Fixed Income Boutique Outlook 2023: A smooth touchdown, or a bumpy landing?

Fixed Income Boutique

Key takeaways

- History gives us comfort that we are starting the year in a better position than in 2022.

- Inflation – and how fast it will shrink – is the big question mark in 2023.

- China’s reopening and the expected slowdown in rate hikes will support emerging markets bonds and bode well for investing in developed markets corporate credit.

A smooth touchdown, or a bumpy landing?

2022 was a tough year for bonds. While the world around us remains very uncertain, I am coming to the view that investing in fixed income may not be a bad place to be as we enter 2023. We all know that we are in a unique situation. Last year was only the third time in a century when both bond and equity returns were simultaneously negative. If we look at the two previous times when this happened – i.e. 1969 and 1931 – they both share one key detail: the decade that followed led to significant growth challenges. In the 1930s we had the Great Depression, while in the 1970s we had to deal with stagflation.

We don't want to underestimate that we're in a difficult position and that we have been here for quite a while. The good news, though, is that whenever there is a risk of recession or slower growth ahead, I don't feel too bad owning bonds. The only big question mark I see in the year ahead is inflation and how fast it will come down.

Let history be our guide here. If we look back to inflation trends since 1970s, we find that reverting to 3% – i.e., an acceptable inflation level – from 4% is easy. But history has shown that it gets increasingly harder to switch back once inflation creeps up above 6%. Once it’s above 8%, it may take up to 20 years to revert to 3%.

We may have to brace for a lengthy, bumpy road ahead after the golden era of low inflation and near-zero interest rates we enjoyed in the past two decades. Now that we have taken all these history lessons in, what’s in store next?

How to navigate future returns for bonds in volatile markets

To navigate the year ahead for fixed income investing, let’s use the analogy of an aircraft cockpit. First, if you want to know where you are going, it helps to know where you've come from.

