Time to adapt?

Conviction Equities Boutique

The benefits of investing in climate mitigation solutions, such as renewable energy and the electrification of transportation, have been broadly discussed for some time. In comparison, climate adaptation is a less-known concept, defined by the Intergovernmental Panel on Climate Change (IPCC) as the process of adjustment to actual or expected climate and its effects. The concept of investing in adaptation solutions and technologies is growing in popularity given the increasing severity and frequency of extreme weather events, and the damaging toll these are having from a human, ecological and financial perspective. It is possible that this focus on adaptation could sharpen even further in the coming years, particularly given the recent change in administration in the US.

In this viewpoint, we take a closer look at the benefits of investing in adaptation solutions and the potential opportunities that it offers global investors. We also ask a very important question: how do the adaptation and mitigation opportunity sets compare in the listed global equity space? To answer this, we compare the holdings of a global adaptation basket of stocks with the opportunity set for the Vontobel Global Environmental Change (GEC) strategy. More on the details later, although the spoiler alert is that there is a healthy level of overlap!

The consequences of rising temperatures

According to the World Meteorological Organization (WMO), 2024 was the warmest year on record at about 1.55°C above pre-industrial levels1. Indeed, WMO data confirms that the past ten years (2015-2024) have been the ten warmest on record. This clear trend in global warming brings with it a host of vital considerations, including the pace of investment in climate mitigation (are renewable energy sources being built and connected to the grid fast enough?) and mankind’s ability to adapt to this new reality of living on a hotter planet.

