2026 global equity outlook: the promise and peril of an AI-driven market

Quality Growth Boutique

Key takeaways

- Given uncertainty around the AI trajectory, we prioritize companies with diversified revenue streams and resilience to AI spending slowdowns.

- The interconnected AI ecosystem relies on external financing and investor optimism, making it vulnerable to financial instability and economic ripple effects.

- An AI driven collapse could trigger a market correction, dampen consumer confidence, and risk a global recession.

- A balanced investment strategy is crucial, combining high-growth opportunities with moderate-growth, defensive stocks.

Equity markets are approaching 2026 elevated by the extraordinary rise of a handful of AI players. This year, global economic growth has synced to the fortunes of AI innovation, making it both a growth engine and a potential pressure point.

Without the benefit of hindsight, it’s difficult to determine whether markets are in a bubble. What is clear, however, is that this growing concentration has left investors more vulnerable to abrupt and dramatic swings. An unraveling of the AI story could trigger a sharp equity market correction, erode consumer confidence, and potentially push the global economy into recession.

This fragile environment warrants an approach grounded in humility and balance – one that seeks to participate in the long-term potential of AI but also avoid overexposure to a narrow set of unknowable winners.

Finding predictable and durable growth in AI

While consumers have shown significant enthusiasm for adopting AI products, as seen in the initial rollout of ChatGPT, businesses so far have experienced less success. A study conducted by MIT this summer revealed that 95% of AI-related projects failed to deliver meaningful cost savings or improvements in profitability.1 A more recent study by McKinsey found that over 60% of organizations are still in the experimental or pilot stages of AI adoption.2

Business use cases for AI currently remain inward-focused, with an emphasis on improving operational efficiency in areas such as knowledge management, software development, and help desk automation. This highlights the challenges of integrating AI into existing workflows and the potential for extended implementation timelines. It also reflects the uncertainty surrounding the scale of productivity gains that AI can ultimately deliver.

Given the risk of a pullback in spending on AI, we believe investors should focus on a more predictable approach by identifying companies whose success is not entirely dependent on AI. We are finding potential opportunities in three key areas:

1. Cloud giants

The three major public cloud companies – Amazon, Microsoft, and Alphabet– are benefiting from increased computing demand driven by generative AI workloads, as reflected in their recent quarterly results. We view these businesses as more attractive than the emerging group of “neoclouds,” which focus primarily on low-margin graphics processing unit (GPU) rentals and have high customer concentration among the major AI labs.

Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) are part of highly profitable companies with other secular growth drivers, giving them greater ability to absorb the potential impact of a pullback in AI spending. They are also better positioned to reallocate AI computing infrastructure toward internal use cases, providing another avenue to digest potential excess capacity. In addition, Alphabet is benefiting from some of the most impactful use cases of AI, such as content recommendation, content generation, and improved ad monetization.

2. Essential infrastructure

In the semiconductor space, we apply the same selective, low-risk lens. Rather than trying to identify which AI chip designer will emerge as the winner, we focus on the irreplaceable "picks and shovels" that supply the entire industry. TSMC fits this profile as it is critical to the functionality and scaling of AI systems, operates with high barriers to entry, and maintains diversified revenue streams that mitigate the risk of an AI spending

As a leading advanced-node foundry, TSMC plays a crucial role for major AI chip designers – including Nvidia, AMD, Apple, and the hyperscalers increasingly developing custom ASICs. This broad end-market exposure, combined with near-monopolistic technology leadership and multi-year capacity commitments from customers, gives TSMC far greater predictability compared to fabless designers.

3. High-moat software

In the software and data analytics area, we believe companies with strong moats and proprietary, hard-to-replicate data are particularly well positioned. We find the growing narrative over ‘vibe coding’ disrupting software companies to be highly exaggerated, particularly for more complex enterprise needs. The net productivity gains from AI are overstated, given the challenges with codebase integration, security, and efficiency.

Software incumbents also benefit from traditional business advantages, such as broader product portfolios (enabling cross-selling and improved customer retention), existing customer relationships, and switching costs. For example, in the case of a company like SAP, which serves some of the most complex businesses in the world, it’s difficult to imagine businesses abandoning a proven platform for untested upstarts when it comes to mission critical needs. We also view the incumbents as well positioned to drive incremental AI monetization given their data and understanding of context and business processes.