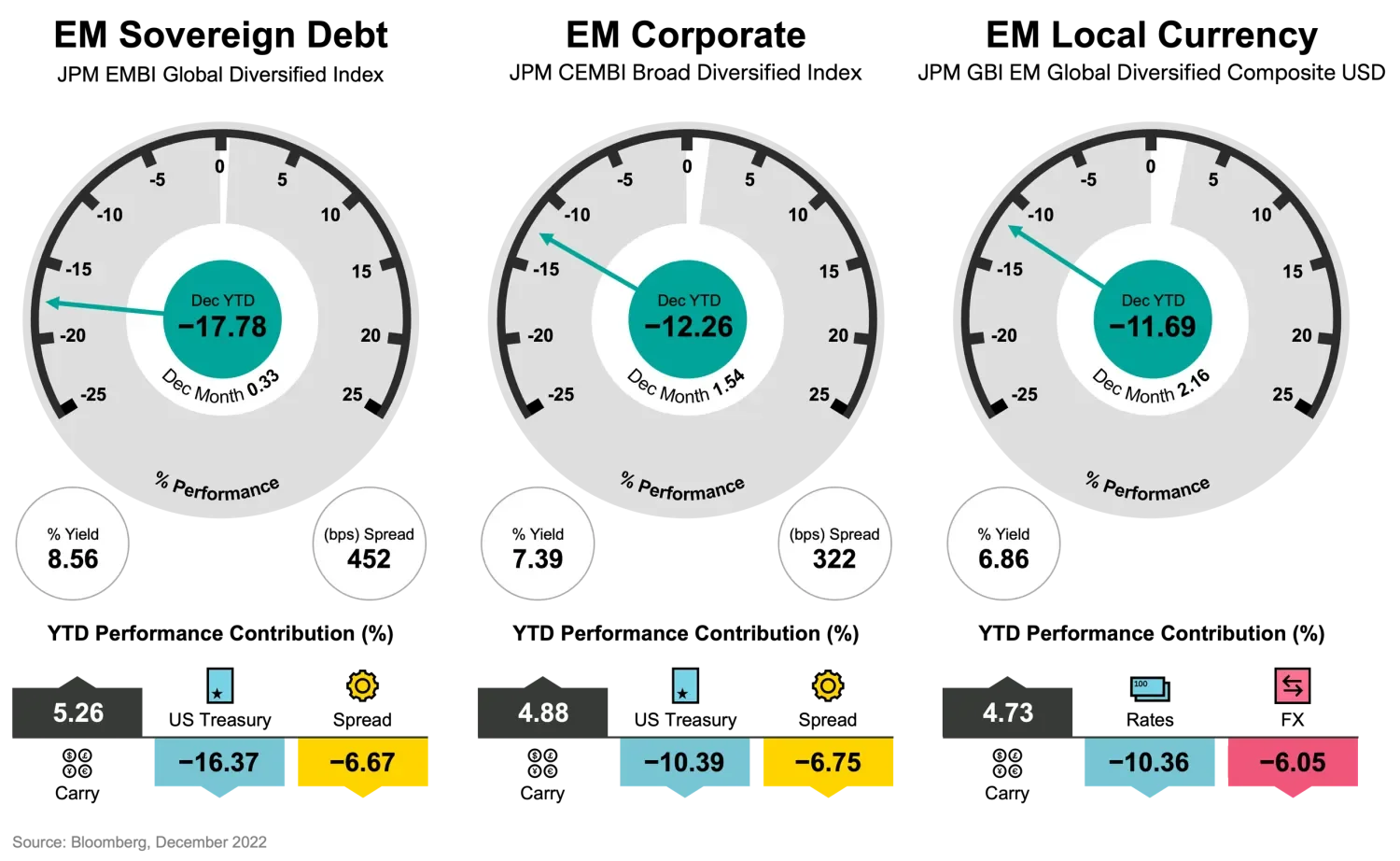

Below we have decomposed the returns of three emerging markets asset classes: sovereign debt, corporate and local currency.

Broadly, let’s analyze how we got here. Performance is a product of the three engines of bond returns. Carry is your protection: there was not enough in 2022, but it’s being rebalanced. This year’s yields are higher, meaning there will be more protection in 2023.

The US Treasury engine faltered last year and detracted from returns as central banks hiked rates because of inflation. Finally, spreads. They reflect risk premium and they widened in 2022, so this engine also detracted from returns.

As an example, let’s take emerging markets sovereign debt on the left. It was down almost 18% in the year to December 2022. What were the reasons for this performance? Once we look at the three engines of bond returns, we can see that carry was 5.26%, and US treasuries were down 16.37%. And then, spreads detracted from returns as they widened -6.67%.

Now that we know where we have been, it’s time to ask where we heading to this year. The good news is on the left-hand side of the dial: we actually have a yield of 8.56%. And what history tells us is that the starting yield is a great predictor of strong returns.

Let’s consider US treasuries now, which also faltered in 2022 and detracted from returns as rates rose to squash inflation. Central banks around the world are in a difficult place – it’s just like trying to find the right temperature on the shower dial. If they do too little, it's not going to be enough, they're going to be cold. If they hike rates too much, they're going to burn themselves.

In my view, 10-year treasuries will have a lot of volatility, because inflation will be one of the key factors in 2023. We know that if inflation falls, you get significant returns, but if it goes up returns will shrink. Given the uncertain and ambiguous nature of the current environment, while there could be significant up-and-down yield moves, I’ll stick to my forecast that 10-year treasuries will end the year where they started.

On the last engine, i.e. spreads, a lot has been priced in because we are all aware of the uncertainties that lie ahead. I think spreads could probably rally about 50 basis points just on the fact that we have less uncertainty. So, we have 8.56% from carry, flat returns from treasuries and then 50 basis points. This means investors could potentially get about 12%, in my view.

