This bond fund aims to generate steady income and above-average investment returns over a full credit cycle, while promoting environmental or social characteristics and respecting risk diversification.

The fund invests across developed markets and their sectors mainly in corporate bonds in euros, with different maturities and seniorities, of issuers of good quality (investment grade) with various ratings, focusing on the mid-yield segment (ratings A+ to BBB-). The fund seeks to promote environmental or social characteristics.

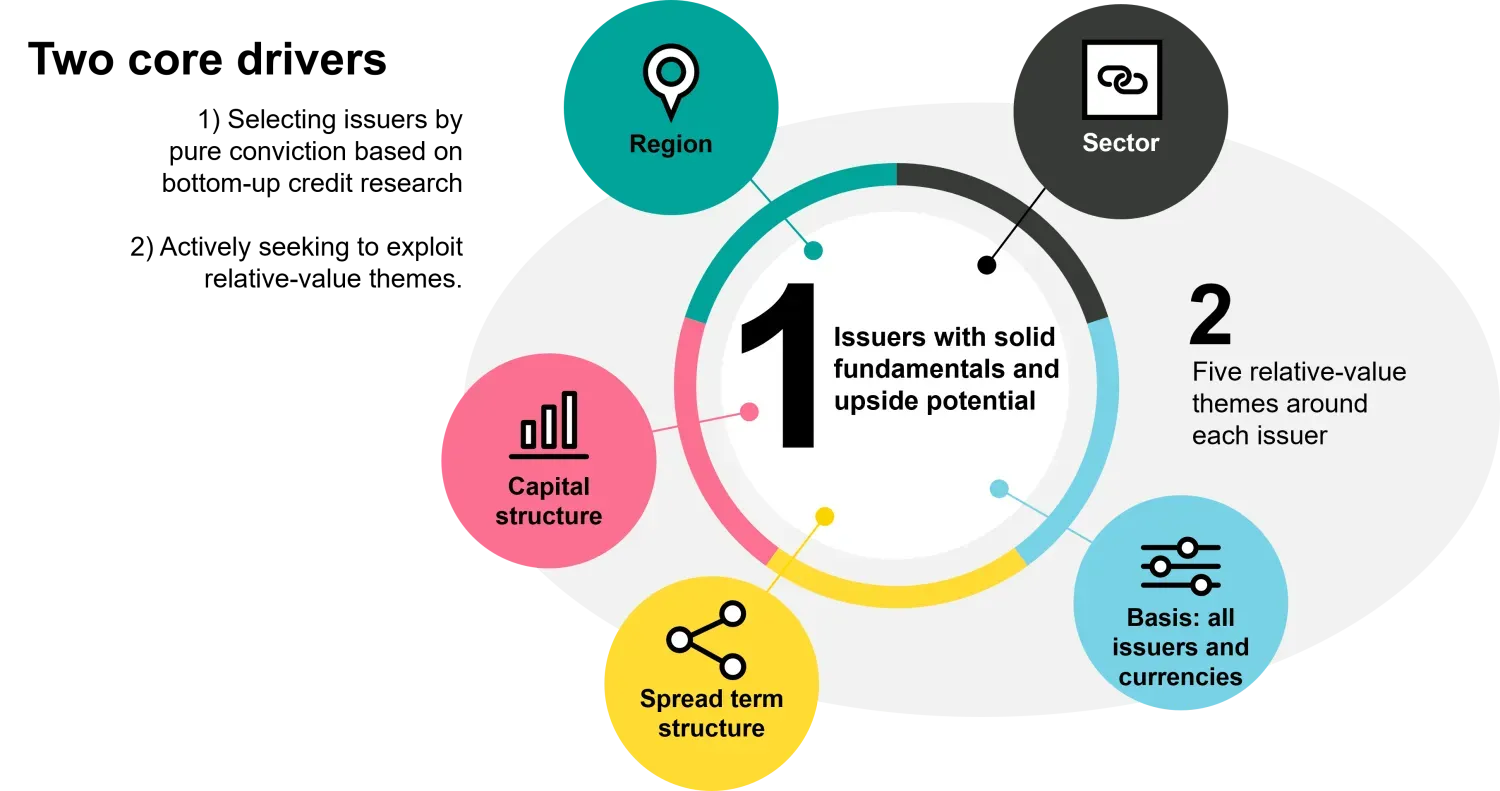

The investment team follows a dedicated process, based on fundamental credit, relative-value, and technical analyses. Top-down assessment of the economy and sectors is followed by bottom-up company analysis, which also considers the 'S' of ESG (Environmental, Social, Governance) standards, specifically empowerment. By means of a filter the team selects paper whose credit spreads offer adequate compensation for the risks involved, while favoring issuers with strong or improving empowerment indicators. Striving to exploit more inefficiencies and diversify broadly, the team combines various issuers and securities in the fund.

"The corporate-bond market presents tremendous opportunities across industries, structures, and issuers. Our experienced team captures that, aiming to preserve value for investors."

Our investment process begins with a top-down review of the European corporate-bond market, where we look at the development of key macro- and microeconomic data, considering technicals, such as new issuance and asset flows into or out of the asset class.

Then, we zoom in and filter by both industry scores/attractiveness and credit metrics to identify potential investable corporate-bond ideas. Our ESG risk concept excludes issuers that derive a certain percentage of their revenues from products/activities referenced under “exclusion approach” in the fund’s legal documentation – such as weapons, thermal coal, or tobacco, those we deem the most controversial, those that are in violation of certain global norms and standards the fund aims to promote, and those not aligned with the United Nations Global Compact Principles.

This is followed by a thorough bottom-up analysis of the names that pass our filters, resulting in a fundamental company view that also considers ESG characteristics, with a special eye on social ones. By bringing this together with our overall market valuation, we come to a buy/hold/sell decision on each issuer.