The AI cycle: virtuous during growth periods but vicious during downturns

The AI ecosystem is deeply interconnected with companies such as Nvidia, OpenAI, Microsoft, Oracle, AMD, and CoreWeave engaging in complex financial and operational relationships. These partnerships include equity investments, revenue-sharing agreements, and backstopping unsold capacity. Although these arrangements are not inherently problematic, they rely heavily on continued investor enthusiasm and the promise of future returns.

If AI companies fail to generate strong cash flows or if investors grow impatient with high capital expenditures and limited visibility into profitability, we believe the ecosystem could face significant challenges. Much like the dot-com era, the circular financing dynamics within AI can create a virtuous cycle during periods of growth but risk becoming a vicious cycle during downturns, highlighting the vulnerabilities of such structures.

For example, OpenAI has reportedly committed approximately $1.4 trillion in data center spending over the next eight years, compared to an expected revenue run rate of over $20 billion by the end of 2025. The company is heavily reliant on external financing, with press reports suggesting that its internal projections anticipate free cash flow burn to increase over the next three years, peaking at nearly -$50 billion in 2028 before approaching breakeven in 2029.

While OpenAI is currently enjoying enviable momentum, its future reliance on external financing could be impacted by factors such as a slowdown in engagement growth, less traction in new product monetization, or a leveling off in the pace of new AI model improvements.

Will AI reinforce or erode the wealth effect?

The combination of a sluggish labor market and inflation, which remains above pre-pandemic levels, is beginning to weigh on the US consumer. Importantly, the impact is highly uneven. Roughly half of all US consumer spending is driven by the top 10% of earners – households that also own the vast majority of financial assets. According to the Federal Reserve, the top quintile of earners holds 87% of equities and mutual funds, and between Q1 2020 and Q2 2025, Americans accumulated more than $63 trillion in additional wealth.

This divergence has reinforced the “K-shaped” economy in 2025. High-income households, buoyed by surging asset values, continue to spend freely on travel, services, and luxury goods. Meanwhile, middle- and lower-income consumers face persistent financial pressure as wage growth struggles to keep pace with inflation. The political implications of these pressures were evident in the populist currents that shaped the 2025 election cycle, unifying both right- and left-leaning narratives around the idea that broad segments of the population are being left behind by the wealth effects of rising markets.

This raises a key question for 2026: what are the implications of a correction, especially given markets’ growing dependence on AI-linked earnings and capital expenditures?

Thus far, AI investment has been largely funded through corporate cash flows and venture capital. But as hyperscalers push to sustain exponential growth in model size, data center build-outs, and chip supply, debt financing has begun to re-enter the picture. With broad US equity indices increasingly concentrated in AI leaders, a meaningful pullback could ripple through the economy not through layoffs or failed AI projects, but through the negative wealth effect of falling asset prices. This dynamic would resemble the aftermath of the dot-com bubble in 2000, when declining equity values disproportionately impacted high-income households and, by extension, overall consumer spending.

