3 reasons to allocate to emerging market equities

Conviction Equities Boutique

Key takeaways

- Emerging market (EM) equities have trailed their developed market (DM) counterparts for the past ten years.

- Lower earnings growth has been the main driver of this underperformance, meaning EM equities now trade at a significant discount to developed market stocks.

- Potential for stronger earnings growth, particularly in Asia, along with a widening differential in emerging versus developed market real GDP growth could be a catalyst for the re-rating of global EM.

- Today’s below-average allocation to EM equities could see significant sums flow into the asset class should this trade reverse.

‘Would you like the good or the bad news first?’ is a phrase that is used a lot, and in keeping with my own preferences I will start with the bad news for those that have been invested in global emerging markets. EM equities have significantly underperformed their development market counterparts for the past 10 years. In fact, over the ten-year period to end September 2022, the MSCI EM Index return of +2.4% p.a. pales in comparison to the MSCI World and S&P 500 Indices, which have returned +10.1% p.a. and +13.2% p.a. respectively.

Now that we have ripped off the band-aid (ouch!), the most important question to ask from an investment perspective is: Does it make sense to allocate to EM equities today and what can we expect in terms of future returns?

In this brief article, we set out some of the key reasons we believe an allocation to EM equities continues to make sense and why we believe it is more important than ever for investors to employ an active approach.

Reason 1: Compelling valuations

For many of us, this is the most complex market environment we have experienced in our working lives – spiralling levels of inflation, conflict in Europe, and a cost-of-living crisis sparked by soaring energy costs. These events are not unprecedented, but they have not impacted us for a considerable period, let alone at the same time. Amid the market chaos, it is difficult to stand back and consider the fundamentals. However, let’s take a moment to do just that and, given that an investor’s entry point will ultimately determine how profitable a trade turns out to be, there is no better place to start than valuation.

