Conviction Equities

Concentrated and fundamentally driven high-conviction equity portfolios managed by four teams specialized in emerging markets, impact investing, thematic investing, and Switzerland.

If you’re looking for a circular economy story that became a huge success, take the history of the iconic scooter Vespa, cobbled together in post-World War II Italy from parts originally designed for planes.

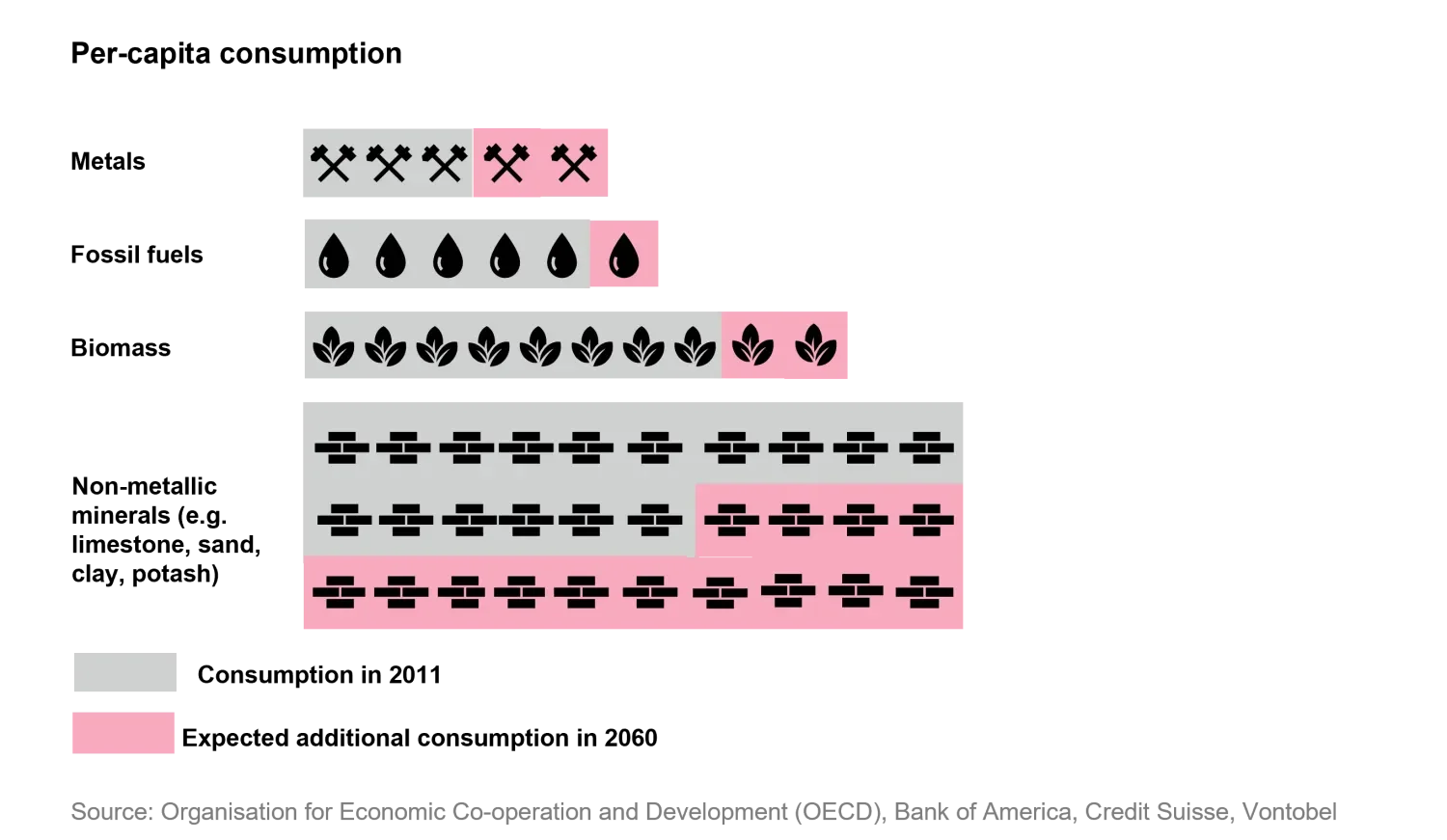

That transformation was driven by necessity. What followed were post-war decades of abundance marked by smooth supply chains and landfills brimming with “e-waste”1, which made us forget that resources are final. This is beginning to change. Today, we are facing a similar situation like Vespa’s creator Enrico Piaggio – how to make the best of scarce materials or reuse products that would otherwise end up on a scrap heap. Meanwhile, the world’s appetite for raw materials is steadily growing (see chart 1).