Finally, we construct our portfolio based on our considerations of the aspects sector, issuer, and ESG, among others. The fund mainly invests in investment-grade corporate bonds rated from A+ to BBB-. When we rate investment risks as low, we may add a limited portion of subordinated instruments and issuers rated BB. When we find more caution appropriate, we may instead add a limited portion of liquid corporate or government bonds rated from AAA to AA-.

A robust risk-management setup, with control and oversight independent of the primary risk owners, provides a solid cover across our entire investment process.

"Performance is overwhelmingly driven by corporate-bond selection. Therefore, by our combined portfolio manager/analyst model and state-of-the-art tools in a disciplined process, we strive to select quality issuers with advantageous social characteristics and best-value structures."

Historically, investment-grade corporate bonds delivered positive returns even in recessionary and zero-growth environments, with their excess returns being less sensitive to the economic cycle. Usually, investment-grade corporate bonds with ratings from A+ to BBB- offer higher yields than top-rated government bonds, while their credit fundamentals are nevertheless solid.

We seek to generate alpha from our selection of corporate bonds with two core drivers, as illustrated in more detail below.

Close to our heart is the notion that a more sustainable future starts with appropriate social norms, not least the empowerment of people. Our ESG approach adopts a screening methodology based on pre-defined empowerment indicators, such as diversity oversight by a company’s management and by specific programs, the percentage of women in total workforce, violations of the International Labour Organization (ILO)’s Core Conventions, and the percentage of employees that receive training. We favor companies that do well in this respect or are on their way to do so, according to our bottom-up analyses.

The European corporate-bond market is slow to react to new trends, and so, presents investment opportunities across industries, structures, and issuers – an ideal ground for active corporate-bond selectors. In addition, the asset class is broad, offering good risk diversification potential.

Mondher Bettaieb, Head of Corporate Bonds, and Claudia Fontanive-Wyss, Portfolio Manager/Analyst, manage the fund, supported by the entire Corporate Bonds team within Fixed Income. The portfolio manager/analyst model and the expertise of the team members in their field enable swift decision-making and efficient allocation to the opportunities they deem most promising.