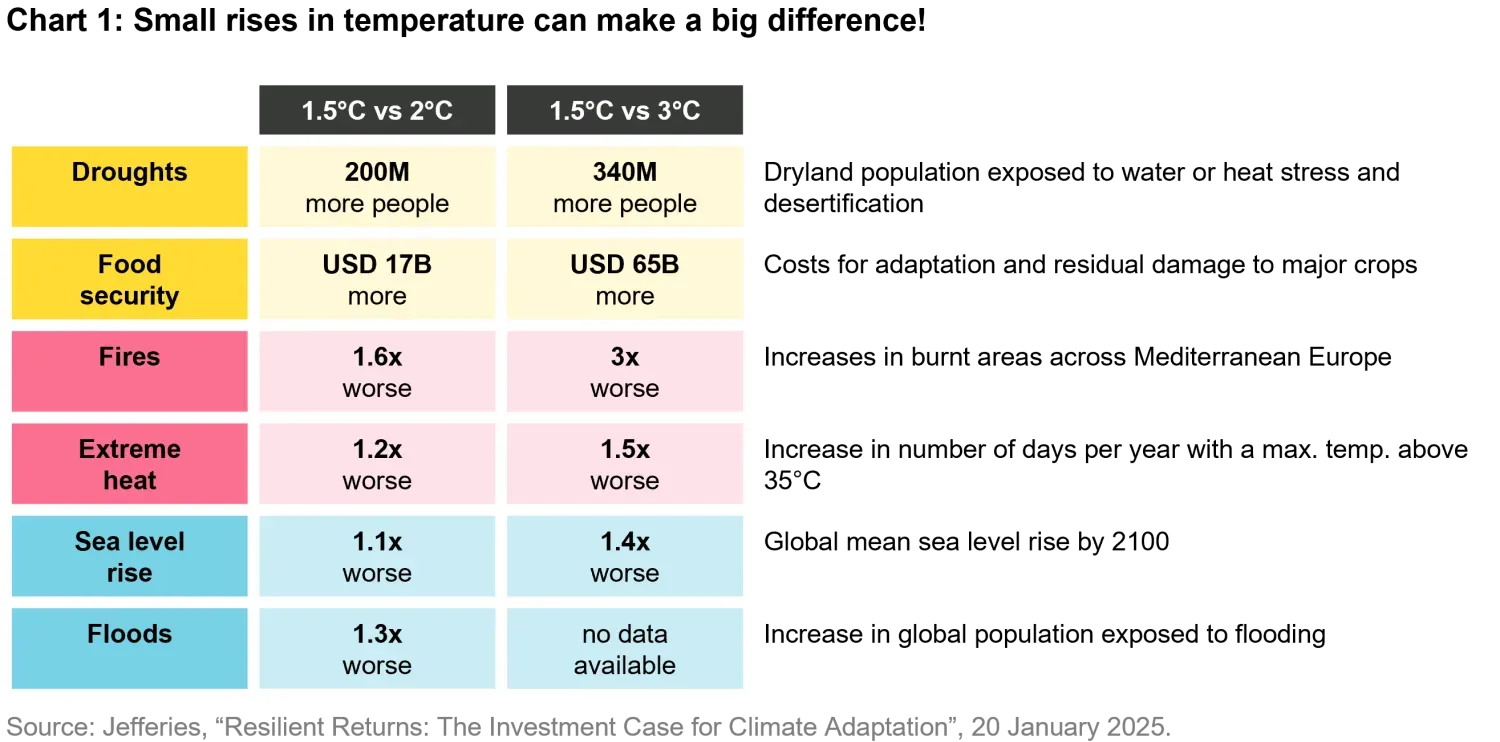

A warmer climate contributes to a myriad of problems, including higher intensity of extreme weather events such as heatwaves, droughts and wildfires. Melting ice and thermal expansion/warming of the oceans is another significant problem, increasing the volume of seawater that is coming onshore during storms and causing serious flooding damage. In an alarming statistic, the Swiss Re Insurance group warns that a global temperature rise of 3.2°C by 2050 could wipe as much as 17 percent from global GDP.

More important than the financial cost is the human toll of climate change, with millions forced to leave their homes every year. The Internal Displacement Monitoring Centre (IDMC) estimates that extreme weather events are triggering more intensive and frequent displacement of people around the globe. IDMC estimates that over the past ten years, there has been an average of 21.9 million movements of people each year linked to weather-related hazards2. This is not just a problem isolated to the developing world. The US Census Bureau found that almost 2.5 million people were displaced in the US during 2023 due to extreme weather events, including tornadoes, wildfires and hurricanes3. The wildfires in Los Angeles in January 2025 were an unfortunate reminder of the large scale that these events can take.

