What’s on the horizon for the global high yield market in 2023?

Fixed Income Boutique

Key points

-

We believe that high yield bonds offer decent risk/reward for investors with a medium- to long-term investment horizon.

-

Market positioning in high yield bonds is very conservative, raising the prospect of a rally if the earnings season is more benign than expected and macro indicators stabilize.

- Valuation has become more attractive for developed market high yield, especially on an all-in yield and bond price basis.

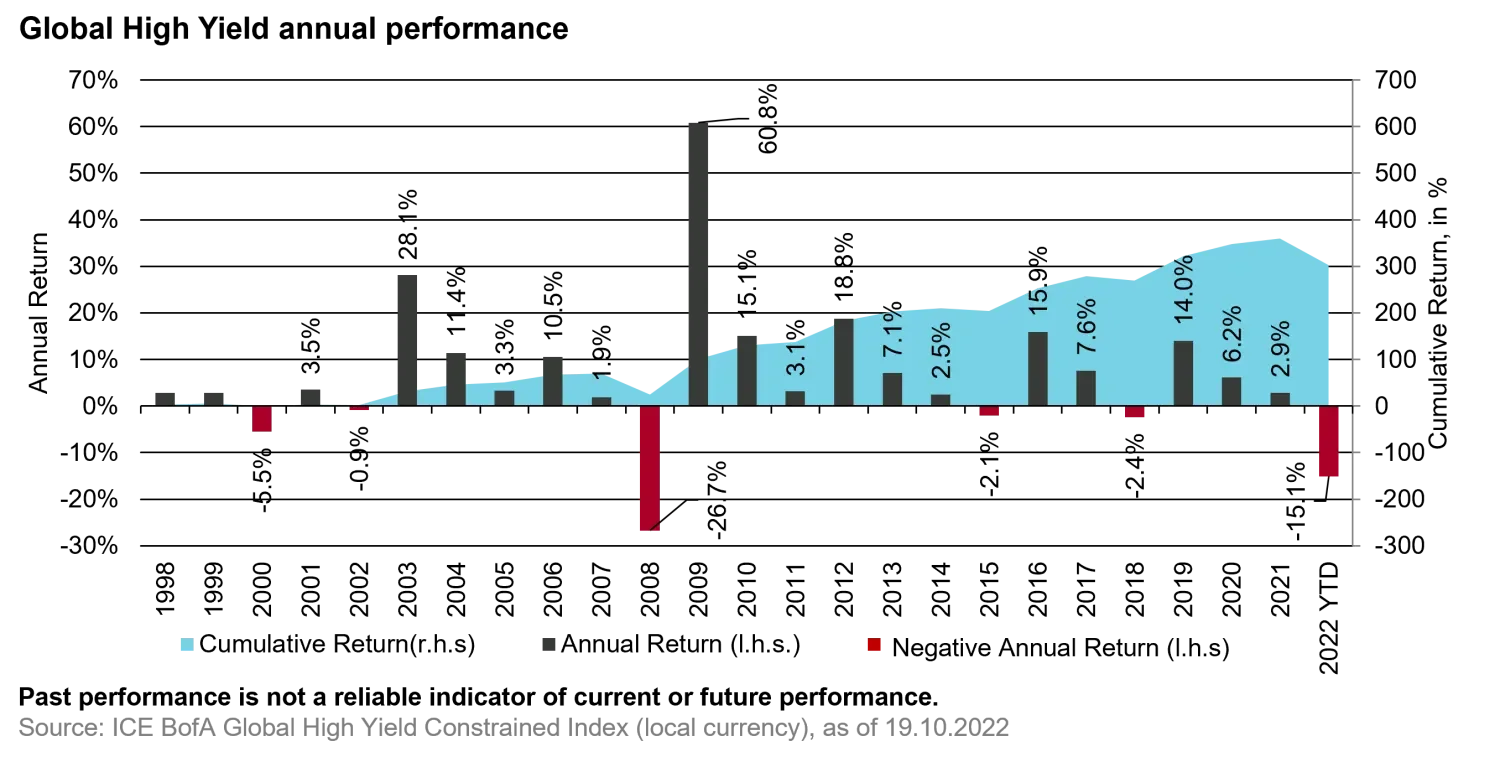

After a challenging year for the global high yield market, we are optimistic on the asset class going into next year. The global high yield market has never had two consecutive years of negative returns since index inception in 1998.

Historically, a down year was mostly followed by strong returns the following year, as shown in the chart below, due to cheapened valuations and the power of high coupon returns.

On the positive side, valuation has become more attractive for developed market high yield, especially on an all-in yield and bond price basis. The yield to worst on developed market high yield has risen to nearly 10%, above last 20-year average of 7.7%.

Prior to this, there had been three periods when developed market high yield bond yields went to 10% or above since the global financial crisis, the eurozone debt crisis in 2011, commodity price crisis in 2016 and the pandemic shock in 2020.

At the current level, we have already priced in a lot of downside. Historically at a starting yield level of 9% and above, 12-month forward looking returns tend to be strong due to the power of carry and price appreciation potential.

Default rates seen below previous cycles

On the negative side, we expect earnings and balance sheet to deteriorate for issuers operating in highly cyclical industries such as retail, chemical and auto. Companies without free cash flow will find themselves further squeezed due to the higher funding cost. For that reason, we prefer the BB and select single B parts of the high yield markets over CCCs.

Defaults are currently running at 1.3% in US high yields and 0.3% in euro high yields over the last 12 months, below historical average annual default rate of 4% for US high yields and 3% for euros high yields. We expect default rates to rise from the current low levels, but well below the worst levels seen in previous cycles.

Looking at the current market pricing in the high yield Credit Default Swap (CDS) market, euro high yields and US high yield CDS indices priced in about 40% and 35% five-year cumulative default respectively.

The last time when we reached 35% cumulative five-year default rate was during the period of the global financial crisis. We don’t expect high yield bond default rates to get anywhere close to that level over a five-year horizon because macroeconomic fundamentals and private sector balance sheet today are in much better shape than in 2008.

In addition, the overall credit quality of the high yield bond universe has improved over the past decade due to the number of large capital-structure fallen angels coming into the universe and weaker credits leaving the universe from the recent two default cycles in 2016 and 2020.

Therefore, while we see spreads remain volatile in the near term until inflation starts to come down, we believe that high yield bonds offer decent risk/reward for investors with a medium to long term investment horizon.

Heading into the last quarter of the year, the corporate earnings release season will start in mid-October. This earnings season will be closely watched as investors assess the impact from inflation and tightening in financial conditions on corporate earnings.

Judging from the recent flow data, investors are sitting on significant amount of cash. If the earnings season turns out to be more benign than expected, the high yield bond market may see a rally into year-end given the conservative positioning from the investor base and the significant cheapening in valuation.

Opportunities in a low liquidity environment

On the other hand, if earnings turn out to be worse than expected and inflation stays sticky, there is scope for further widening in spreads. In terms of market technicals, market liquidity has been pretty challenging the whole year on the back of the relentless volatility and low risk appetite from dealers.

We expect market liquidity to deteriorate further as we head into year-end, which can cause meaningful dislocations. High yield bond prices will not only be driven by fundamentals but also market positioning.

Popular short positions can see big squeezes higher and vice versa. The low liquidity environment is always a challenge to navigate but at the same time it also provides opportunities as prices deviate from fundamentals.

Important Information: Certain of the information herein is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. We believe that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, there is no assurance that estimates or assumptions regarding future financial performance of countries, markets and/or investments will prove accurate, and actual results may differ materially. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions. Past performance is not a reliable indicator of current or future performance.