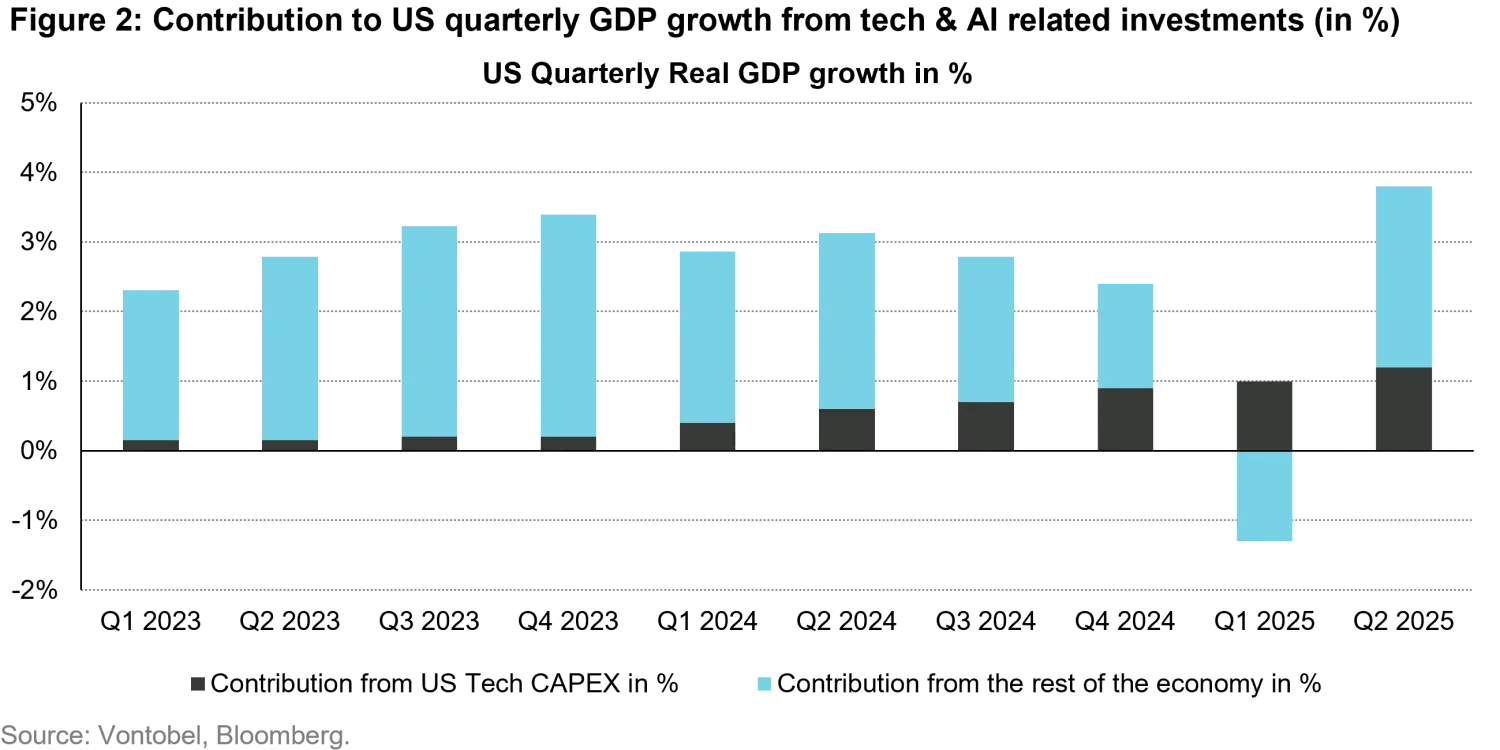

A second transmission channel is also now firmly in place: AI capex as a major driver of US GDP. By late 2025, IT-related capex is estimated to account for more than half of quarterly GDP growth. This means that the same force that has pushed markets higher could become a drag if investment expectations reset. In this way, AI has become both a tailwind and a potential vulnerability for the 2026 macroeconomic outlook.

Finding growth and resilience uncorrelated to AI

Given the uncertainty surrounding AI and its interwoven role in global equity markets and the broader economy, we believe it is essential to uncover opportunities that are largely independent of the AI evolution. In our view, investors should focus on two key categories:

- Strong double-digit growth that can rival AI driven growth

- Moderate growth, with strong defensive characteristics

This dual strategy allows portfolios to generate attractive growth should the AI narrative continue, while simultaneously mitigating risk by avoiding overexposure to a narrow set of unknowable winners. The moderate-growth investments provide downside protection in the event that the AI story unravels, which could trigger a sharp equity market correction, erode consumer confidence, and potentially push the global economy into recession.

We begin by identifying opportunities whose growth rivals that of hyperscalers and hardware companies, while remaining resilient regardless of the pace and direction of the AI evolution. For example, Ferrari has historically delivered a total return of 18%. While AI may change certain features of automobiles, it is unlikely to disrupt the value of Ferrari’s strong luxury brand, which is ultimately the moat, competitive advantage, and true value of the business. The Ferrari of 2040 may look very different, but the allure and premium value of the “Ferrari” brand are unlikely to diminish, making it a stable and uncorrelated growth opportunity. We can compare this to the growth of a hyperscaler like Microsoft, which has achieved a historical total return of 22%3, yet Ferrari is completely independent of AI.

In the US, Netflix is another compelling example. The company has historically delivered a total return of 31%4 and benefits from a stable, subscription-based revenue model, yet Netflix’s primary growth engine operates largely outside of the realm of AI. While AI may impact certain features of Netflix’s platform, such as account personalization or content recommendations, the company’s market share in streaming is likely to remain strong. Currently, Netflix’s growth is driven by its lower tier, ad-supported subscriptions. Investing in Netflix provides exposure to a key growth lever outside of AI, while also positioning investors to benefit from AI’s potential role in enhancing targeted advertising. With respect to AI and advertising, the company stands to benefit from its vast repository of consumer data it has collected through its core product offering, unlocking additional growth opportunities.

In addition to these high-growth players, we believe it is also important to maintain exposure to more defensive growth companies that remain uncorrelated to the AI theme. A prime example is Waste Management, a leader in the waste collection business. While its historical total return of 12%4 is lower than the AI darlings, Waste Management operates a recession resilient business due to the essential nature of garbage collection.