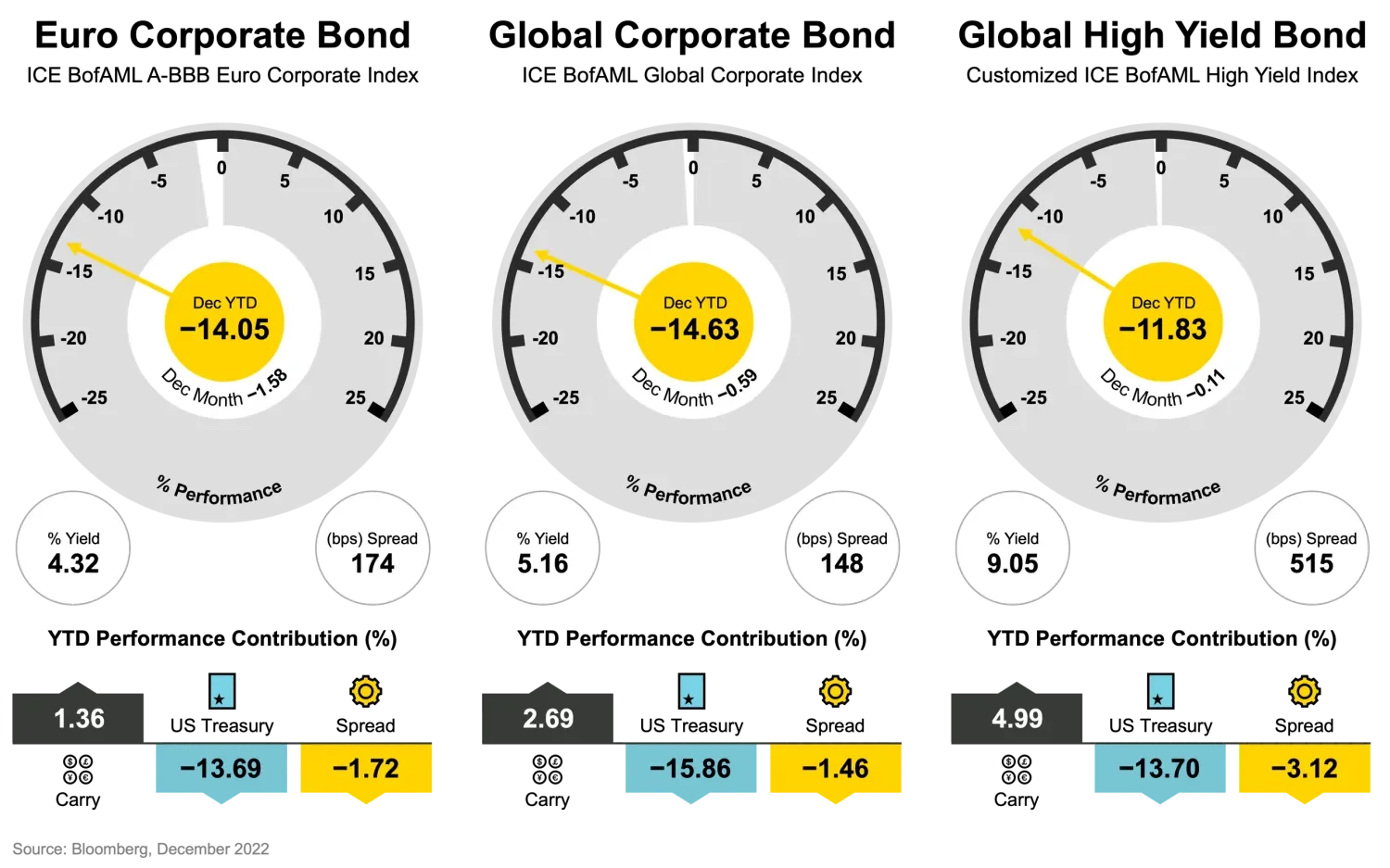

Now, you don't have to agree with my numbers, but you could apply the same reasoning to developed markets corporate bonds, as shown by the cockpit below, by now understanding where you have been.

What’s the path ahead for bonds in 2023?