All data is as at 30 Sep 2024 unless otherwise indicated.

| 1M | YTD | 1Y | 3 yrs p.a. | 5 yrs p.a. | Since Inception | |

|---|---|---|---|---|---|---|

| N EUR | 1.2% | 4.5% | 11.4% | -1.6% | -0.2% | 6.8% |

| Index | 1.2% | 3.9% | 9.7% | -1.4% | -0.4% | 4.9% |

| 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | |

|---|---|---|---|---|---|---|---|---|---|---|

| N EUR | 8.5% | -15.3% | -0.6% | 3.9% | 8.8% | -2.9% | NA | NA | NA | NA |

| Index | 8.2% | -14.1% | -0.9% | 2.8% | 6.6% | -1.3% | NA | NA | NA | NA |

| Portfolio | Index | |

|---|---|---|

| Volatility | 7.0% | 6.5% |

| Active Share () | ||

| [3 years annualized] | ||

All data is as at 31 Oct 2024 unless otherwise indicated.

| Portfolio Manager | Mondher Bettaieb-Loriot |

|---|---|

| Fund Domicile | Luxembourg |

| Fund Currency | EUR |

| Share Class Currency | EUR |

| Risk Level | 4.00 (7 Oct 2024) |

| Year End | 31 August |

| Index | ICE BofAML A-BBB Euro Corporate Index |

| Share Class Launch date | 30 May 2017 |

| Distribution Type | Accumulating |

| Swing pricing | Yes |

| SFDR Classification | Article 8 |

| Fund Registrations | AT, CH, DE, ES, FI, FR, GB, IE, IT, LI, LU, NL, NO, PT, SE, SG |

| Share Class Registrations | AT, CH, DE, ES, FR, GB, LI, LU, NL, SG |

| Highest since launch | 113.42 |

|---|---|

| Lowest since launch | 90.86 |

| Share class size in mln. | EUR 22.88 |

| Management fee | 0.55% |

|---|---|

| TER* | 0.79% (29 Feb 2024) |

| OCF | 0.79% (29 Feb 2024) |

| ISIN | LU1612361102 |

|---|---|

| Valor | 36720881 |

| Bloomberg | VOECMYN LX |

| WKN | A2JKLU |

| Depository | State Street Bank International GmbH (Luxembourg Branch) |

|---|---|

| Management Company | Vontobel Asset Management SA, Luxembourg |

| Swiss Paying Agent | Bank Vontobel AG |

| Swiss Representative | Vontobel Fonds Services AG |

| Share class | Currency | ISIN | Distrib. | Type | Launch date | Management fee | TER* |

|---|---|---|---|---|---|---|---|

| A | EUR | LU0153585566 | Distributing | Retail | 27 Sep 2002 | 1.10% | 1.34% (29 Feb 2024) |

| AI | EUR | LU1258889689 | Distributing | Institutional | 14 Jul 2015 | 0.55% | 0.75% (29 Feb 2024) |

| AN | EUR | LU1683480963 | Distributing | Retail | 3 Oct 2017 | 0.55% | 0.79% (29 Feb 2024) |

| B | EUR | LU0153585723 | Accumulating | Retail | 27 Sep 2002 | 1.10% | 1.34% (29 Feb 2024) |

| C | EUR | LU0153585996 | Accumulating | Retail | 16 Jul 2007 | 1.50% | 1.74% (29 Feb 2024) |

| H (hedged) | CHF | LU0863290267 | Accumulating | Retail | 16 Jan 2013 | 1.10% | 1.40% (29 Feb 2024) |

| HI (hedged) | USD | LU1054314221 | Accumulating | Institutional | 10 Apr 2014 | 0.55% | 0.81% (29 Feb 2024) |

| HI (hedged) | CHF | LU1047498362 | Accumulating | Institutional | 31 Mar 2014 | 0.55% | 0.81% (29 Feb 2024) |

| HN (hedged) | GBP | LU1092317624 | Accumulating | Retail | 6 Oct 2014 | 0.55% | 0.85% (29 Feb 2024) |

| HN (hedged) | CHF | LU1767066514 | Accumulating | Retail | 9 Feb 2018 | 0.55% | 0.85% (29 Feb 2024) |

| I | EUR | LU0278087860 | Accumulating | Institutional | 13 Jul 2007 | 0.55% | 0.75% (29 Feb 2024) |

| N | EUR | LU1612361102 | Accumulating | Retail | 30 May 2017 | 0.55% | 0.79% (29 Feb 2024) |

Subject to change, without notice, only the current prospectus or comparable document of the fund is legally binding.

