Quality Growth: The last man standing

Quality Growth Boutique

Key takeaways

- With inflation rising sharply, interest rates quickly increasing from very depressed levels, and slowing economic growth, investors today are navigating a volatile environment.

- The value trade seems to be running out of steam. Shares of many builders, engineering firms, automobile manufacturers and money-center banks have started to underperform the general market.

- The pendulum may swing back to Quality Growth, with its emphasis on companies with high margins, pricing power, low debt levels, and consistent earnings.

2022 has been off to a volatile start and markets are likely in for a continued rough ride this year. The possibility of a recession looms over several countries as central banks embark on a monetary tightening cycle to kill the high-inflation wave currently confronting them.

Rising interest rates are tough on high-growth, highly-valued companies – those with plenty of enthusiasm about the future, but little earnings today. These companies did relatively well over the past decade in an ultra-low interest rate and substantial fiscal stimulus regime. But inflation has exploded, and those days are over.

Global growth forecasts are being cut as economists realize that their rosy scenarios of steady growth in 2022-23 have become much thornier. In April, the IMF reduced its 2022 global GDP forecast to 3.6%, 0.8% lower than just three months earlier and 1.3% lower than six months ago.

In a high-inflation, slow-growth scenario, investors must tread a cautious path

Over the past several years, investors generally shunned quality and quality growth companies in favor of other styles. First, there was the rush into momentum growth strategies as interest rates were cut to zero in Spring 2020, and the lockdown-induced recession quickly ended. Investors gave companies with little or no earnings sky-high valuations on the notion that money was free, thus discounting future earnings to present value became a simple game. Next, in 2021, came the “great rotation” away from growth and into value strategies. Investors saw a window for higher earnings for cyclical companies (including energy and materials), industrials and money-center banks, and bid up stock prices in these sectors.

Fast-forward to today and many of these value companies are rolling over. Blame it on inflation, blame it on Covid-19’s resurgence in China, blame it on Vladimir Putin, the world has become a less certain, indeed scarier place to invest. With the exception of the energy and materials sectors, the value trade seems to be running out of steam. Not surprisingly, as rates rise and economies slow, shares of many builders, engineering firms, automobile manufacturers and money-center banks have started to underperform the general market as investors fret about a growth slowdown.