Looking back to previous cycles, it’s rare that bonds will give you negative returns two years in a row. We know the world is still uncertain. Inflation will continue to grab headlines in 2023. The good news is there have been adjustments in the market and yields are higher, so history gives us comfort that we are starting the year in a better position than in 2022.

In this Fixed Income Boutique 2023 outlook, the team heads reveal how they are going to find opportunities in the challenging times ahead.

The tide is turning for emerging markets fixed income, says Luc D’hooge, Head of Emerging Markets Fixed Income, who has spotted multiple green shoots suggesting this year could be more positive for the asset class. After a difficult year with high volatility, valuations are out of line with fundamentals, offering opportunities for active managers.

Mondher Bettaieb-Loriot, Head of Corporate Credit, sees central banks becoming less hawkish this year, which bodes well for snapping up the attractive coupons available now and lock in investment income for years to come.

I’m sure you will find our insights of value as you position your portfolios for the new year. On behalf of the whole Fixed Income Boutique, I wish you a prosperous 2023.

The tide is turning for emerging markets bonds in 2023

Looking back to 2022, financial markets have had one of the worst years in several decades across all asset classes. Sentiment toward emerging markets bonds was bleak until mid-October. This is not surprising, given that the repricing of interest rates, combined with the conflict in Ukraine, has been deeply negative for risk assets in general.

Investors got tired of this extremely long correction and opted to sit on the sidelines, frightened by a complex inflation outlook and ongoing continuous outflows, while valuations became extremely tempting.

These were perfect conditions to create an impressive market turn. Even including this strong recovery of 8.1% over the last quarter of 2022, the JP Morgan Emerging Market Bond Index Global Diversified was down 17.8% over 2022, the worst year since 1994. As we enter 2023, there are multiple signs suggesting that this could be a more positive year for this asset class. We believe there are important reasons why investors should consider switching back to emerging markets bonds now.

Rally in emerging market credit

Fixed income markets, and in particular emerging markets, have recently experienced a wave of optimism.

Although the US Federal Reserve is not done hiking yet, we are less likely to encounter hawkish surprises in 2023 as disinflation has already been ongoing for several months.

The Fed’s new dot plot has confirmed what markets already knew: the central bank intends to hike rates to around 5% and then pause to see how the economy and inflation react after their aggressive tightening. Yet, the labor market continues to create jobs at more than twice the pace consistent with the rate of working population growth. As a result, we continue expect a likely late rather than imminent recession in the US, which should allow the Fed to hold rates at around 5% for longer than the market is currently pricing in. Hence, we remain slightly cautious on duration.

More positive signals are coming from China, after the government moved to ease its zero-Covid policy and provided support measures for its housing market. As a result, the JP Morgan Corporate Emerging Market Bond Index Broad Diversified (CEMBI BD) rallied 6.9% in the last two months of 2022 and continued to rally in January, leaving investors with more confidence about the new year.

Emerging markets bonds do offer higher yields

Investing in emerging markets bonds is sensible for several reasons. Firstly, the asset class currently has attractive valuations. After a difficult year with high volatility, valuations are out of line with fundamentals, which offers opportunities for active managers to outperform in this inefficient asset class.

The various emerging markets bond segments offer a significantly higher yield than their developed markets counterparts. For example, emerging market corporates and local-currency bonds have a yield of 7.4% (JP Morgan CEMBI BD) and 6.9% (JP Morgan Government Bond Index-Emerging Markets Global Diversified) respectively, while emerging market hard currency sovereign debt offers a yield of 8.6% (JP Emerging Market Bond Index Global Diversified). By comparison, the yield for 5- and 10-year US treasuries is less than 4%, and just 2.6% for German bunds.

Secondly, the fundamental data for emerging market bonds are often stronger than those from developed markets. For example, emerging market corporates are less net leveraged compared to the US and European corporates.

Local currency bonds have also been rebounding and returned 9.4% in the last two months of 2022, outpacing their hard-currency emerging markets sovereign counterparts (+7.9%). Their performance is due to multiple drivers. The tightening of monetary policies by central banks in emerging markets has been more aggressive and timelier when compared to developed countries, while the US dollar is deflating as the Fed’s hiking cycle is reaching its end. Moreover, better growth prospects than developed markets, as well as long-term improvements in current accounts, make these countries more resilient against external shocks than in the past.