The benefits of adaptation

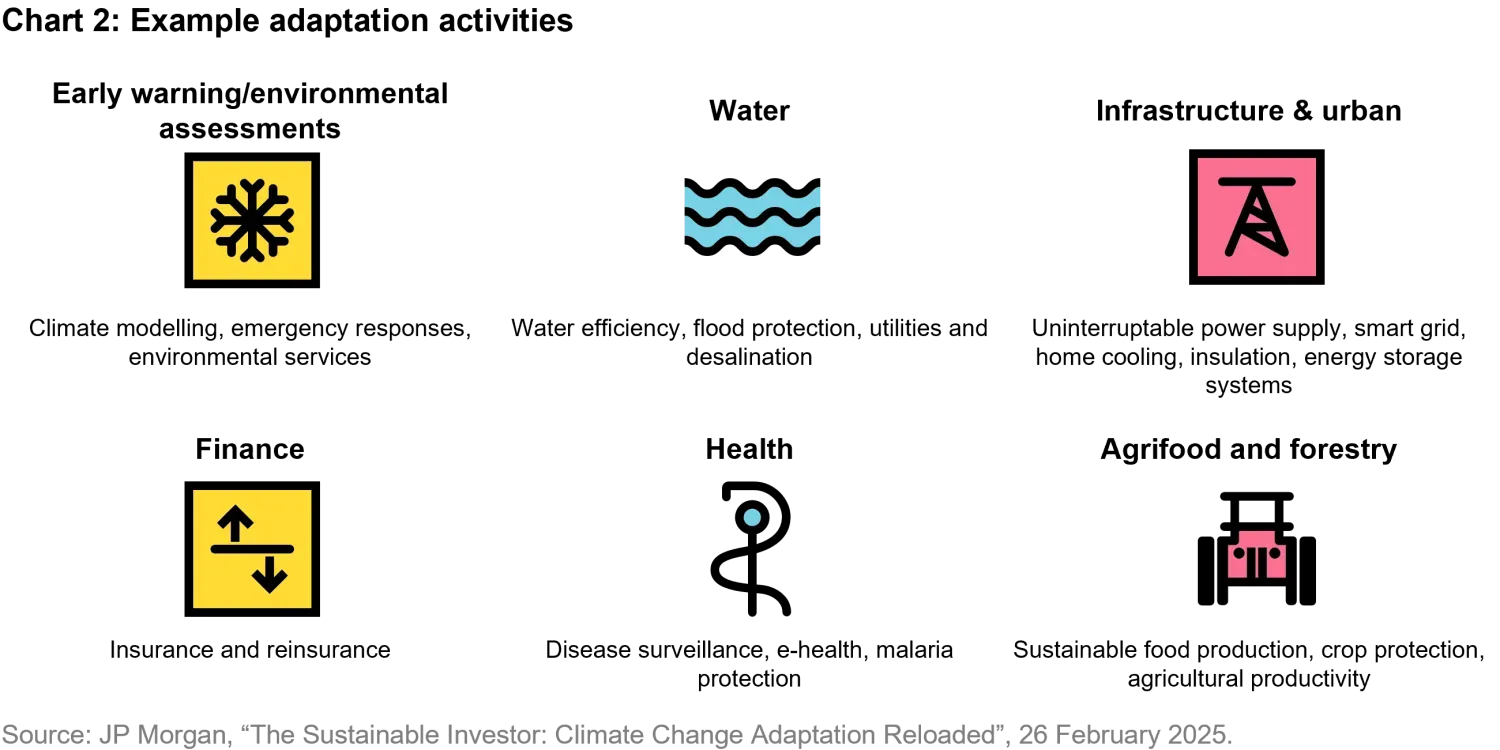

We believe there are good reasons why investors should consider investing in companies that offer adaptation technologies and solutions. Firstly, solutions in this space may be able to reduce exposure and vulnerability to climate impacts by building adaptive capacity, which is defined by the IPCC as the ability of systems, institutions, humans and other organisms to adjust to potential damage, to take advantage of opportunities, or to respond to consequences. An excellent example of this is the investments needed for a country’s vital infrastructure, such as energy grid networks, transportation, water and sanitation. Upgrading the resilience of these vital areas of infrastructure should enjoy strong support from both governments and local communities, particularly when extreme weather events highlight the weaknesses in the current structures. The decision from governments to support such investments is also less controversial given the positive real-time benefits they can provide to local communities, both in terms of security (think of investments in flood protection for example) and economic development. In comparison, mitigation investments are often seen as a public good where the benefits won’t be realized for many years to come (think of onshore/offshore wind farms) and there is a potential moral hazard/free rider problem from an economic perspective.

Indeed, climate adaptation features prominently in the political guidelines for the new European Union (EU) Commission's mandate. During its current five-year term, which runs until November 2029, the Commission aims to develop a European Climate Adaptation Plan to support member states when it comes to the implementation of adaptation measures in a smarter and faster way. The economics behind this EU initiative are summed up by a recent World Bank report, which estimated that adaptation costs in the EU could range between EUR 15bn to EUR 64bn annually. However, climate-related disasters are estimated to have cost Europe more than EUR 77bn in 2023, highlighting a need to invest now4. This global adaptation gap highlights interesting opportunities for investment, with adaptation ideas arguably providing a source of diversification away from the focus of traditional climate mitigation finance. That said, an investment case becomes even more resilient if a company’s solutions help address both adaptation and mitigation issues.

From an investment perspective, it is also becoming easier to identify companies that are producing adaptation solutions due to the increasing number of adaptation taxonomies that have been developed in recent years. For example, a recent analysis from the Global Adaptation and Resilience Investment (GARI) working group and the MSCI Sustainability Institute found that one in ten companies in a universe of approximately 8,000 publicly listed companies provide adaptation and resilience products and services5. This type of analysis suggests adaptation is a viable option for investors in the listed global equity space. It also brings us back to the question we posed at the beginning: how do these adaptation taxonomies compare to existing mitigation opportunity sets?

