Navigating the tech market steamroller: Will DeepSeek’s efficiency gains prompt a reversal?

Quality Growth Boutique

At the end of last year, we compared the market’s bull run over the past two years to a steamroller. The narrowness of the market and the heightened concentration in information technology in the S&P 500 index and to the US in the MSCI All Country World Index was a boon to those overexposed, but a potential risk if the trend were to reverse course. Has the steamroller started to go in reverse?

Global equity markets were blindsided last week by the announcement that a practically unknown Chinese company, DeepSeek was able to replicate some of the success of leading AI LLMs from OpenAI, Meta, and others, but at a fraction of the cost. While one can quibble about the specifics of how this was accomplished, the surprise called into question the durability of certain business models and the potential need for the significant capex on data centers and GPUs from Nvidia. Until recently, many investors assumed that the war chests leading tech companies have amassed and are spending on AI equaled a competitive moat. If efficiency gains prove more can be accomplished with less, it will have significant ramifications for the industry.

Firstly, it shows what some had begun to assume, that LLMs are being commoditized. This means the majority of the economic benefit will likely flow to the applications on top of LLMs or the cloud providers (Microsoft, Amazon, Google) that incorporate it into their existing platform and not the companies (mostly who are private) that have raced to train the fastest and most efficient models. Some investors (us included) called this into question last year when we were concerned about the return on investment for all this spending.

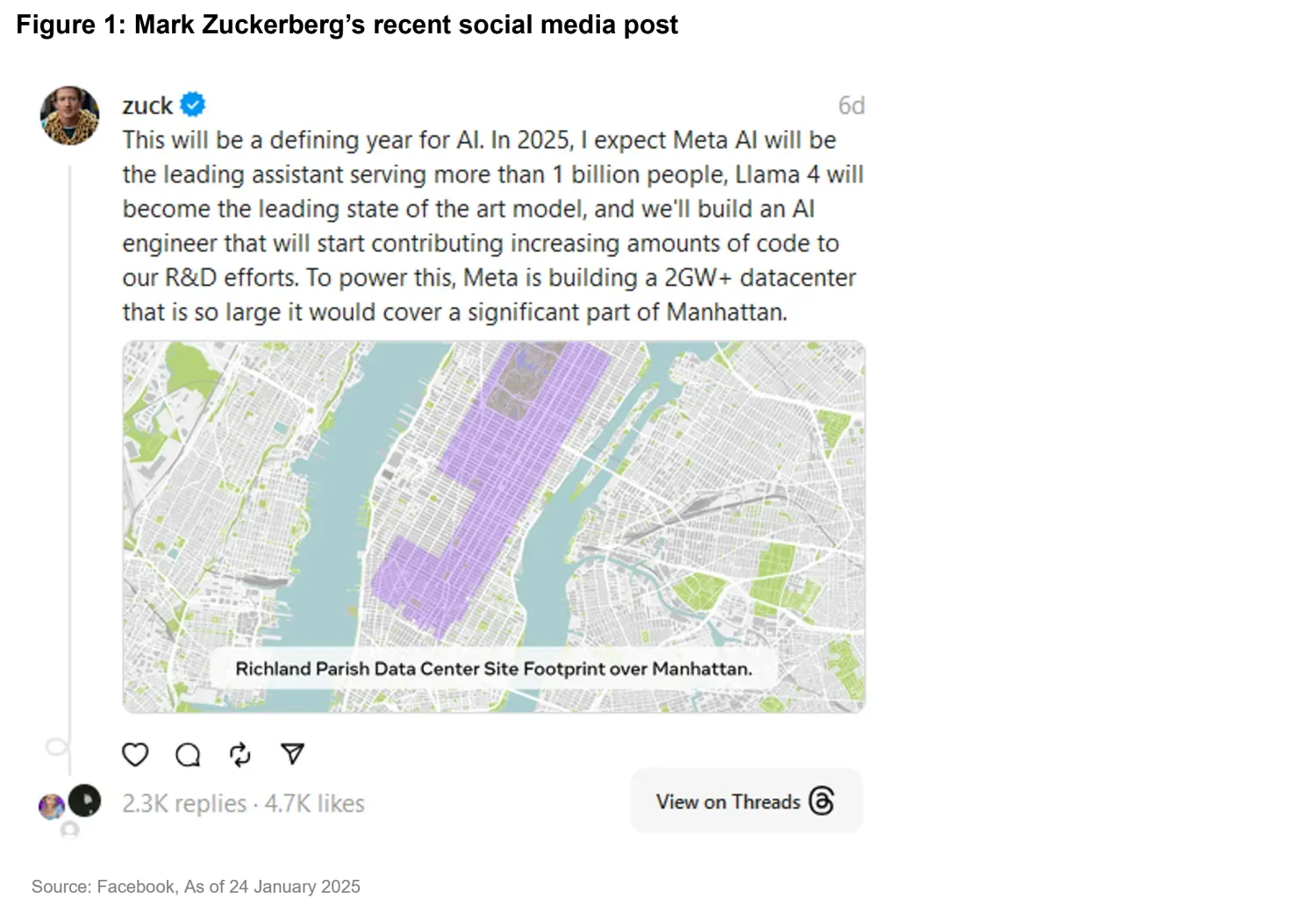

The second implication is that if LLMs are essentially table stakes and can be trained and run at much lower cost, then the amount of money needed to be invested in GPUs and data centers may not be as structural as the bulls believe. Capex by the four largest hyperscalers (Amazon, Google, Microsoft, Meta) is expected to exceed USD 300 billion in 2025, which is roughly double what was spent two years ago. Much of this is going into data centers, and just recently, Mark Zuckerberg posted that Meta was building a data center so large that it would cover a significant part of Manhattan!