As 2023 gets under way, we see a solid case for emerging markets local currency bonds as a further diversification segment within the emerging markets asset class.

Last, but not least, there is a high level of diversification in emerging markets. The over 700 issuers across 59 different countries in the CEMBI index offer even more diversification potential. Those countries tend to have different economic cycles and political characteristics. Companies in emerging markets can also have different ownership structures, such as state-owned quasi sovereign or private companies that are active in multiple sectors.

What does China’s reopening mean for emerging markets bonds in 2023?

We remain relatively optimistic about China’s reopening after the country relaxed its strict zero-Covid policy. It probably won’t be a smooth process, as surging cases may take a toll on the demand-side of the economy in the short term. But it is an earlier, faster, and more definitive reopening than most investors had expected, boding well for the country’s economic activity as well as the global markets in the medium term. This is particularly true for emerging markets, given that China is either the first or second most important trading partner for almost every emerging market.

What’s ahead for emerging markets bonds in 2023

Uncertainties around inflation and interest rates, geopolitics and a global recession will remain in the coming months. However, the 2022 selloff in fixed income markets appears to be behind us.

As European gas prices have shrunk back to their pre-war level, the chances of a severe recession in Europe have decreased further. Together with the European Central Bank’s newly found hawkishness, this should be bullish for the euro, which in turn tends to be correlated with a positive sentiment for emerging markets assets.

Fixed income tends to have an asymmetry in the potential performance outcomes. In the low yield environment, we had this asymmetry for years, meaning that bonds could drop more than they could potentially rally. This was a hurdle for fixed income and was supportive for equities.

With the strong pick up in yields, the asymmetry has become an important tailwind. Carry is creating a strong buffer against rising yield, and rather than a ceiling above potential returns, it provides a bottom under potential corrections.

Such asymmetry is not in place for equity markets, which are also still facing an uncertain economic backdrop, as companies’ pricing power is questioned while their costs increase. We believe that many investors will rebalance their assets in favor of fixed income, especially in the US where pension funds are heavily invested in equities. With its potential for high returns, emerging markets fixed income is probably a good alternative for them.

Technicals will also remain positive for emerging markets bonds

Emerging markets are not only facing better prospects in 2023 than most investors would have thought back in October, but the technical picture is quite positive.

What do we mean by this? In bond trading, technical refers to the relative supply of demands of specific bonds – the price of a good will increase if demand rises while the supply remains constant, and vice versa.

What makes it technical is that the demand-supply equilibrium for a bond (or a category of bonds when talking about emerging markets fixed income more broadly) can change while the fundamentals, or the underlying desirability (risk-reward proposition) of the bond, remain constant.

How so? This year, it is estimated that about USD 55 billion emerging markets bonds will mature and outstanding bonds will also pay about USD 55 billion in coupons. This is cashflow that is returned to investors and therefore it automatically reduces investors’ emerging markets exposure. In usual times, this force has been more than sufficiently countered by new bond issuance.

In other words, typically, emerging markets sovereigns and companies end up issuing more bonds than what they end up amortizing and paying in coupons. This isn’t a debt time bomb.

On the contrary, this can be perfectly sustainable. Emerging market countries and companies are growing; thus debt ratios do not have to increase – and can even decrease – despite positive net financing (gross issuance minus amortizations and coupons).

In 2023, the picture is quite different: fiscal deficits have shrunk compared to the pandemic years on the back of strong growth so financing needs are smaller, and with yields still high debt management officers are still reluctant to tap capital markets unless strictly necessary.

Thus, on aggregate emerging markets are expected to provide more cashflow back to investors via coupons and amortizations than they are willing receive back via new bond issuance. This is a positive technical picture.