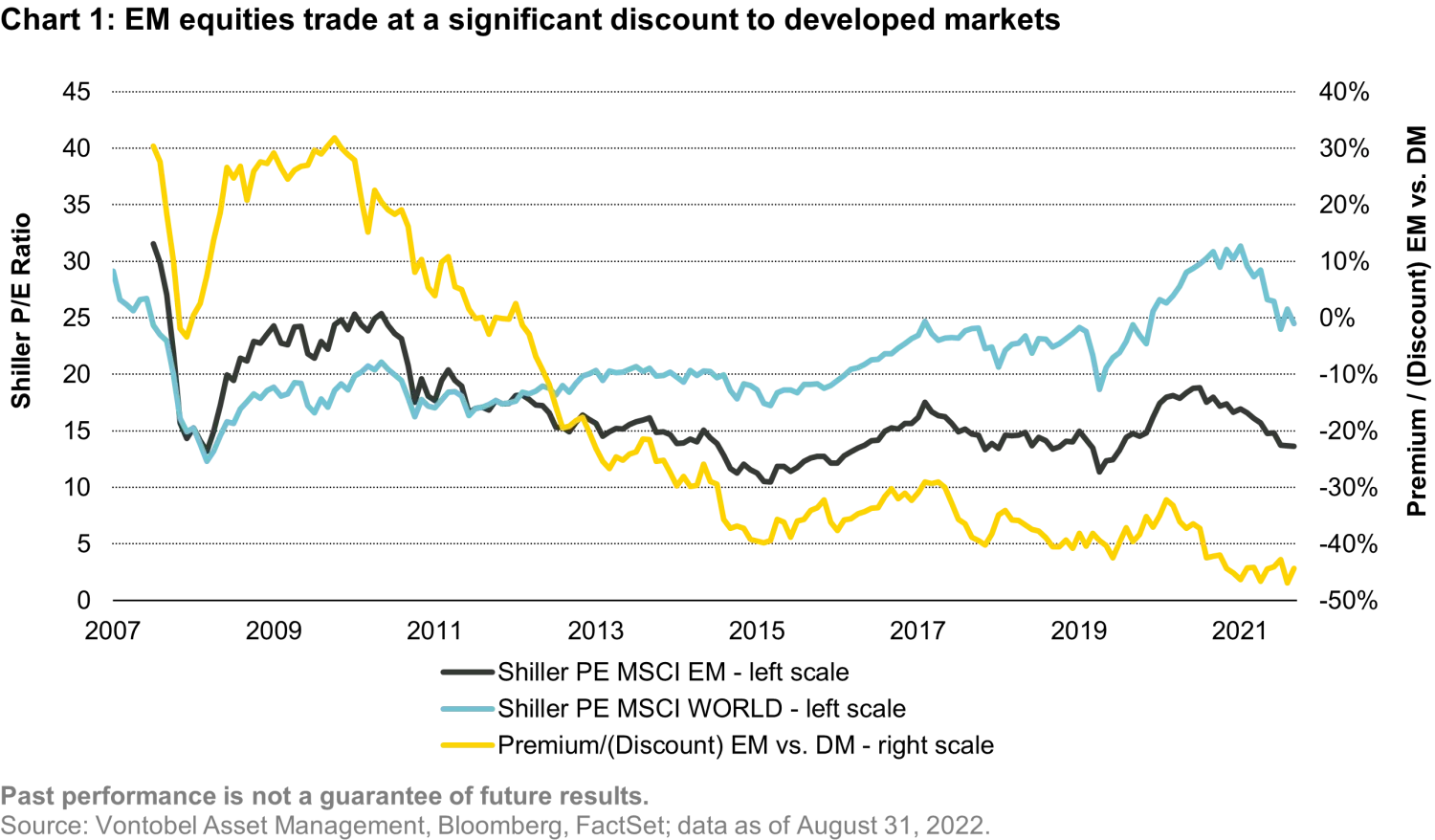

It is hard to believe that EM equities once traded at a significant premium to developed markets, but that is exactly what happened at the end of the commodities super cycle from 2000-2011. That premium has since evaporated, and the asset class now trades at a 44% discount to DM equities based on Shiller P/E – the cyclically adjusted price-to-earnings ratio which adjusts ten years of earnings for inflation. While Shiller P/E holds no predictive power for returns over the short term, the ratio can be a powerful indicator of long-term returns and as such should not be ignored.

Reason 2: Uplift in Asian earnings and GDP growth

EM equities represent compelling value on a relative basis for a very good reason. In general, earnings growth for EM corporates has been much weaker in comparison to developed market corporates. For example, earnings growth for the MSCI Asia ex Japan index fell from 13% during 2000-2010 to 7% during 2011-2021. This begs the question: What happens to earnings going forward and what impact could this have on returns?