If LLMs can be trained with less cost and at smaller scale, then all that investment could look like the overbuilding of fiber optics in the 1990s. Those fiber investments brought us high speed internet, streaming video, etc., but overcapacity depressed prices and economics flowed to the users of the rails rather than the rails themselves. In the past three years, the picks and shovels have profited the most. While there was plenty of growth, the question we ask is: “is it durable?” And that is a question that even the bulls now aren’t so sure they have the answer to.

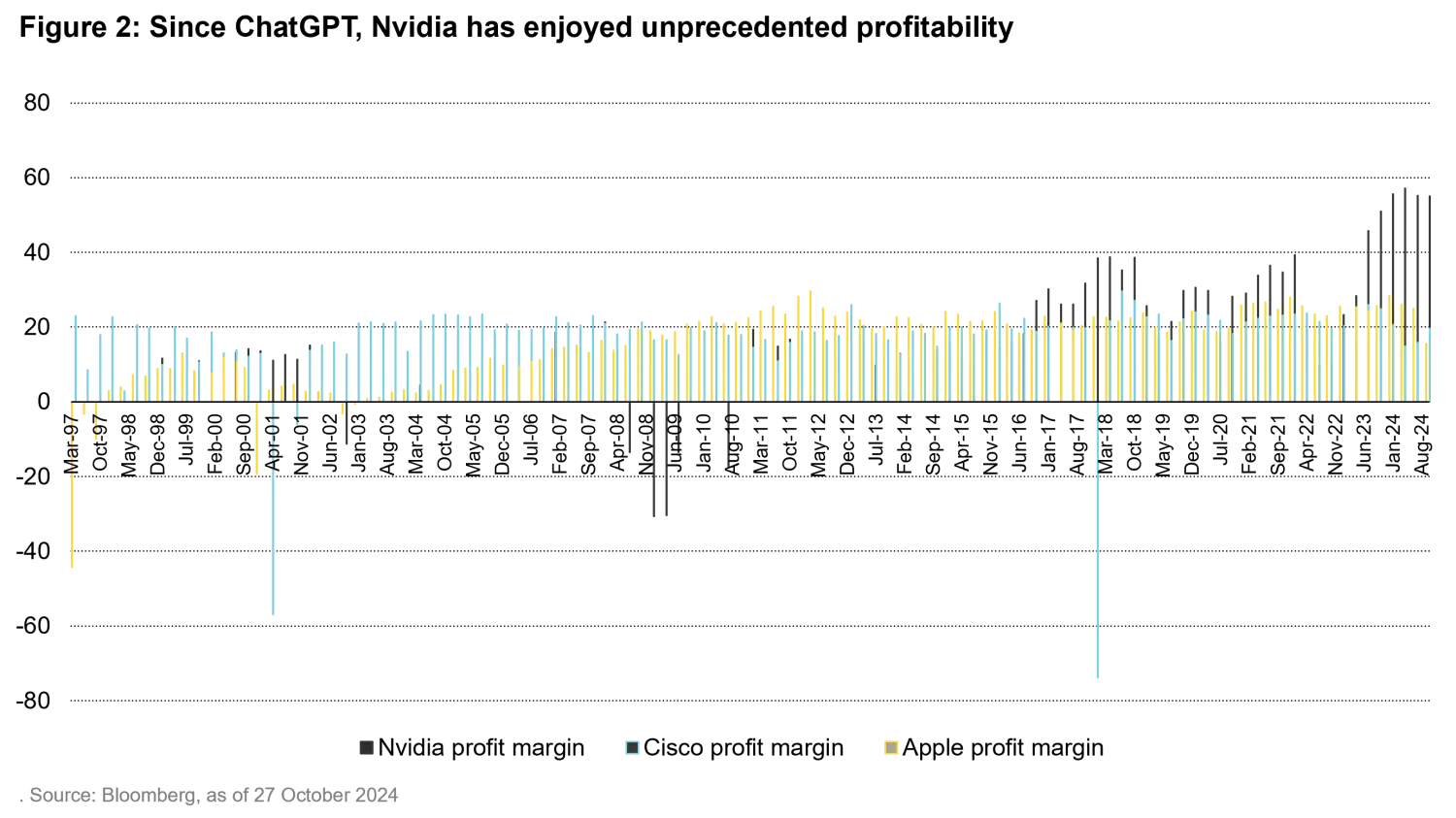

Of course, the AI bulls will say that as the cost curve shifts downward, adoption of AI tools will increase and that will continue to fuel the need for data centers and GPUs. That may be the case, but if you are building LLMs that are commoditized, do you need the latest and most expensive GPU’s from Nvidia? DeepSeek has shown a cheaper and more efficient path. Capitalism is a funny thing, as Jeff Bezos once said: “Your margin is my opportunity.” As illustrated below, Nvidia has delivered some enormous margins over the last few years. Can this be sustained in a world where AI models are built and run at a cheaper and smaller scale?

As we digest these new developments, we continue to implement our disciplined and patient approach which can unlock opportunity in both our AI exposed names as well as those in lesser appreciated areas of the market that have perhaps been overlooked. The recent environment has been supportive as the market has started to recognize the durability in many companies that have been outside of the AI spotlight. While we will only know for sure if the market steamroller goes into reverse in hindsight, the recent developments are another reminder of the importance of differentiating between speculation and investing. After four decades of being patient managers of our client’s capital, we remain as convinced as ever that our steady approach to compounding is the best recipe for success.