Additionally, most cross-over investors significantly reduced their emerging markets exposure through 2022 as the global economic outlook darkened and remain underweight today. Now that the emerging markets outlook appears less uncertain, many investors will probably seek to change their positioning – including those who have been long equities and short bonds for over a decade. As a result, there will be more money pursuing fewer existing emerging markets bonds for a little while.

Capital markets may open even for frontier markets sooner than we had thought

One of investors’ main worries back in mid-October was that there could be a wave of emerging markets sovereign defaults because capital markets were closed to high yield issuers. Therefore sovereigns would eventually have to default if they were unable to rollover their upcoming debt maturities.

Our counter argument had been that most frontier markets did not need to refinance in 2023 and could wait until 2024 when financing conditions would be more favorable. This is particularly true for most sub-Saharan African sovereigns, which have been quite pro-active in their debt management. But it seems like some sovereign may not have to wait so long to return to the markets.

In early January, Mongolia issued a new bond to roll over its short-term maturities with a yield of less than 9%. This may still sound like an elevated borrowing cost, but we must bear in mind that this was a distressed sovereign with no market access and with yields reaching 13% in October. It was still trading at 10% the business day before they issued. Investors just had to believe that they had market access.

True, things have improved for Mongolia since then thanks to China’s reopening, but that’s also the case for most emerging markets. This point is important because the reopening of capital markets for frontier markets more broadly would drastically reduce default risks.

The ongoing positive developments in China and the markets taking comfort from the expected slowdown in the pace of interest rate hikes will continue to support emerging markets bonds going forward.

Easing rate hikes in 2023 mean now is the time to switch to developed markets corporate bonds

Overall, we are quite positive about developed markets corporate credit as we give way to 2023, turning the corner on one of the most challenging years for traditional investment strategies.

Less aggressive moves from central banks

Looking at the macroeconomic angle, we had identified that central banks would become less aggressive with rate hikes this year – and this is now substantiated.

US Federal Reserve Chair Jay Powell made a compelling statement when he noted in November that “at the end of the day, people do not borrow at Fed fund rates. They borrow at bank rates.”

If, for example, the Fed reaches a benchmark peak of around 475 basis points by February, the average American would borrow money from banks at rates of at least 6%, which is expensive and meaningfully restrictive. For credit cards, the rate would be even higher. This means that the consumer should start to be significantly squeezed.

Hence the impact of the Fed committee’s actions is already becoming visible. The weakness in economic activity will spread more broadly and with a lag, and this is also why lower employment, lower money creation and lower inflation should follow suit – which represents our base case. Our expectation is that the Fed will soon pause and start cutting rates again towards the year end and this should end up being supportive for the US and global economy and our markets.

In the European area, on the other hand, the prospect of a mild recession remains higher with the risk of a policy mistake increasing. Inflation in the European area is different than in the US: it seems stickier and is essentially non-core (i.e. around 70% food and energy). So, is it really stickier? This is where the dilemma lies. As it is non-core, it is unlikely to stick for a very long time, however, as we believe the food and energy inflation base effects will soon become more favorable from the second quarter.

The rapid acceleration of energy and food prices in 2022 should reverse from the second quarter of 2023 and should result in lower annual prints. Nevertheless, the European Central Bank’s governing council seems unlikely to take any chances on this. Our peak ECB rate has moved up and is now envisaged in the region of 2.75% to 3.0%, with the ECB also likely to reverse course come the year end.

Investment grade credit spreads seen stabilizing and narrowing 20 to 30 basis points

The limited hikes expected in 2023 are already priced in and should bring yield stability, which in turn results in credit spread stability. Credit spreads in the European Area are also close to recessionary levels and are pricing in a lot of weakness.

When adjusted for very solid credit fundamentals, we think credit spreads may have already reached their peaks for this cycle, as credit metrics are much stronger than during the Covid pandemic. For example, leverage both in the US and European Area is much lower today (in the region of 2.0 times compared with just over 3.0 times during Covid) with spreads not too far away from peak-Covid levels. In other words, the spread for one turn of leverage has been more elevated, and this is not justified in our view.