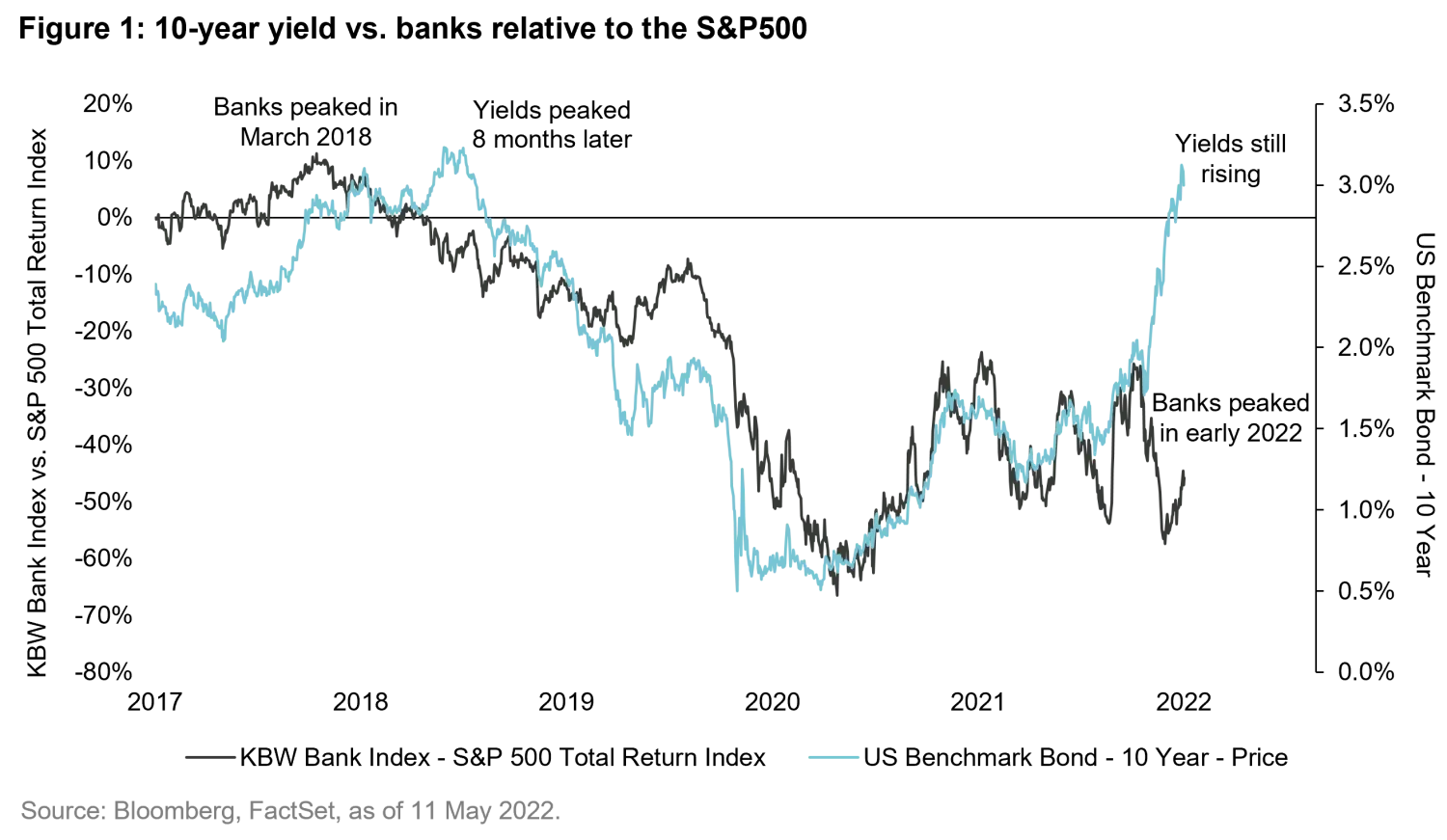

US banks, for instance, are contending with mortgage rates that have doubled over the past 18 months to approximately 5.1% in late-April, leading to lower loan growth for the housing sector. Investment banking businesses have slowed due to market volatility and higher interest rates. Banks see the writing on the wall and are increasing their credit reserves for more difficult times to come. Investors, meanwhile, are weighing the factors pressuring banks, looking at higher interest rates and the concomitant lower growth forecasts, and deciding it is not a good scenario for bank stocks. Bank shares peaked in January-February of this year and have lately been declining sharply. They tend to precede a downward move in interest rates, and the last time they peaked in 2018, interest rates continued to rise for 8 months (Figure 1).

The last holdouts in the value space are the energy and materials sectors. But commodity prices are not a one-way bet, and production is bound to increase in the US, Canada, and in OPEC countries as oil prices remain high. The old adage, “the cure for high energy prices is high energy prices” should come into force, reducing the price of oil and of gas, and hence the valuations of energy companies. Materials are a diverse group where some economically-sensitive metals/minerals may suffer a great deal, while others supplying to the nuclear or EV sectors may do relatively well. In the medium and longer-term, however, commodities are cyclical and should eventually fall in price as supply exceeds demand.

How will this investment roller coaster play out for long-term equity investors?

Like the end of a long evening of revelry, this decline in the fortunes of both momentum growth and value companies leaves the Quality Growth investors, in our opinion, still standing. They are the ones invested in companies that can provide consistent earnings growth and earn high operating margins due to the economic moats around their businesses. They can own companies with the power to increase prices during inflationary periods. Their companies have relatively low debt levels and can withstand higher interest rates more easily. They should see relatively benign comments from their companies’ CEOs about current and future business prospects. In short, we believe they should sleep relatively well at night.