* TER includes performance fee where applicable

All data is as at 30 Sep 2024 unless otherwise indicated.

View all documents View latest documents

| Document | Date | DE | EN | ES | FR | IT |

|---|---|---|---|---|---|---|

| Factsheets & Commentaries | ||||||

| Factsheet | Sep 2024 | |||||

| Factsheet | Aug 2024 | |||||

| Factsheet | Jul 2024 | |||||

| Factsheet | Jun 2024 | |||||

| Factsheet | May 2024 | |||||

| Factsheet | Apr 2024 | |||||

| Factsheet | Mar 2024 | |||||

| Factsheet | Feb 2024 | |||||

| Factsheet | Jan 2024 | |||||

| Factsheet | Dec 2023 | |||||

| Factsheet | Nov 2023 | |||||

| Factsheet | Oct 2023 | |||||

| Factsheet | Sep 2023 | |||||

| Factsheet | Aug 2023 | |||||

| Factsheet | Jul 2023 | |||||

| Factsheet | Jun 2023 | |||||

| Factsheet | May 2023 | |||||

| Factsheet | Apr 2023 | |||||

| Factsheet | Mar 2023 | |||||

| Factsheet | Feb 2023 | |||||

| Factsheet | Jan 2023 | |||||

| Factsheet | Dec 2022 | |||||

| Factsheet | Nov 2022 | |||||

| Factsheet | Oct 2022 | |||||

| Factsheet | Sep 2022 | |||||

| Factsheet | Aug 2022 | |||||

| Factsheet | Jul 2022 | |||||

| Factsheet | Jun 2022 | |||||

| Factsheet | May 2022 | |||||

| Factsheet | Apr 2022 | |||||

| Factsheet | Mar 2022 | |||||

| Factsheet | Feb 2022 | |||||

| Factsheet | Jan 2022 | |||||

| Factsheet | Dec 2021 | |||||

| Factsheet | Nov 2021 | |||||

| Factsheet | Oct 2021 | |||||

| Factsheet | Sep 2021 | |||||

| Factsheet | Aug 2021 | |||||

| Factsheet | Jul 2021 | |||||

| Factsheet | Jun 2021 | |||||

| Factsheet | May 2021 | |||||

| Factsheet | Apr 2021 | |||||

| Factsheet | Mar 2021 | |||||

| Factsheet | Feb 2021 | |||||

| Factsheet | Jan 2021 | |||||

| Factsheet | Dec 2020 | |||||

| Factsheet | Nov 2020 | |||||

| Factsheet | Oct 2020 | |||||

| Factsheet | Sep 2020 | |||||

| Factsheet | Aug 2020 | |||||

| Factsheet | Jul 2020 | |||||

| Factsheet | Jun 2020 | |||||

| Factsheet | May 2020 | |||||

| Factsheet | Apr 2020 | |||||

| Factsheet | Mar 2020 | |||||

| Factsheet | Feb 2020 | |||||

| Factsheet | Jan 2020 | |||||

| Factsheet | Dec 2019 | |||||

| Factsheet | Nov 2019 | |||||

| Factsheet | Oct 2019 | |||||

| Factsheet | Sep 2019 | |||||

| Factsheet | Aug 2019 | |||||

| Factsheet | Jul 2019 | |||||

| Factsheet | Jun 2019 | |||||

| Factsheet | May 2019 | |||||

| Factsheet | Apr 2019 | |||||

| Monthly Commentary | Sep 2024 | |||||

| Monthly Commentary | Aug 2024 | |||||

| View more Factsheets & Commentaries View less Factsheets & Commentaries | ||||||

