How to engage with Chinese companies – local language skills help

Conviction Equities Boutique

Key takeaways

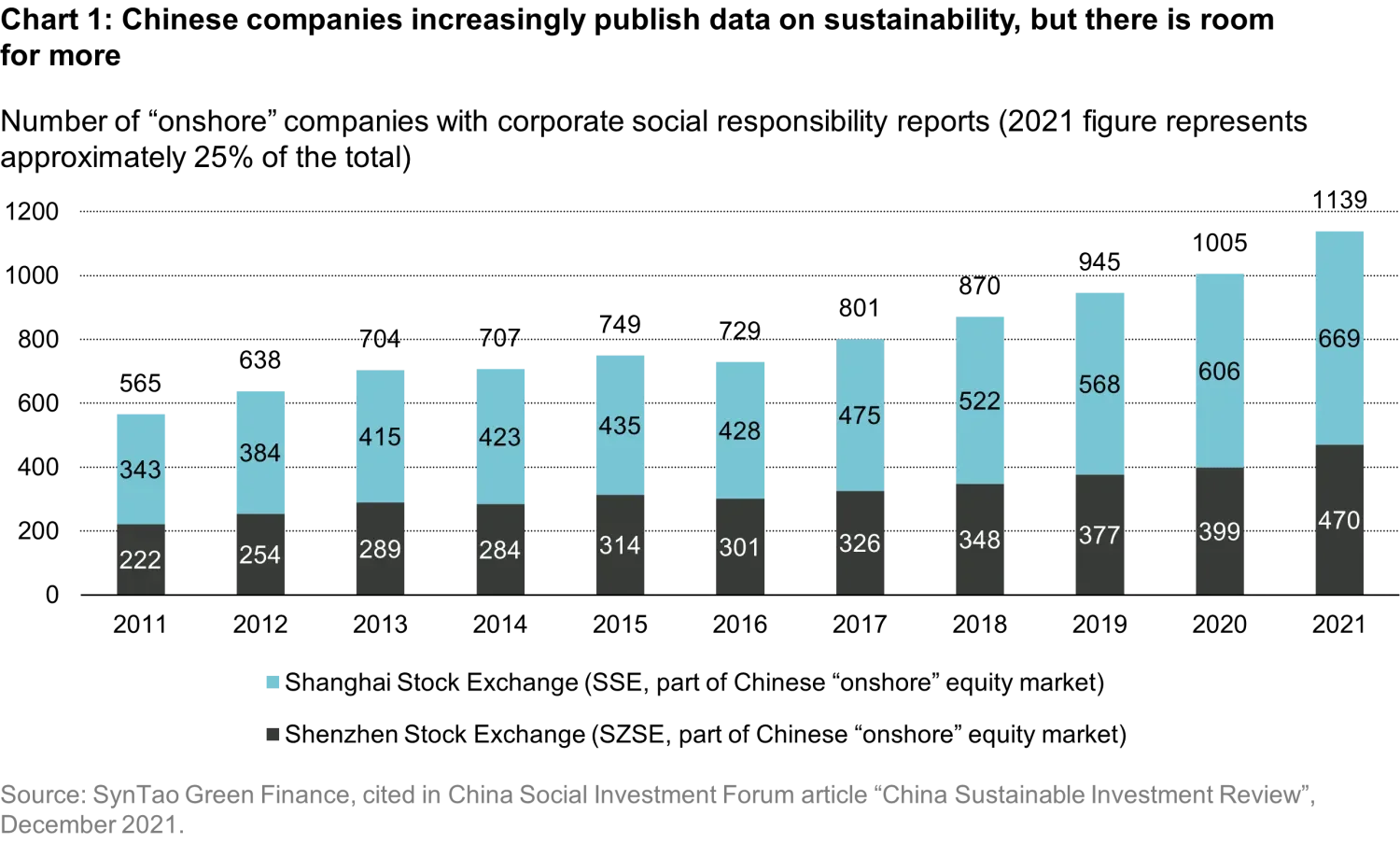

- The number of Chinese companies’ reports on sustainability matters is growing steadily, but the data on environmental, social and governance (ESG) aspects needs a closer look.

- Demanding investors are well-advised to engage with the companies, i.e. make an active effort to get a clear picture, and eventually influence how companies collect and present the information, but they need to tread carefully.• Demanding investors are well-advised to engage with the companies, i.e. make an active effort to get a clear picture, and eventually influence how companies collect and present the information, but they need to tread carefully.

- For instance, talking the local language helps, says Gayle Chan, the Hong Kong-based ESG analyst for mtx Equities, citing a concrete example.

