Fixed Income Boutique

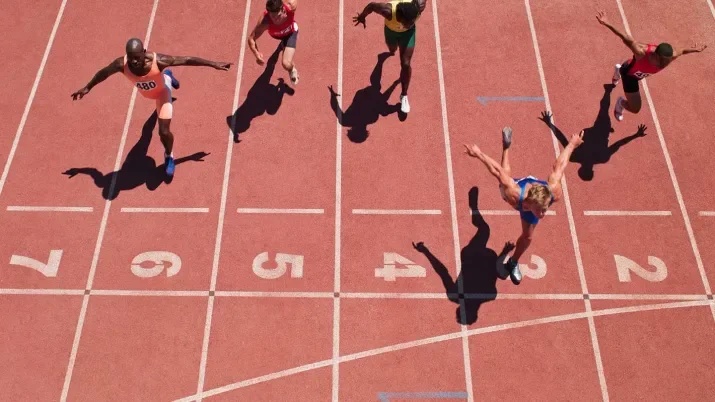

The end sprint for 2023: five reasons why investment grade bonds could deliver the extra edge

Short-term government bonds have enjoyed heightened levels of attention this year, but what will give fixed income investors that extra performance boost as the finish line for 2023 draws closer? Our Fixed Income Boutique’s corporate bond team shares five reasons why switching to actively managed investment grade bond funds could deliver that extra edge.

Conviction Equities Boutique

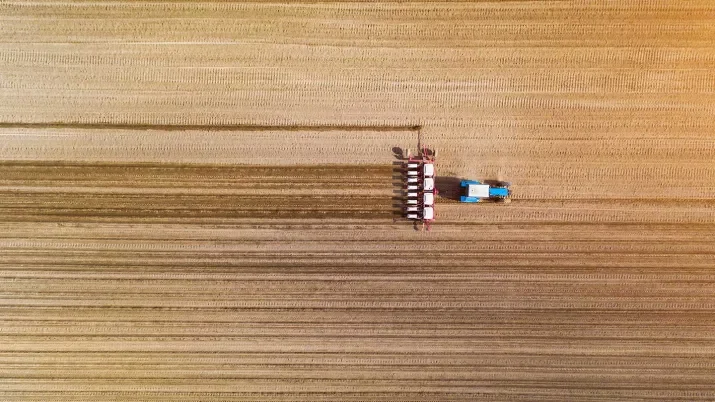

Reap what you sow: seek to harvest your "double dividend"

Financial return and positive impact are equally important in impact investing – but so is measurement.

Conviction Equities Boutique

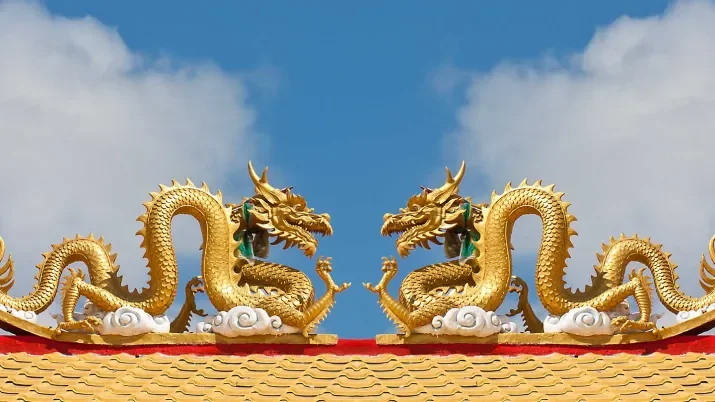

The China paradox: underrepresented or too dominant in emerging market equities?

After a multi-decade era of significant economic growth, China is now the second largest global economy and dominant in the MSCI emerging market index. How should emerging market equities investors balance this with the potential implications of recent economic and political moves out of Beijing and shifting demographic patterns?

Conviction Equities Boutique

How to invest when the world is on the brink?

We reap what we sow: the “double dividend” concept seeks to offer financial returns and a better tomorrow

Conviction Equities Boutique

Reap what you sow: seek to harvest your "double dividend"

Generating financial returns and making a positive impact on our planet and society are equally important in impact investing – but so is measurement. To effectively measure impact, we use a systematic and repeatable approach with a commitment to full transparency at all times.

Asset management

How to thrive without water? The challenge of water scarcity

Clean and safe water is essential to human survival. A key building block of our world, it’s also at the center of many global challenges. World Water Week draws attention to the need for innovation at a time of unprecedented challenges.

TwentyFour

Fixed income opportunities in a soft landing scenario

After a difficult 2022, bonds may be poised for unusually high returns compared to historic averages. And not just in the US -- we see opportunities in European CLOs and RMBS. They offer double digit yields for short-dated debt and look very attractive on a relative value basis compared to domestic credit.

Fixed Income Boutique

Planets align for emerging market local currency bonds

After a tumultuous decade, the stars may be set to favor emerging market local currency bonds again. Portfolio manager Carl Vermassen says there are good reasons to believe their outperformance so far this year isn’t just a one-off lucky shot.