| PRIIPs KIDs | ||||||

| Key Information Document (KID) | Oct 2024 | |||||

| Legal Documents | ||||||

| AGM EGM invitation | Jan 2024 | |||||

| AGM EGM invitation | Jan 2023 | |||||

| AGM EGM invitation | Jan 2022 | |||||

| AGM EGM invitation | May 2021 | |||||

| AGM EGM invitation | Jan 2021 | |||||

| AGM EGM invitation | Jan 2020 | |||||

| Articles of Association | Apr 2016 | |||||

| Notification to Investors | Oct 2024 | |||||

| Notification to Investors | Sep 2024 | |||||

| Notification to Investors | Jun 2024 | |||||

| Notification to Investors | May 2023 | |||||

| Notification to Investors | Nov 2022 | |||||

| Notification to Investors | Jan 2022 | |||||

| Notification to Investors | Sep 2021 | |||||

| Notification to Investors | Jul 2021 | |||||

| Notification to Investors | May 2021 | |||||

| Notification to Investors | Mar 2021 | |||||

| Notification to Investors | Feb 2021 | |||||

| Notification to Investors | Apr 2020 | |||||

| Notification to Investors | Nov 2019 | |||||

| Sales Prospectus | Oct 2024 | |||||

| View more Legal Documents View less Legal Documents | ||||||

| Sustainability Related Disclosures | ||||||

| Periodic Disclosure | Aug 2023 | |||||

| Pre-contractual Disclosure | Jul 2024 | |||||

| Statement on principal adverse impacts of investment decisions on sustainability factors | Jun 2024 | |||||

| Sustainability Related Disclosures | Jul 2024 | |||||

| Financial Reports | ||||||

| Annual Distribution | Nov 2023 | |||||

| Annual Report | Aug 2023 | |||||

| Distribution Dates | Jan 2024 | |||||

| Quarterly Distribution | Sep 2024 | |||||

| Quarterly Distribution | Jun 2024 | |||||

| Quarterly Distribution | Mar 2024 | |||||

| Semi-Annual Report | Feb 2024 | |||||

| Semi Annual Distribution | Apr 2024 | |||||

| Semi Annual Distribution | Apr 2023 | |||||

| View more Financial Reports View less Financial Reports | ||||||

| Dealing Information | ||||||

| Holiday Calendar 2024 | Jan 2024 | |||||

| List of Active Retail Share Classes | Mar 2024 | |||||

| Policies | ||||||

| Sanctioned Countries | Oct 2022 | |||||

| Shareclass Naming Convention | Jan 2022 | |||||

RISKS

Subject to change, without notice, only the current prospectus or comparable document of the fund is legally binding.

Limited participation in the potential of single securities

Success of single security analysis and active management cannot be guaranteed

It cannot be guaranteed that the investor will recover the capital invested

Derivatives entail risks relating to liquidity, leverage and credit fluctuations, illiquidity and volatility

Interest rates may vary, bonds suffer price declines on rising interest rates

Investments in foreign currencies are subject to currency fluctuations

Mid-yield bonds may be more speculative investments than bonds with a higher rating due to higher credit risk, higher price fluctuations, a higher risk of loss of capital deployed

Information on how sustainable investment objectives are achieved and how sustainability risks are managed in this Sub-Fund may be obtained here.

Neither the Sub-Fund, nor the Management Company nor the Investment Manager make any representation or warranty, express or implied, with respect to the fairness, correctness, accuracy, reasonableness or completeness of an assessment of ESG research and the correct execution of the ESG strategy.

Morningstar rating: © 2024 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

ANY INDEX OR SUPPORTING DATA REFERRED TO HEREIN IS THE INTELLECTUAL PROPERTY (INCLUDING REGISTERED TRADEMARKS) OF THE APPLICABLE LICENSOR. ANY PRODUCT BASED ON AN INDEX IS IN NO WAY SPONSORED, ENDORSED, SOLD OR PROMOTED BY THE APPLICABLE LICENSOR AND IT SHALL NOT HAVE ANY LIABILITY WITH RESPECT THERETO. Refer to vontobel.com/terms-of-licenses for more details.