Earnings revisions should be lighter in 2023

Sentiment is not crumbling either, pointing to a more positive scenario as the change in the interest-rate trend takes shape – i.e. rates rising by smaller increments and less aggressively.

Even though PMIs are expected to cool off over the next twelve months, we do not forecast a collapse in earnings. As a result, earnings revisions should be lighter than forecast from now on.

We made this our base case as US consumption, whilst likely to get squeezed, should still enjoy some support from the lower gasoline prices. Considering that the employment picture there should remain quite resilient despite being weakened by the Fed hikes, the case for a soft landing in the US remains alive and well.

For the European area, the risk of a wage spiral in the euro area is rather contained compared to the US. European inflation is essentially non-core leading to just a mild recession. In addition, Germany, France, Spain, Italy have all announced fiscal offsets to shield consumers from the food and energy price burden, and European gas prices are now declining considerably to pre-Ukraine war levels.

We also note that earnings revisions have held up, helped – among others – by a very strong banking sector that should enjoy record net interest income in 2023 without much higher provisions. European banks have not fully consumed the provisions set aside during the Covid pandemic – as these were not fully released back, but rather prudently kept by management teams.

All these factors should ensure that credit spreads remain quite resilient and well supported as we progress into 2023.

In fact, we think both European and US corporates have not been this attractive for a very long time, with higher yields and higher spreads offering great coupons for their current relative credit fundamentals.