Chart 1: The growing hunger for raw materials is incompatible with a sustainable economy

Welcome to the world of circular economy in the 21st century, although it’s early days. According to a study by the professional services company Accenture, we are at a “low circularity” stage today with less than 10% of the global economy making the cut. However, this is already an improvement on the previous approach of “make-use-waste”. 2 There are signs that the mindset of consumers is changing. For anecdotal evidence, consider expressions such as “zero waste”, “right to repair”, “from farm to fork” or “cradle to cradle”3 that have started to influence our thinking. Or, to remain within the corporate sphere, note the ascent of 3D printing, a technology that minimizes materials consumption.4 According to Goldman Sachs, a circular economy could help add 4.5 trillion US dollars in additional economic output by 2030, and 25 trillion US dollars by 2050.5

If asset managers and investors want to ride this wave, they need to evolve and question their investment views or processes from time to time. We for our part have addressed the question how better to consider lifecycle management by refining our screening. To achieve higher granularity, we have defined two new measures named circular economy and functional materials, hoping to identify investment opportunities tied to leading companies.

Some of them have made circularity part of their business model. An example is Ireland-based Smurfit Kappa, which produces packaging from recycled and primary raw fibers. A growing trend to replace plastic packaging by paper-based solutions also offers prospects. One worry is the rising price of recycled boxes, an input material at the heart of the company’s circular economy model. Through its business model, it is in line with the UN Sustainable Development Goal number 12, “responsible consumption and production”.

Other examples are two American companies Clean Harbors and LKQ Corporation. The former is a collector of used motor oils that are turned into “fresh” lubricants. The latter harvests components from salvage vehicles for reuse in car repairs. The company has established a broad second-hand market with appropriate product quality checks. It’s worth noting that the idea of buying parts of used cars – or the whole product, for that matter – has become more widespread in the era of post-Covid hick-ups in global supply chains.6

The idea of circularity has given rise to a new branch of technology start-ups focused on food technology. California-based Apeel Sciences, for example, has developed a plant-based edible coating to prevent fruits or vegetables from rotting in an unrefrigerated environment.

As consumers, we have grown familiar with a surcharge on our electronic gadgets or plastic bottles to ensure they are recycled properly. Consumer advocacy groups and regulatory agencies were often instrumental in bringing about these changes, and the corporate world had to adapt. Today, the European Union, for example, under its multi-billion plan to become carbon neutral by 2050, is pushing companies down the “green” path. The so-called European Green Deal includes the EU Taxonomy, a classification system to distinguish “sustainable” from “non-sustainable” economic activities.

Another initiative is the “right to repair” legislation in the European Union for electronic devices. Taking this to the next level, could avoiding waste altogether be the next goal? Goldman Sachs Research pointed out that while net zero carbon commitments have become common, there are far fewer “zero waste” pledges. This seems strange because 70% of greenhouse gas emissions are directly linked to the handling and use of materials7; the bank said.

The massive investment flows that will come with such developments bode well for the companies that are aligned with environmental objectives, however lofty these may seem. Among the prospective beneficiaries will be those whose products and supply chains mirror the idea of the circular economy, whether by careful planning or a masterstroke that produced an Italian icon, the Vespa scooter. And at some stage, successful and carefully chosen companies could turbocharge investors’ portfolios (in an environment-conscious manner)

Important Information

Companies discussed for illustrative purposes only and should not be considered a recommendation to purchase, hold or sell any security. No assumption should be made as to the profitability or performance of any company identified or security associated with them. Certain information herein may include projections or other forward-looking statements regarding future events or future financial performance of countries, markets and/or investments. These statements are only opinion and actual events or results may differ materially, as such, undue reliance should not be placed on such forward-looking information. Vontobel reserves the right to make changes and corrections to the information and opinions expressed herein at any time, without notice.

1. BofA Global Research highlighted that the amount of “e-waste” thrown away each day in America is equivalent to 1,000 laptops, and US landfills are projected to reach capacity within 18 years. Scarcity Primer, February 23, 2022.

2. Accenture research cited in World Economic Forum (WEF) publication Circular Economy and Material Value Chains; A circular car industry could slash carbon emissions – here’s how

https://www.weforum.org/agenda/2021/01/circular-car-industry-could-slash-carbon-emissions-accenture/

3. A term introduced in 2010 by William McDonough and Michael Baumgart in Cradle to cradle: Remaking the way we make things. According to this concept, manufacturing processes should be set up to heed environmental and health concerns.

4. Waste to wealth: The circular economy advantage, Peter Lacy and Jakob Rutqvist, 2016, cited in Goldman Sachs Research publication The evolution towards a circular economy, May 3, 2022

5. Goldman Sachs Research published May 3, 2022, citing Waste to wealth: The circular economy advantage, Peter Lacy and Jakob Rutqvist, 2016

6. How Surging Used-Car Prices Are Turning Vehicles Into a Profitable Investment, Bloomberg, March 16, 2022

https://www.bloomberg.com/news/articles/2022-03-16/used-car-prices-are-surging-here-s-how-people-are-making-a-profit

7. Goldman Sachs Research cites The Circularity Gap Report 2022, a publication by Circle Economy, an Amsterdam-based co-operative focusing on the circular economy.

https://www.circularity-gap.world/2022