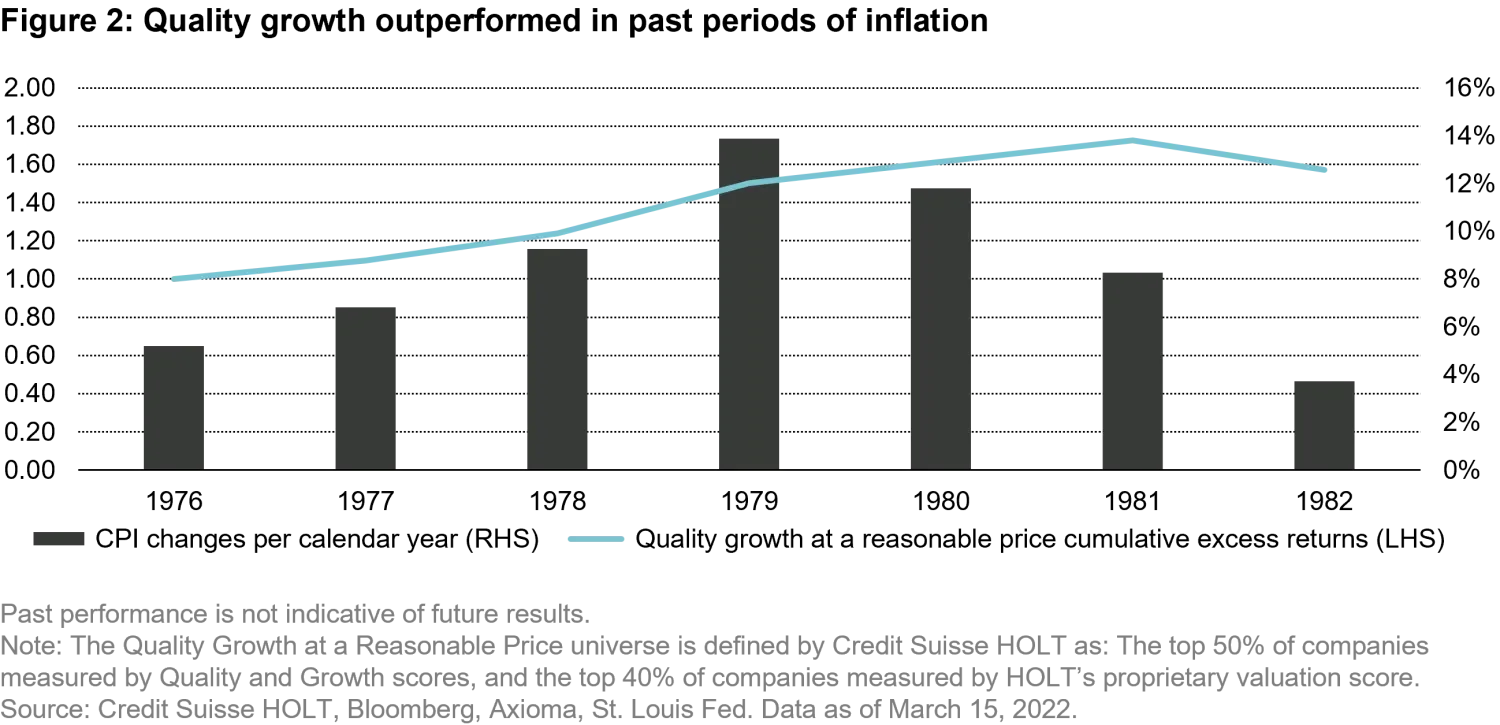

The consumer staples sector, a traditional source of high-quality, dependable growth names, began reporting quarterly results in April. Nestle, Procter & Gamble, and Heineken announced they had increased prices by about 5% each. Quality companies can raise their prices to protect their profit margins. Investors reward such companies by buying their shares during inflationary times, as happened in the late-1970s when inflation raged through economies.

With inflation rising sharply, and interest rates quickly increasing from very depressed levels, we have entered a new phase, one where the pendulum may swing back to Quality Growth, with its emphasis on companies with high margins, pricing power, low debt levels, and consistent earnings. We believe they are the slow but ultimately successful tortoises in the long foot race investors engage in to beat the overall market.

Disclaimer:

Any investments discussed may or may not be held in in of one of our strategies and are for illustrative purposes only. There is no assurance that Vontobel will make any investments with the same or similar characteristics as any investments presented. The investments are presented for discussion purposes only and are not a reliable indicator of the performance or investment profile of any composite or client account. Further, the reader should not assume that any investments identified were or will be profitable or that any investment recommendations or that investment decisions we make in the future will be profitable.

Certain of the information contained in this article is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Vontobel believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.