Does the China stock market rally have legs?

Conviction Equities Boutique

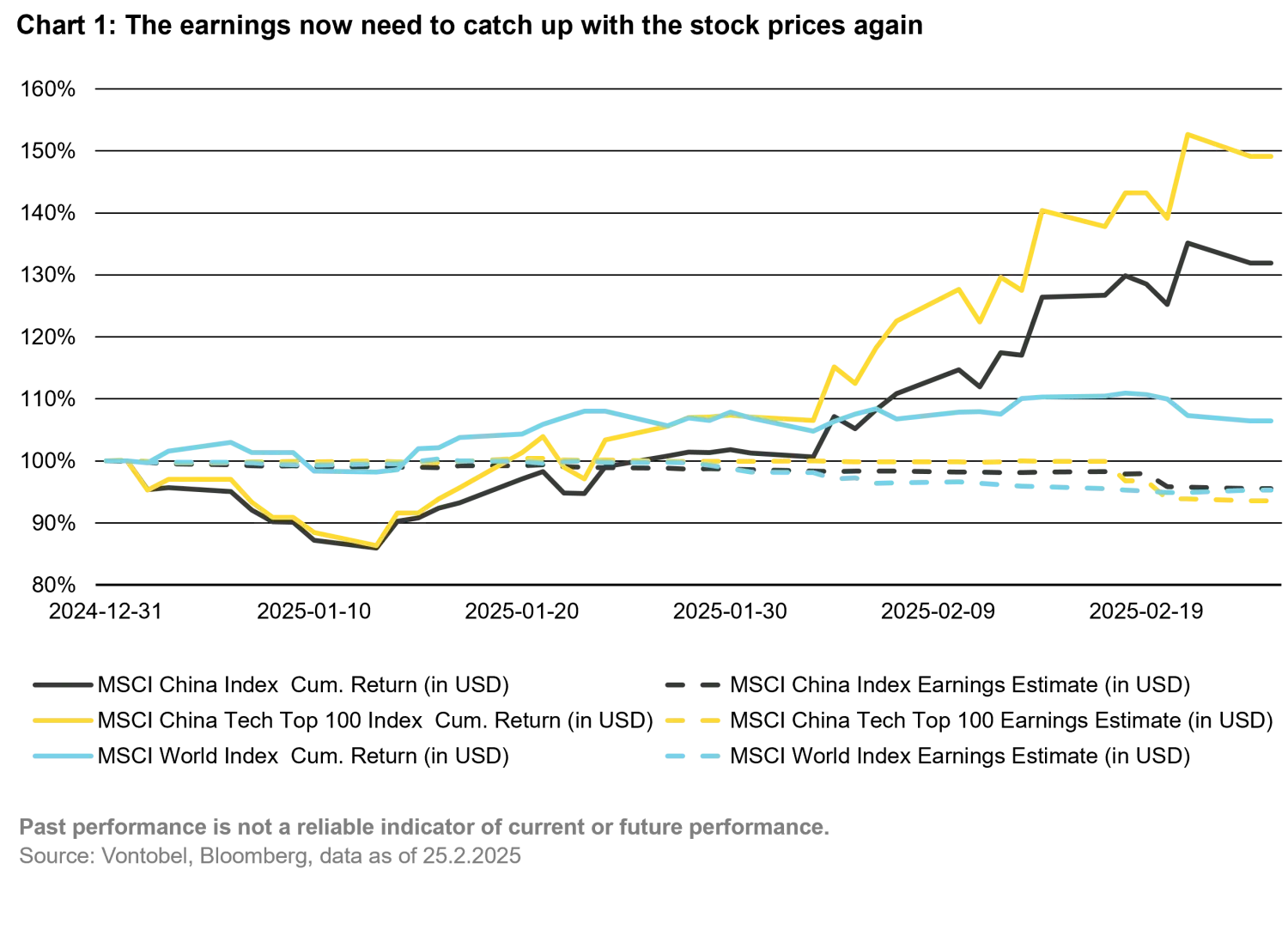

China has emerged as one of the best performing stock markets in the world this year so far, a development that is rather surprising given the common narrative that Trump's trade tariffs would have a negative impact. The driving force behind this unexpected performance is the Chinese tech sector, fuelled by market hopes that a larger adoption of Artificial Intelligence (AI) could potentially boost the earnings of these tech companies. It is noticeable that the recovery has not reached the broader market, with stock prices of companies from the old economy significantly lagging.

The question of whether this trend can persist and the reasons behind it is now being debated. It is fair to say that valuations, even following the recovery in recent months, are still reasonable and remain inexpensive in numerous market segments relative to their historical norms. Hence, it's unsurprising that Chinese stocks also responded positively to President Xi's meeting with tech industry leaders. This has bolstered investor confidence in the ability of China's private sector to spearhead technological innovation and, consequently, future earnings growth. From here, a confirmation of improved earnings from Chinese tech companies will therefore be needed to solidify and extend the recent rally.

From that perspective, it’s crucial to note that Chinese tech firms may still be awaiting their 'DeepSeek' moment. While AI adoption holds great potential, these companies still need to demonstrate that they can effectively monetize this technology, as it is also the case for US early AI movers. There are positive signs, for instance that more targeted marketing is driving better advertising and ecommerce revenues at Alibaba and Tencent, while cloud revenues are accelerating across the board where Baidu noted better margins and Alibaba generally expects higher margins from AI services. The challenge lies not just in integrating AI into their operations, but also in transforming it into a profitable business. As in the US, a greater adoption of AI requires large capital investments in hardware and software. There is a possibility that those investments could negatively affect profits in the short to medium term.

The US president issued the "America First Investment Policy" memo on February 21, potentially limiting US funds from investing in certain Chinese stocks. The memo suggests new restrictions on US pension and endowment funds investing in Chinese high-tech sectors like AI and advanced manufacturing. The impact on specific companies is unclear at this point, but those in the AI supply chain, including hardware, software, and internet firms, could be affected. The types of companies facing US investment restrictions are unclear. However, the memo's uncertainties could cause near-term share price volatility for HK and ADR AI-related stocks, as investors may take profit or offload positions for risk management.

Furthermore, we believe that the key to the continued success of Chinese stocks lies in the resurgence of consumer confidence and a sequential stabilization of the overall economy. This could potentially be triggered by further piecemeal stimulus measures. China needs to find a way out of the deflationary spiral, and this can only be achieved through stabilizing house prices. A support to domestic demand, clearly identified by the Chinese authorities at the end of 2024 as a priority for this year, has become even more crucial given that Chinese exports to the US are likely to be hit by increasing US tariffs during the course of the year. However, one should not overestimate the importance of exports to the US for the Chinese stock market. Listed companies in China generate about 85% of their revenues domestically. Therefore, the recovery of the domestic economy is of greater importance.

A potentially more supportive environment for tech stocks and the likely continuation of stimulus to boost domestic demand lead us to believe that companies at the intersection of these two developments, the recovery of private consumption and a broader and profitable application of AI, can continue to perform strongly in the months ahead. For example, platform companies, that provide technological tools and applications to other companies, could be in a prime position to benefit from such an environment.