure 5). In other words, one could argue that the risk of high-octane funds was always there, it simply needed a spark to trigger an eruption. Expanding this analysis to include more globally oriented managers versus the MSCI All Country World Index (ACWI) highlights a similar pattern (Figure 6).

This recent bout of performance whiplash leaves investors asking a lot of questions. Most notably, is the environment going forward more likely to look like the low-rate environment of the past? Or will it look different? Perhaps it will resemble a more typical time in history when recessions were more frequent and the long economic expansion of the past 40 years that was supported by accommodative central banks is an outlier. One can argue both sides and no one can be certain of the future. Nevertheless, investors are well advised to look more closely at the underlying risk in their equity exposures and understand whether return profiles will continue to be repeatable in a different market environment.

How to avoid a wolf

One way to protect from risks in the market is to refrain from focusing on growth to the exclusion of all else. This is not to imply that a given business cannot be on the path to greatness, but when the market only looks at a company’s potential and ignores the risks, it pays to be wary. Growing companies that also have a proven, high return business model today, and trade at reasonable valuations, are a more conservative, and historically fruitful way to protect in a market downturn and can provide a smoother ride through the cycle. In our view, a quality growth manager should not singularly focus on growth but look for quality businesses first. While this approach may exclude some of the fastest-growing companies, we believe investing in growth for the sake of growth is not a great strategy. Profitable growth is.

Take for example US-based Mondelez1, a global leader with a diverse offering of snacks with a number one position in biscuits and number two in chocolate.

- Benefits from two long tailed trends: 1) snack categories are likely to continue to grow due to on-the-go lifestyles, and 2) Mondelez generates most of its revenue from faster growing international markets.

- Entrenched retail relationships and resources help expand its well-known brands, such as Oreo and Cadbury. Well-known global brands with unmatched scale create a cost advantage, which further strengthens its competitive position.

- Unlike other areas, snacks are generally less impacted by private label competitions and price hikes do not result in volume declines.

- Expected to grow earnings at 8% for the next 5 years, while offering a dividend yield of 2.6%.

- At 20x next year’s earnings, is sensibly priced and given the predictability of its underlying businesses, offers shareholders the potential for steady returns.

Another example is RELX1, a UK-based company that over the past decade has transformed into a conglomerate of leading information service businesses in the scientific, technical, medical, risk and legal fields.

- Benefits from an oligopolistic industry, structural demand, a high percentage (~60%) of recurring revenues, and high switching costs

- Proprietary database LexisNexis is competitive moat in legal profession, with over 144 billion legal documents. It is protected from AI tools like ChatGPT, which leverage the internet.

- Expected to grow earnings near 10% for the next 5 years, while offering a dividend yield of 2%.

- At 25x next year’s earnings, is sensibly priced and given the predictability of its underlying businesses, offers shareholders the potential for steady return.

Building a portfolio of companies with characteristics like Mondelez and RELX allows us to sleep well at night. A select number of high-quality businesses that have competitive advantages, pricing power, stable and predictable earnings growth, and being mindful of what you pay for them, has historically yielded market beating returns, but with less risk..

![]()

![]()

1. Companies highlighted are portfolio holdings of the Quality Growth Vontobel Funds and provided for informational purposes only as a demonstration of our investment management approach and processes. References to holdings should not be considered a recommendation to purchase, hold, or sell any security. No assumption should be made as to the profitability or performance of any security associated with them.

Important Information: Holdings discussed herein for illustrative purposes only. There is no assurance that any securities discussed will remain in the portfolio at the time you receive this communication or that securities sold have not been repurchased. Securities discussed do not represent the entire portfolio and, in the aggregate, may represent only a certain percentage of the portfolio’s holdings.

Any projections or forward-looking statements regarding future events or the financial performance of countries, markets and/or investments are based on a variety of estimates and assumptions. There can be no assurance that the assumptions made in connection with the projections will prove accurate, and actual results may differ materially.