The number of Chinese companies’ reports on sustainability matters is growing steadily (see chart 1). Quantity aside, the quality of data on environmental, social and governance (ESG) aspects needs a discerning eye. Therefore, demanding investors are well-advised to engage with the companies, i.e. make an active effort to get a clear picture, and eventually influence how companies collect and present the information. Here’s how we as shareholders in various Chinese companies go about it.

Fact-finding and education, carefully calibrated

ESG engagement in emerging markets such as China goes beyond what western investors usually understand by it. It’s partly a fact-finding mission, partly an educational mission, and chances to achieve success are greatly improved if investors speak the local language. Naturally, one needs to tread carefully.ESG engagement in emerging markets such as China goes beyond what western investors usually understand by it. It’s partly a fact-finding mission, partly an educational mission, and chances to achieve success are greatly improved if investors speak the local language.

Naturally, one needs to tread carefully. We try to make sure our fact-finding and ESG education efforts are carefully calibrated. In our interactions, we share our understanding and experience in ESG research with the companies without imposing too much of our expectations on them. Among the characteristics of China’ corporate world are unique management cultures and often a high degree of family or state ownership. Thus, by respecting the circumstances of an individual company, we aim to build long-term relationships where communications can be open, honest and purposeful. We think it’s also helpful that our discussions are always conducted in Chinese.

In addition to our own engagements, we partner with expert engagement specialists, BMO Responsible Engagement Overlay (REO) to improve the breadth of our engagement activities and to leverage our voice with other shareholders to elicit positive change. REO establishes collaborative engagements on a long-term plan with pre-defined objectives and milestones. This allows us to exercise greater influence, together with other BMO clients, than the size of our holdings would otherwise permit.

Smart exchanges with Chinese smart phone maker

Our dealings with a mobile phone manufacturer is a case in point. At first sight, the company with Chinese and African production facilities and global reach seemed to have all the necessary sustainability credentials: certifications on environmental management, quality management, occupational health and safety and data security and privacy management. However, during our detailed analysis, we found that its ESG disclosure is sub-optimal, partly because the company only went public in 2019 on the Shanghai Stock Exchange. Thus, we could not conclude if there are adequate processes in place should negative events arise from risk exposure. Furthermore, the US-based index provider MSCI flagged questions surrounding labor-related risk and copyright violations during the past five years. We decided we needed to engage with the company for two purposes: 1) fact-finding on topics such as supply chain due-diligence, ethical sourcing of raw materials, and business ethics; and 2) to encourage the company to improve ESG disclosures.

We held a conference call with the company’s investor relations (IR) representatives in late 2021. We reiterated our concerns on the lack of transparency and explained that adequate disclosure helps investors to evaluate its future financial position in relation to its exposure and management of operational risks. Company’s IR provided explanations on causes and subsequent resolutions on past controversies and shared insights on current processes that have been put in place for better management in these areas. At the end of the meeting, the company reassured us that publishing an ESG report will be made a priority. Given the company’s strong financial fundamentals, leading industry positioning and its commitment to make improvements in management of material ESG topics and transparency, we initiated an investment position in the company.

In February 2022, the company approached us for suggestions on the breadth and depth of disclosure in their upcoming ESG report, which was subsequently published in April 2022. We found significant improvement in ESG disclosure. Policies and programs have been established to strengthen its oversight mechanism on data privacy, supply chain and business ethics management.

Investors can help improve companies’ ESG profile

At this point, we believe a milestone has been reached for this engagement case. But this is not the end of our work. Given the company is one of the largest mobile phone manufacturers globally, helping it to improve its ESG practices could have an impact on the wider industry. We will continue to engage with the company on various subjects including low-carbon transition, improving e-waste program and board diversity.

Our current engagement approach has enabled us to gain insights on material issues of China A shares companies. We continue to develop and formalize our own engagement approach, from merely fact-finding to establishing long term relationships with purposeful dialogues, expressing our opinions on subject matters, and setting clear objectives for investee companies on their journey in ESG management.

Important Information

Companies discussed for illustrative purposes only and should not be considered a recommendation to purchase, hold or sell any security. No assumption should be made as to the profitability or performance of any company identified or security associated with them. Certain information herein may include projections or other forward-looking statements regarding future events or future financial performance of countries, markets and/or investments. These statements are only opinion and actual events or results may differ materially, as such, undue reliance should not be placed on such forward-looking information. Vontobel reserves the right to make changes and corrections to the information and opinions expressed herein at any time, without notice.