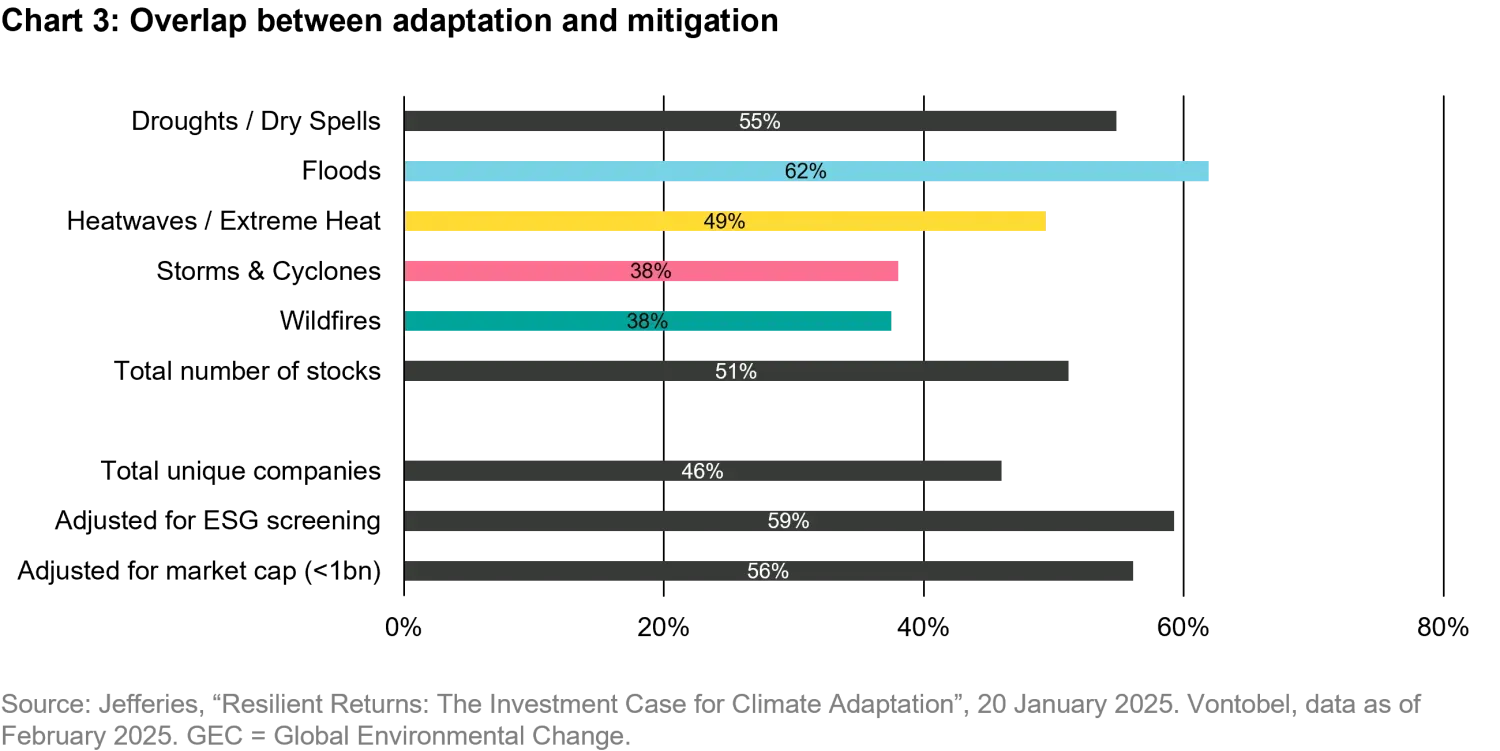

In order to help answer this question, we reviewed the holdings of one such taxonomy, which was published in January 20256. In developing the taxonomy, the authors identified key weather and climate-related natural disasters that are increasing with severity and frequency. These were deemed to be droughts, floods, heatwaves/extreme heat, storms and cyclones, and wildfires. Companies were then identified that had exposure to adaptation solutions to these identified natural hazards. The total number of companies identified was just shy of 400.

When comparing these companies with our own opportunity set within the GEC strategy, we found that approximately half were also within the GEC opportunity set. This drops to slightly lower than half (46 percent) when looking at unique companies, which strips out any double counting of companies that contribute towards more than one natural hazard. When adjusting the universes for some basic ESG screening and market cap sizing (<1bn market cap), the overlap in names increased even further to 59 and 56 percent respectively. In terms of natural hazards, the GEC universe had the largest overlap when it came to flood and drought, with the lowest overlap in wildfires and storms and cyclones. In summary, these results suggest that many listed companies are providing solutions that fit both goals of adaptation and mitigation.

Prevention is better than cure

We believe adaptation measures are becoming more important given the increased frequency and severity of extreme weather events. As a result, many investors are naturally looking to allocate capital to companies providing solutions in this space. As demonstrated earlier, it is likely that investors in traditional climate mitigation strategies already have some exposure to adaptation solutions via companies that are providing solutions that fit into both camps of adaptation and mitigation. These types of companies are arguably more attractive and resilient from an investment perspective, given their immediate and future benefits to society. That said, we believe that investors should not lose sight of a very wise saying: prevention is better than cure. In our view, it remains vital that we continue to mitigate and decarbonize the economy, which is necessary if we are to achieve a more sustainable future for all.

1. www.wmo.int: WMO confirms 2024 as warmest year on record at about 1.55°C above pre-industrial level, 10 January 2025.

2. www.internal-displacement.org: Internal Displacement in 2024: Monitoring the crisis, measuring progress, 10 December 2024.

3. U.S. Census Bureau Household Pulse Survey, Week 63, 8 November 2023.

4. www.worldbank.org: Europe Urgently Needs to Increase Its Disaster and Climate Resilience, 15 May 2024.

5. www.msci-institute.com: Methodology: Developing an investible universe of climate adaptation and resilience companies, 14 March 2024.

6. Jefferies: Resilient Returns: The Investment Case for Climate Adaptation, 20 January 2025.