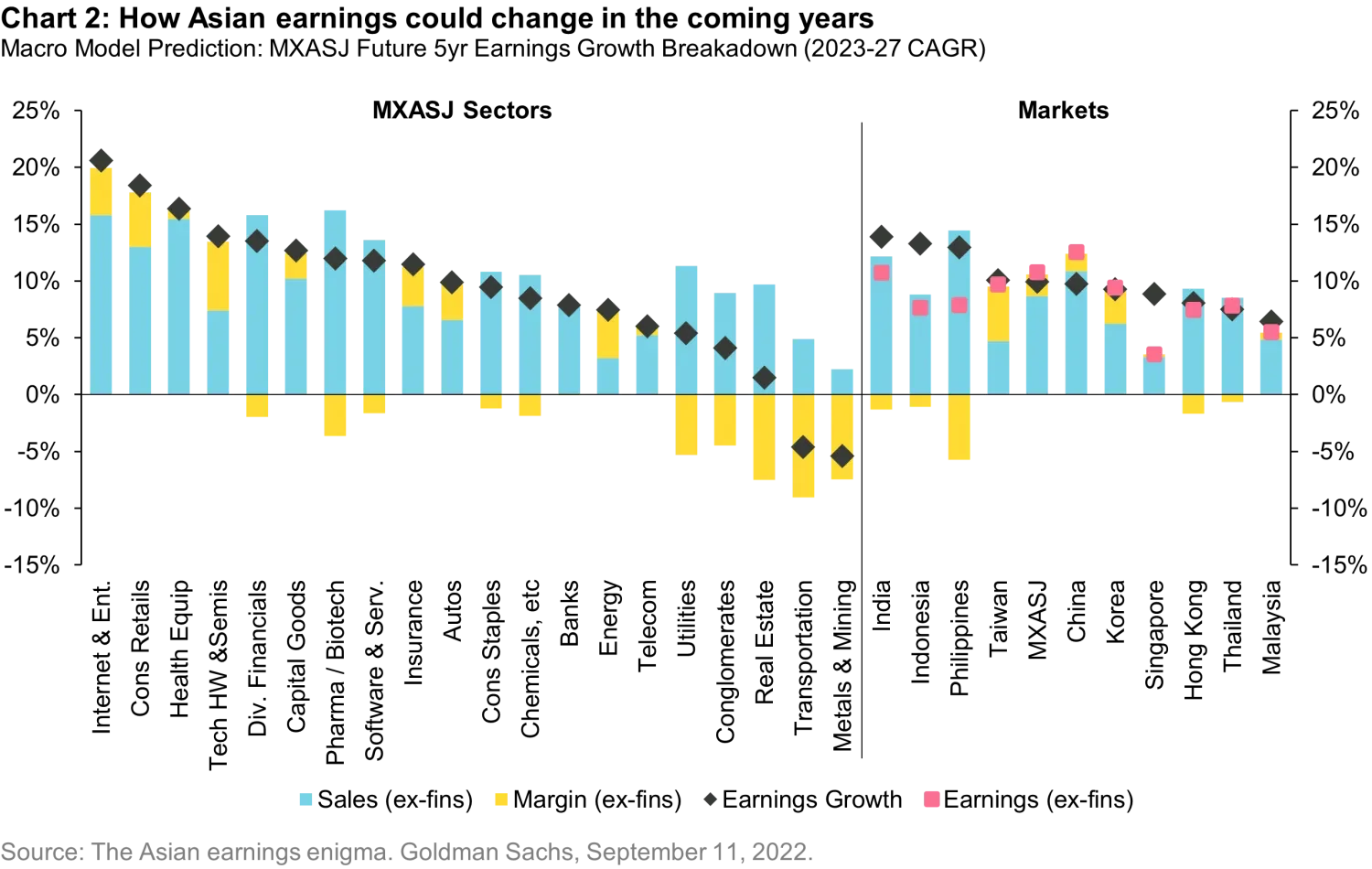

An earnings model devised by Goldman Sachs, which analyzes fundamental data by sector and macro data by country, estimates that earnings growth in Asia could increase to 10% p.a. over the next five years. This would represent a considerable increase in earnings from the 2011-2021 period, which could spur a period of valuation expansion for Asian equities, which in turn would lift global emerging markets.

Supporting this potential growth in corporate earnings is the forward-looking differential between emerging and developed market real GDP growth. While this differential is estimated to fall below 1% in 2022, it is expected to widen again significantly in 2023. According to JP Morgan estimates, real GDP growth in emerging markets could grow to 3.2% in 2023 compared to just 0.9% for developed markets. This widening of growth differential is emanating from China and EM Asia, which are expected to grow by 4.6% and 4.1% in 2023 respectively.

Reason 3: Moving from ‘out of favor’ would mean significant inflows

Finally, emerging market equities are currently under-represented in the average investor’s portfolio. According to JP Morgan, global investors currently allocate 6.4% to EM equities, which is significantly below the 20-year average of 8.9%. A change in sentiment and reversion to this long-term average would represent inflows of almost US$750 billion. Investors moving to a neutral or overweight position to EM equities earlier than the herd would obviously reap more reward should such a reversal in sentiment take place.

Conclusion

Investors in EM equities have endured a difficult ten years. However, as investors we need to look forward and there are reasons to believe that the asset class is set for a brighter next chapter. Relative valuations appear attractive while earnings are potentially set to rebound in Asia at the same time as GDP growth will be much faster than the developed world. Given these factors, and the fact that EM equities are currently underweight in the average investor’s portfolio, we believe emerging market equities are on the road to recovery and any further short-term pain will be outweighed by the opportunity for longer-term gain.

Important Information

The views herein are those of Vontobel and may change at any time and without notice. Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, Vontobel cannot guarantee the sources’ accuracy or completeness. Such information is not intended to predict actual results and no assurances are given with respect thereto. Some of the information provided may contain projections or other forward-looking statements regarding future events or future financial performance of countries, markets and/or investments. There is no guarantee that any such future events will come to pass and actual events or results may differ materially.

Past performance is not an indication of future results. Indices are unmanaged; no fees or expenses are reflected; and one cannot invest directly in an index.