Technicals stay supportive on better rates visibility

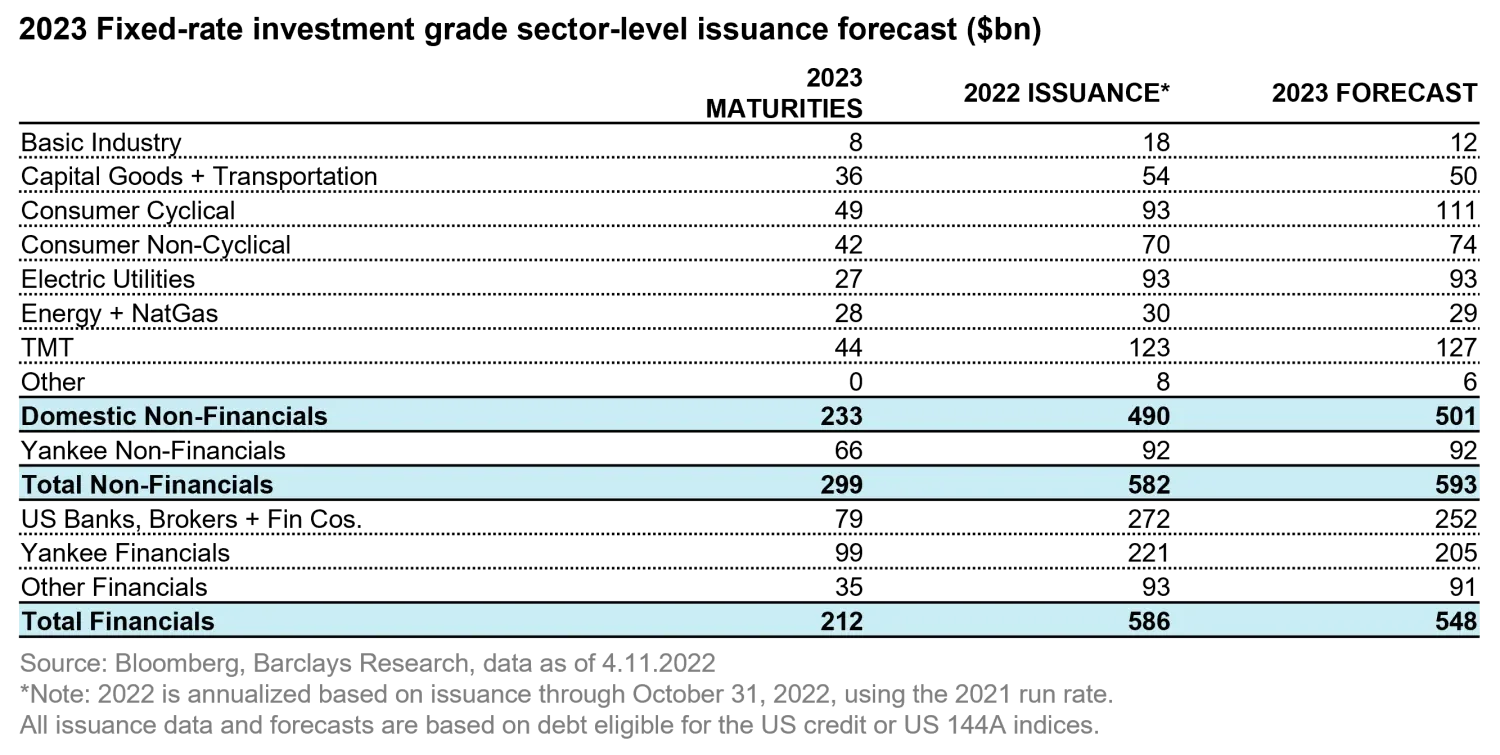

The credit markets’ technicals also remain supportive. The ECB continues to re-invest its corporate book, or at least part of it, and it is still creating good demand. Indeed, even if one assumes that only half of the EUR28 billion maturing bonds in 2023 are re-invested, this is still good support for the euro corporate bond market. This is in comparison to an expected investment grade net supply of just about EUR40 billion for the whole year versus EUR54 billion in 2022 according to the table below.

There should be limited net financial supply in 2023 as financial institutions continue to carry hefty and unused deposit bases. From their side, industrial companies are also maintaining very large cash balances and are not fully spending their operating cash flows, and therefore their issuance levels would also decelerate.

For the US, Barclays reports that investment grade issuance should remain on a par with 2022 issuance volumes, or about USD 500 billion gross for domestic non-financials and about USD 250 billion for US banks – excluding Yankee financials, slightly down from the USD 272 billion seen in 2022.

As for the domestic non-financial volumes, the net supply forecast is just USD 325 billion with merger and acquisitions related supply of about USD 150 billion, which is well below the USD 210 billion average recorded going back to 2015.

In all, we believe the new issue market should stay quite open, due to the low expected issuance, and the more attractive credit yields that are on offer. In fact, the all-in yields have become quite enticing to investors in both absolute terms and relative to equities. Investors’ surveys point to a growing allocation to developed markets investment grade credit as they start their new year. And, in turn, this should create quite good demand and ensure the successful placement of new issues from fundamentally sound companies.

No longer doom and gloom in 2023

There are good reasons to be more optimistic about the state of the developed investment grade markets, as we believe there is still a path to a soft landing in the US.

The near-recessionary spread levels priced in our European area investment grade corporate bond segment are also very supportive, given the solid corporate credit fundamentals now.

We have also become more upbeat for our global high yield segment as it offers a solid entry point on nominal yield. This mean that the 2023 US treasury yield tightening plus the high carry offered should cushion against any eventual default losses there, and by a considerable margin.

Like their high-grade counterparts, high-yield companies entered the 2022 market downturn with good credit metrics (US and European area net leverage of between 3.5 and 4 times respectively). Their maturity wall for the next couple of years remains also quite light, making any bond-for-bond refinancing and bond-for-loan refinancing not that onerous. Besides, forward-looking high yield returns have generally been quite strong when the starting yield is as high as 8%.

In short, as 2022 gives way to 2023 there are grounds for hope and now really is the time to start building those positions and take an advantage of the great coupons that are on offer to lock in attractive investment income for years to come. And upside surprises can materialize, especially if inflation surprises and decelerates more rapidly than many anticipate and if quantitative tightening ends up ending naturally as the Fed ensures ample reserves for the US money market to function properly.

We choose to toast away 2022 on a positive note with two plausible upside surprises for 2023. We wish you a prosperous and safe New Year with developed markets corporate bonds.