Conviction Equities Boutique

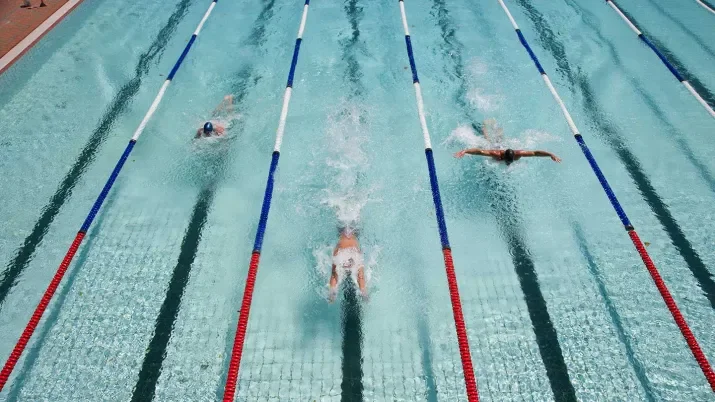

Can EM equities play catch-up in the second half of the year? Spoiler alert: we believe so!

Investors can look back at having had to navigate a difficult first half of the year. Emerging-market equities, though posting positive returns, trailed their developed-market counterparts. Could things turn around in the remainder of the year, leading to an outperformance of EM stocks?

Fixed Income Boutique

Central banks at the fork in the road

As the US Federal Reserve meets this week, what should investors brace for? Our Head of Corporate Credit Mondher Bettaieb Loriot suggests Fed officials are likely to hit the pause button on rate hikes as inflation and growth keep trending down. Across the Atlantic, however, the European Central Bank might not be ready to apply the brakes just yet.

Quality Growth Boutique

The fallout of the US banking crisis and how quality can provide resilience

With regional banks in the US concerned about deposit flight, financial conditions are tightening, increasing the probability of a hard landing for the economy. Quality companies that do not rely on leverage and whose earnings tend to be more resilient during times of economic weakness can be an attractive option for investors.

Quality Growth Boutique

International Equities: A compelling growth story unfolds

Multinationals listed in the US can provide exposure to global revenues. But an international approach also offers access to world leading companies that have no equivalent in domestic markets. And with valuations at a wide discount to the US, and below long-run averages, the story in international equities is both timely and compelling.

Fixed Income Boutique

Hunting alpha in China's real estate bond jungle

Is China’s property market on the mend? Are there any more humps in the road before it turns the corner? Our emerging markets credit specialists Cosmo Zhang and Wouter van Overfelt explain how contrarian investors who may have missed the strong rebound in December can now spot potential opportunities for generating alpha.

Quality Growth Boutique

Measured growth wins races: compounding capital in tougher conditions

Low interest rates, declining tax rates, and constrained wages contributed to margin expansion for large US companies over the past decade. Companies whose growth is driven by these temporary factors may be more vulnerable in tough conditions, while quality companies with structural growth drivers designed to succeed in all conditions may prevail.

Fixed Income Boutique

Ready for takeoff? Are corporate bonds set for a smooth climb?

After the “great repricing” of 2022, is corporate credit now ready for takeoff? Our corporate credit experts, Mondher Bettaieb Loriot and Christian Hantel, analyze the reasons behind the revival of high-grade corporate credit and explain why they remain optimistic about investment-grade markets in Europe and the US.

TwentyFour

Why short dated IG is the “best game in town” for 2023

2022 was the worst year for bonds in living memory. So, could 2023 be similarly bad for other asset classes? Chris Bowie looks at the case for short dated investment grade credit for 2023.

Quality Growth Boutique

ESG at Vontobel Quality Growth: A common sense approach

ESG research is an extension of our philosophy of long-term thinking and fits seamlessly into our existing research process. We focus on material issues rather than broad ESG scores, which enables us to understand and get ahead of risks that can jeopardize earnings predictability.

Conviction Equities Boutique

Emerging market equities: What follows the lost decade?

When comparing the earnings trajectory of emerging markets corporates with that of their developed-market counterparts, many investors consider this a lost decade. Are emerging market stocks now set to bounce back?

Quality Growth Boutique

Unions 101: A review of current labor risks

What’s behind the demands for unions globally? When are higher wages a threat to the bottom line? And which companies are best placed to manage the risk? In his back-to-basics blog on organized labor, Sudhir Roc-Sennett answers these critical questions for investors.

TwentyFour

Time to extract value from Europe’s new credit premium

In our view, European credit now represents a strong medium term value opportunity that investors cannot afford to ignore.

Fixed Income Boutique

Chinese economy: The New Year marks the return to normalization

As China readies for the Year of the Rabbit, there are several causes for celebration, says Fixed Income Boutique Credit Analyst Cosmo Zhang. Economic recovery could come earlier and stronger than expected in the first quarter of 2023, as mobility and supply chains return to normal despite a Covid surge.

TwentyFour

European ABS 2023: Enjoy the income, embrace the transparency

While European ABS was not immune to negative returns amid the considerable fixed income headwinds of 2022, it gave investors largely what they look to this allocation for – lower volatility and better performance than mainstream bonds. In our view, the forward-looking opportunity looks equally compelling.

Asset management

Geopolitical terms: Vocabulary for a new world

As new regimes emerge, so do new words to explain them. Understanding the world, one geopolitical term at a time.

Multi Asset Boutique

Big Data: Man and Machine as a Team in the Investment Process

Should we blindly follow a machine? Or is human judgment needed to make weighed decisions? We believe that man and machine must act as a team to achieve the best results. That's why we developed the Wave, which is based on a big data approach and serves as a compass in our investment process.