Although AI could augment its future growth, the core service of waste collection will remain indispensable. Further, we believe Waste Management’s ownership of limited landfill space provides a significant competitive advantage and pricing power, ensuring its relevance even in a future dominated by AI. The relatively lower growth of such companies can be viewed as the cost of “insurance,” offering better downside protection. For example, Waste Management’s median drawdown has been -8% compared to -18% for the global equity market.5

Opportunities outside of AI in Europe

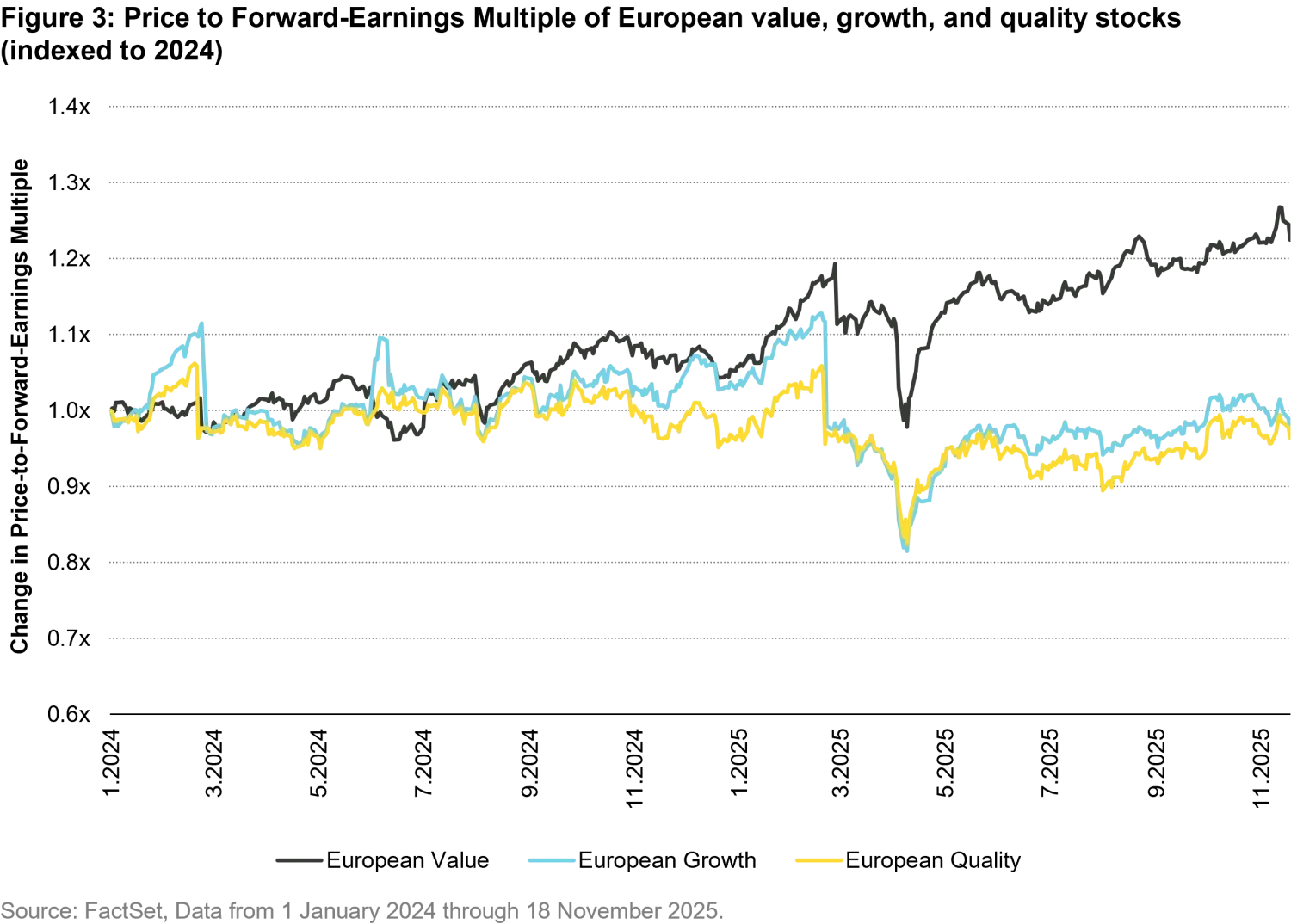

Despite the intense focus on AI, it’s particularly striking that non-US value stocks have kept pace with the Nasdaq 100 – often viewed as the benchmark for high-growth technology companies. A large part of this global value renaissance comes down to the re-rating of cyclical sectors – especially banks. Investors are now pricing in stronger earnings potential, improved capital return policies, and a more supportive fiscal and monetary outlook.

European banks, in particular, have been standout beneficiaries. For the first time since the Global Financial Crisis, their price-to-book ratios have climbed above 1x – a symbolic and significant shift in investor sentiment. While there are reasons for this, we note that since 2024, European value stocks have increased their multiples, while European growth and quality companies have not (Figure 3). We therefore now see significant opportunities in Europe among high-quality growth companies, particularly those with strong fundamentals and resilient business models.

For instance, Galderma, a leading dermatology company, stands out as a compelling case. Galderma operates in unique and resilient markets, including skin health and injectable aesthetics, which are largely independent of broader macroeconomic trends. The company also has a growing franchise in treating certain skin disorders, conditions that are unaffected by economic cycles. This triple focus on injectable aesthetics, skin health, and medical dermatology provides a stable and diversified revenue stream. Moreover, Galderma’s commitment to innovation has enabled it to achieve above-market growth. Like Ferrari, Galderma’s business is not tied to artificial intelligence, ensuring its growth trajectory remains distinct from broader market trends.

L'Oréal is another example of a European company with structural growth that is independent of AI. The company benefits from geographic and category diversification, offering products across a wide price spectrum and capitalizing on the long-term expansion of the beauty market. L'Oréal’s ability to innovate and identify emerging brands to add to its portfolio further strengthens its position as a global leader in this industry.

Beyond AI in emerging markets: resilient growth opportunities in China, India, and Brazil

Emerging Markets have made a strong comeback this year, but we are mindful that returns have also been quite concentrated among AI-related stocks. Taiwan and South Korea, in particular, have emerged as key beneficiaries of the global AI data center frenzy, as they are home to many technology hardware companies that are critical to the AI supply chain. We estimate that AI-related companies have contributed approximately 40% of the MSCI Emerging Market Index's year-to-date return. It is therefore equally important to identify companies that can grow earnings, regardless of how AI unfolds.

We have found compelling, predictable long-term growth companies in diverse sectors across China, India, and Brazil, among others.

Nongfu Spring, China’s largest bottled water producer, is one such example. The company benefits from significant pricing power, brand equity, scale, and distribution advantages, which are reflected in its growing market share and impressive returns on capital. In recent years, the Nongfu Spring has successfully diversified its portfolio by building leading positions in fast-growing categories such as unsweetened tea, juice, and functional beverages, which now account for more than 60% of profits. We expect that Nongfu can continue to deliver attractive revenue and earnings growth.

Bharti Airtel, one of India’s leading telecom providers, is another compelling structural growth business. Following years of industry consolidation, Bharti now operates in a duopolistic market alongside Reliance Jio. This favorable industry structure supports rational competition, enabling improved pricing power and greater visibility into returns. We believe Bharti is poised to deliver attractive earnings growth that is driven by structural tailwinds such as increasing data consumption, the expansion of digital services, and growth in average revenue per user (ARPU).

In Brazil, water and waste management company Sabesp offers a similarly strong growth trajectory, driven by its privatization, efficiency initiatives, and efforts to improve water sanitation in the state of São Paulo. Importantly, Sabesp benefits from a stable regulatory framework and significant opportunities to expand water and sanitation coverage, which provide a high degree of visibility into the company’s future earnings and cash flows.

2026 calls for a measured, diversified approach

While the promise of AI remains compelling, its market dominance and reliance on external financing create vulnerabilities that cannot be ignored. By seeking opportunities in areas of predictable growth and resilience – both within and outside the AI ecosystem – we believe investors can better navigate the uncertainties of this transformative era. As with any period of rapid innovation, a measured, diversified approach will be critical to weathering potential volatility and capitalizing on long-term opportunities.

1. https://mlq.ai/media/quarterly_decks/v0.1_State_of_AI_in_Business_2025_Report.pdf

2. https://www.mckinsey.com/~/media/mckinsey/business%20functions/quantumblack/our%20insights/the%20state%20of%20ai/november%202025/the-state-of-ai-in-2025-agents-innovation-and-transformation.pdf?shouldIndex=false

3. Historical total Return = EPS growth plus free cash flow yield over the last 7 years. As of 31 October 2025.

4. Historical total Return = EPS growth plus free cash flow yield over the last 7 years. As of 31 October 2025

5. As of 31 October 2025